Lately, many retail and institutional traders have been opening as much as the opportunity of holding cryptocurrencies to attain a well-balanced portfolio. Hedge funds, banks, mutual funds, and people all add cryptocurrency to their portfolios as a result of its current worth and the long run potential of blockchain expertise, and also you, too, shouldn’t be omitted.

Crypto funding technique refers back to the set of methods and approaches traders use to maximise income whereas minimizing dangers when investing in digital currencies. The crypto world is very risky and sophisticated, with quite a few elements influencing cryptocurrencies’ costs.

As such, traders want a strong understanding of the risky market and crypto buying and selling methods, mixed with the instruments for elementary and technical evaluation to make knowledgeable funding choices. By using a profitable cryptocurrency funding technique, traders can mitigate dangers and make the most of alternatives within the ever-evolving digital forex area.

You probably have little to no concept about methods to get began and methods to make investments cash in cryptocurrencies, this text is for you. It’s going to delve deep into numerous cryptocurrency investing methods and focus on their benefits and drawbacks that can assist you get began.

Let’s get proper to it!

A crypto investing technique will depend on your private preferences, funding targets, and danger tolerance. We are going to cowl among the most used and confirmed methods for crypto investing, particularly:

- Purchase and maintain

- Greenback-cost averaging (DCA)

- Early-bird investing

- Copy buying and selling

- Following buying and selling hype and narratives

- Shopping for micro-cap altcoins

- Collaborating in airdrops

- Technical evaluation buying and selling

- Arbitrage buying and selling

- Excessive-frequency buying and selling

Right here’s a better look into the very best crypto investing methods:

Purchase and Maintain Technique

The phrase “purchase low, promote excessive” succinctly encapsulates the buy-and-hold technique. Additionally known as place buying and selling, the buy-and-hold technique is without doubt one of the finest investing methods to earn passive revenue. This crypto funding technique allows merchants to not really feel involved about short-term market fluctuations however purchase and retailer their crypto for an extended timeframe.

