Uniswap is an revolutionary decentralized alternate protocol constructed on Ethereum. It goals to unravel decentralized exchanges’ liquidity downside by permitting the alternate platform to swap tokens with out counting on patrons and sellers creating that liquidity. Uniswap incentivizes Uniswap customers to take care of the alternate’s liquidity, offering parts of the transaction charges and newly minted UNI tokens to those that take part.

UNI is the token for Uniswap. It’s a governance token, so homeowners can take part in selections on community upgrades and insurance policies, with every vote being proportional to the quantity of UNI cryptocurrency they stake.

Learn on to study every little thing it is advisable know in regards to the Uniswap mission, the UNI token, and learn how to begin investing in UNI.

Step #1: Choose a Crypto Change

Uniswap (UNI) tokens can be found on a rising variety of cryptocurrency exchanges. Go to the market web page on CoinStats to view the alternate platforms supporting UNI. Examine the exchanges’ safety, consumer expertise, charge construction, supported crypto belongings, and many others., to decide on the one with the options you want, resembling inexpensive transaction charges, top-notch safety, excessive buying and selling quantity, an intuitive platform, round the clock customer support, and many others. Additionally, take into account whether or not the cryptocurrency alternate is regulated by the Monetary Business Regulatory Authority (FINRA) and lets you purchase UNI utilizing your most well-liked cost technique.

To commerce cryptocurrencies, you have to use a centralized or decentralized crypto alternate, so let’s look into the main points of every sort under.

Centralized Change

A centralized crypto alternate or CEX, resembling Coinbase, eToro, Binance, and many others., capabilities as a intermediary between patrons and sellers and fees particular charges for utilizing their providers. Most crypto transactions are carried out on centralized exchanges, permitting customers to purchase and promote cryptocurrencies for fiat currencies such because the US greenback or digital belongings like BTC and ETH. Centralized exchanges require their customers to observe KYC (know your buyer) and AML (anti-money laundering) guidelines by offering some info and private identification paperwork. Nonetheless, the downside of buying and selling on a CEX is that it’s extremely weak to hacking or cybersecurity threats.

Decentralized Change

Alternatively, a decentralized alternate (DEX), like Uniswap, SushiSwap, Shibaswap, and many others., is a non-centralized different to a centralized alternate and isn’t ruled by any central authority. As a substitute, it operates over blockchain and fees no charge apart from the gasoline charge relevant on a specific blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use good contracts to let individuals commerce crypto belongings while not having regulatory authority. They deploy an automatic market maker to take away any intermediaries and provides customers full management over their funds. This technique is safer since no safety breach is feasible. Nonetheless, decentralized exchanges are much less user-friendly when it comes to interface and forex conversion. As an example, they don’t at all times permit customers to commerce crypto with fiat forex; customers must both already personal crypto or use a centralized alternate to get crypto. One other downside of decentralized exchanges is that it has failed to realize liquidity ranges akin to centralized exchanges. It additionally takes longer to seek out somebody trying to commerce with you as DEX engages in peer-to-peer commerce, and if liquidity is low, you’ll have to just accept concessions on value and shortly promote or purchase low-volume crypto.

You’ll be able to checklist something on a DEX, which suggests you’ve got entry to new, in-demand belongings whereas additionally taking up extra threat.

Step #2: Create an Account

After you’ve chosen a cryptocurrency alternate that fits your funding wants, you have to register with the alternate utilizing a sound electronic mail or cellular quantity. A hyperlink can be despatched to your tackle, and you have to click on it to confirm your account. As soon as the account is activated, you have to create an elaborate password, and also you’re good to go.

Some exchanges have strict KYC and AML necessities, and so as to get verified, you have to present private info resembling:

- Full identify

- Residential tackle

- Date of Delivery

- ID Doc.

In some circumstances, you may additionally must add a selfie or endure video verification to finalize the verification course of.

As soon as your identification verification is full, it’s beneficial to activate two-factor authentication (2FA) for an additional layer of safety.

Step #3: Deposit Funds

The subsequent step is to deposit funds into your account. Many crypto exchanges help fiat currencies like USD, EUR, and many others. Merely choose your most well-liked deposit technique, resembling a financial institution switch, wire switch, credit score or debit playing cards, e-wallets, PayPal, and many others., and the forex you want to deposit. Faucet on “Deposit Funds,” enter the quantity you need to deposit and click on “Deposit.”

Some deposit strategies are extraordinarily quick, whereas others, relying on the quantity, require affirmation from authorities. Keep in mind to judge the charges of various deposit strategies since some have bigger charges than others.

Linking your debit card to your crypto account is advantageous because it allows you to make prompt or recurring purchases, however remember that it attracts a further charge.

It’s often free to make a financial institution switch out of your native financial institution accounts, however you need to nonetheless double-check along with your alternate.

UNI could be traded for an additional cryptocurrency or a stablecoin; the buying and selling pairs range between exchanges. So, you have to seek for UNI on the spot market to pick out a pair from the checklist of accessible buying and selling pairs.

Step #4: Purchase UNI

Comply with the steps under to position a market order to purchase UNI immediately on the present market value:

- Click on the search bar, enter UNI, and choose “Purchase UNI” or the equal.

- Choose a buying and selling pair you want to purchase UNI towards.

- Select the cost technique, the forex you want to use, and enter the quantity of UNI or the fiat quantity to be spent. Most exchanges will routinely convert the quantity to indicate you what number of UNI tokens you’ll get.

- Double-check the transaction particulars and click on “Affirm.”

- The UNI tokens can be displayed in your stability as soon as the transaction is processed.

You may as well place a restrict order indicating that you just need to purchase UNI at or under a selected value level. Your dealer will ask you the variety of cash you want to purchase and the utmost value you’re able to pay for every when you’ve positioned an order. The cash will solely seem in your pockets in case your dealer fulfills your order at or under your requested pricing. The dealer might cancel your order on the finish of the day or go away it open if the worth will increase over your restrict.

If you happen to’re planning to maintain your newly bought cash for an prolonged interval, we extremely advocate securely storing them in a {hardware} pockets.

To commerce UNI on spot markets, go to the Commerce web page and seek for the UNI pairs ( UNI/USD or UNI/USDT). Choose the buying and selling pair and test the worth chart. Click on “Purchase UNI,” choose the “Market,” enter your quantity or select what portion of your deposit you’d prefer to spend by clicking on the proportion buttons. Affirm and click on “Purchase UNI.”

Congratulations on including Uniswap (UNI) tokens to your crypto portfolio!

Step #5 (Optionally available): Retailer UNI

Whereas your UNI tokens could be saved in your brokerage alternate pockets, consultants extremely advocate storing your valuable cash away from alternate wallets, as these is likely to be inclined to hacks and interference.

We extremely advocate creating a personal pockets with your personal set of keys. Relying in your investing preferences, you may select between software program and {hardware} wallets:

Software program Wallets

If you happen to’re trying to commerce UNI commonly, software program or sizzling wallets supplied by your chosen crypto alternate will swimsuit you. The power of software program wallets lies of their flexibility and ease of use. A software program pockets is probably the most easy-to-set-up crypto pockets and allows you to simply work together with a number of decentralized finance (DeFi) purposes. Nonetheless, these wallets are weak to safety leaks as a result of they’re hosted on-line. So, if you wish to hold your personal keys in a software program pockets, conduct due diligence earlier than selecting one to keep away from safety points. We advocate a platform that gives 2-factor authentication as an additional layer of safety.

Examples of software program wallets embrace CoinStats Pockets, MetaMask, Coinbase Pockets, Belief Pockets, and Edge Pockets, amongst others.

{Hardware} Wallets

{Hardware} or chilly wallets are often thought-about the most secure solution to retailer your cryptocurrencies as they provide offline storage, thereby considerably decreasing the dangers of a hack. They’re secured by a pin and can erase all info after many failed makes an attempt, stopping bodily theft. {Hardware} wallets additionally allow you to signal and ensure transactions on the blockchain, supplying you with an additional layer of safety towards cyber assaults. These are extra appropriate for knowledgeable customers who personal giant quantities of tokens.

Ledger {hardware} wallets are arguably probably the most safe {hardware} wallets letting you securely handle your digital belongings. The Nano X is designed for superior customers and presents extra cupboard space and superior options than Ledger Nano S, designed for crypto newcomers.

A {hardware} pockets is costlier than a sizzling pockets, with costs ranging between $50 – $200.

Examples of chilly wallets are Trezor Mannequin T, Ledger Nano X, CoolWallet Professional, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

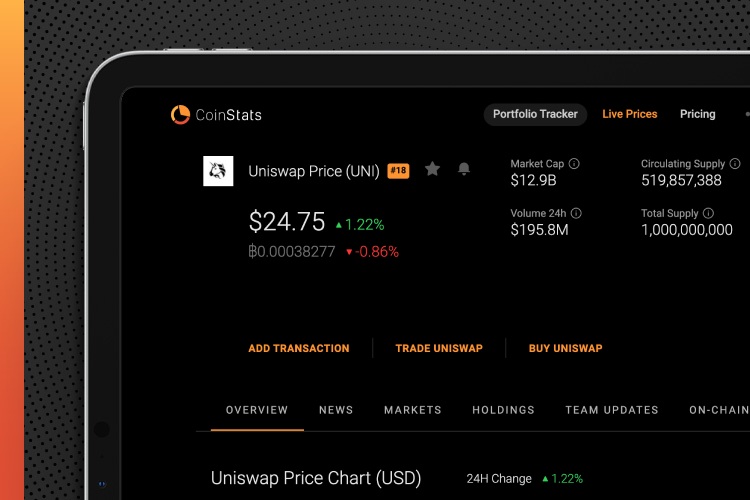

Step #6 (Bonus Step): Observe UNI Tokens

The crypto market is unstable, and managing your portfolio may get tough for those who maintain a number of belongings. Using a portfolio tracker will enable you to hold monitor of your UNI tokens and all of your crypto investments from one platform always. CoinStats presents among the best crypto portfolio trackers available in the market; yow will discover extra info right here.

You may as well monitor the revenue, loss, and liquidity of UNI throughout a number of exchanges on CoinStats.

CoinStats helps over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It presents charting instruments, analytical knowledge, superior search options, and up-to-date information. Right here you’ve got the chance to attach a limiteless variety of portfolios (wallets and exchanges), together with:

- Binance

- MetaMask

- Belief Pockets

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To attach, go to the CoinStats Portfolio Tracker web page and:

- Click on Add Portfolio and Join Pockets.

- Click on the pockets you need to connect with (e.g., Ethereum Pockets).

- Enter the pockets tackle and press Submit.

What Is Uniswap (UNI)?

Uniswap is a decentralized alternate or DEX engaged on the Ethereum blockchain. It was launched in 2018 and is the second-biggest cryptocurrency program when it comes to market capitalization globally.

Uniswap is an Automated Liquidity Protocol for buying and selling ERC20 tokens. In distinction to different exchanges, which take buying and selling fees, Uniswap works for public welfare. It permits customers to alternate tokens with none intermediaries, reaching a excessive stage of decentralization.

Uniswap operates by way of contracts constructed into its protocol and makes use of an introductory numerical assertion and provides of ETH and tokens to do the same activity.

The protocol depends on liquidity suppliers creating liquidity swimming pools that present liquidity throughout the platform, permitting customers to seamlessly swap between primarily any ERC-20 tokens with out the necessity for an order ebook.

In distinction to a centralized alternate, there isn’t any itemizing course of on Uniswap. Any ERC-20 token could be launched for buying and selling on the Uniswap platform so long as a liquidity pool is on the market. Uniswap doesn’t cost any itemizing charges, making it important for brand new or smaller ERC-20 tasks.

Uniswap permits customers to retain management of personal keys, eliminating the danger of shedding belongings if the alternate is ever hacked.

Uniswap fees customers a flat 0.30% charge for each commerce on the platform and routinely sends it to a liquidity reserve.

When a liquidity supplier exits, they obtain a portion of the full charges from the reserve relative to their staked quantity in that pool.

After the Uniswap v.2 improve, a brand new protocol charge was launched that may be turned on by way of a group vote and sends 0.05% of each 0.30% buying and selling charge to a Uniswap fund to finance future growth. Presently, this charge possibility is turned off; nevertheless, LPs will begin receiving 0.25% of pool buying and selling charges if it’s turned on.

How Uniswap (UNI) Works?

Uniswap doesn’t observe the centralized exchanges’ typical engineering of superior commerce and works with out an order ebook. It makes use of Fixed Product Market Maker design, a variation of a typical decentralized alternate mannequin generally known as Automated Market Maker (AMM).

AMM are good contracts that maintain liquidity swimming pools (reserves) that merchants can alternate in trades. These swimming pools are funded by incentivized liquidity suppliers.

Anybody who lends an equal worth of two tokens within the pool is a liquidity supplier. In return for his or her stake in liquidity swimming pools, merchants pay a charge to the pool distributed to liquidity suppliers in accordance with their share of the pool.

These tokens can both be an Ethereum token and any ERC-20 token or two ERC-20 tokens. These swimming pools are made up of stablecoins resembling USDC, DAI, or USDT, but this isn’t obligatory. LPs are rewarded with liquidity tokens primarily based on their share of the complete liquidity pool.

Uniswap (UNI) is the asset that powers Uniswap. Its major use case is as a governance token. Uniswap (UNI) tokens allow a decentralized cost technique, offering extra management over your cash. UNI will also be used for hypothesis, funding, or as a substitute for costly and sluggish worldwide transfers. It will probably additionally contribute to another monetary system for individuals with entry to smartphones however not a checking account.

The right way to Purchase Uniswap (UNI) on CoinStats?

CoinStats is likely one of the greatest crypto platforms round. It lets you test present market costs, together with in-depth info on a number of of the largest and fastest-growing cryptocurrencies.

CoinStats is a cryptocurrency analysis and portfolio tracker app that gives helpful info on cryptocurrency information and funding recommendation to assist buyers make higher selections.

To purchase UNI on CoinState, all you need to do is create an account on the platform. This can be a easy, simple course of. As soon as your account has been created, go to the search part and enter UNI. From right here, you’ll be able to simply make trades and swap tokens.

As well as, guides and academic weblog posts resembling UNI value or how-to-buy guides like learn how to purchase cosmos, learn how to purchase AAVE on Coinstats, and rather more are extremely beneficial for buyers.

Issues to Know Earlier than Shopping for Uniswap (UNI)

Along with the knowledge on Uniswap described above, there are just a few extra components to think about earlier than shopping for Uniswap (UNI):

Lending and Liquidity

Uniswap rewards customers who lend their crypto to make sure there are adequate funds in its liquidity swimming pools.

When including liquidity, it is advisable contribute equal quantities of each cryptocurrencies to the pool. In return to your contribution, Uniswap can pay you a share of the gasoline charges for that liquidity pool.

The thought is that customers can earn tokens in alternate for offering the liquidity essential to facilitate trades of a selected token pair on the platform.

Danger

Crypto belongings are extremely speculative, contain a excessive diploma of threat, and may lose their worth quickly and considerably sooner or later.

So, be sure you perceive the dangers concerned earlier than shopping for Uniswap. One other potential downside with crypto buying and selling is that regulators might attempt to put down decentralized finance, DeFi as an entire, which may negatively have an effect on Uniswap.

This content material and any info contained therein is meant for informational and academic functions solely, doesn’t represent a advice by CoinStats to purchase, promote, or maintain any safety, monetary product, or instrument referenced within the content material, and doesn’t represent funding recommendation, monetary recommendation, buying and selling recommendation, or another recommendation.

Uniswap: To Commerce or Promote

After the acquisition of your tokens, you’ll must resolve learn how to use them. You have got three choices: to carry, promote, or commerce.

You have got two choices for promoting your Uniswap tokens:

- You’ll be able to promote your UNI tokens immediately for {dollars}, with the choice of withdrawing this cash to your checking account or bank card.

- In case your chosen platform doesn’t permit a direct sale from UNI to fiat forex, you need to alternate your Uniswap for Ethereum or Bitcoin, then switch your ETH or BTC to a platform the place you’ll be able to convert these for {dollars}. You’ll then be capable to switch the cash to your checking account or bank card.

To commerce tokens on Uniswap, observe these steps:

- Join your pockets. Hook up with Uniswap utilizing a pockets.

- Select the token pair. Select from out there ERC-20 tokens on the “Swap” part of the web site. You will want to decide on each the token you’re promoting and the one you’re shopping for.

- Evaluate settings. Skilled merchants can use the settings icon within the prime left nook of the Swap interface to set slippage tolerance and most commerce time.

- Swap. Click on “Swap,” evaluation the transaction (together with Uniswap buying and selling charges), and ensure it by your pockets (which is able to embrace Ethereum gasoline charges). After affirmation, the AMM mannequin completes the remainder of the transaction on the Ethereum blockchain, and also you obtain your new tokens into your pockets routinely.

Conclusion

The Uniswap mission’s decentralization and open governance by its UNI token make it extremely popular. Uniswap’s liquidity swimming pools are additionally enticing for buyers who need to earn earnings on cryptocurrency staking. AMM procedures on Uniswap are permissionless, which means there are not any necessities to meet KYC standards and no cyber attackers. Uniswap is user-friendly – the one factor it is advisable commerce is an Ethereum pockets. Final however not least, there isn’t any must pay for token or coin itemizing tax.