Welcome to The Interchange! In case you obtained this in your inbox, thanks for signing up and your vote of confidence. In case you’re studying this as a publish on our website, join right here so you may obtain it immediately sooner or later. Each week, I’ll check out the most popular fintech information of the earlier week. It will embody all the things from funding rounds to traits to an evaluation of a specific house to sizzling takes on a specific firm or phenomenon. There’s a variety of fintech information on the market and it’s my job to remain on high of it — and make sense of it — so you may keep within the know. — Mary Ann

Hi there! It’s my first full week again in a while, and I’m excited. Seems having COVID helped me get extra relaxation than I’ve had in a really lengthy whereas. (Silver linings.)

The week of Thanksgiving turned out to be much less boring than I anticipated — I reported that three of different financing startup Pipe’s co-founders have been stepping down as the corporate looked for a “veteran” CEO to take the corporate to the following degree.

For some context, I’ve been overlaying Pipe because it raised $6 million in a seed spherical led by Craft Ventures again in 2019. I’ve watched it develop over time, in varied methods. All of the whereas, I’ve been in touch with its CEO and co-founder Harry Hurst. So once I received the information that he was planning to go away the corporate, together with two of his co-founders, I used to be stunned. This isn’t a typical factor. Co-founders don’t typically step down so quickly after an organization was based and achieved unicorn standing. And it’s virtually extraordinary for 3 co-founders to go away on the identical time.

After that article printed, I used to be inundated with tweets, messages, and so forth…with various allegations round “the actual causes” that Pipe’s co-founders have been stepping down. Amongst these rumors have been claims that Pipe made roughly $80 million in loans to 1 or a number of crypto mining corporations. The outfit or outfits have since gone out of enterprise and the $80 million is believed to have been utterly written off, these people claimed (a lot of whom mentioned that they had “heard” in regards to the occasions).

To be clear, if we reported on each rumor we heard right here at TechCrunch, we’d flip into the “Nationwide Enquirer” of the startup world. On the identical time, when a reporter is supplied with the identical data from a number of sources who they know and belief, it’s then irresponsible to not comply with up on these claims. In order that’s what I did.

Finally, Pipe denied the claims in opposition to it however in that denial, a few fascinating issues got here to gentle. First, the startup’s board — regardless of its lengthy checklist of buyers — consists of solely the three co-founders who’re stepping down and one unbiased director, Peter Ackerson, a common associate at Fin Capital who himself grew to become a VC simply three years in the past. Second, I came upon that after a brand new CEO is discovered, that particular person will assume Hurst’s seat on the board.

Now, I’m not right here to “take sides.” I don’t know what really has, or has not, gone down behind the scenes at Pipe. However regardless, this all struck me as odd. For one, how can a startup that has raised some $300 million and is valued at $2 billion not have a extra unbiased board? Two, why would Hurst — who has been the very vocal frontman of Pipe since its inception — go away the board? Lastly, it seems there’s a fourth co-founder, Michal Cieplinski, whose title was notably not talked about in any respect when the opposite three founders’ departures have been introduced. Apparently, he stays in his position as chief enterprise officer.

For now, I can solely report on what I’m informed. As time goes on, we’ll see if extra particulars surrounding this uncommon growth emerge.

Picture Credit: Pipe

X1

When pressed, Pipe declined to disclose particulars round its financials. So maybe it felt much more refreshing when shopper fintech X1 fortunately shared particulars round its income in an interview final week. The corporate was based in 2020 to supply a bank card to shoppers primarily based on their revenue, quite than their credit score rating. It launched that bank card to most people in mid-September after amassing a waitlist of 600,000. Whereas I don’t know what number of cardholders the corporate at present has, I used to be impressed that it has seen its income triple over the previous 6 months — from $1 million per thirty days to $3 million per thirty days, giving it an annual income run fee of $36 million. Not dangerous. Not dangerous in any respect.

X1 is without doubt one of the few fintechs I’ve coated that opted NOT to lift in 2021. That will have been a really clever determination. Its valuation was not inflated, so after elevating $25 million earlier this 12 months in a Sequence B spherical, buyers clamored to supply it one other $15 million earlier this month — at a 50% larger (undisclosed) valuation.

The startup feels low-key in a sector that has been filled with hype and chest-beating lately. It not too long ago lured away an Apple exec to function its chief threat officer, and in line with CEO and co-founder Deepak Rao, it’s already conducting audits (others within the house ought to take notice!).