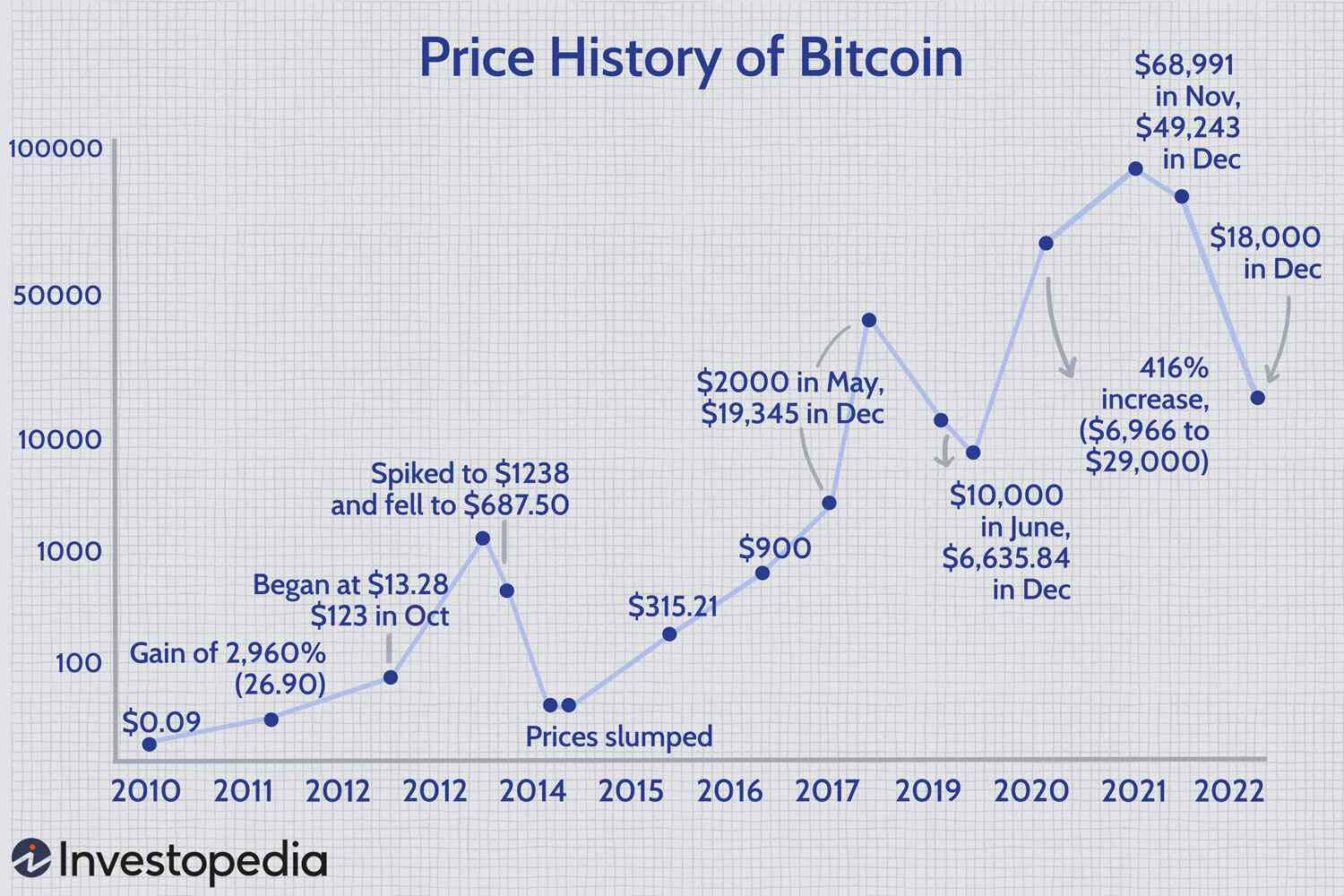

For instance, for those who’d invested $100 in Bitcoin in 2012 and didn’t promote, you may have roughly $50 million in the present day. Bitcoin has had a number of corrections and crashes throughout this era, however the investor utilizing the purchase and maintain technique wouldn’t be involved with these relying on the timeframe of the commerce.

This technique is finest for traders who imagine in initiatives with robust fundamentals and may afford to not see any returns for a number of years. They purchase crypto and maintain it long-term to revenue from a future value improve.

Benefits

- The buy-and-hold technique helps filter out the noise with any funding.

- Capital achieve taxes may be deferred for long-term investments.

- The probability of a badly timed resolution is slim.

Disadvantages

- Buyers usually are not proof against losses.

- Usually, one dangerous timing can have an effect on the entire portfolio.

- There could be extra alternatives for revenue in a buying and selling session, resulting in extra good points for an lively investor.

Greenback-Price Averaging (DCA)

Greenback-cost averaging is a well-liked funding technique used throughout totally different asset courses. The technique entails an computerized system of creating fastened greenback quantity investments (crypto allocation technique), no matter a token’s value.

It entails leveraging the ups and downs of a crypto value to attain a good common value when the crypto value skyrockets. For instance, individuals who purchased a set quantity of Bitcoin on crypto exchanges each month between $1 and $1000 would have made a big revenue when the worth hit $60,000.

A extra important enchancment to the DCA is a technique known as worth investing when a price investor will begin investing in a specific cryptocurrency in the event that they imagine it’s underpriced in comparison with their perceived worth.

Benefits

- The investor shouldn’t be affected by short-term volatility.

- It’s straightforward to implement for each novices and skilled merchants within the crypto area.

- The DCA course of may be automated.

Disadvantages

- This crypto investing technique doesn’t repay long run except there’s a robust bull run.

Early-Chicken Investing

When new initiatives want funds to launch a product, they normally carry out some type of funding rounds. Within the case of crypto initiatives, traders are sometimes given the choice to put money into preliminary coin choices (ICOs) or comparable crowdfunding-type choices. It is a approach to supply stakes within the challenge’s native token for investing within the challenge, just like the Preliminary Public Providing (IPO) for conventional property within the inventory market.

ICOs may be very worthwhile however carry important dangers as a result of their unregulated nature, so performing due diligence earlier than investing in an ICO is a should.

A number of the issues to search out out earlier than investing embody:

- Guarantee readability of goal

Test if the challenge wants an ICO or if it may possibly carry out simply as properly with out one. Additionally, decide what the funds will probably be used for and their allocations.

- Analysis concerning the group

Are the group members new to the crypto area, or have they got prior expertise with crypto initiatives? Test the earlier initiatives they’ve been engaged with and their roles and success in these initiatives. This may make the probabilities of dropping cash slimmer.

- Test the ICO’s authorized doc

Buyers ought to carry out due diligence and test the challenge’s proof of authenticity.

Benefits

- Token costs in ICOs are sometimes the bottom an investor can get.

Drawback

- A challenge would possibly fail after the ICO, leaving traders with nugatory tokens.

Copy Buying and selling

Copy buying and selling is an funding technique that entails copying the trades of a extra skilled or profitable dealer on a crypto trade. In essence, you’re entrusting your investments to a different dealer with a confirmed monitor report of profitable trades.

The method normally entails a social buying and selling platform with a listing of skilled merchants whose trades you may select to duplicate. Copy buying and selling is a superb selection for individuals desirous to earn whereas studying the intricacies of the crypto market or not having time to commerce persistently.

Benefits

- It allows traders to profit from the data of an skilled investor, probably main to higher funding returns.

