A broadly adopted crypto dealer claims the uncertainty shrouding Bitcoin’s (BTC) subsequent bull market would be the gas that ends the bear market.

The pseudonymous crypto analyst Rekt Capital warns their 330,300 Twitter followers that any ‘robust bearish convictions’ might trigger them to overlook out on the following huge bull run.

“Individuals doubting if BTC will expertise one other Bull Market is precisely what is required for one to occur

BTC Bull Markets are constructed on FOMO [fear of missing out]

To FOMO into an uptrend, you must really feel you’re lacking out

And robust bearish convictions will make you miss out.”

Subsequent, the analyst dives into the psychology of worth zones. They use June highs and lows for example, mentioning that BTC’s June lows at the moment are performing as a resistance degree.

“BTC June lows had been as soon as a assist

Now June lows are performing as resistance

When it comes to psychology, individuals had been prepared to purchase at June lows

However now individuals are way more prepared to promote at June lows

How issues have modified inside just a few months.”

Seemingly advising their followers to be affected person, Rekt says that, traditionally talking, Bitcoin bear market bottoms take months to settle.

“Typical BTC Bear Market bottoms are inclined to take months to develop earlier than a brand new macro uptrend begins

Capitulating into an absolute generational backside is one factor

The prolonged consolidation that follows is one other.”

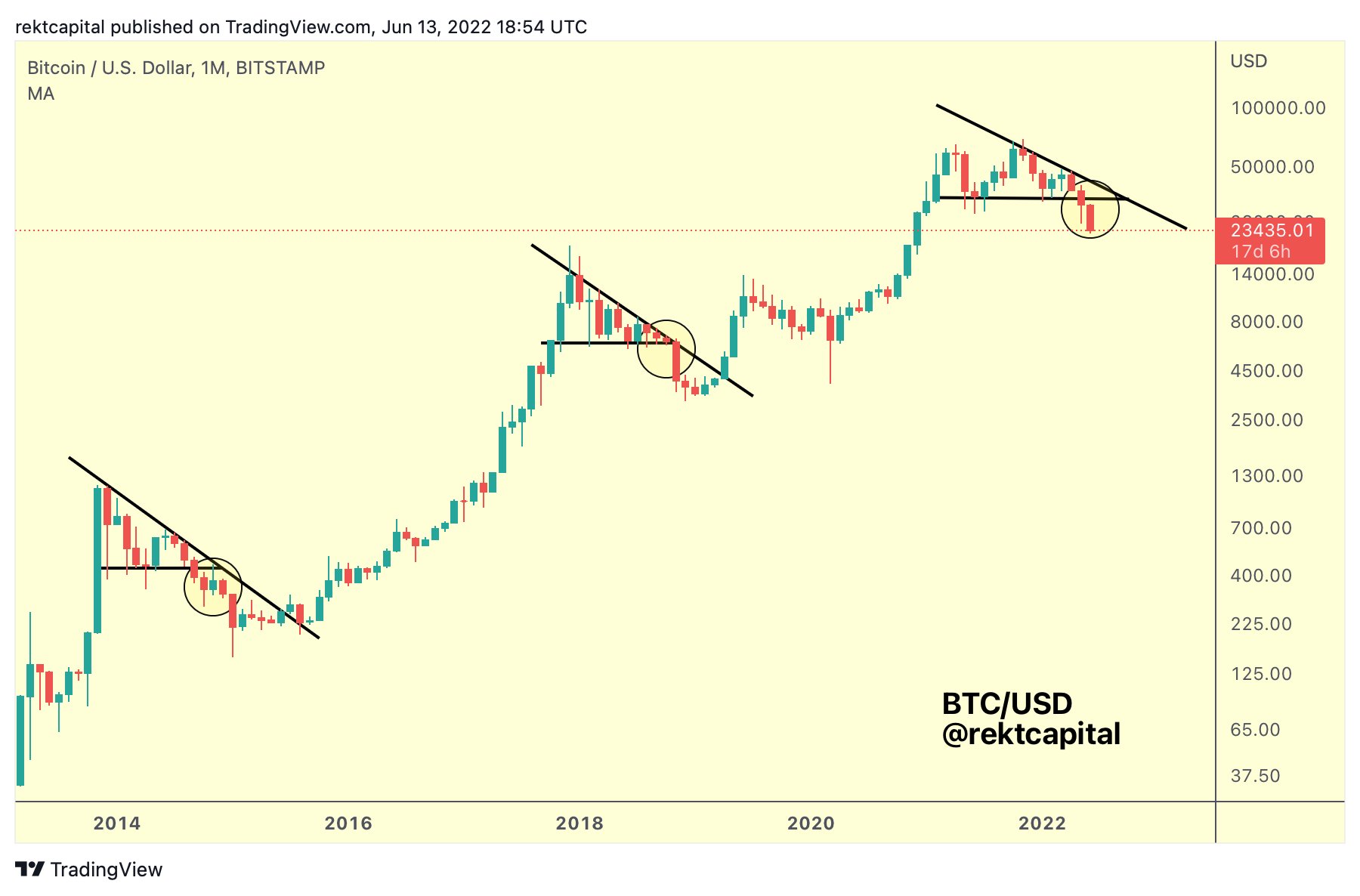

For instance their level about bear market bottoms, capitulation, and consolidation, the dealer additionally shares a long-term Bitcoin chart they first shared again in June.

“In line with the Three Macro Triangles, BTC is now within the Downtrend Acceleration part in an effort to kind a generational backside.”

BTC goes for $16,652 at time of writing, up 5.7% on the week however down 76% from the all-time excessive reached on November 10, 2021.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/johnpluto