The corporate is now taking over the likes of Robinhood because it gears as much as launch its personal investing platform, which can give its cardholders a manner to purchase shares with the reward factors they earn utilizing its card. It’s a novel idea and we’ll see the way it works out. On that subject, one factor I discovered fascinating: FPV Ventures, a enterprise agency based by Google Analytics founder Wesley Chan, led X1’s $25 million Sequence spherical. Properly, Chan was additionally an early investor in Robinhood. X1 declined to touch upon that reality, however it is only one different instance of VCs backing startups that very intently resemble others that they’ve already backed. In a world the place corporations are always evolving and iterating, it shouldn’t be surprising. But it surely does really feel a bit…awkward, to say the least.

Weekly Information

Stripe introduced it constructed a fiat-to-crypto onramp. The corporate described it as “a customizable widget that builders can embed immediately into their DEX, NFT platform, pockets, or dApp. Stripe claims to deal with all of the KYC, funds, fraud, and compliance and that the on-ramp might be built-in “with simply 10 strains of code.” Romain goes deeper on the subject right here.

Eric Wu, co-founder of Opendoor, stepped down from his position as CEO of the actual property fintech. Carrie Wheeler, who has served as the corporate’s CFO for simply over two years, is taking up the position of CEO. Wu will now function president of Opendoor’s new market providing, Opendoor Exclusives. On the time of the launch final month, Wu mentioned: “We’ve designed Opendoor Exclusives to be a brand new market the place you may immediately purchase and promote a house, with none of the effort of the standard actual property mannequin.”

Finextra reported that “Klarna has launched a platform that connects retailers with creators and influencers that may assist them attain their goal markets. The Creator Platform guarantees to match retailers with the best influencers after which monitor efficiency metrics — together with site visitors, gross sales and conversion charges — in actual time. Already stay within the US, it’s now obtainable in all markets during which Klarna operates, offering an extra advertising and marketing channel for the agency’s 450,000 retail companions.”

Information like this doesn’t precisely bolster the case for fintech. In line with the Chicago Solar-Instances, “since 2020, greater than 3,500 complaints have been filed about San Francisco-based Chime Monetary Inc. with the federal Client Monetary Safety Bureau about closed accounts, unauthorized costs or different points. Most are marked ‘closed with rationalization,’ that means the corporate resolved them privately with the shopper…Some Chime prospects who’ve complained about sudden account closures have been shocked to listen to that it may take as much as a month to get their a reimbursement.”

As reported by the very gifted Joanna Glasner, who writes for my former employer, Crunchbase Information: “Final 12 months, monetary companies was the main sector for enterprise funding, with at the least $131 billion globally going into startups within the house. This 12 months, the trade nonetheless ranks among the many largest recipients of enterprise capital funding. Nevertheless, funding to startups within the house has been dropping each quarter this 12 months, with This autumn more likely to be the bottom but.”

American Specific goes deeper on B2B funds. On December 1, the bank card big launched Amex Enterprise Hyperlink. A spokesperson informed me it will provide “a brand new B2B funds answer for community issuers and acquirers to supply to their enterprise prospects.” Its objective is to supply “extra streamlined, environment friendly, and versatile methods for companies to pay one another on the Amex community”

Seen on TechCrunch+

Is FTX’s failure a stress take a look at for company bank card startups? As reported by Natasha Mascarenhas: “Ramp not too long ago despatched a message to crypto corporations utilizing its company card companies saying that it’s considerably reducing spending limits and including new necessities. Some customers have been briefly suspended from spending altogether…Whereas Ramp considerably backtracked on the modifications, its transfer provides a window into how company bank card corporations might be stress-tested within the present atmosphere. Brex, Ramp’s largest competitor, mentioned that there have been no modifications to crypto customers’ spending limits.”

Of all of the enterprise capital funding invested in 2021, round one in each 5 {dollars} went to fintech. However this increase now appears behind us, as world fintech funding exercise returned to pre-2021 ranges. Worse, fintech didn’t escape the current waves of tech layoffs, with high-profile corporations like Brex, Chime and Stripe making headlines for this disheartening cause over the previous couple of weeks. And but, fintech startups are nonetheless getting based and funded this 12 months. Of the 223 corporations in Y Combinator’s summer season 2022 batch, 79 fell roughly into the fintech class. Why are founders and buyers nonetheless inserting bets in fintech and the place? To search out out extra, Anna Heim reached out to fintech-focused VC agency Fiat Ventures.

ICYMI

As reported by Manish Singh: “Shares of Paytm in November slid to an all-time low of 477 Indian rupees ($5.8), per week after the lockup interval for early backers of the Indian monetary companies agency ended final week and mounting issues of rising competitors.”

Sarah Perez reported: “In November, PayPal-owned Venmo rolled out two modifications to its peer-to-peer funds app, together with the flexibility to donate to charities by means of Venmo in addition to a redesigned money-sending expertise. The latter goals to make it simpler to see how a lot you’re sending and who you’re sending to, whereas additionally enhancing the flexibility to both pay or request a number of funds without delay.”

And right here’s some information that inadvertently received neglected of the November 20 version of our e-newsletter…my apologies (I blame COVID mind!)! Thanks once more to Kyle Wiggers for drafting the write-ups.

Block’s Sq. desires to get into the bank card recreation — however it’s going the partnership path to get there. The corporate introduced that it’s teaming up with American Specific to launch a brand new bank card focused at Sq. sellers on the Amex community. Particulars have been robust to return by at publish time — Sq. says it’ll reveal extra in regards to the card early subsequent 12 months — however the press launch means that the cardboard, quickly obtainable to all “eligible” Sq. sellers within the U.S., will combine with Sq.’s present companies to let cardholders set up their funds and handle money movement from a single pane of glass.

Fintech startups — startups dabbling in banking, investing, budgeting and funds — remained red-hot this 12 months, with 18% of world enterprise {dollars} going to fintechs in Q2 2022. That’s not stunning in gentle of current findings from digital analytics firm Amplitude, which present that fintech apps and companies continued so as to add new customers over the past 12 months, hitting a peak in June and July at 22% larger progress in comparison with August 2021. The stats align with the outcomes of a 2021 Plaid survey exhibiting that just about 9 in ten People now use some type of fintech app to handle their monetary lives. Clearly, the financial downturn apart, fintech is right here to remain — and going robust.

With the “purchase now, pay later” (BNPL) market on much less agency floor than it as soon as was, among the largest distributors are on the hunt for various strains of income. Enter Klarna’s value comparability device, which the BNPL startup is positioning in opposition to procuring companies like Google Purchasing and Purchasing.com. Constructed on high of tech acquired by means of Klarna’s $1 billion acquisition of PriceRunner earlier this 12 months, the brand new device permits customers to filter product searches by standards corresponding to measurement, coloration, rankings, availability and delivery choices and look at historic pricing information, which exhibits how the price of the product has fluctuated over time. Klarna earns cash by driving site visitors and gross sales for its retail prospects.

Talking of Klarna, CEO Sebastian Siemiatkowski says that the collapse of crypto alternate FTX could encourage monetary sector regulation that’ll make it tougher for fintech corporations to compete in opposition to conventional lenders. Talking to Bloomberg, he mentioned: “I’m a bit bit involved that these debacles that we’ve seen will once more inhibit that and constantly extend the overly massive profitability that we’ve seen within the banking trade.” There’s not a ton of proof to assist this, however it’s undeniably true that regulators are making ready to take an extended, laborious take a look at crypto particularly after years of legislative inaction. The Washington Publish experiences that the Treasury Division has positioned calls to massive crypto exchanges to evaluate the dangers of a broader contagion and congressional committees have readied opinions, together with a Home inquiry that might see FTX founder Sam Bankman-Fried testify below oath subsequent month.

Fundings and M&A

Seen on TechCrunch

Client finance app Djamo eyes Francophone Africa growth, backed by new $14M spherical

Southeast Asia insurtech Igloo will increase its Sequence B to $46M

AirTree and Greycroft return to guide Australian regtech FrankieOne’s Sequence A+

Seen elsewhere

Neobank for Native People raises pre-seed funding

Peter Thiel’s VC fund backs TreeCard, a fintech that vegetation bushes whenever you spend