- Copy buying and selling via a user-friendly social platform interface/crypto trade is comparatively easy.

Disadvantages

- The dealer you’re copying might expertise losses or might not carry out in addition to you had hoped.

- Social buying and selling platforms usually cost charges that may impression your total returns.

- Within the crypto world, previous efficiency shouldn’t be indicative of future returns.

Following Buying and selling Hype and Narratives

Investing in cryptocurrencies primarily based on hype and narratives is turning into more and more well-liked as a buying and selling technique. Hype and narratives consult with the tales, rumors, and information surrounding a cryptocurrency that may have an effect on its value and buying and selling quantity.

Crypto traders utilizing this technique put money into crypto, which generates a whole lot of buzz and media protection. They use hype and narratives to determine undervalued and overvalued cash to purchase when the hype is low and promote when it’s excessive.

The concept behind this technique is that hype and narratives can create a self-fulfilling prophecy. If sufficient individuals begin speaking a couple of specific coin, it may possibly create a buzz that pulls extra consumers, growing the worth. Equally, if detrimental rumors begin circulating, it may possibly trigger panic and sell-offs, driving the worth down.

A crypto investor utilizing this technique should be vigilant in monitoring the information and social media for any indicators of modifications in sentiment or narratives. This could contain monitoring particular key phrases, hashtags, and mentions associated to a specific coin to determine rising developments or developments.

Benefits

- The potential for short-term revenue is immense.

Disadvantages

- Narratives and hype may be unpredictable and subjective.

- It’s extremely vulnerable to rug pulls and manipulations by insiders.

- It wants fixed monitoring of reports and sentiments.

- Not advisable for brand new merchants as many cash don’t have inherent utility.

Shopping for Micro-Cap Altcoins

Because the crypto markets evolve, extra traders take into account micro-cap altcoins as a viable funding technique. Micro-cap altcoins are digital property with a small market capitalization, normally beneath $50 million, usually missed by mainstream traders however have the potential for prime returns if their initiatives succeed.

The first rationale behind shopping for these cash is that Bitcoin would possibly achieve 10,000% on its present value, however many cryptocurrencies are properly primed to rally by at the least 3,000%. Since they’re undervalued and largely missed, an early crypto investor is commonly the rally’s finest beneficiary.

Different causes individuals use this crypto investing technique embody the next:

1. Diversification

Investing in micro-cap altcoins can assist diversify your crypto portfolio, decreasing your total danger and probably growing your returns.

2. Rising expertise

Micro-cap altcoins are sometimes tied to rising applied sciences and developments with long-term progress potential. Micro-cap altcoins might turn into the early adopters of recent industries and applied sciences.

Benefits

- Appropriate for long-term investments.

- Small-cap crypto investments may very well be a gem in a number of years.

- Usually, massive initiatives fall throughout the market cap of micro-cap initiatives as a result of some corrections. This could sign an excellent purchase if there’s nothing basically improper with the challenge.

Disadvantages

- These cash are sometimes extremely risky and may undergo important value fluctuations.

- They are often good for pump and dump schemes.

- Many small-cap initiatives have hazy roadmaps and inexperienced groups.

Collaborating in Airdrops

An airdrop is a advertising method crypto corporations use to draw traders to their initiatives. Airdrops contain making a gift of free crypto cash to customers for finishing minimal duties or assembly particular necessities. For instance, an organization might supply free crypto cash to anybody who follows them on social media or indicators up for his or her e mail e-newsletter.

Buyers can make the most of airdrops as an funding technique by rigorously researching the initiatives providing airdrops and finishing the required duties to obtain free tokens. When you obtain the crypto property, you may maintain onto them and wait for his or her worth to extend earlier than promoting them for a revenue.

Nevertheless, it’s necessary to notice that not all airdrops are created equal. Some airdrops are scams, whereas others will not be value your effort and time. As an investor, you will need to do your individual analysis and solely put money into initiatives with a strong monitor report and good potential for progress.

You’ll be able to search on-line for lists of upcoming airdrops, be part of crypto communities on social media platforms like Telegram and Reddit, and comply with crypto influencers to remain up to date on new airdrops.

Benefits

- It’s free to implement.

- No start-up price and nice potential returns.

- Widespread initiatives like OP and Aptos have airdropped a few of their tokens.

Disadvantages

- Many airdrops are scams.

- Individuals who use airdrops are principally after good points, not as a result of they imagine within the challenge. This could hamper long-term holdings.

