The irregularities and lack of belief that characterize centralized exchanges (CEX) have irritated many builders into creating absolutely decentralized exchanges (DEX) that compete with and set up the true code of decentralization.

A type of decentralized exchanges is ApeSwap. This text will provide you with an entire information into what it’s, the way it works, what it presents, and each different factor you must know. Let’s get began.

Govt Abstract

- ApeSwap is a decentralized change on BNB Chain.

- ApeSwap supplies a full toolkit for DeFi functions, together with shopping for tokens that commerce towards BANANA, token swaps, providing liquidity, staking, lending and borrowing, IDOs, and margin buying and selling.

- With BANANA and GNANA serving as the 2 principal utility tokens, ApeSwap operates on a dual-token paradigm. GNANA compensates customers with entry to governance and particular perks, whereas BANANA tokens are used to reward liquidity suppliers.

- DeFi Yield, Certik, and BSC Gemz have audited ApeSwap in 2021 and 2022, respectively. No severe flaws have been found.

- To encourage prospects to commerce their tokens, ApeSwap permits companions to publish tokens on the change, arrange staking swimming pools, and run yield farms.

What’s ApeSwap?

ApeSwap is a decentralized change (DEX) on the BNB Chain that gives a full toolkit for DeFi functions. This consists of entry to all kinds of monetary companies like token swaps, liquidity provision, various financial savings, staking, lending and borrowing, IDOs, tokenized belongings, and margin buying and selling.

The decentralized change, which has relationships with vital initiatives like KAI, LUNR, FRAX, and Animoca Manufacturers, is thought to be one of many largest within the Binance ecosystem. By way of transparency, safety, and help, ApeSwap sees its purpose as giving the crypto lots reasonably priced monetary options.

Why was ApeSwap created?

The trendiest pattern proper now within the crypto business is DeFi. The ApeSwap platform focuses closely on decentralizing each side of the traditional monetary sector and opening up entry to companies like loans, insurance coverage, and others to all members of society, particularly these on the backside and in much less developed nations that haven’t at all times had quick access to those companies.

ApeSwap’s purpose is to determine a sustainable, neighborhood-driven decentralized autonomous group (DAO) that goals to decentralize typical finance and set up a simply financial system.

ApeSwap is attempting to deal with points confronted by its centralized rivals, akin to the danger of hacking, mismanagement, and arbitrary charges, and to take the place of centralized intermediaries in monetary functions akin to derivatives, insurance coverage, and loans.

With greater than 1.7 billion people unbanked people globally, it has been not possible for them to entry important monetary companies which will give them extra energy. ApeSwap thrives on this house by using blockchain protocols and cryptocurrency tokens to decentralize all monetary companies.

The massive probabilities to achieve from what was beforehand not possible have contributed to the ApeSwap’s protocol rising enchantment among the many common public.

Who Based Apesawap?

A bunch of individuals deeply skilled in cryptocurrency buying and selling, farming, and dealing with different crypto initiatives fashioned ApeSwap.

They believed they may unite after collaborating within the DeFi ecosystem for some time to introduce a extra equitable, open, and community-driven decentralized change. The initiative was given the hasty identify “ApeSwap “— created by DeFi apes for DeFi apes.

Over 15 staff members make up ApeSwap, established in 2021. All the staff stays nameless and is offered behind avatars like Donkey Kong or Harambe. The entire listing of co-founders consists of:

- ApeGuru — extremely skilled full stack developer.

- ApeTastic — extremely skilled good contract developer.

- Harambe Nakamoto — knowledgeable on tokenomics, analytics, and engineering

- DK — enterprise improvement and advertising and marketing guru

- Obie Dobo — knowledgeable neighborhood supervisor (King of the neighborhood jungle)

On the ApeSwap staff doc, all profiles are fairly intensive, although they’re all nameless. All the crew has been engaged on the undertaking for a couple of 12 months, which largely reduces the probabilities of ApeSwap being a rip-off.

What Makes ApeSwap Distinctive?

A decentralized change, which permits customers to commerce between greater than 150 tokens on BNB and Polygon, is the primary providing of ApeSwap, which additionally supplies the usual toolkit for DeFi functions. On token swaps, ApeSwap costs buying and selling charges of 0.2%. A portion of the charges goes to the ApeSwap Treasury, whereas the remainder is distributed to liquidity suppliers. ApeSwap additionally launched leverage buying and selling in Q1 of 2022.

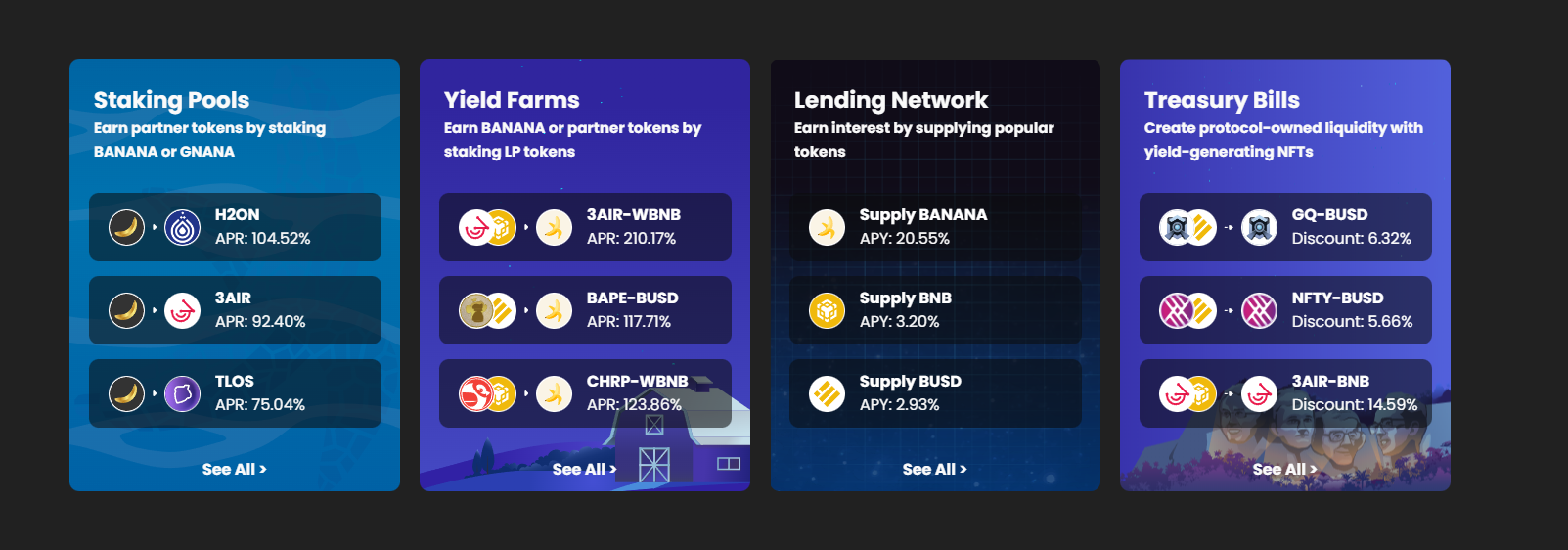

One other necessary side of ApeSwap is its yield farms, encouraging customers to contribute liquidity by staking APE-LP tokens. Its auto-compounding vaults, the place tokens are robotically staked to provide farming yields, can be found to anybody looking for a passive funding strategy. BANANA tokens are additionally burned and repurchased by Burning Vaults, with income from farming actions on the platform.

Preliminary Ape Choices (IAOs) are IDOs at ApeSwap that may both be official IAOs (authorized and authorized by ApeSwap ) or self-serve IAOs (unapproved tasks).

Moreover, 1,000 “non-fungible apes” have been made accessible by ApeSwap for buying and selling at its NFA Public sale Home. The change additionally intends to work with its associate, Liquid Collectibles, to provide a set of “non-fungible bananas.”

What’s ApeSwap (BANANA) Token?

The primary native utility token within the ApeSwap ecosystem is known as BANANA. The protocol makes use of BANANA to do a lot of duties, akin to paying customers for bringing liquidity to the ApeSwap platform and inspiring markets on the ApeSwap Lending Community.

On the Swap tab of the Change (of alternative) web page, customers should buy BANANA utilizing BNB Chain, Polygon, or Ethereum tokens.

Each Thursday, ApeSwap burns BANANA tokens to take away them from circulation and ease inflationary strain with a purpose to handle return-on-emissions for the protocol.

On the Change web page’s Liquidity tab, customers can present liquidity to the ApeSwap DEX after which stake their liquidity supplier (LP) tokens in any accessible Yield Farms or BANANA Maximizers to earn BANANA. Or, they will lend or borrow crypto belongings on ApeSwap’s lending community to obtain BANANA rewards.

What Can I Do With BANANA?

BANANA might be employed within the methods listed beneath:

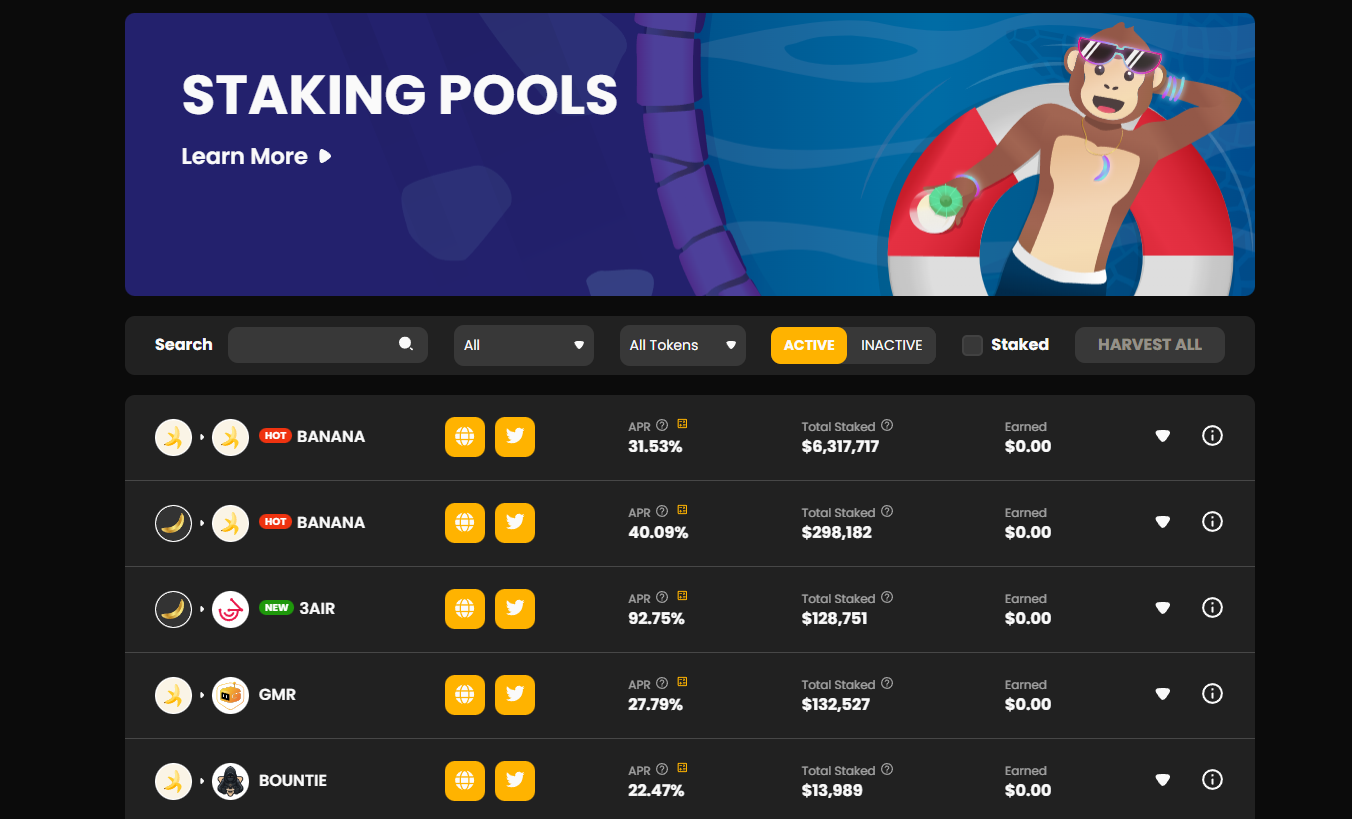

- To earn extra BANANA or tokens from associate tasks, stake your BANANA tokens in ApeSwap’s staking swimming pools.

- To purchase GNANA on the Golden BANANA web page

- To create liquidity supplier tokens (APE-LP tokens) on the Change web page by combining BANANA with BNB or BUSD. These tokens earn buying and selling charges and might be positioned in yield farms or BANANA maximizers to generate passive income.

- To earn BANANA by buying Treasury Payments with APE-LP tokens throughout a predetermined vesting time.

- To earn curiosity by lending BANANA by means of the lending community.

- To get liquidity with out promoting BANANA, borrow towards your BANANA on the lending community.

BANANA Tokenomics – Laborious Cap

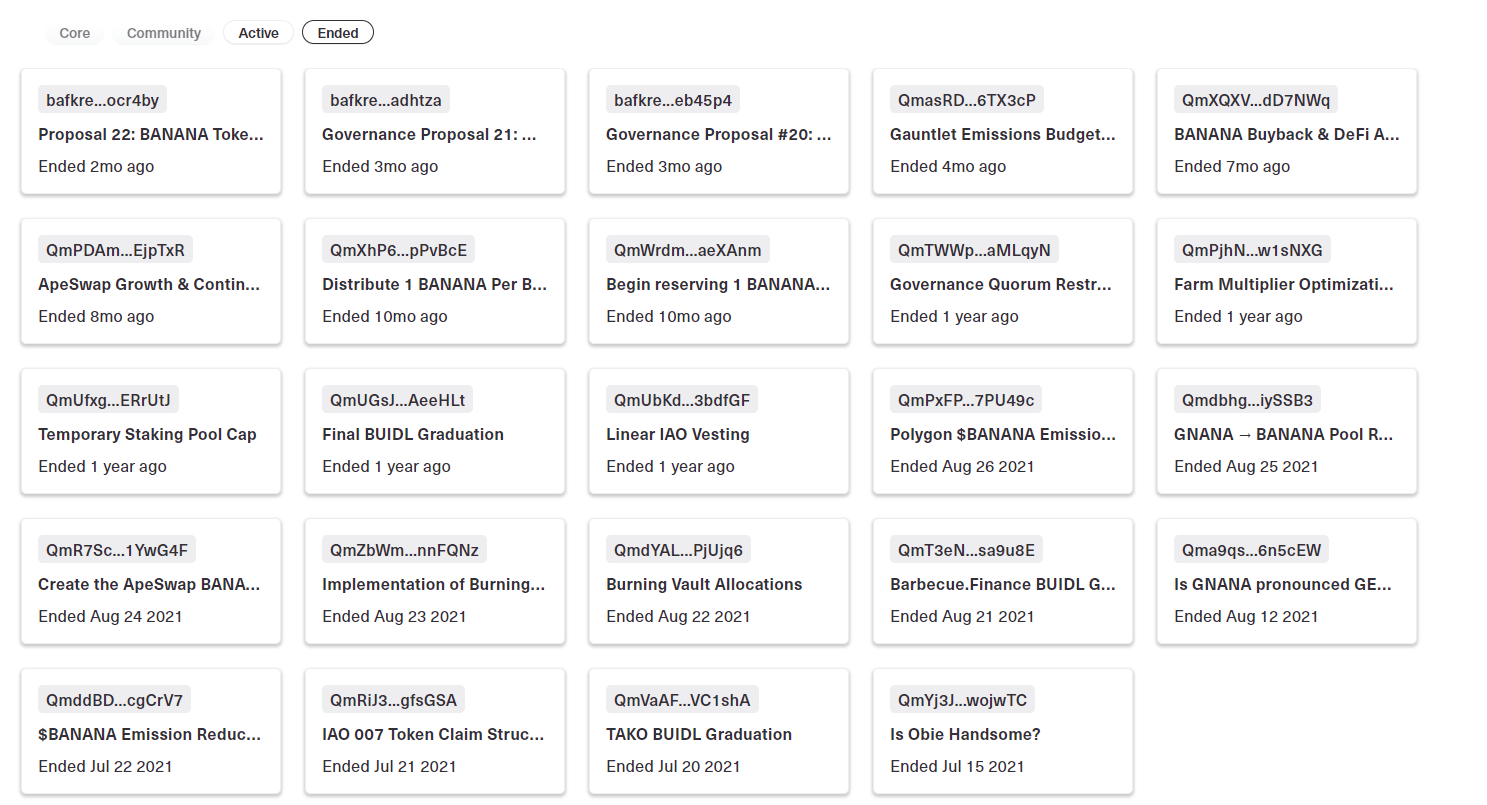

Voters in ApeSwap DAO accepted Governance Proposal 22 to impose a tough cap of 420,000,000 BANANA on August 31, 2022. This means that there’ll by no means be extra BANANA tokens produced (i.e. the sum of all BANANA in circulation, together with these burned).

