Be a part of Our Telegram channel to remain updated on breaking information protection

Litecoin (LTC) value began a restoration towards $100 as traders scrambled to hunt a protected haven for his or her investments following the FTX-induced crash. Nevertheless, the worth was rejected by the $80 psychological stage inflicting LTC to show right down to the present value of round $72. Because of the current value downturn, the vast majority of LTC traders are in losses. Nevertheless, for one more transfer upward, Litecoin might have help from the broader market.

Right here, an evaluation of Litecoin’s current value motion is introduced giving the explanation why an upside correction could possibly be on the radar for the altcoin.

1. A Vital Assist Zone

Litecoin began a restoration rally towards the $100 psychological stage on November 22, recording a formidable 33% climb to brush shoulders with $83.5 on November 25. Consumers’ makes an attempt to pump the worth increased have been annoyed by overhead stress from the $80 provide zone. At press time, the thirteenth largest cryptocurrency by market capitalization was buying and selling under $75. Consumers have been required to reclaim this stage to rekindle any hopes of restarting the uptrend.

LTC was buying and selling above an essential help space stretching from $57 and $60. Merchants will discover that every one the essential transferring averages are mendacity inside this zone. The 50-day easy transferring common (SMA), the 100-day SMA and the 200-day SMA are sitting at $59.73, $57, and $58 respectively. Purchaser congestion on this zone is probably going to offer Litecoin value with the tailwinds it requires to propel it upward.

Due to this fact, if LTC turns up from the present stage, it might verify the start of an uptrend that’s prone to take the proof-of-work (PoW) crypto first above the instant resistance at $75, after which to the $83.5 swing excessive. Above that, Litecoin might rise to confront resistance from the $100 psychological stage, representing a 14.8% ascent from the present value.

LTC/USD Each day Chart

2. Bullish Technical Indicators

Aside from the numerous demand zone, technical indicators on the each day chart supported Litecoin’s constructive outlook. The Relative Energy Index (RSI) was transferring throughout the constructive area suggesting that the market nonetheless favored the upside. Furthermore, this momentum power indicator was positioned at 60, suggesting that LTC was nonetheless underneath the management of consumers, including credence to the bullish outlook.

One other indicator validating the constructive forecast for LTC value was the place of the Shifting Common Convergence Divergence (MACD) indicator above the zero line within the constructive area. This indicated that Litecoin’s market sentiment was nonetheless constructive. As well as, the motion of the 12-day exponential transferring common (EMA) (blue line) above the 26-day EMA added credence to the crypto’s constructive outlook.

Moreover, the technical indicators had beforehand despatched two bullish indicators within the current previous which have been nonetheless in play. The primary one got here from the SuperTrend indicator which reversed from crimson to inexperienced and moved under the worth on November 23. This index, just like the transferring averages, overlays the chart whereas monitoring LTC’s pattern. It incorporates the common true vary (ATR) in its calculations, which helps gauge market volatility. So long as the index is inexperienced and stays under the worth, bulls are prone to stay in an advantageous place.

One other purchase sign got here on November 24 when the 50-day SMA crossed above the 200-day SMA. Thus, so long as the golden cross stands, it’s crucial to say that the Litecoin value is squarely within the consumers’ fingers.

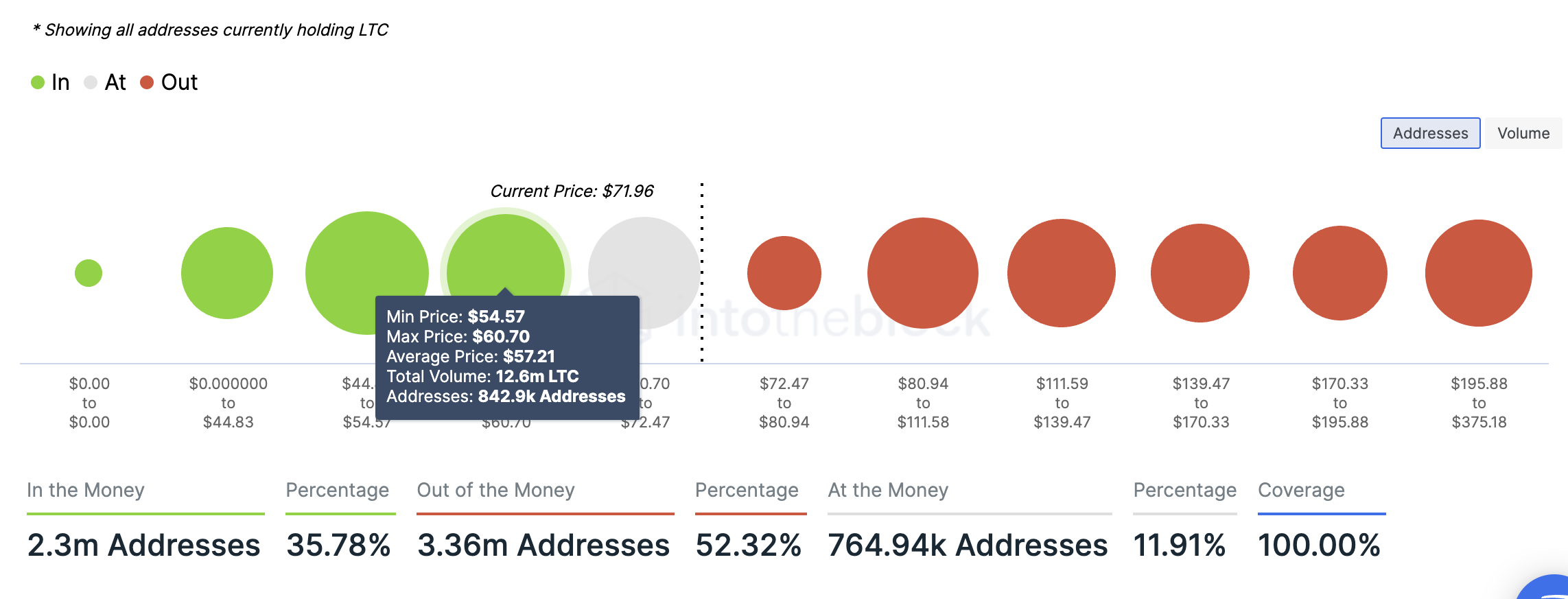

3. GIOM Metrics

The each day chart above confirmed that Litecoin was buying and selling above a comparatively sturdy help zone. Included inside this space have been the transferring averages situated between $57 and $60. Additional down, bears could be confronted by shopping for stress from the psychological stage at $55, moreover the $54 foothold.

This was supported by on-chain metrics from IntoTheBlock’s World In/Out of the Cash (GIOM) mannequin, which confirmed that LTC sat on comparatively sturdy help. For instance, all of the strains of protection outlined above are throughout the $54.7 and $60.70 value vary, the place roughly 12.6 million LTC are being held by roughly 842,900 addresses.

Litecoin GIOM Chart

Any makes an attempt to push the worth under the mentioned stage could be met by shopping for from these traders who might wish to enhance their earnings. The following demand stress would trigger Litecoin to rise even increased.

4. Optimistic Feedback and Fundamentals

Litecoin’s upward trajectory may be fueled by constructive feedback in regards to the altcoin from crypto Twitter. For instance, a dealer going by the identify JK on Twitter noticed that the LTC value motion had fashioned a double-bottom towards Ethereum on the each day chart. He posted an LTC/ETH chart on Sunday saying, “Litecoin LTC accomplished double backside to realize 65% towards ETH in November.”

This was confirmed by a veteran dealer Peter Brandt who, drawing from his roughly 5 a long time of buying and selling, hailed JK’s “appropriate interpretation of classical chart patterns”.

At all times nice to see the right interpretation of classical chart patterns. Thanks JK https://t.co/RQUnvn2BHM

— Peter Brandt (@PeterLBrandt) November 27, 2022

Observe {that a} double-bottom is a extremely bullish chart formation pointing to a significant change in value actions from a previous downtrend. Total, the “digital silver” has had a constructive November. Litecoin briefly decoupled from the final market downturn to outperform the top-cap cryptos for probably the most a part of November. At press time, LTC is up 20.57% for the month, based on knowledge from CoinMarketCap.

Knowledge from Santiment, an on-chain analytics firm, reveals that LTC’s value progress coincided with a pointy enhance in addresses holding 1,000 or extra LTC since Might this 12 months. This was a sign of elevated curiosity by giant holders in Litecoin as they added to their holdings in anticipation of a continued enhance in value.

One other constructive elementary supporting Litecoin’s upside is the halving occasion anticipated in lower than a 12 months’s time. In response to info shared by Litecoin Basis, the group behind Litecoin crypto, the following halving is predicted to happen inside roughly 250 days.

Like Bitcoin, Litecoin has a hard and fast provide. Nevertheless, as a substitute of Bitcoin’s most provide of 21 million BTC, it’s 84 million LTC. In easy phrases, a Litecoin halving implies that the rewards awarded to miners will likely be halved because the coin turns into scarcer.

The subsequent Litecoin Halving will likely be in 250 days!

⚡84,000,000 Max Provide

⚡2.5-minute block intervals

⚡Halving occasion each 4 years

⚡Change into scarcer over time

⚡Lower in provide, demand risesBe taught extra: https://t.co/TguLa8AAY7 #LitecoinFACT #Litecoin pic.twitter.com/2HCoPcUfCL

— Litecoin Basis ⚡️ (@LTCFoundation) November 26, 2022

The reward quantity is at present 12.5 LTC. Nevertheless, after the forthcoming halving occasion, this will likely be minimize in half to six.25 LTC. This pattern is predicted to proceed till 2124.

Moreover, the Litecoin community has processed its 135,000,000th transaction in what it describes as “over 11 years of steady, immutable, uncensorable, flawless uptime.”

Different Crypto Funding Alternatives

With the larger crypto market nonetheless struggling to get better from the FTX catastrophe and the potential chapter of different key market gamers, it could be an excellent time to discover shopping for at a reduction different altcoins that haven’t pumped lately or investing in lower-cap tasks in presale.

Three tasks which have already raised a big quantity of capital of their presales and are poised for future progress are Sprint 2 Commerce (D2T), RobotEra (TARO), and Calvaria (RIA) all of which have promising returns as soon as they’re listed on exchanges within the close to future.

Sprint 2 Commerce (D2T)

Sprint 2 Commerce is a decentralized change constructed on the Ethereum blockchain that’s set for launch early subsequent 12 months. The staff behing D2T has up to now raised $7.3m raised with so 83% of tokens in stage 3 of the presale offered. Within the fourth and last stage of the presale, the D2T value will rise to $0.0533.

RobotEra (TARO)

TARO is an Ethereum-based sandbox Metaverse on account of launch its alpha model in Q1 2023 and can allow gamers to construct and play as robots inside a digital world based mostly on NFTs. RobotEra has surpassed the quarter of one million {dollars} milestone with roughly $266,000 raised within the ongoing presale.

Calvaria (RIA)

Calvaria is a blockchain-based card-trading recreation enabling gamers to battle with their NFT playing cards and earn rewards. RIA, the platform’s native token is at present within the final stage of the presale with over $2.1 million raised and solely 30% of tokens left.

Associated Information:

Be a part of Our Telegram channel to remain updated on breaking information protection