Anybody can look like an investing wizard when markets are going up and up with no sign of ending. The place it will get difficult is after they take a dive, particularly if values keep depressed over a protracted interval. This unlucky state of affairs is named a bear market, and it’s the bane of buyers’ existence in each conventional and digital belongings. How lengthy a crypto bear market will final is anyone’s guess, however studying what to do in a bear market might help your portfolio experience out the storm. Forward we’ll check out some methods for learn how to survive a crypto bear market.

On this article

- What is a bear market in crypto?

- Bear vs bull markets

- Is crypto in a bear market proper now?

- Indicators of a crypto bear market

- Different latest bear markets in crypto

- Crypto bear market methods

What’s a bear market in crypto?

In contrast to a crypto winter, which is much less clearly outlined, a bear market should meet exact numeric thresholds to be formally declared. A bear market is claimed to happen when asset costs drop by 20% or extra from latest highs and stay decrease for a protracted size of time. This implies even throughout a typical market hunch when asset costs have fallen by high-teens percentages, we’re not technically in bear market territory except it reaches that 20% mark and stays there. Bear markets aren’t any enjoyable for any investor, however they’re a standard a part of a wholesome market cycle. To be usually pessimistic in regards to the route of markets is named a “bearish” outlook.

Bear vs bull markets

A bull market is the alternative of a bear market. Traders are seeing inexperienced, and crypto asset costs have shot up from their most up-to-date lows with out backsliding. As a result of cryptocurrency markets usually expertise a lot sharper worth actions than conventional markets, the brink for what’s thought of a crypto bull market is often increased. An organization’s share worth popping 20% in every week can be massive information, however it’s not unusual for a cryptocurrency to leap 50% or extra in a single day. Bull markets are sometimes characterised by extended elevated asset values, and a complete lot of high-fiving. When an investor is assured in regards to the total state of the market, they’re usually described as being “bullish”. Learn full information to bear vs bull markets.

Is crypto in a bear market proper now?

When you’ve checked your crypto portfolio just about anytime in 2022, you in all probability already know the reply to this. Sure, we’re very a lot within the grips of a very grumpy crypto bear market as of late 2022.

Indicators of a crypto bear market

While you have a look at the signs, it turns into readily obvious the bears are accountable for the crypto market.

- Asset costs down considerably for extended interval (far more than 20% most often)

- Investor confidence has bottomed out

- Many new buyers have fled the market

- Unhealthy information and FUD (worry, uncertainty and doubt) piling up, sending asset costs decrease

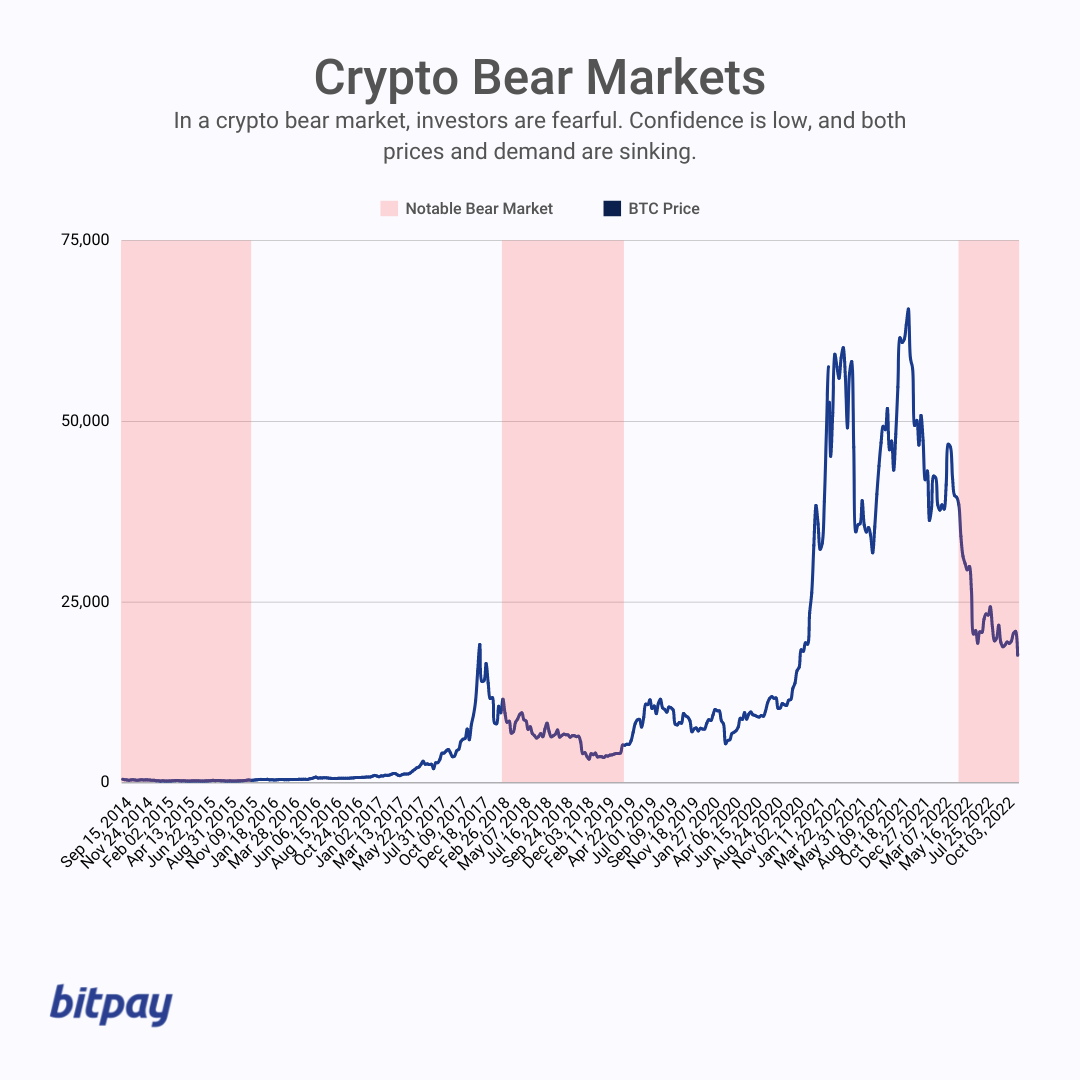

Different latest crypto bear markets

The crypto market has been by means of bear markets earlier than, and nearly definitely will once more as soon as the bulls regain management. There have been a number of different crypto bear markets since cryptocurrency has risen to reputation.

Q4 2017 – Q4 2018 (1 yr)

Bitcoin’s stratospheric rise in direction of the top of 2017 was shortly adopted by a yearlong crypto bear market, following the hack of Coincheck and an rate of interest hike by the Federal Reserve. Bitcoin peaked at $19,279 on the market’s peak, and slid as little as $3,242 over the following 12 months earlier than issues picked up once more. PayPal enabling crypto use and the NFT increase are stated to be the precipitating components that introduced in regards to the finish of the 2017-18 bear market.

Q4 2013 – Q4 2015 (2 years)

A sequence of scandals and bans between 2013-2015 helped knock Bitcoin’s worth from a once-unthinkable $1,136 down to only $103 over the two-year bear market. The decline began when the FBI shut down the infamous digital black market platform Silk Highway in 2013. That very same yr, China stepped up its crypto crackdown, saying a complete ban within the nation. A yr later, the notorious Mt Gox hack shook the crypto world, rattling investor confidence. Some components believed to be answerable for the turnaround embody the launch of Ethereum, Japan permitting crypto buying and selling and the preliminary coin providing (ICO) increase.

Crypto methods to contemplate whereas in a bear market

Until you’ve received a crystal ball, unimaginable luck or an understanding of market dynamics that places Warren Buffett to disgrace, you’re in all probability not going to beat a full-fledged bear market. However there are some methods you’ll be able to make use of to assist guarantee your portfolio lives to battle one other day.

- Greenback-cost averaging

- Keep centered on long-term objectives

- Don’t panic and skim an excessive amount of into the hivemind

- Diversify belongings, however be cautious of high-risk initiatives

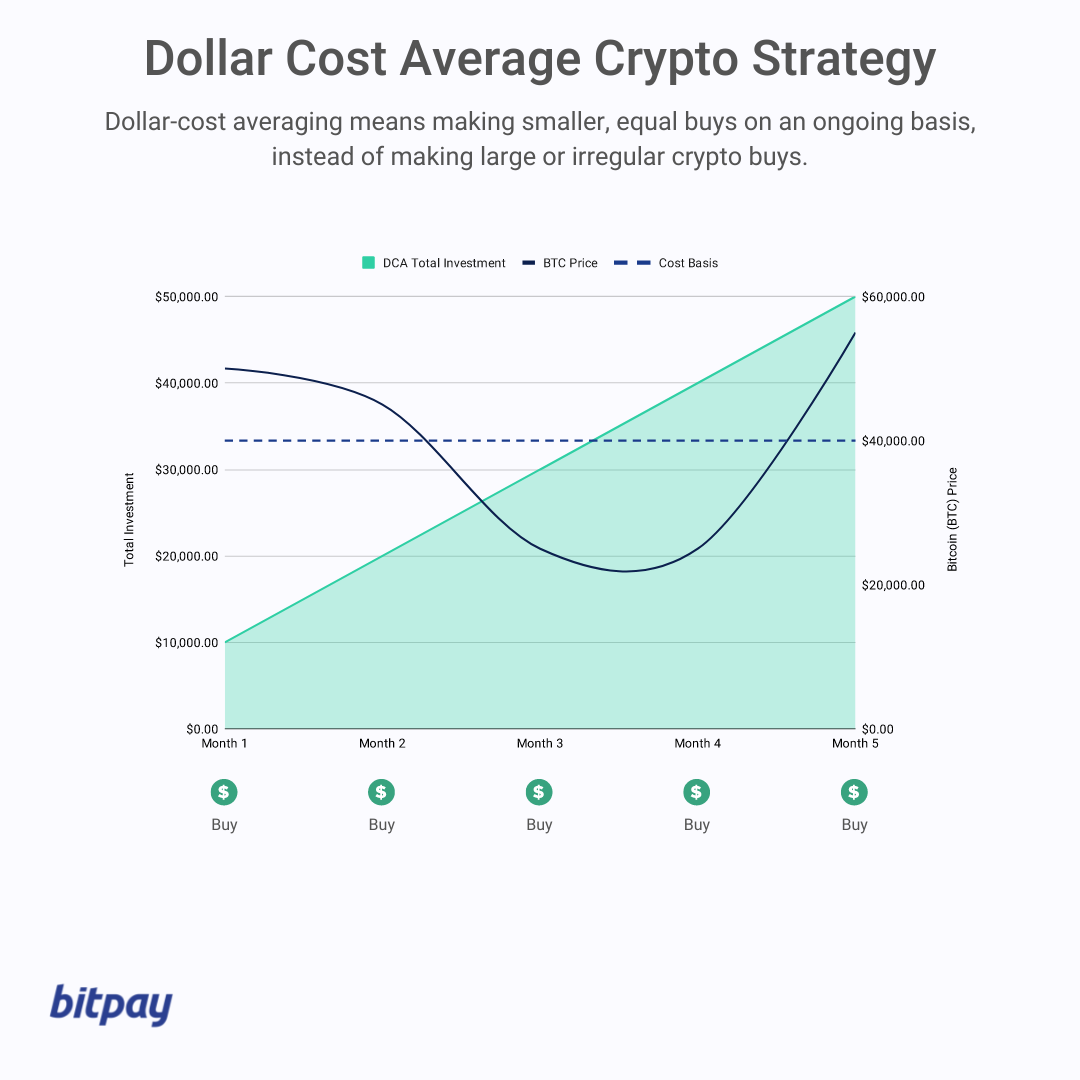

Greenback-cost averaging

Many buyers view market downturns as alternatives, and you may enhance your possibilities of taking benefit with a dollar-cost averaging (DCA) technique. DCA entails buying set greenback quantities of belongings at common intervals, it doesn’t matter what’s occurring out there. The fundamental concept is that DCA provides you an opportunity to extend your holdings when costs are decrease. Over time, the technique reduces your price foundation, or the typical worth you paid for every unit of an asset.

Keep centered on long-term objectives

Solely you already know why you purchased crypto within the first place. When you invested with its long-term prospects in thoughts, massive market swings month to month and even yr to yr don’t essentially impression that imaginative and prescient. When markets are down, attempt to keep in mind your causes for getting concerned in digital belongings and truthfully consider whether or not they nonetheless maintain.

Don’t panic and skim an excessive amount of into the hivemind

One of the vital essential guidelines of investing is to maintain a stage head. That goes double when market situations are less-than-favorable. Panicked buyers make poor selections, and typically understand massive losses they didn’t should by yanking their holdings out of the market prematurely. At all times take crypto information with a grain of salt, however particularly in a bear market, when locations like Crypto Twitter are flooded with worry, uncertainty and doubt (FUD). Attempt to not let your self get carried away with the positivity or negativity you encounter. And please, don’t take crypto funding recommendation from “some man on Twitter”.

Diversify belongings, however be cautious of high-risk initiatives

Even in a down market, crypto belongings are a superb solution to diversify your funding portfolio. However don’t let the promise of outsized positive aspects cloud your higher judgment. There are lots of, many official crypto initiatives out there price your consideration. However there are additionally loads of charlatans who will promise the moon and by no means ship. Earlier than you set your hard-earned cash into any funding, do your homework. And by no means make investments cash you’ll be able to’t afford to lose, whether or not it’s a bull or a bear market.