The highest 10 cryptocurrencies make up a large majority of the full crypto market cap, however there are literally 1000’s of smaller tokens and tasks on the market that compose the remainder. Typically, for varied functions we’ll get into momentarily, you’ll need to swap one cryptocurrency for an additional. This as soon as required promoting one token for fiat, then buying the second with the fiat. It was an costly and inefficient methodology to leap between cash, but it surely was the norm till the innovation of token swaps.

Forward we’ll dive into find out how to swap cryptocurrency, together with some key options and advantages.

On this article

What’s crypto swapping?

Crypto swapping means that you can immediately commerce one cryptocurrency for an additional, with no crypto-to-fiat trade required. Saving time and paying much less in charges are apparent advantages, but it surely’s removed from the one purpose customers take part in swapping.

Crypto tokens are successfully the keys to their native blockchain’s kingdom, affording holders varied advantages inside their ecosystems. Token holders might have the chance to vote on neighborhood governance proposals that information the way forward for a challenge or stake their share in trade for passive curiosity revenue. Swapping makes it simpler for crypto customers to discover the additional reaches of the blockchain, and be part of a number of tasks they want to help.

Typically swaps are essential to cowl the charges on a transaction that may solely be paid in a selected blockchain’s native coin. Different instances, merchants will carry out a token swap within the hopes of capitalizing on a transfer out there they sense is coming. Taking part in sure protocols, comparable to decentralized finance (DeFi), can solely be achieved through particular blockchains. This implies for those who’re a Bitcoin consumer, you could have to swap for some Ethereum or one other ERC-20-compatible token in order for you entry to the DeFi ecosystem.

Crypto swap vs trade/commerce

It’s true that the phrases “swap” and “commerce” could be taken as synonyms, however in crypto parlance they’ve fairly completely different meanings. Though the top result’s basically the identical (begin with one coin, finish with one other), their respective processes fluctuate vastly.

Buying and selling requires exchanging one cryptocurrency for fiat after which buying one other coin with the fiat you obtained. If going down on a crypto trade, you’ll be hit with no matter fee or different charges they cost on each side of the transaction.

Swapping, alternatively, permits customers to seamlessly switch one cryptocurrency for an equal quantity in worth of one other. Transactions occur instantaneously, and with out the necessity to first trade crypto for fiat. Crypto exchanges supply up varied “buying and selling pairs”, asset mixtures that may be swapped inside their platform. Totally different swap providers supply completely different buying and selling pairs, and people permitting swaps between two very small or obscure cash could also be harder to search out.

How do I swap crypto?

Swapping is a well-liked exercise amongst crypto customers, so providers of varied varieties and sizes now supply swaps. There are three major venues the place crypto swapping takes place:

- Inside a pockets (just like the BitPay Pockets)

- Decentralized exchanges

- Centralized exchanges

Swapping inside the BitPay Pockets

Swapping instantly from the BitPay Pockets is a simple method to preserve full management over your crypto conveniently in a single place. The BitPay Pockets is a non-custodial pockets (aka self-custody), which means that there is no such thing as a third get together holding your crypto. You have got full management over your property, BitPay simply assists in making the transactions. BitPay companions with Changelly to facilitate low-fee swaps for over 50 cash throughout the preferred blockchains.

