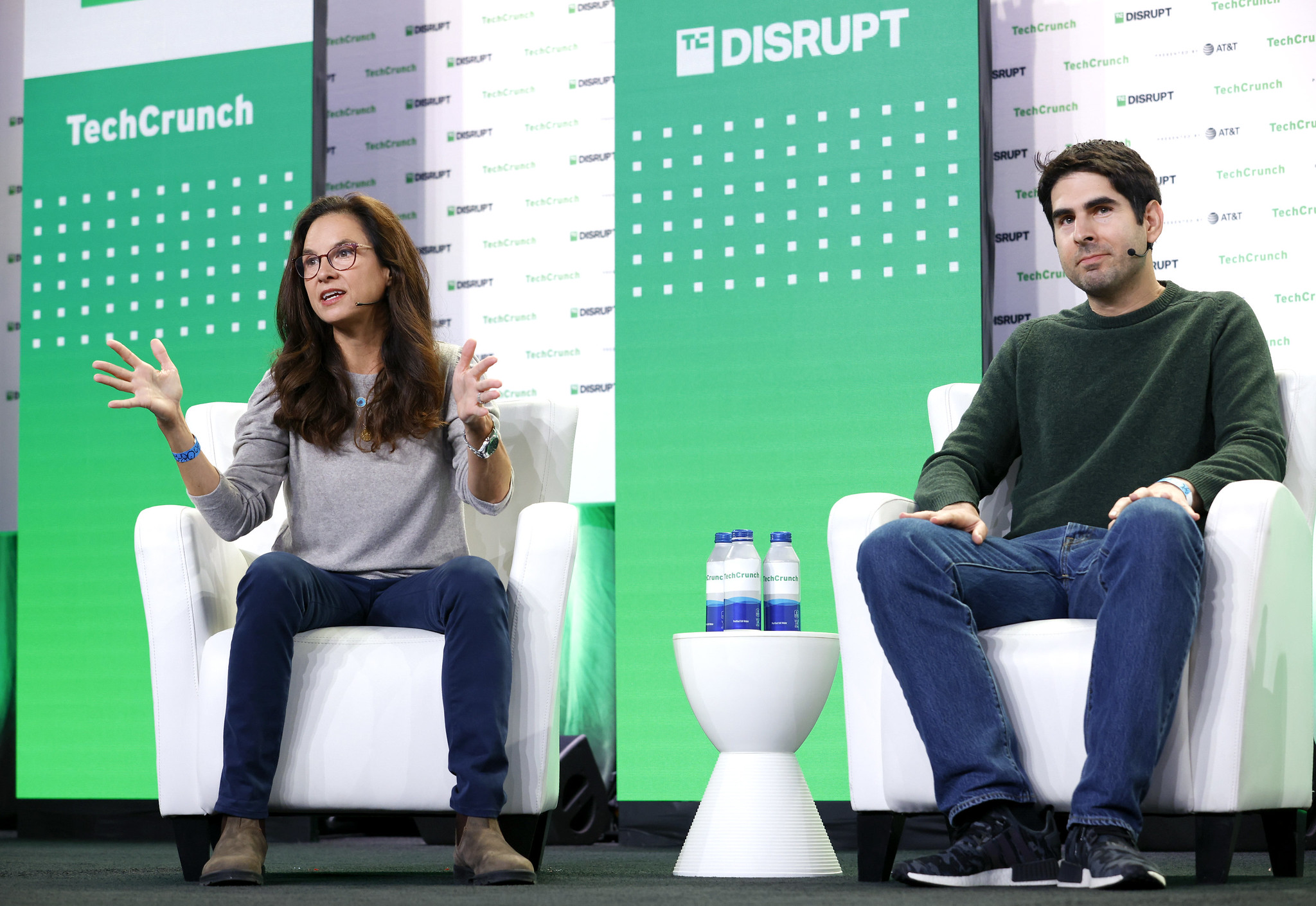

Final week at TechCrunch’s annual Disrupt occasion, this editor sat down with VCs from two corporations which have come to look related in methods during the last 5 or so years. A kind of VCs was Niko Bonatsos, a managing companion at Normal Catalyst (GC), a 22-year-old agency that started as an early-stage enterprise outfit in Boston and that now manages many tens of billions of {dollars} throughout as a registered funding advisor. Bonatsos was joined onstage by Caryn Marooney, a companion at Coatue, which started life as a hedge fund in 1999 and now additionally invests in growth- and early-stage startups. (Coatue is managing much more billions than Normal Catalyst – upwards of $90 billion, per one report.)

Due to this blurring of what it means to be a enterprise agency, a lot of the discuss centered on the end result of this evolution. The overarching query was: does it make sense that corporations like Coatue and GC (and Perception Companions and Andreessen Horowitz and Sequoia Capital) now deal with practically each stage of tech investing, or would their very own traders be higher off in the event that they’d remained extra specialised?

Whereas Bonatsos known as his agency and its rivals “merchandise of the instances,” it’s straightforward to wonder if their merchandise are going to stay fairly as engaging within the coming years. Most problematic proper now: the exit market is all however frozen. With a world recession looming, it’s additionally going to be notably difficult to ship outsize returns after elevating the quantities which have flowed to enterprise corporations during the last handful of years. Normal Catalyst, for instance, closed on $4.6 billion again in February. Coatue in the meantime closed on $6.6 billion for its fifth growth-investment technique as of April, and it’s reportedly out there for a $500 million early-stage fund in the intervening time. That’s some huge cash to double or triple, to not point out develop tenfold. (Historically, enterprise corporations have aimed to 10x traders’ {dollars}.)

Regardless of these headwinds, not a single agency has expressed plans to provide traders again among the large quantities of capital it has raised.

I used to be considering right this moment about final week’s dialog and have some extra ideas in italics about what we mentioned on stage. What follows are excerpts from the interview, edited for size. To catch the entire dialog, you may watch it across the 1:13-minute mark within the video beneath.

TC: For years, we’ve seen a blurring of what a “enterprise” agency actually means. What’s the consequence when everyone seems to be doing all the pieces?

NB: Not everybody has earned the fitting to do all the pieces. We’re speaking about 10 to perhaps 12 corporations that [are now] able to doing all the pieces. In our case, we began from being an early-stage agency; early stage continues to be our core. And we discovered from serving our clients – the founders – that they need to construct enduring corporations and so they need to keep personal for longer. And because of this, we felt like elevating progress funds was one thing that might meet their calls for and we did that. And over time, we determined to change into a registered funding advisor as effectively, as a result of it made sense [as portfolio companies] went public and [would] develop very effectively within the public market and we may proceed to be with them [on their] journey for an extended time period as a substitute of exiting early on as we had been doing in earlier instances.

CM: I really feel like we’re now on this place of fairly fascinating change . . .We’re all transferring to satisfy the wants of the founders and the LPS who belief us with their cash [and for whom] we should be extra inventive. All of us go to the place the wants are and the setting is. I feel the factor that stayed the identical is perhaps the VC vest. The Patagonia vest has been fairly commonplace however all the pieces else is altering.

Marooney was joking in fact. It also needs to be famous that the Patagonia vest has fallen out of style, changed by a good costlier vest! However she and Bonatsos had been proper about assembly the calls for of their traders. To a big diploma, their corporations have merely mentioned sure to the cash that’s been handed to them to take a position. Stanford Administration Firm CEO Robert Wallace advised The Data simply final week that if it may, the college would stuff much more capital into sure enterprise coffers because it seeks our superior returns. Stanford has its personal scaling situation, defined Wallace: “As our endowment will get larger, the quantity of capability that we obtain from these very fastidiously managed, very disciplined early-stage funds doesn’t go up proportionally . . .We will get greater than we acquired 15 or 20 years in the past, but it surely’s not sufficient.”

TC: LPs had file returns final 12 months. However this 12 months, their returns are abysmal and I do marvel if it owes in some half to the overlapping stakes they personal in the identical corporations as you’re all converging on the identical [founding teams]. Ought to LPs be involved that you just’re now working in one another’s lanes?

NB: I personally don’t see how that is totally different than the way it was once. If you happen to’re an LP at a high endowment right this moment, you need to have a bit of the highest 20 tech corporations that get began yearly that might change into the Subsequent Massive Factor. [The difference is that] now, the outcomes in more moderen years have been a lot bigger than ever earlier than. . . . What LPs must do, as has been the case during the last decade, is to put money into totally different swimming pools of capital that the VC corporations give them allocation to. Traditionally, that was in early-stage funds; now you could have choices to put money into many alternative automobiles.

In actual time, I moved on to the subsequent query, asking whether or not we’d see a “proper sizing” of the trade as returns shrink and exit paths develop chilly. Bonatsos answered that VC stays a “very dynamic ecosystem” that, “like different species, must undergo the pure choice cycle. It’s going to be the survival of the fittest.” But it surely in all probability made sense to linger longer on the problem of overlapping investments as a result of I’m unsure I agree that the trade is working the identical approach it has. It’s true that the exits are bigger, however there may be little query that many privately held corporations raised an excessive amount of cash at valuations that the general public market was by no means going to assist as a result of so many corporations with far an excessive amount of cash had been chasing them.

