The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Genesis Seems For Liquidity Injection

Should you don’t find out about Genesis Buying and selling maybe it’s best to. They signify the spine infrastructure of the institutional investor base within the bitcoin and broader crypto markets. For lending, buying and selling, hedging, trade yields and extra, Genesis Buying and selling was the brokerage to facilitate all of this exercise within the area. Bear in mind these juicy yields from the BlockFi and Gemini Earn merchandise within the area? Genesis is the intermediary between these platforms and hedge funds to generate that yield.

Genesis held a brief consumer name to announce the suspension of redemptions, withdrawals and new mortgage originations. With publicity to FTX and Alameda Analysis, the corporate now wants one other liquidity injection after having practically $175 million locked in a buying and selling account with FTX. As an preliminary response, father or mother firm Digital Forex Group (DCG, the father or mother firm of Grayscale), injected $140 million into the enterprise to maintain operations operating easily. But, Genesis is now scrambling to search out extra capital. It’s the explanation Gemini Earn needed to halt withdrawals.

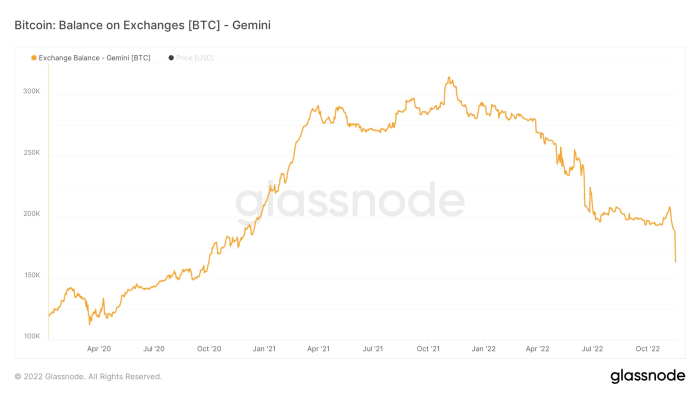

Though Gemini has been vocal that the remainder of their operations are working usually, limiting the Gemini Earn product and having service outages throughout the platform appear to have sparked a small rush to get bitcoin off the trade: 13% of the full bitcoin stability has left during the last 24 hours. As we’ve highlighted earlier than, exchanges aren’t the place to your bitcoin, particularly when there’s a excessive chance that there’s one other trade (and even a number of) left to fall.

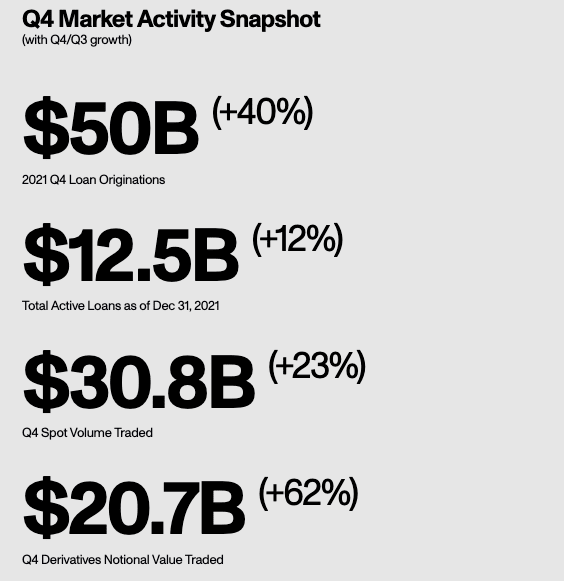

To provide you an thought of dimension, Genesis had $50 billion in mortgage originations in a single quarter and a $12.5 billion energetic mortgage e-book on the peak of the market again in 2021. But, mortgage originations and the energetic mortgage e-book each took a hefty haircut, falling to $8.4 billion and $2.8 billion respectively, as of the third quarter of this yr. Again in July, Genesis filed a $1.2 billion declare in opposition to Three Arrows Capital that was picked up by DCG to maintain the hit off Genesis’ books. Loans had been partially collateralized with shares of GBTC, ETHE, AVAX and NEAR tokens.

Supply: Genesis Quarterly Report

We all know from on-chain exercise that Genesis had tons of interactions with Alameda, Gemini and BlockFi by way of their OTC buying and selling desk; FTT was additionally a prime token obtained and despatched in that exercise. With out Genesis sharing extra particulars, we don’t know the extent of the publicity and capital wanted to make prospects complete. But, the truth that the father or mother firm DCG hasn’t already stepped in to supply one other liquidity injection is a warning signal on the place this may find yourself. Information surfaced that Genesis is searching for a $1 billion credit score facility instantly. Not good.

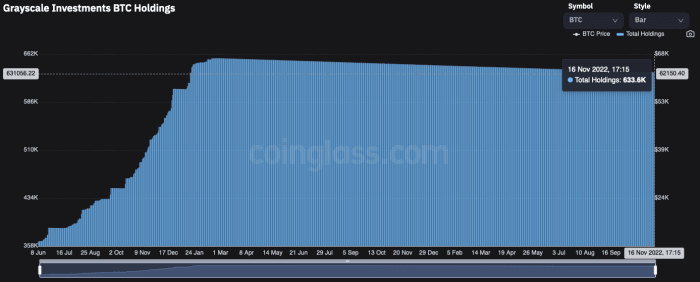

Within the worst-case situation, the dearth of funding provided by DCG may spark questions round accessible liquid property. DCG and Grayscale have dissolved trusts earlier than and that possibility is just not off the desk. It’s an unlikely path however actually one to spotlight since Grayscale is the biggest holder of bitcoin by way of the Grayscale Bitcoin Belief, holding practically 633,600 bitcoin. Simply, this could possibly be a regulatory subject or one other limitation (that we don’t find out about) the place DCG can not provide the capital to Genesis.

Supply: Coinglass.com

Circle, the issuer of the stablecoin USDC, additionally has ties to Genesis. But, they spotlight that their Circle Yield product solely accounts for $2.6 million in collateralized loans excellent which, if true, is pretty insignificant.

We’ll seemingly hear extra concerning the state of Genesis within the coming days since they need/want the capital injection by Monday. This is able to be an enormous hit to a laundry record of establishments within the trade if withdrawals stay suspended and funds tied up. Genesis displays the precise purpose why the general contagion of the FTX and Alameda Analysis collapse has but to play out. Defaults and insolvencies are available waves, not . It takes weeks and months to see the place the largest holes are and who’s having liquidity, counterparty and/or insolvency troubles.

On prime of that, practically each main participant and market maker has pulled their money from exchanges to shore up their very own stability sheets and reduce counterparty danger. Liquidity available in the market is skinny and the time is ripe for volatility to ensue. Though the market has appeared to discover a non permanent backside amid the entire detrimental information headlines during the last week, the unknown draw back danger nonetheless far outweighs the upside potential within the brief time period.

Related Previous Articles: