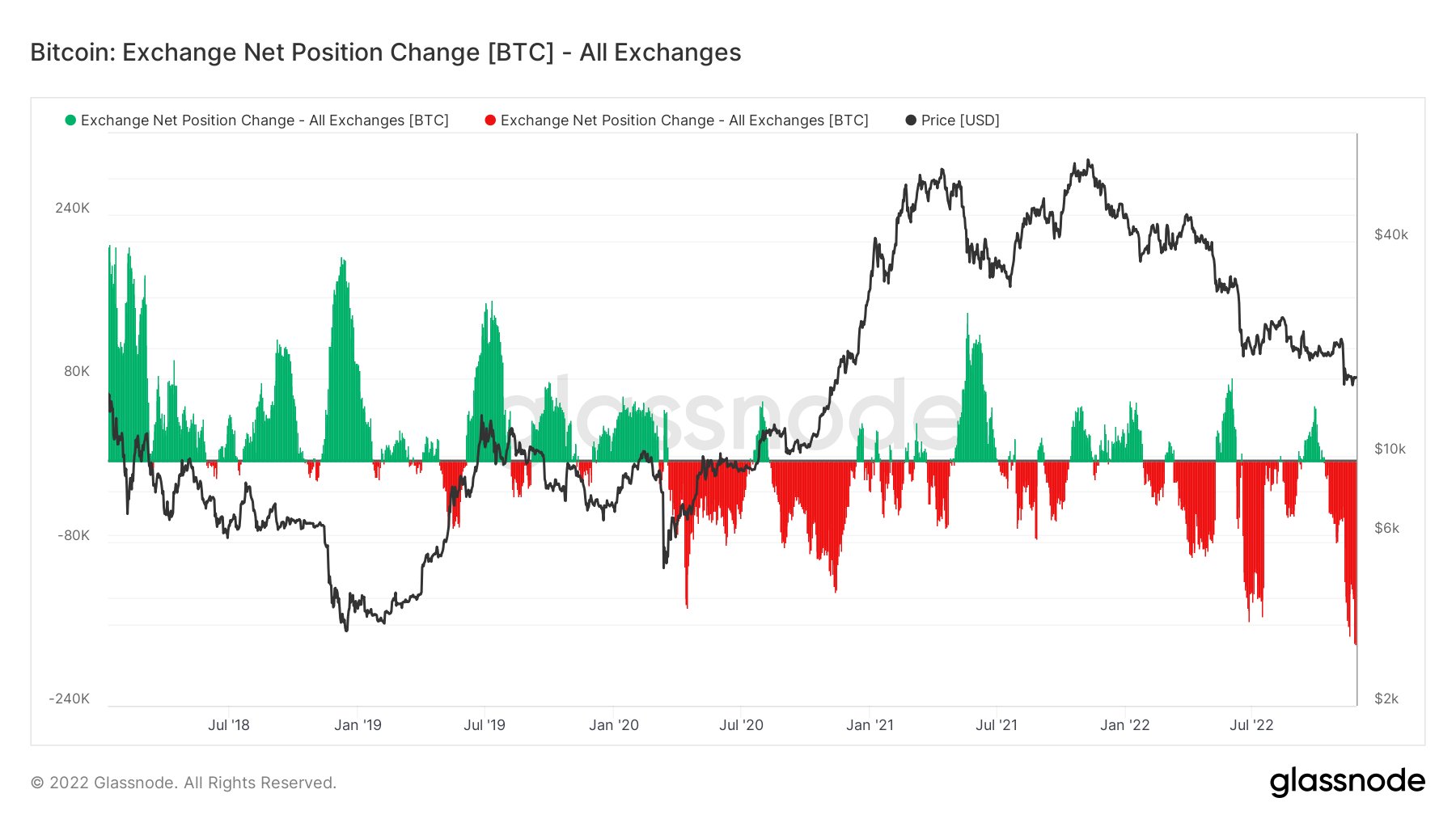

Main analytics agency Glassnode reveals that crypto exchanges are witnessing an enormous exodus of Bitcoin as BTC holders take the initiative to self-custody their cash.

Based on Glassnode’s Bitcoin alternate internet place change metric, which tracks the 30-day provide held in alternate wallets, 179,250 BTC value over $2.8 billion at time of writing has exited centralized crypto exchanges within the final month.

Taking a look at Glassnode’s chart, the present price of BTC leaving crypto alternate platforms is at its highest in over 4 years.