Professionals

- Quick swaps on high cash

- Swapped crypto stays in a self-custody pockets beneath your management

- Consumer-friendly course of; little technical data required

- Excessive swap limits

- Removes the prospect of human error vs a handbook swap

Cons

- Some limitations on swapping obscure tokens

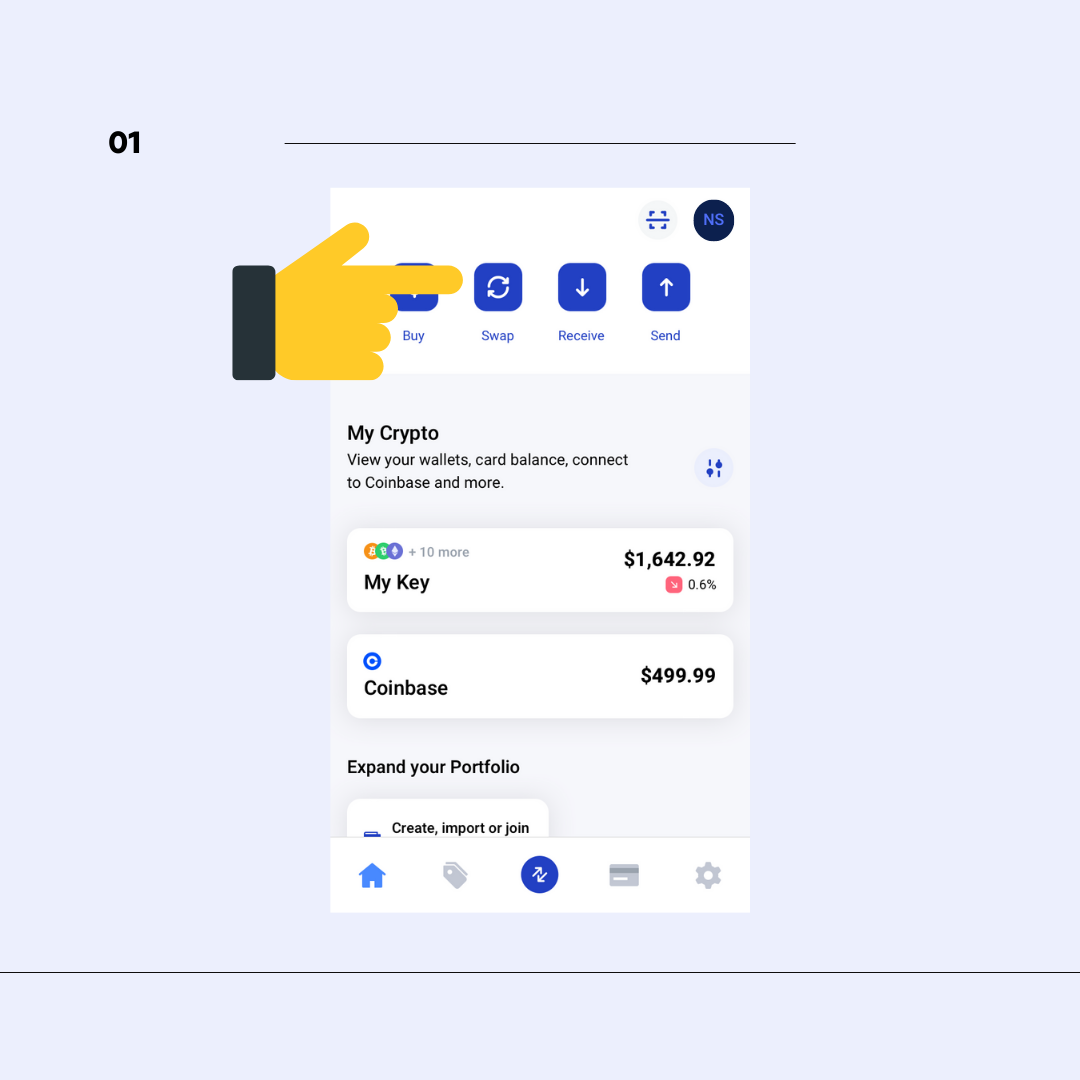

Step 1: Faucet Swap

Open your BitPay Pockets and faucet the Swap possibility on the house display screen.