How Many ApeSwap (BANANA) Tokens are in Circulation?

With BANANA and GNANA serving as the 2 principal utility tokens, ApeSwap operates on a dual-token paradigm. GNANA compensates customers with entry to governance and particular perks, whereas BANANA tokens are used to reward liquidity suppliers. 4 main use circumstances have been pre-established for the BANANA token:

- Staking it to earn extra BANANA.

- Shopping for GNANA with it.

- Lending BANANA on the lending platform for rewards.

- Swapping it for different tokens.

Moreover, you must know that BANANA has a limiteless complete provide and is an inflationary coin. Because it stands, 316,800 bananas are launched per day and distributed as follows:

- Yield Farms (BNB Chain): 39.5%

- BANANA Pool: 22.7%

- Lending Community (Ola): 9.09%

- Yield Farms (Polygon): 9.09%

- Bonds: 9.09%

- Dev Pockets: 6.36%

- Burned: 2.73%

- $GNANA Pool: 1.36%

BANANA as a Deflationary Token:

Finally, BANANA will flip right into a deflationary token. In consequence, ApeSwap has put into place a number of deflationary mechanics:

- Quarterly buyback and burn: 50% of commerce commissions go towards BANANA buybacks and burns.

- Weekly Thursday burns

- IDO-generated GNANA is used to buy again and burn BANANA.

- Initiatives partnering with ApeSwap burning BANANA

- Burning Vaults makes use of 10% of the charges it receives to buy stablecoins and retailer them completely in vaults. These vaults’ rewards are used to buy and burn $BANANA.

What Provides ApeSwap (BANANA) Worth?

ApeSwap (BANANA) will get its worth from its utility. Being a governance token, the extra individuals maintain, purchase, and swap BANANA, the extra worth is ascribed to the ApeSwap platform. The vary of swap choices additionally accessible with the BANANA token makes it simpler to generate liquidity. In easy phrases, the extra BANANA finds utility, the upper its worth. Subsequently, its present worth is a mirrored image of its present utility standing.

How Does ApewSwap Work?

Customers can buy BANANA and GNANA tokens by linking their crypto pockets to the change and exchanging one other token. Moreover, ApeSwap supplies token swaps between totally different tokens and has generated greater than $16 billion in complete transaction quantity and greater than $200 million in TVL.

Customers can add liquidity to a liquidity pair on the change by connecting their wallets to the ApeSwap DEX. In change, customers get LP tokens, which they will stake to get a bit of the BANANA emissions as a reward.

Moreover, customers can stake their BANANA within the ApeSwap burning vaults to extend their portion of the accessible BANANA provide. ApeSwap presently presents 69% APY on staked BANANA and 87% APY on the liquidity pair of BANANA-BUSD.

Customers can farm yield on a variety of buying and selling pairs. Particular farm multipliers on its BANANA farms management the dispersed emitted banana to the farms. Customers are inspired so as to add extra liquidity to those pairs by farms with greater multipliers since they provide larger BANANA incentives.

Customers can share within the buying and selling commissions and BANANA rewards by staking their LP tokens in yield farms. By paying out their tokens, Jungle Farms additionally permits associate tasks to encourage their liquidity. Farmers who present the best yields earn the associate token reasonably than BANANA.

By way of ApeSwap, customers and protocols may also increase cash. Treasury Payments and Preliminary Ape Choices (IAOs) are two of the fundraising choices supplied by ApeSwap.

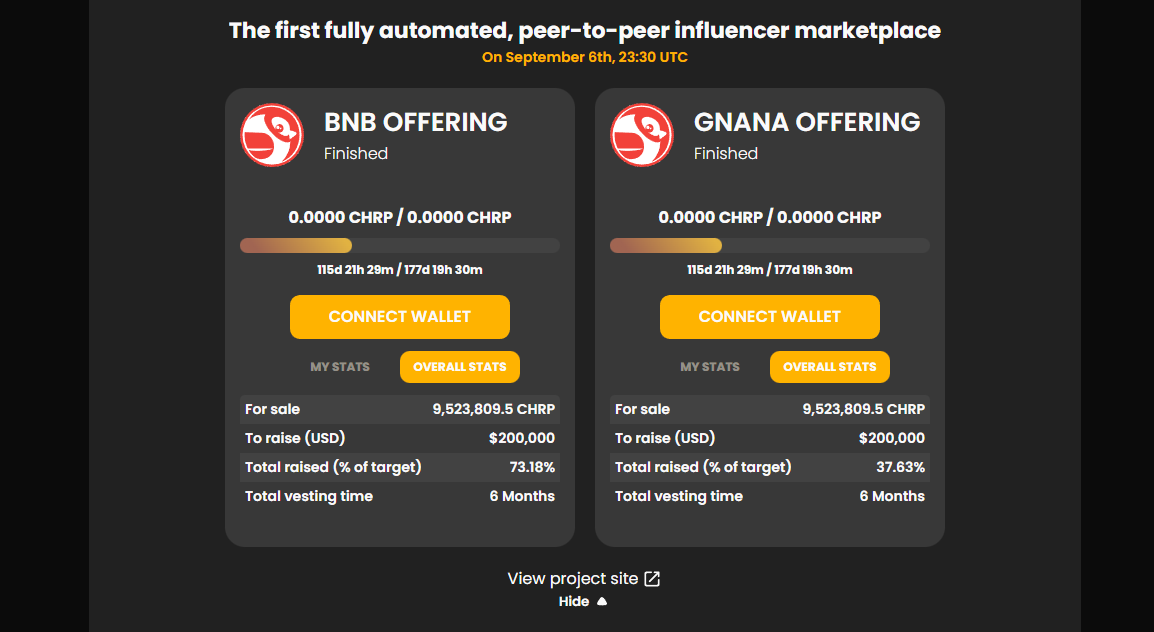

Preliminary Ape Choices (IAO)

Customers can take part in new and upcoming tasks by means of Preliminary Ape Choices. Preliminary Ape Choices (IAO), because the identify suggests, are fundraising actions that ApeSwap customers can take part in to launch new tokens and enhance their liquidity.

IAOs are available in two varieties: official and self-serve. ApeSwap audits tasks in official IAOs from an inventory of official IAO associate candidates, offers them advertising and marketing help, and grants them entry to the raised BNB. Individuals pays with BNB or GNANA, which makes use of the GNANA token’s larger buying energy to reward its holders.

With Self-serve IAOs, cryptocurrency tasks can launch their crowdfunding marketing campaign and generate their very own ApeSwap DEX liquidity. Nevertheless, neither ApeSwap nor the platform supplies advertising and marketing help to those IAOs.

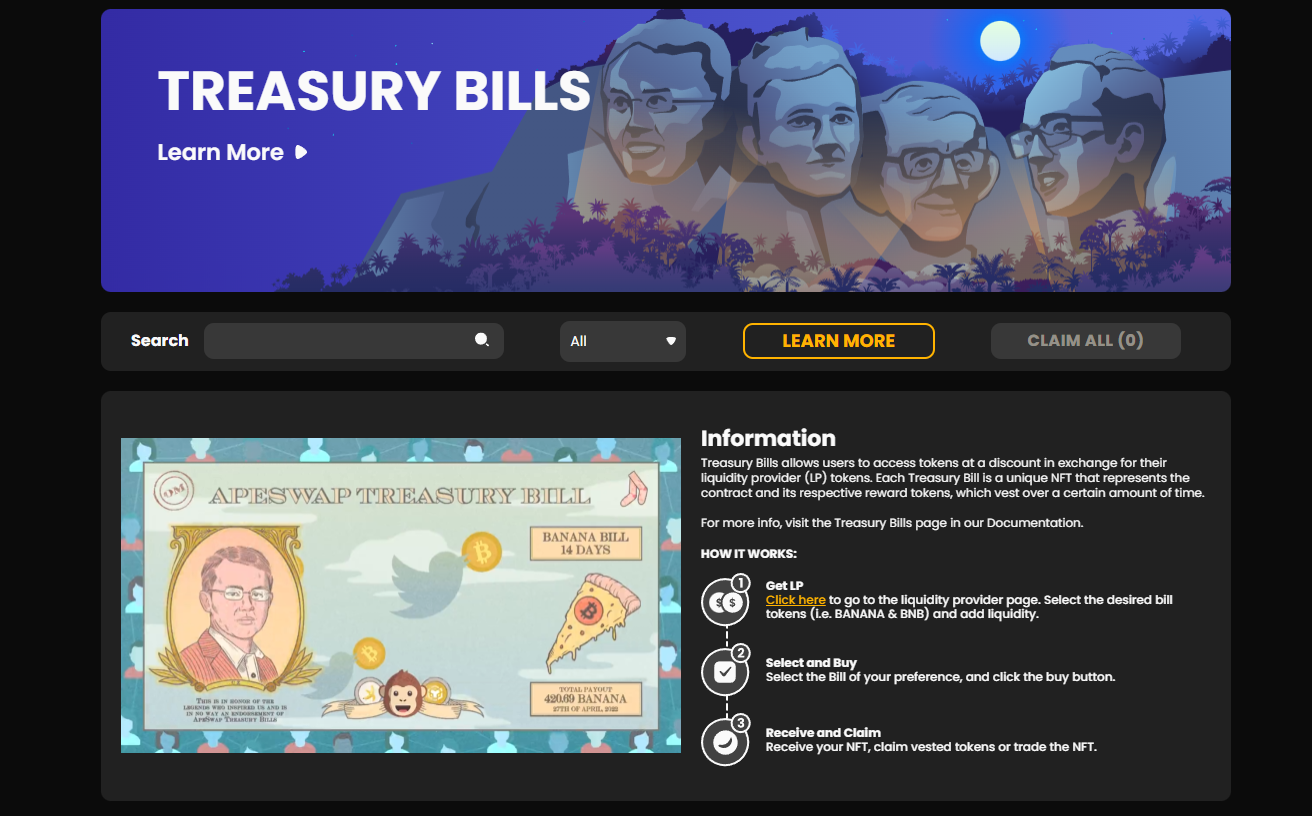

Treasury Payments

Registered as the primary yield-generating NFT product on the change, Treasury Payments are a brand new endeavor to safeguard ApeSwap’s long-term viability. In change for offering liquidity, customers can get BANANA Payments or Jungle Payments. As Olympus DAO supplies liquidity by means of its bonds, so does this to create protocol-owned liquidity for ApeSwap.

Whereas Jungle Payments create associate tokens and provides these protocols entry to their protocol-owned liquidity, BANANA payments present BANANA tokens at a reduction.

The ApeSwap Lending Community permits customers to lend and borrow cash. Buyers can profit from the worth of their belongings whereas nonetheless sustaining possession by borrowing. A token’s collateral issue determines the quantity that may be borrowed. As an illustration, WBTC has a 70% collateral element, which permits customers to borrow as much as 70% of the worth of their WBTC. Customers who lend cash will get a distribution APY in BANANA tokens and a provide APY within the forex they invested (WBTC in the event that they lend WBTC).

What Does ApeSwap Provide?

DeFi Lending and Borrowing

On their platform, ApeSwap presents customers quite a lot of choices to take a position, revenue from collaborating in a number of actions. Most of those actions heart on rewarding customers in BANANA, the native cryptocurrency that serves as ApeSwap’s utility token and is used to reward customers.

By way of the ApeSwap platform, any investor can buy the native BANANA token along with lending and borrowing quite a lot of different cryptocurrencies, like DAI, ETH, USDC, ZRX, USDT, WBTC, BAT, REP, and SAI.

DeFi lending is one space that has attracted prospects’ consideration. Subsequently, ApeSwap has developed options that present loans to individuals or enterprises with out intermediaries.

The protocol facilitates lending and borrowing of cryptocurrency belongings and permits all events concerned to get curiosity for committing cryptocurrency. As buyers not must spend time, effort, and cash interacting with typical monetary business intermediaries, such companies have grown more and more essential.

DeFi Rewards and Incomes

One space that has considerably enhanced the lives of many buyers is the availability of doable rewards. This retains luring people to the DeFi business and accelerates the uptake of DeFi applied sciences.