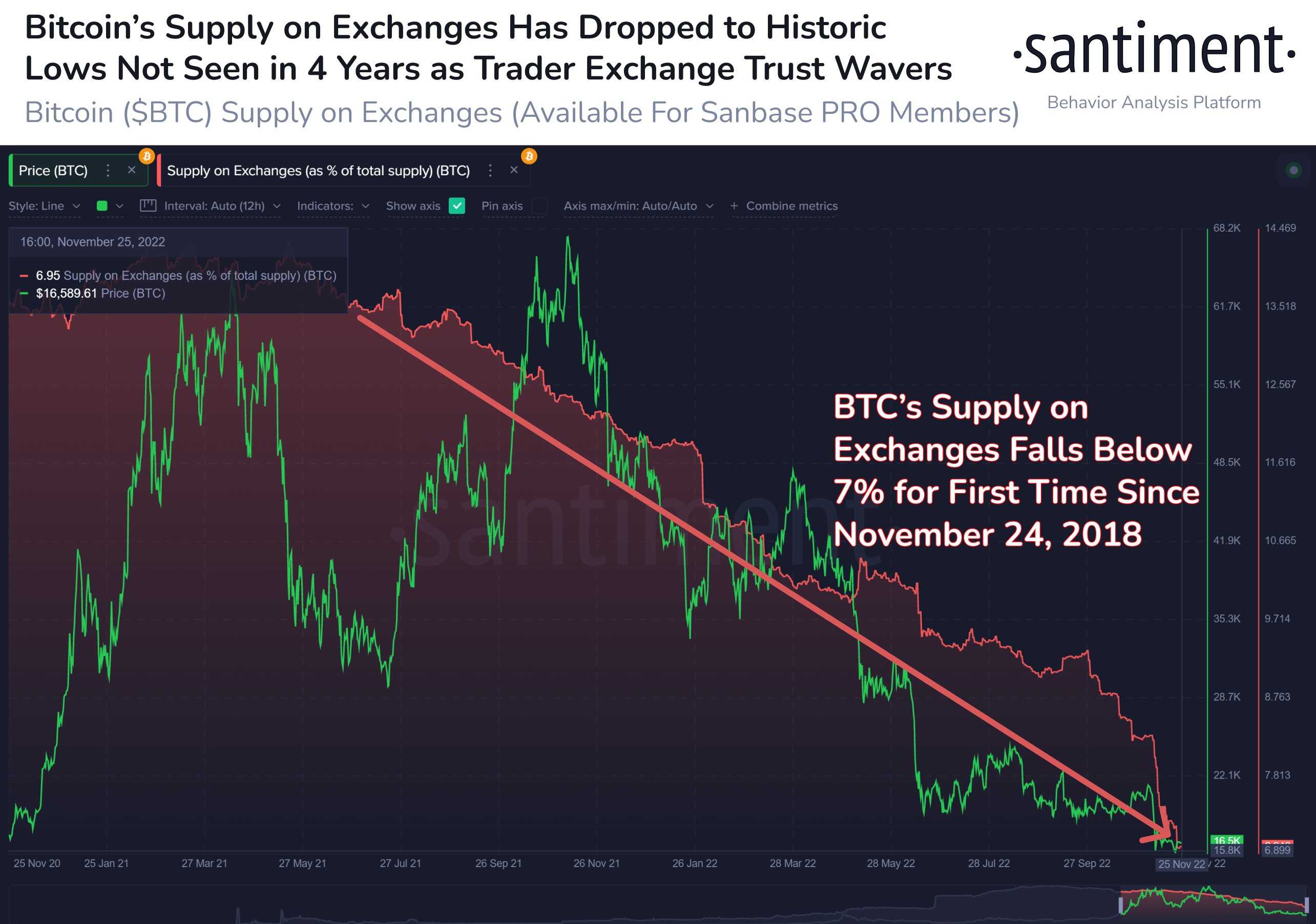

Analytics agency Santiment can be holding a detailed watch on the availability of Bitcoin sitting on crypto exchanges. Based on Santiment, BTC’s provide on crypto exchanges has fallen beneath 7% for the primary time since November twenty fourth, 2018.

“Simply 6.95% of Bitcoin is sitting on exchanges, based on Santimentfeed information. There had already been a gradual shift in BTC shifting into self custody going again to Black Thursday (Mar 2020). However with the FTX fallout, this pattern has accelerated.”