TC: On the planet of startups, energy shifts from founders to VCs and again once more, however till very just lately, it had grown founder pleasant to an astonishing diploma. I’m considering of Hopin, a digital occasions firm that was based in 2019. In keeping with the Monetary Instances, the founder was capable of money out practically $200 million price of shares and nonetheless owns 40% of the corporate, which I discover mind-blowing. What occurred?

NB. Nicely, we had been one of many traders in Hopin.

TC: Each of your corporations had been.

NB: For a time period, it was the fastest-growing firm of all time. It’s a really worthwhile enterprise. Additionally COVID occurred and so they had the right product on the good time for the complete world. Again then Zoom was doing actually, rather well as an organization. And it was the start of the loopy VC funding acceleration interval that will get began within the second half of 2020. So loads of us acquired intrigued as a result of the product appeared good. The market alternative appeared fairly sizable, and the corporate was not consuming any money. And when you could have a really aggressive market scenario the place you could have a founder who receives like 10 totally different gives, some gives have to sweeten the deal slightly bit to make it extra convincing.

TC: Nothing towards founders, however the individuals who have since been laid off from Hopin should have been seething, studying [these details]. Have been any classes discovered, or will the identical factor occur once more as a result of that’s simply the best way issues work?

CM: I feel that individuals who begin corporations now are not beneath that like [misperception that] all the pieces goes up into the fitting. I feel the technology of folks that begin now on each side are going to be much more clear-eyed. I additionally assume there was this sense of like, “Oh, I simply need cash with no strings connected.” . . . And that has dramatically modified [to], “Have you ever seen any of this earlier than as a result of I may use some assist.”

NB: Completely. Market situations have modified. If you happen to’re elevating a progress spherical right this moment and also you’re not one among one [type of company] or exceeding your plan dramatically, it’s in all probability more durable as a result of loads of the crossover funds or late-stage traders go open up their Charles Schwab brokerage account and so they can see what the phrases are there and so they’re higher. They usually should purchase right this moment; they’ll promote subsequent week. With a personal firm, you may’t do this. On the very early stage, it’s slightly little bit of a perform of what number of funds are on the market which can be keen to jot down checks and the way a lot capital they’ve raised, so on the seed stage, we haven’t seen a lot of a distinction but, particularly for first checks. If you happen to’re a seed firm that raised final 12 months or the 12 months earlier than, and also you haven’t made sufficient progress to earn the fitting to boost a Sequence A, it’s slightly bit more durable. . .To the perfect of my information, I haven’t seen corporations resolve to boost a Sequence A with actually nasty phrases. However in fact we’ve seen this course of take longer than earlier than; we’ve seen some corporations resolve to boost a bridge spherical [in the hopes of getting to that A round eventually].

For what it’s price, I believe early founder liquidity is a a lot larger and thornier situation than VCs need to let on. Actually, I talked later at Disrupt with an investor who mentioned that he has seen a lot of founders in social settings whose corporations have been floundering however as a result of they had been capable of stroll away with hundreds of thousands of {dollars} on the outset, they aren’t precisely killing themselves making an attempt to avoid wasting these corporations.

TC: The exit market is cooked proper now. SPACs are out. Solely 14 corporations have chosen a direct itemizing since [Spotify used one] in 2018. What are we going to do with all these many, many, many corporations which have nowhere to go proper now?

NB: We’re very lucky, particularly in San Francisco, that there are such a lot of tech corporations which can be doing actually, rather well. They’ve loads of money on their stability sheet and hopefully sooner or later, particularly now that valuations appear to be extra rationalized, they might want to innovate by means of some M&A. In our trade, particularly for the big corporations like ours, we need to see some smaller exits, but it surely’s concerning the enduring corporations that basically can go the gap and produce a 100x return and pay for the entire classic or the entire portfolio. So it’s an fascinating time, what’s occurring proper now within the exit panorama. With the phrases rationalizing, I might assume we’ll see extra M&A.

Naturally, there’ll by no means be sufficient acquisitions to avoid wasting many of the corporations which have acquired funding in recent times, however to Bonatsos’s level, VCs are betting that a few of these exits shall be large enough to maintain institutional traders as eager on VC as they’ve grown. We’ll see over the subsequent couple of years if this gamble performs out the best way they count on.