For buyers, ApeSwap protocol supplies quite a lot of methods to make cash and obtain rewards on the platform, together with staking and locking tokens in its liquidity pool. Yield farming is a worthwhile exercise by which members deposit cryptocurrency into the ApeSwap liquidity pool for a predetermined period of time in change for rewards.

Buyers can stake any asset they personal to any most popular liquidity pool for rewards through the use of ApeSwap’s native token (BANANA).

Buyers as soon as needed to undergo many processes to perform this, however because of ApeSwap, it’s now an easy activity. One solely must convert their cryptocurrency into the BANANA token, after which they will stake it wherever they like or buy BANANA on the undertaking’s official web site.

The ApeSwap platform additionally advises customers on the place to stake for one of the best returns and different high investing alternatives. Such suggestions are pretty correct as a result of they’re data-driven and make use of subtle algorithms.

DeFi Insurance coverage

The rates of interest generated through staking and yield farming far exceed these supplied by organizations like banks. Nevertheless, there’s a substantial threat related to giant returns. Due to this, the ApeSwap platform aids prospects in hedging towards potential dangers related to good contracts. Together with safeguarding towards hackers and bug exploitation, ApeSwap safeguards buyers’ belongings from depreciating when farmed or staking.

ApeSwap Distinctive Options

Partnerships

The “most related and most supporting DEX in crypto” is how ApeSwap describes itself. Its 200+ companions are unfold all through quite a lot of blockchain-related industries, together with NFT, GameFi, DeFi, bridge, launchpads, incubators, and extra. In its ApeSwap Jungle, ApeSwap features a listing of its companions. ApeSwap is ready to supply advertising and marketing as a service to different protocols resulting from its place as a DeFi hub with all of the required options for customers.

A Number of Use Circumstances

ApeSwap consists of all the everyday options of a decentralized change, together with token swaps, lending and borrowing, yield farming, staking, and extra. Nevertheless it goes additional than that, providing worthwhile companies to buyers and protocols.

Its Treasury Payments, as an illustration, allow ApeSwap and different protocols to provide protocol-owned liquidity. One other illustration could be its Preliminary Ape Choices, which function a launchpad. Along with giving protocols a mechanism to kickstart liquidity and benefit from ApeSwap’s advertising and marketing expertise, in addition they enable customers to spend money on potential new protocols.

Group

ApeSwap is run as a DAO and makes an effort to be open about the way it generates and makes use of cash. ApeSwap reserves governance for its most necessary long-term neighborhood members—GNANA holders. It additionally exposes protocol income and burn mechanics on its Financials web page.

Getting Began with ApeSwap

Starting your journey with ApeSwap is so simple as:

- Taking part by partaking with the neighborhood, using the DeFi platform, and buying the BANANA and GNANA native utility tokens.

- Using the DEX to commerce between numerous cryptocurrency tokens on BNB Chain, Polygon, and Ethereum.

- Creating liquidity between cryptocurrency token pairs that reward liquidity supplier (LP) tokens, which might then be staked in yield farms or maximizers to generate BANANA. These tokens can be used to earn buying and selling charges.

- Incomes tokens from associated tasks, staking BANANA or GNANA in staking swimming pools.

- Using the ApeSwap Lending Community to lend and borrow cryptocurrency belongings.

- Participating in preliminary ape choices for brand-new cryptocurrency tasks.

- Shopping for Treasury Payments with LPs to get low-cost BANANA or associate tokens that vest over time.

ApeSwap additionally permits associate crypto tasks to. :

- Promote their cryptocurrency on the decentralized change.

- Get recommendation from the staff.

- Work together with the thriving partnership setting.

- Co-market with the staff to draw new prospects.

- Provide Yield Farms that encourage customers to extend the liquidity of their tokens on the change.

- Make the most of Preliminary Ape Choices and Jungle to boost cash.

Conclusion

The blockchain sector and the worldwide market at giant have benefited from DeFi. ApeSwap supplies decentralized monetary devices that assure easy transactions and maximize buyers’ returns along with performing as a decentralized retailer of worth.

Not like different platforms, ApeSwap is easy to make use of and comprehend. Because of the platform’s use of BNB Chain and its low switching charges, swapping and staking are much more handy and advantageous.

In different phrases, ApeSwap is pushing innovation to develop novel and efficient person engagement methods. The platform is more and more rising as the perfect possibility for buyers wishing to optimize their investments.