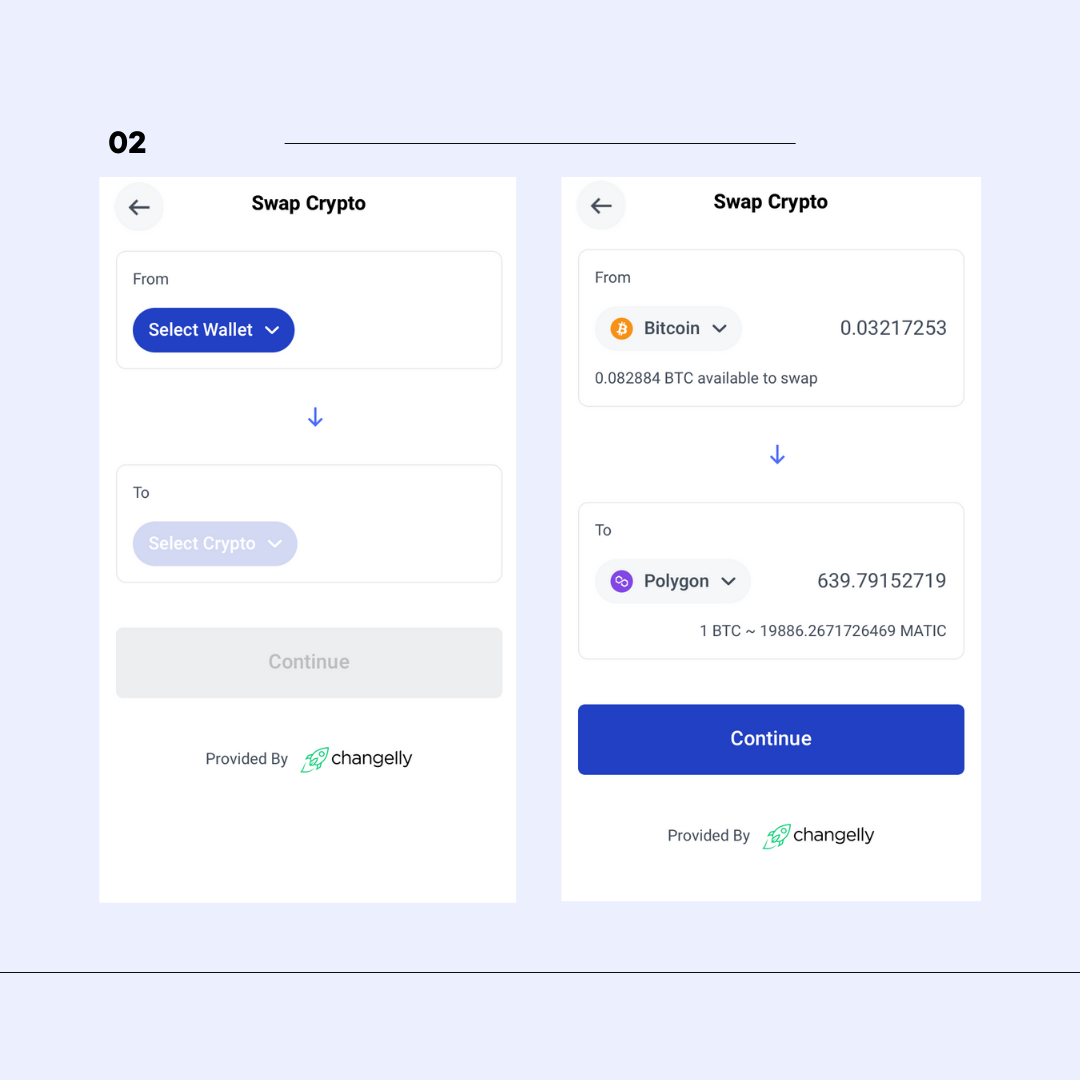

Step 2: Select your swap pair

Choose the crypto you need to swap (From) and the token you’d prefer to obtain (Swap to). Then enter the quantity of crypto you need to swap (both in fiat or sats/gwei).

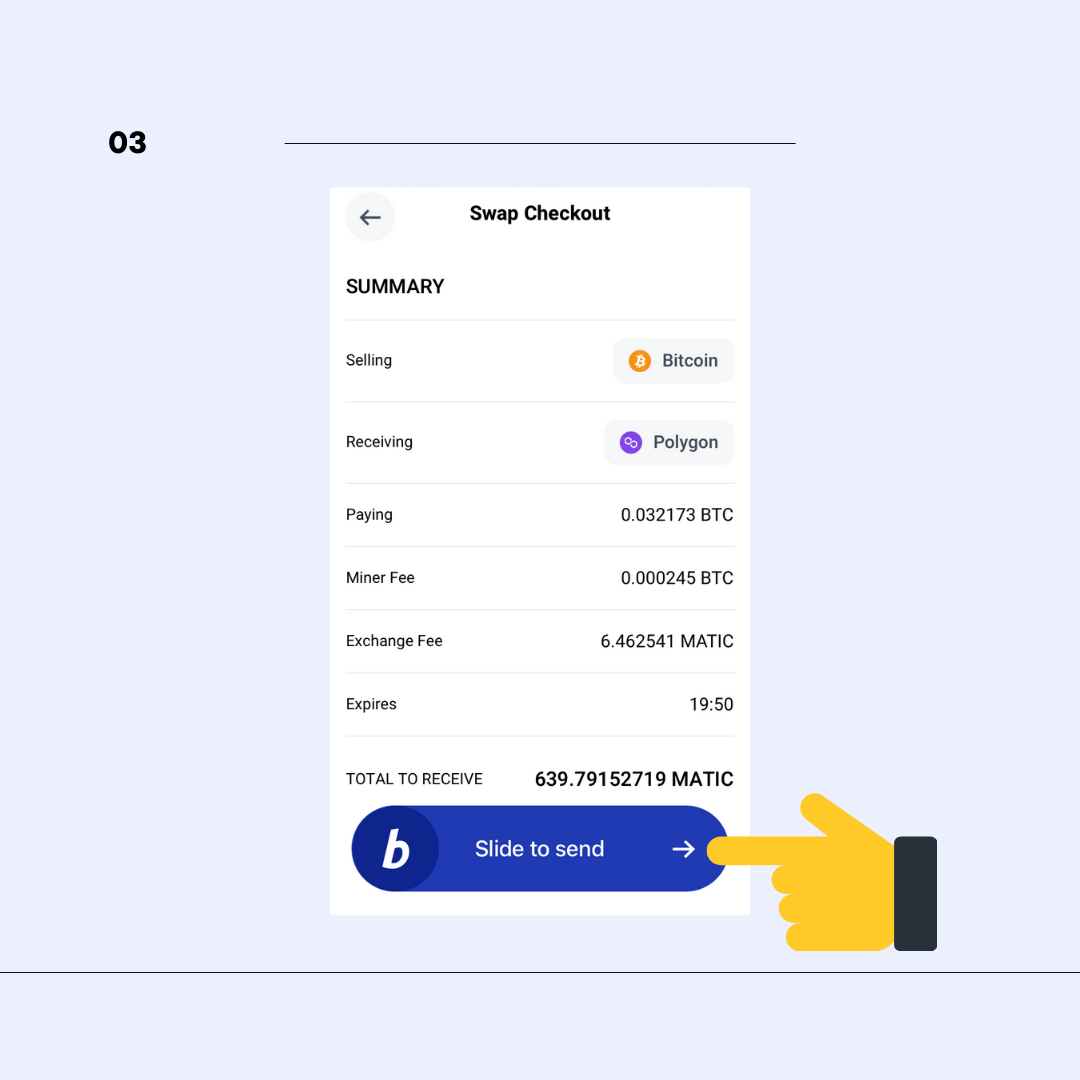

Step 3: Evaluate swap particulars and ensure

You’ll see a swap particulars web page with the swap abstract together with outgoing funds, affiliate charges and the full quantity of crypto you’ll obtain. This supply will expire, so be sure to substantiate the swap in a well timed method. Settle for Changelly phrases and slide to substantiate the swap.

Swap on a DEX (Decentralized Alternate)

A decentralized trade (DEX) includes no central governing authority, and as a substitute is regulated utilizing self-executing sensible contracts. DEXes are peer-to-peer, which means they permit customers to instantly trade cryptocurrency with no intermediary. You’ll be able to normally inform if a service is a DEX as a result of their names usually include the phrase “swap”. Some widespread choices embrace Uniswap, PancakeSwap and SushiSwap.

Professionals

- Extra anonymity transacting by a DEX

- Improved safety; no have to belief a third-party

- No third-party holds your personal keys

- Can swap nearly any cash

Cons

- Much less user-friendly; requires extra technical know-how

- Transaction dimension could be restricted by low liquidity in smaller tasks or cash

Swap on a CEX (Centralized Alternate)

Centralized exchanges, comparable to Coinbase or Kraken, are platforms owned or operated by a central group that facilitates transactions between customers. Many CEXes supply crypto swapping providers, mainly differentiating their choices by the number of out there buying and selling pairs in addition to their transaction charges. As a result of most customers begin their crypto journeys with a centralized trade, they’re designed to be user-friendly. As an arm of the custody service, your crypto obtained within the swap will stay beneath management of the trade.

Professionals

- Excessive liquidity permits for larger-volume buying and selling

- Platforms are simple to make use of for all crypto expertise ranges

- Low technical data wanted

Cons

- Should entrust safety of personal keys to 3rd get together

- Exchanges determine which buying and selling pairs to make out there

What’s an atomic swap?

Very like the way you’d by no means put diesel gasoline in a standard engine, makes an attempt to ship crypto to an incompatible blockchain can lead to catastrophe, together with misplaced funds. For instance, you’ll be able to’t ship Bitcoin to an Ethereum tackle, and vice versa. To securely execute a commerce throughout blockchains requires an atomic swap, a peer-to-peer methodology of exchanging cryptocurrencies between two completely different blockchains with out the necessity for any third-party involvement.

Atomic swaps embrace built-in features requiring each members to satisfy sure predetermined steps earlier than a transaction could be finalized. Atomic swaps make the most of one thing referred to as Hashed Timelock Contracts (HTLC) which impose sure buying and selling circumstances and a time constraint mandating additionally they have to be accomplished inside a set time.

A simplified model of how this works is as follows. Alice and Bob have agreed to trade her 25 ETH for his 1.5 BTC. First, Bob should create a sensible contract tackle to which he sends his BTC. The contract will auto-generate a novel cryptographic key that’s wanted to entry the funds. Primarily based on this key, the sensible contract additionally generates an encrypted (or “hashed”) model of the important thing, which Bob then sends to Alice.

Utilizing this hashed key, Alice can confirm that Bob has certainly deposited his funds. Nonetheless there’s no potential approach for her to withdraw the funds till the circumstances of the swap have all been met. Alice should then generate her personal contract tackle based mostly on the hashed key the place she will be able to ship her ETH. As soon as Bob claims the funds Alice has locked up within the sensible contract, the password Alice must entry Bob’s deposit is mechanically revealed.

Is swapping crypto taxable?

The dreaded “taxable occasion” is the scourge of any trustworthy crypto dealer. It’s well-known that any crypto-to-fiat trade is taken into account taxable within the eyes of the Inside Income Service (IRS). However what many individuals don’t know is that even crypto swaps are seen as taxable occasions, and due to this fact are topic to capital beneficial properties tax.

Which cryptos can I swap?

Between the choices outlined above, you’ll be able to trade nearly any cryptocurrency for every other, although some swaps could also be tougher to search out. If using a centralized trade (CEX), your choices will likely be restricted by the buying and selling pairs the corporate decides to supply. By means of a decentralized trade (DEX), peer-to-peer swaps of any two cryptos can happen so long as there’s a prepared get together on each side of the transaction.