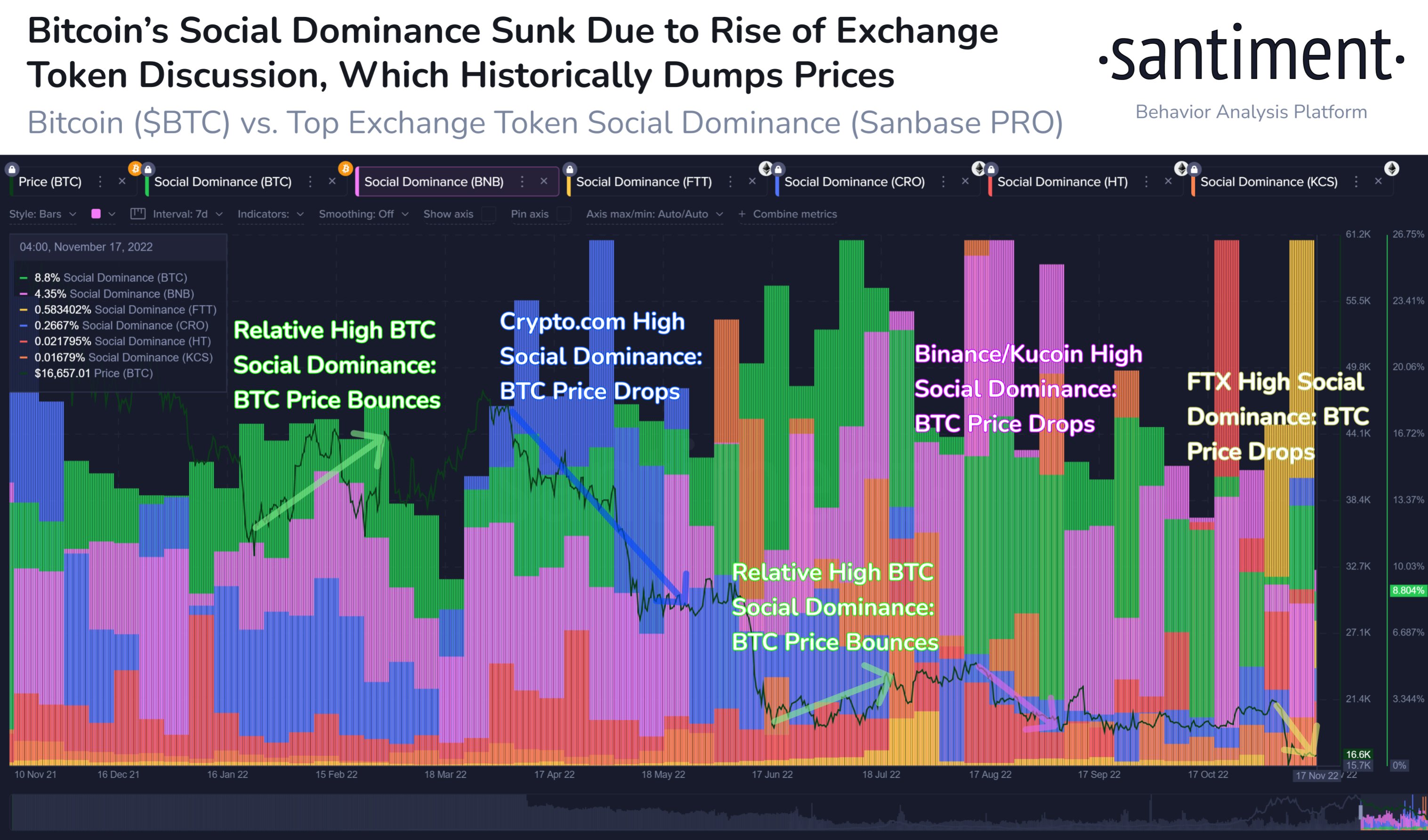

Earlier this month, Santiment famous that crypto has a historical past of bouncing when market individuals shift their focus away from digital asset exchanges.

“Crypto typically thrives when exchanges are NOT a focus. Essentially the most impactful alternate collapse ever could have lasting shockwaves. However as proven, the important thing for a turnaround will probably be focus shifting away from alternate tokens and again to Bitcoin.”

On November eleventh, Sam Bankman-Fried’s FTX filed for chapter amid accusations that the crypto alternate mishandled buyer funds. The information despatched shockwaves throughout the trade, prompting many traders to withdraw their digital property from centralized crypto platforms.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia