Current headlines have been dominated by bulletins of huge headcount reductions throughout the tech business and particularly at giants like Meta, Amazon and Twitter. Nevertheless it’s not simply the massive names pulling again on headcount — non-public SaaS corporations have equally been implementing hiring freezes and headcount reductions for nearly half a 12 months now.

This isn’t shocking, as VCs began pushing for extra concentrate on capital effectivity and the “Rule of 40” earlier this summer time because it grew to become clear that the “progress in any respect prices” mentality was going out of favor and the aim was to increase runway to climate the storm.

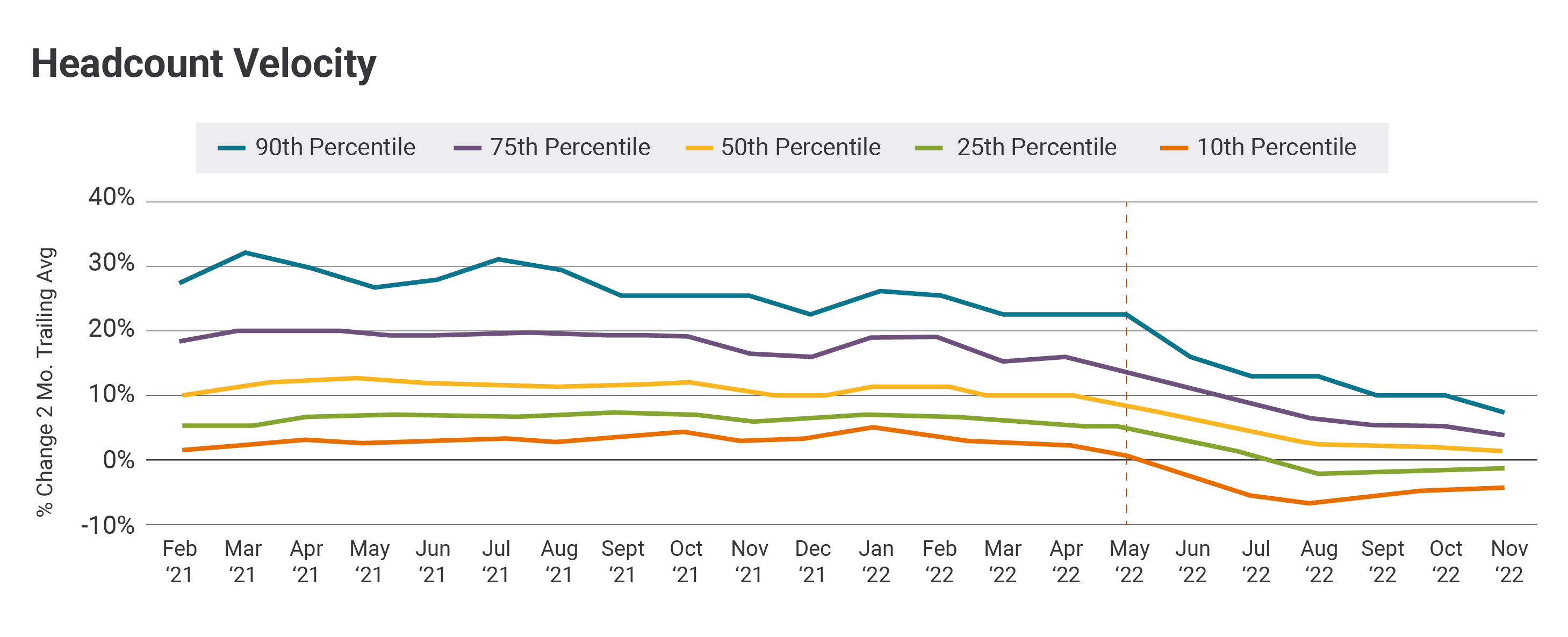

To get a greater understanding of headcount fluctuations inside the non-public market, we programmatically tracked the headcount of 150 non-public Sequence A to Sequence C B2B Enterprise SaaS startups throughout numerous industries over 24 months.

Listed here are the highlights of our examine:

Corporations are decreasing headcount progress to increase runway

Headcounts rose each month throughout the final 4 months at a median price of round 2% in comparison with the ten% we noticed beforehand. Moreover, the twenty fifth percentile of startups confirmed reductions in headcounts, indicating that many corporations are taking drastic measures to increase their runway.

For corporations with a powerful stability sheet, sturdy backers and low burn/product-market match, now’s the most effective time to make vital hires.

This can be a gloomy indicator as startups brace for added macro headwinds and repricing occasions.

One other spherical of cuts are probably early subsequent 12 months

If the macro setting doesn’t enhance, we’d anticipate one other wave of job cuts after corporations’ fourth-quarter board conferences (often in January or February).

Many corporations will talk about their CY ’23 forecasts, and headcount is all the time a lever to increase runway since it might probably account for as much as 80% of a startup’s bills. On condition that many corporations have maintained their headcounts, we may even see them having to put folks off to cut back burn.

Tighter hiring began as early as Could 2022

Personal corporations started tapping the brakes proper round Could 2022, and extra corporations began appearing in unison, as seen from the tighter headcount velocity interquartile vary, which was compressed closely however has now stabilized.

Corporations serving HR and procurement noticed the steepest drop

As these companies have shrunk throughout the business, corporations offering tech aimed toward HR and procurement professionals noticed the steepest drop in headcount progress. Nonetheless, all of the tracked buyer profiles have trended towards decreasing hiring efforts.

There’s numerous accessible expertise

On a optimistic be aware, this is a wonderful time for corporations with product-market match (and supportive buyers) to rent the fitting expertise, as massive tech is decreasing headcount and the market is flooded with distinctive expertise.

From aggressive headcount progress to holding flat

Till April, most corporations had been hiring aggressively, with headcount rising month over month at over 10%, and the seventy fifth percentile was near about 20%.

In distinction, the present median is +1% and the seventy fifth percentile is +4%.

This downward pattern kicked off in Could and continues immediately. The interquartile vary continues to compress, with the median in the end heading towards flat headcount (i.e., changing pure attrition however not hiring past that). The twenty fifth percentile fell into layoff territory round August, however each the tenth percentile and twenty fifth percentile have since pulled again.

Picture Credit: Eddie Ackerman

Now that now we have set the stage: