That is an opinion editorial by Thibaud Marechal, builder of Knox bitcoin custody supplier.

There was a whole lot of protection across the FTX catastrophic failure, with present developments and warning indicators from the previous. Will this have an affect on bitcoin within the coming years? I don’t care about shitcoin casinos, as most of them will most likely be regulated as securities exchanges or shut down attributable to outright fraud or insolvencies. That is nearly a executed deal. However what about bitcoin?

Let’s play and sport and speculate on the impact FTX can have on the way forward for bitcoin.

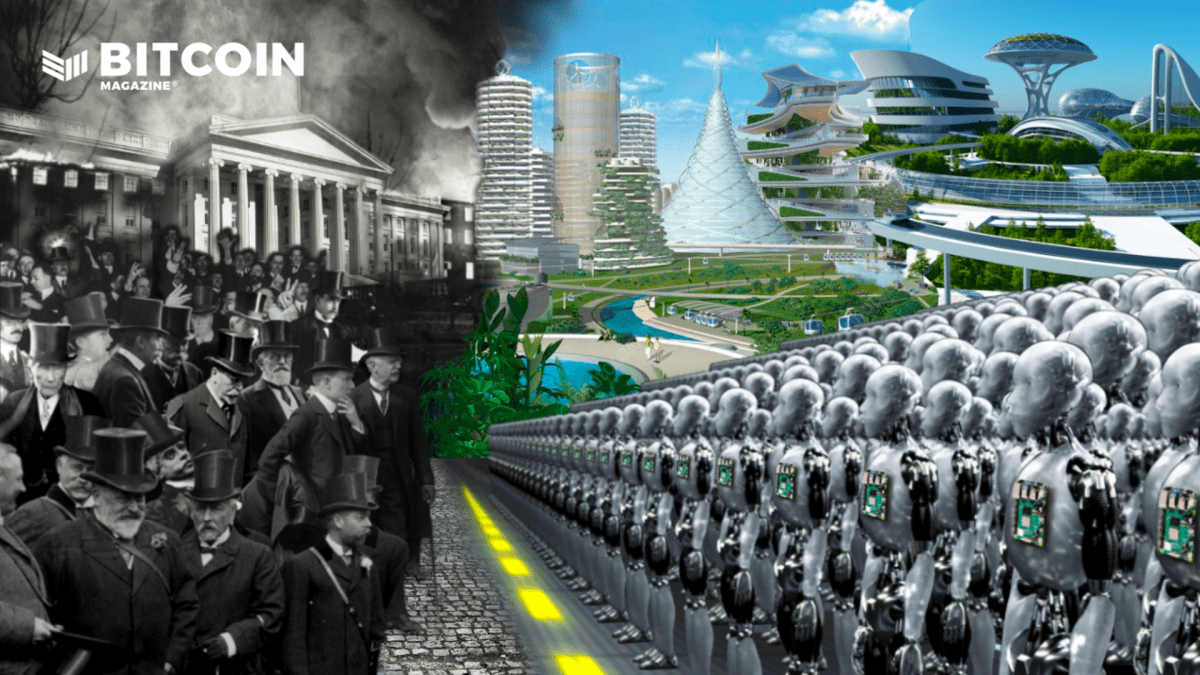

Bitcoin utilization goes to separate — progressively then abruptly. It’s been within the works for the reason that genesis block was produced on January 3, 2009. There might be two methods to make use of bitcoin: as a black market good or as paper bitcoin on regulated exchanges. This future has nearly at all times been true, however the distinction will turn out to be extra clear-cut quickly sufficient. What do I imply by that?

Regulators are going to manage; that’s what they do. Bitcoin can’t be regulated, however custodial ramps similar to exchanges, brokers and lenders can and they are going to be attacked. Self-custody is most certainly going to be regulated out of the marketplace for most patrons. It’s going to turn out to be very exhausting to purchase bitcoin and take full custody of it on these venues — perhaps even near unimaginable. This date is coming quickly.

Fast, anon! You continue to have time earlier than the on-ramps are closed, however how a lot? Three years or six months? The timeline is unclear. It’s going to quickly be unimaginable to purchase bitcoin on an trade and transfer that bitcoin into self-custody the place you maintain your individual keys. Most custodial entities — that are trusted third events — might be prevented from permitting customers to withdraw below the disguise of regulatory compliance and shopper safety. You’ll purchase paper bitcoin, aka faux bitcoin: These are IOUs to get synthetic publicity to the worth of bitcoin. You won’t be able to assert that IOU and redeem it. Need to maintain that bitcoin with keys that you simply management? Overlook it, as a result of it will likely be very exhausting. Few exchanges will enable customers to self-custody and fewer will struggle for the appropriate of economic sovereignty. All they’ll do is promote paper bitcoin or cease operations for many companies.

On one finish, folks will purchase bitcoin IOUs on custodial entities giving up full KYC (know-your-customer) particulars, automated tax reporting and nil privateness. Bitcoin goes for use because the underlying asset to the worldwide monetary surveillance community, the likes of which now we have not but seen. Regulated firms will kind a community of compliance on high of Bitcoin and stop you from holding what may have been actually yours. Maybe they’ll even wrap it right into a central financial institution digital foreign money (CBDC) to guard you towards the volatility of bitcoin. You’ll purchase paper bitcoin and you can be glad.

On the opposite finish, bitcoin will flourish because the instrument that it at all times must be: black market cash. This would be the starting of a brand new period for Bitcoiners who’ve zero fiat, i.e., the Bitcoiners who run full nodes, have full privateness and pay peer-to-peer for stuff with their hard-earned sats. CoinJoins would be the norm for many customers to solely share what they need with whom they need with a view to defend their private data from being surveilled by chain evaluation firms. Some will name it a round economic system, others will name it the black market. It’s going to function 100% on webs of belief. Bitcoin might be purchased with out KYC between friends, utilizing money or financial institution wires when attainable. It’ll be a small breath of recent air within the period of digital surveillance and it’ll final till the remainder of the faux Bitcoin community, choked by regulation, finally collapses below its personal weight attributable to large quantities of fractional reserves. Bitcoin can have succeeded in releasing itself from any state intervention and monetary parasites, however that highway might be lengthy and sinuous.

Till then, the bitcoin worth may very well be severely suppressed for a few years and self-custody could also be demonized, with hefty fines and government-sponsored intimidations just like Govt Order 6102. Are you prepared, anon? Don’t miss out. That is your probability to redeem your self and select what’s best for you and your loved ones. Till then: tick tock, subsequent block.

This can be a visitor submit by Thibaud Marechal. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.