With the unprecedented development of the decentralized finance (DeFi) trade, Aave (AAVE) community is changing into a market chief and occupies a prime place within the cryptocurrency lending and borrowing sector.

Learn on to be taught all the things you’ll want to find out about Aave, essentially the most trending DeFi Protocol. We are going to talk about how Aave works, its benefits over different protocols, and the place and how one can purchase Aave tokens or borrow in Aave.

Step 1: Choose a Crypto Alternate

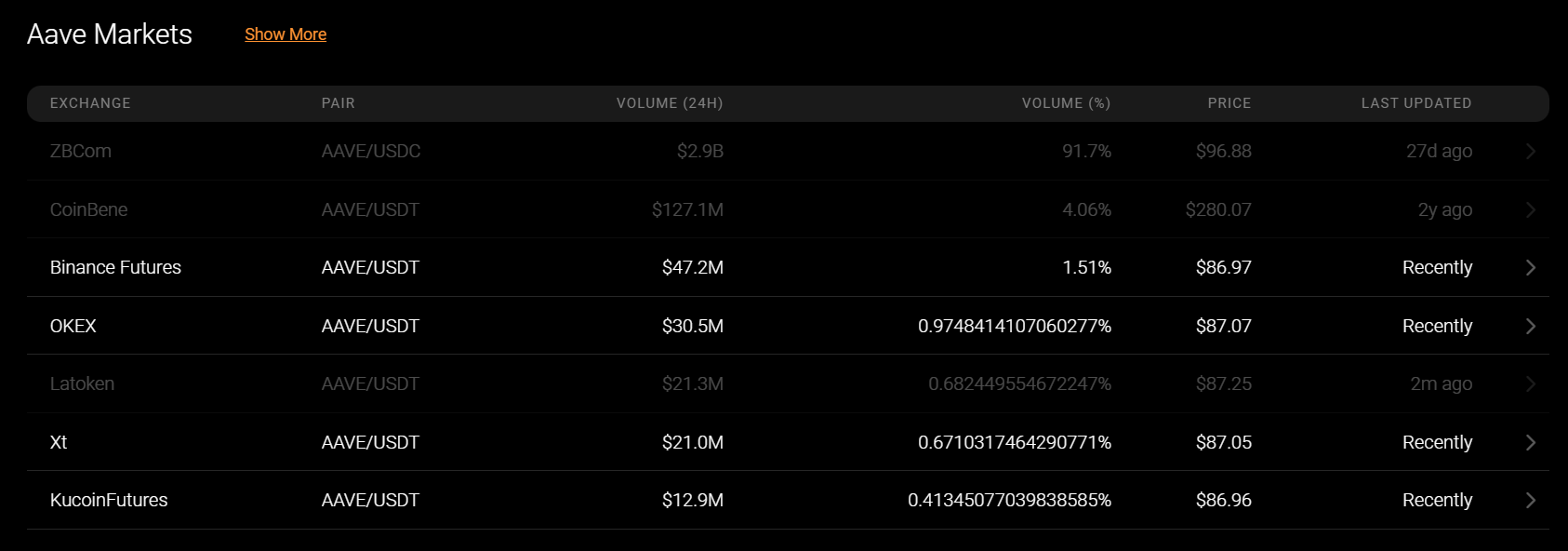

You should purchase AAVE tokens on a number of cryptocurrency exchanges. Go to the market web page on CoinStats to view the trade platforms supporting AAVE. Evaluate the exchanges’ safety, consumer expertise, charge construction, supported cash, and so on., to decide on the one which has the traits you want, resembling inexpensive transaction charges, an intuitive platform, round the clock customer support, and so on. Additionally, think about whether or not the cryptocurrency trade is regulated by the Monetary Trade Regulatory Authority (FINRA), and so on., and lets you purchase AAVE utilizing your most popular cost methodology.

Step 2: Create an Account

After you’ve chosen a cryptocurrency trade that fulfills all of your standards, the next step is to register with the trade utilizing a legitimate e mail or cell quantity. A hyperlink might be despatched to your e mail, and you need to click on it to confirm your e mail. As soon as the account is activated, you need to create an elaborate password, and also you’re good to go.

Some exchanges have strict KYC and AML necessities, and in an effort to get verified, you need to present private data resembling:

- Full identify

- Residential tackle

- Date of Delivery

- ID Doc

In some circumstances, you may additionally must add a selfie or endure video verification to finalize the verification course of.

As soon as your identification verification is full, it’s really useful to activate two-factor authentication (2FA) for an additional layer of safety.

Step 3: Deposit Funds

The subsequent step is to deposit funds into your account. Many crypto exchanges help fiat foreign money resembling USD, EUR, and so on. Merely choose your most popular deposit methodology, resembling a financial institution switch, wire switch, credit score or debit playing cards, e-wallets, PayPal, and so on., and the foreign money you want to deposit. Faucet on “Deposit Funds,” enter the quantity you wish to deposit, and click on “Deposit.”Some deposit strategies are extraordinarily quick, whereas others, relying on the quantity, require affirmation from authorities. Bear in mind to guage the charges of various deposit strategies since some have bigger charges than others.

Linking your debit card to your crypto account is advantageous because it allows you to make immediate or recurring purchases, however bear in mind that it attracts a further charge.

It’s often free to make a financial institution switch out of your native financial institution accounts, however you must nonetheless double-check along with your trade.

AAVE might be traded for an additional foreign money like Ethereum or a stablecoin like Binance USD (BUSD); the buying and selling pairs fluctuate between exchanges, and you need to seek for AAVE on the spot market to pick a pair from the checklist of accessible buying and selling pairs.

Step 4: Purchase AAVE

Comply with the steps under to position a market order to purchase AAVE immediately on the present market value:

- Click on the search bar, enter AAVE, and choose “Purchase AAVE” or the equal.

- Select the cost methodology, the foreign money you want to use, and enter the quantity of AAVE or the fiat quantity to be spent. Most exchanges will routinely convert the quantity to point out you what number of AAVE tokens you’ll get.

- Double-check the transaction particulars and click on “Affirm.”

- The AAVE tokens might be displayed in your steadiness as soon as the transaction is processed.

You too can place a restrict order indicating that you simply wish to purchase AAVE at or under a selected value level. Your dealer will ask you the variety of cash you want to purchase and the utmost value you’re able to pay for every when you’ve positioned an order. The cash will solely seem in your pockets in case your dealer fulfills your order at or under your requested pricing. The dealer might cancel your order on the finish of the day or go away it open if the value will increase over your restrict. In case you’re planning to maintain your newly bought cash for an prolonged interval, we extremely advocate securely storing them in a {hardware} pockets.

To commerce AAVE on spot markets, go to the Commerce web page and seek for the AAVE pairs (AAVE/USD or AAVE/USDT). Choose the buying and selling pair and test the value chart. Click on “Purchase AAVE,” choose the “Market,” enter your quantity or select what portion of your deposit you’d prefer to spend by clicking on the share buttons. Affirm and click on “Purchase AAVE.” Congratulations on including AAVE tokens to your crypto portfolio!

Step 5 (Optionally available): Retailer AAVE

Whereas your AAVE tokens might be saved in your brokerage trade pockets, consultants extremely advocate storing your treasured cash away from trade wallets, as these may be inclined to hacks and interference.

We extremely advocate creating a personal pockets with your personal set of keys. Relying in your investing preferences, you may select between software program and {hardware} wallets:

Software program Wallets

In case you’re seeking to commerce AAVE often, software program or sizzling wallets supplied by your chosen crypto trade will swimsuit you. The energy of software program wallets lies of their flexibility and ease of use. A software program pockets is essentially the most easy-to-set-up crypto pockets and allows you to simply work together with a number of decentralized finance (DeFi) purposes. Nonetheless, these wallets are susceptible to safety leaks as a result of they’re hosted on-line. So, if you wish to hold your personal keys in a software program pockets, conduct due diligence earlier than selecting one to keep away from safety points. We advocate a platform that gives 2-factor authentication as an additional layer of safety.

Examples of software program wallets embrace CoinStats Pockets, MetaMask, Coinbase Pockets, Belief Pockets, and Edge Pockets, amongst others.

{Hardware} Wallets

{Hardware} or chilly wallets are often thought-about the most secure solution to retailer your cryptocurrencies as they provide offline storage, thereby considerably decreasing the dangers of a hack. They’re secured by a pin and can erase all data after many failed makes an attempt, stopping bodily theft. {Hardware} wallets additionally allow you to signal and ensure transactions on the blockchain, providing you with an additional layer of safety in opposition to cyber assaults. These are extra appropriate for skilled customers who personal giant quantities of tokens.

Ledger {hardware} wallets are arguably essentially the most safe {hardware} wallets letting you securely handle your digital belongings. The Nano X is designed for superior customers and affords extra space for storing and superior options than Ledger Nano S, designed for crypto learners.

A {hardware} pockets is costlier than a sizzling pockets, with costs ranging between $50 – $200.

Examples of chilly wallets are Trezor Mannequin T, Ledger Nano X, CoolWallet Professional, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

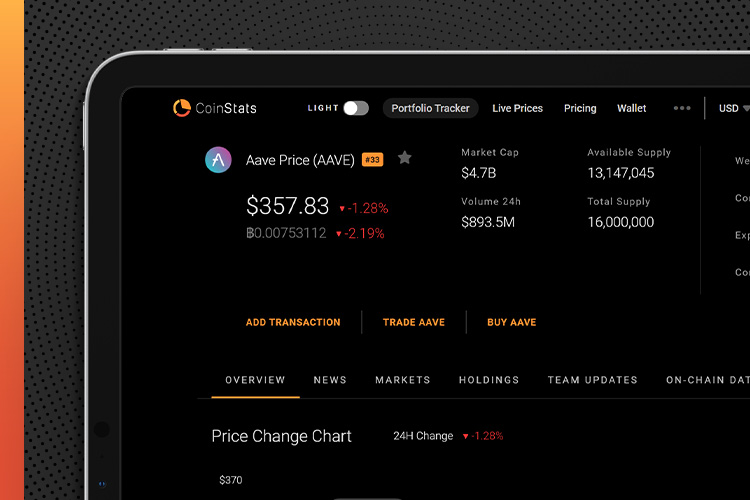

Step 6 (Bonus Step): Monitor AAVE Tokens

The crypto market is risky, and should you maintain a number of belongings, managing your portfolio might get tough. Using a portfolio tracker will enable you to hold monitor of your AAVE tokens and all of your crypto investments from one platform always. CoinStats affords the most effective crypto portfolio trackers available in the market; you will discover extra data right here.

You too can monitor the revenue, loss, and liquidity of AAVE throughout a number of exchanges on CoinStats.

CoinStats helps over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It affords charting instruments, analytical information, superior search options, and up-to-date information. Right here you’ve got the chance to attach an infinite variety of portfolios (wallets and exchanges), together with:

- Binance

- MetaMask

- Belief Pockets

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To attach, go to the CoinStats Portfolio Tracker web page and:

- Click on Add Portfolio and Join Pockets.

- Click on the pockets you wish to connect with (e.g., Ethereum Pockets).

- Enter the pockets tackle and press Submit.

The place to Purchase Aave (Kraken Advice)

There are a number of methods to purchase Aave.

Kraken is extremely really useful as a result of lowest transaction charges amongst all the crypto exchanges. Kraken can be rated one of the safe and trusted crypto exchanges on the planet.

The protocols are rigorously examined and are particularly designed to offer most safety to your digital belongings.

To buy Aave utilizing Kraken, merely observe the steps described within the earlier chapter. You’ll be able to fund your account utilizing fiat foreign money.

The way to Purchase AAVE Utilizing CoinStats

CoinStats is one other good way to purchase Aave. All it’s important to do is create an account with CoinStats. You’ll be able to log in to your Coinbase account or create a brand new profile altogether. Seek for Aave and click on on Commerce Aave. It ought to be famous that you could Commerce Aave after linking your CoinStats profile to your Binance Good Chain Pockets.

You even have the choice of constructing funds via fiat foreign money; nonetheless, this feature is presently restricted to US customers.

Issues to Word When Buying and selling Aave

After finishing your buy, you’ll be able to start buying and selling instantly or maintain on to your token reserves. Because the market is risky, with crypto values altering at times, you may be inclined to reap the benefits of the value fluctuations within the quick time period.

You too can convert the extra Aave tokens you’ve got gained as revenue right into a stablecoin resembling USD Coin and Tether. As well as, some brokers permit changing your Aave earnings on to fiat foreign money resembling US {Dollars} and Euros.

Whereas buying and selling, particularly should you execute a number of trades per day, it’s necessary to decide on a dealer with comparatively low transaction charges.

Lastly, you must ensure to make use of stablecoins as collateral as a result of volatility of crypto. If the worth of your collateral drops drastically (past the given threshold), it could possibly result in liquidation and added charges.

Issues to Contemplate When Selecting an Alternate to Purchase Aave

There are some things to think about whereas selecting amongst cryptocurrency exchanges:

- Status: That is maybe an important issue to think about. Alternate platforms are often appreciated for his or her repute, e.g., Binance.

- Liquidity: You also needs to think about liquidity – how simply Aave is transformed into money or different cash. Excessive liquidity will imply few fluctuations in value.

- Transaction Charges: As mentioned within the earlier chapter, you must think about exchanges with low transaction charges, resembling Kraken, to make worthwhile transactions.

- Wash Buying and selling: Watch out for wash buying and selling on the platform.

- Person Critiques: Person evaluations are extraordinarily useful sources of details about services. The identical applies to crypto trade platforms. Contemplate platforms with optimistic buyer experiences and scores.

Temporary Historical past of AAVE

Aave was established in November 2017 by developer Stani Kulechov who initially launched Aave as ETHLend, with the native token LEND, after an preliminary coin providing (ICO) raised $16.2 million. The Crypto-backed peer-to-peer platform ETHLend would join cryptocurrency lenders and debtors, making it potential to borrow belongings and for lenders to earn curiosity.

ETHLend was later adjusted and rebranded as Aave. The Aave Protocol formally launched on the Ethereum blockchain on 9 January 2020, providing instant-access ‘flash loans’ to customers with out the necessity for collateral.

Aave Protocol has been described as a “decentralized, open-source, and non-custodial cash market protocol” the place depositors can earn curiosity by offering liquidity to lending swimming pools. The important thing distinction was Aave’s algorithmic cash market operate versus ETHLend’s individually matching debtors with appropriate lenders. In Aave’s liquidity pool system, crypto mortgage belongings are pooled collectively, and rates of interest are decided algorithmically. If belongings are in brief provide, rates of interest are set increased; conversely, curiosity is about decrease if there’s a plentiful provide of an asset.

Aave launched new digital services, i.e., Aave Pocket, Aave Lending (SaaS), Aave Gaming, Aave Custody, and Aave Clearing.

How Does AAVE Work?

As an open-source no custodial lending protocol, Aave facilitates loans in quite a lot of cryptocurrencies. Underneath the system’s requirement, lenders need to deposit their funds into liquidity swimming pools, and debtors can borrow from such liquidity swimming pools. The debtors, nonetheless, should deposit a collateral quantity higher than the quantity they borrow in one other cryptocurrency. The Aave protocol has an algorithm that routinely liquidates a borrower’s collateral if its worth falls under a specified ratio to safeguard in opposition to volatility.

Aave offers uncollateralized loans, i.e., flash loans, enabling you to borrow immediately and simply, with out collateral, supplied that the liquidity is returned to the pool inside one transaction block. As Aave spokesperson explains: “Flash loans allow a personalized sensible contract to borrow belongings from our reserve swimming pools inside one transaction on the situation that the liquidity is returned to the pool earlier than the transaction ends. If this doesn’t occur, the transaction is reversed to successfully undo the actions executed till that time, guaranteeing the security of the funds within the reserve pool.”

Aave is audited and secured – every mortgage on the community is managed by a wise contract, verified by third-party auditors. Lenders and debtors can work together with the consumer interface shopper, API, or straight with the sensible contracts on the Ethereum community. The rates of interest are versatile and are freely agreed upon by each events as a result of diploma of belief afforded.

Tokens: AAVE and aTokens

Aave’s AAVE token affords reductions on transaction charges to customers who submit AAVE as collateral, whereas customers who borrow AAVE will not be charged a charge. AAVE holders additionally acquire governance rights over the Aave community.

The second kind of Aave protocol’s tokens is aToken. The Aave protocol permits customers to earn curiosity in real-time as a result of deposits are tokenized as aTokens, issued at a 1:1 ratio upon the deposit of belongings into Aave’s liquidity pool. Curiosity can be paid in aTokens, however they’re transformed again to the asset when lenders withdraw their funds.

Conclusion

Whereas there’s a extensive number of cryptocurrencies on the market, not all of them are worthwhile. There’s appreciable threat concerned in any type of cryptocurrency funding.

Aave, nonetheless, has a number of benefits to be thought-about whereas occupied with investing. Amongst its key benefits are:

- Aave is a decentralized lending system that enables shoppers to borrow, lend and earn pursuits on their crypto belongings with out intermediaries.

- Your complete platform is extremely safe. It operates primarily based on a Security Module protocol, stopping the system from experiencing a capital scarcity. When there aren’t enough belongings to pay again lender deposits, AAVE tokens saved within the security module are bought to cowl the deficit.

- Aave has a fantastic vary of creative decentralized finance merchandise, i.e., flash loans, fee switching, and so on.

- It has a variety of cryptocurrencies to lend/borrow from.

- Aave has aggressive charges.

The primary goal of the AAVE token is governance. Stakeholders can vote on requested adjustments and whether or not new cryptocurrencies ought to be added to the platform for lending and borrowing. To vote, you’ll want to have AAVE tokens or stkAAVE (Staked AAVE) tokens. The tokens themselves signify a monetary share of AAVE.