Technical Evaluation Buying and selling

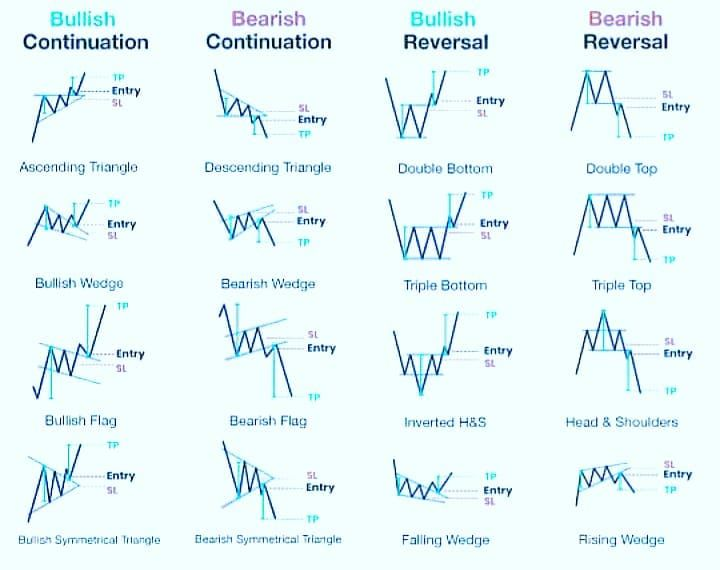

Technical evaluation is an funding technique that entails analyzing previous market information and utilizing it to foretell future value actions. When utilized to cryptocurrencies, it may possibly assist merchants make knowledgeable choices about when to purchase and promote their digital property.

Probably the most frequent sorts of technical evaluation is chart evaluation, which entails inspecting charts of previous value actions to determine patterns and developments. Different methods embody indicators like transferring averages to determine developments in market information and oscillators to measure the momentum of value actions. Combining these methods together with your market data lets you make knowledgeable choices about when to purchase or promote a selected digital asset.

Benefits

- Technical evaluation is predicated on information slightly than subjective opinions or hypothesis. This makes it a beneficial device for merchants trying to make rational choices primarily based on precise market information.

- Buyers can revenue from frequent patterns.

Disadvantages

- Market situations can change, making chart patterns irregular.

Arbitrage Buying and selling

Arbitrage buying and selling is a cryptocurrency investing technique that entails shopping for and promoting the identical asset on totally different exchanges to make the most of value variations. Cryptocurrency costs can fluctuate considerably throughout totally different exchanges, presenting a singular alternative for traders to revenue from the worth variations.

Arbitrage buying and selling entails buying a cryptocurrency on one trade for a cheaper price and promoting it on one other for a better value. The distinction in costs is the revenue earned by the dealer. The investor’s aim is to execute trades shortly and make the most of the worth variations earlier than they disappear.

Benefits

- It’s a low-risk technique. For the reason that dealer is shopping for and promoting the identical asset in the identical interval, the chance of loss is minimal.

- It doesn’t rely on market developments or long-term value actions however depends on short-term value fluctuations.

Disadvantages

- It may be difficult to execute because it requires a deep understanding of the cryptocurrency market and the power to determine value discrepancies shortly.

- It could contain important transaction charges.

- Not appropriate for brand new merchants.

Excessive-Frequency Buying and selling

Excessive-frequency buying and selling (HFT) is a buying and selling technique that makes use of superior algorithms to execute trades at lightning-fast speeds. This buying and selling method is prevalent in crypto, the place risky and quickly altering market situations require quick and correct decision-making.

As a cryptocurrency investing technique, HFT goals to generate income by profiting from tiny value actions inside milliseconds. HFT merchants leverage superior applied sciences, reminiscent of high-speed information feeds, highly effective computer systems, and sophisticated algorithms, to investigate market developments and execute trades at breakneck speeds.

Benefits

- Processing huge quantities of information and executing trades in real-time permits merchants to capitalize on even the smallest value modifications, producing important income over time.

Disadvantages

- The cryptocurrency market’s excessive volatility may end up in important losses for HFT merchants, particularly in cases of sudden market actions.

- The prevalence of high-frequency buying and selling in cryptocurrency markets can result in elevated market instability and manipulation.

Further buying and selling methods embody yield farming technique (a mixture of offering liquidity to a decentralized trade, staking, and depositing your crypto right into a lending platform) and swing commerce crypto technique (through which merchants keep of their place for a brief or medium time-frame)

Conclusion

In conclusion, crypto investing is a high-risk, high-reward endeavor requiring cautious consideration and planning earlier than coming into the decentralized finance (DeFi) world. Numerous methods traders can use embody shopping for and holding for the long run, day buying and selling, margin buying and selling utilizing borrowed funds, and diversifying their portfolio.

Do not forget that there isn’t a one-size-fits-all method to crypto investing, and what works for one investor might not work for one more. Moreover, staying knowledgeable about market developments and developments is crucial, because the cryptocurrency market is consistently evolving. By staying disciplined and knowledgeable, traders could make knowledgeable choices and probably reap the rewards of this thrilling and dynamic asset class.