Cross-border funds startup Buckzy raises $14.5 million in Sequence A financing

Intuit to amass monetary well being startup SeedFi

Brazilian unicorn Loft denies receiving down spherical

Tweet of the Week

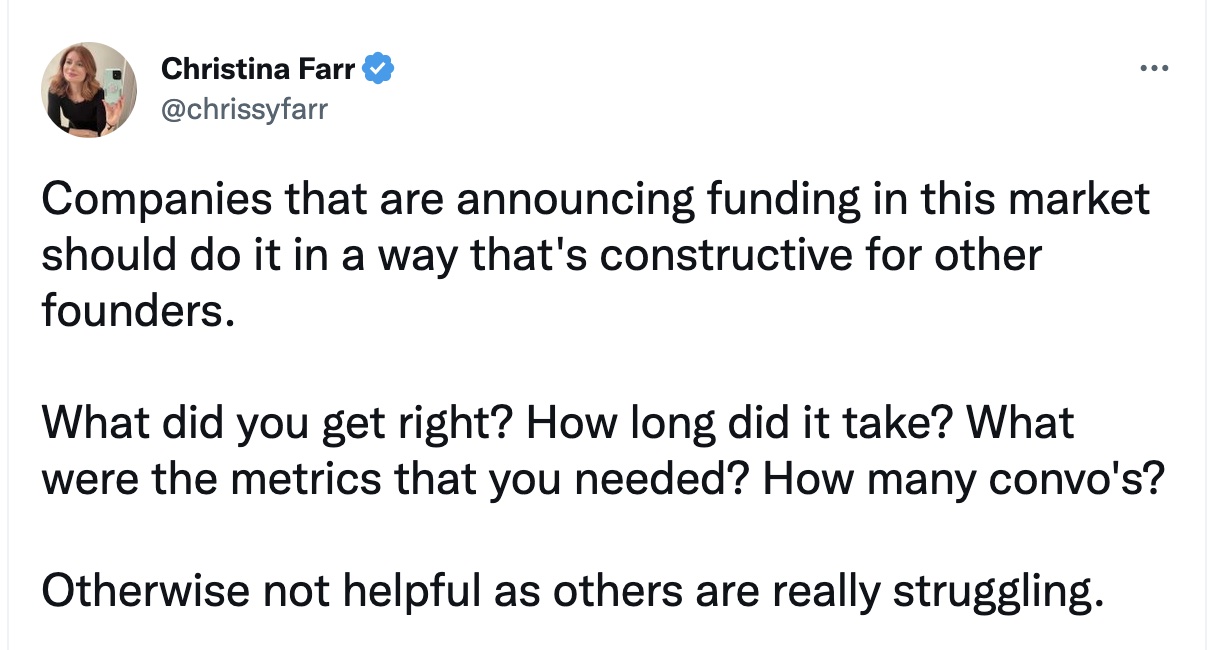

Former journalist turned VC Chrissy Farr had a notable tweet this week, during which she mentioned: “Firms which can be saying funding on this market ought to do it in a manner that’s constructive for different founders. What did you get proper? How lengthy did it take? What have been the metrics that you simply wanted? What number of convo’s? In any other case not useful as others are actually struggling.”

I really feel compelled to carry this up as a result of the best way I cowl funding rounds has essentially modified from 2021. Let’s be trustworthy — the folks often most concerned with studying about an organization’s increase are people who both work at, or have invested in, the corporate itself. Actually, it’s possible you’ll be stunned to know that funding-focused articles are hardly ever among the many most learn on the TC website. I spotted that to proceed overlaying 10 funding rounds per week was probably not doing our readers a favor. So today, I attempt to deal with corporations that (a) are doing one thing that seems to be actually distinctive or novel and totally different from present tech; (b) are prepared to share income figures or specifics round their financials; (c) have a compelling origin story — say, founders with nontraditional backgrounds or hailed from different high-profile corporations or startups; (d) can share specifics and context round their increase and the way it got here collectively; and (e) run counter to present narratives or traits….amongst a couple of different issues.

Backside line is we get inundated with pitches. Critically, you can not even think about. We’ve to be tremendous selective about what we select to cowl. To not point out the truth that by committing to a ton of funding tales, we’re leaving much less room and time to cowl breaking information and write profiles, options or traits and analytical items. So, once I say thanks, however no thanks I’m not capable of cowl your funding spherical outdoors of together with a point out in my e-newsletter, please don’t comply with up one other 10 occasions. It’s not private.

Picture Credit: Twitter

Podcasting

Do you know that I document the Fairness podcast each week with my fantastic co-hosts and expensive mates Alex Wilhelm and Natasha Mascarenhas? You possibly can hearken to our newest episode right here. Oh, and I’m SO proud to report that Fairness was ranked among the many high 5% shared podcasts globally on Spotify!

Additionally, again in September (I don’t suppose I ever shared this), I used to be honored to be a visitor on Miguel Armaza’s Fintech Leaders podcast. Among the many subjects we mentioned: why I like overlaying the startup world and a few tips about how one can pitch your story to tech reporters, the way forward for tech media, my thought of what good journalism actually means…and much more! Hear in right here.

With that, I’ll shut. Thanks as soon as once more for studying/sharing/subscribing. See you subsequent week! Till then, take excellent care. xoxoxo — Mary Ann

Acquired a information tip or inside details about a subject we coated? We’d love to listen to from you. You possibly can attain me at maryann@techcrunch.com. Or you may drop us a notice at ideas@techcrunch.com. In case you want to stay nameless, click on right here to contact us, which incorporates SecureDrop (directions right here) and varied encrypted messaging apps.