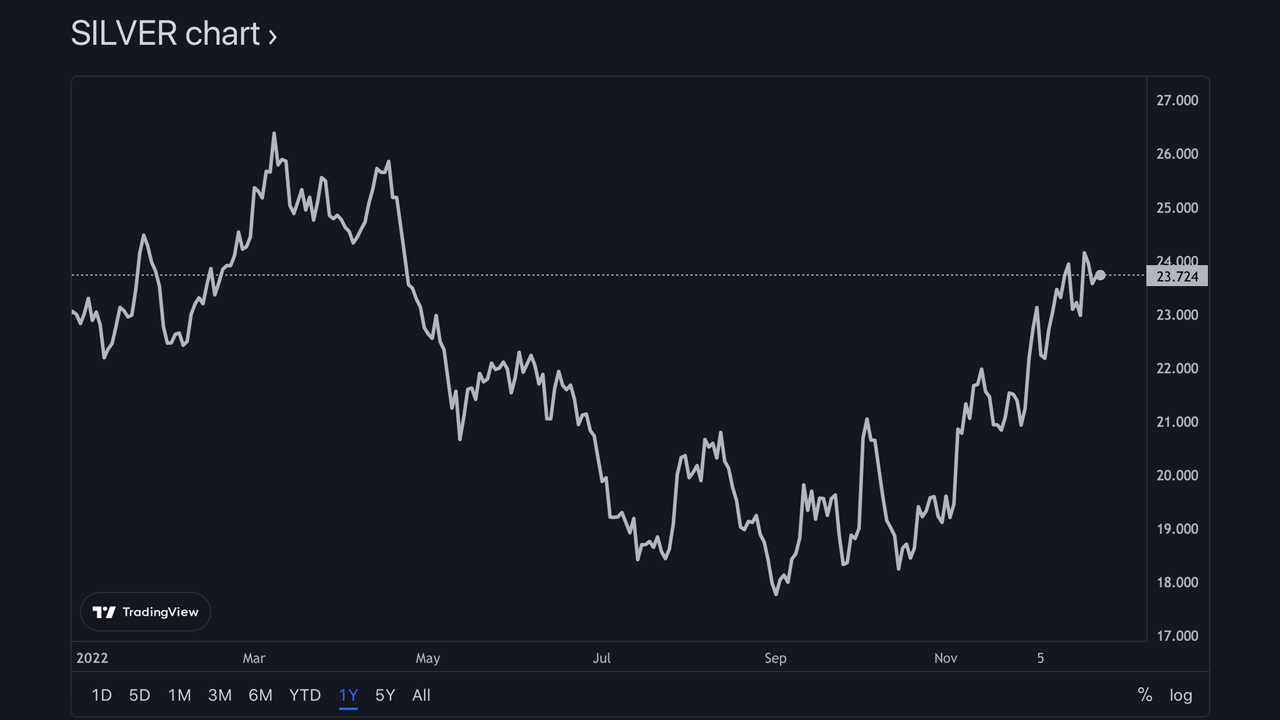

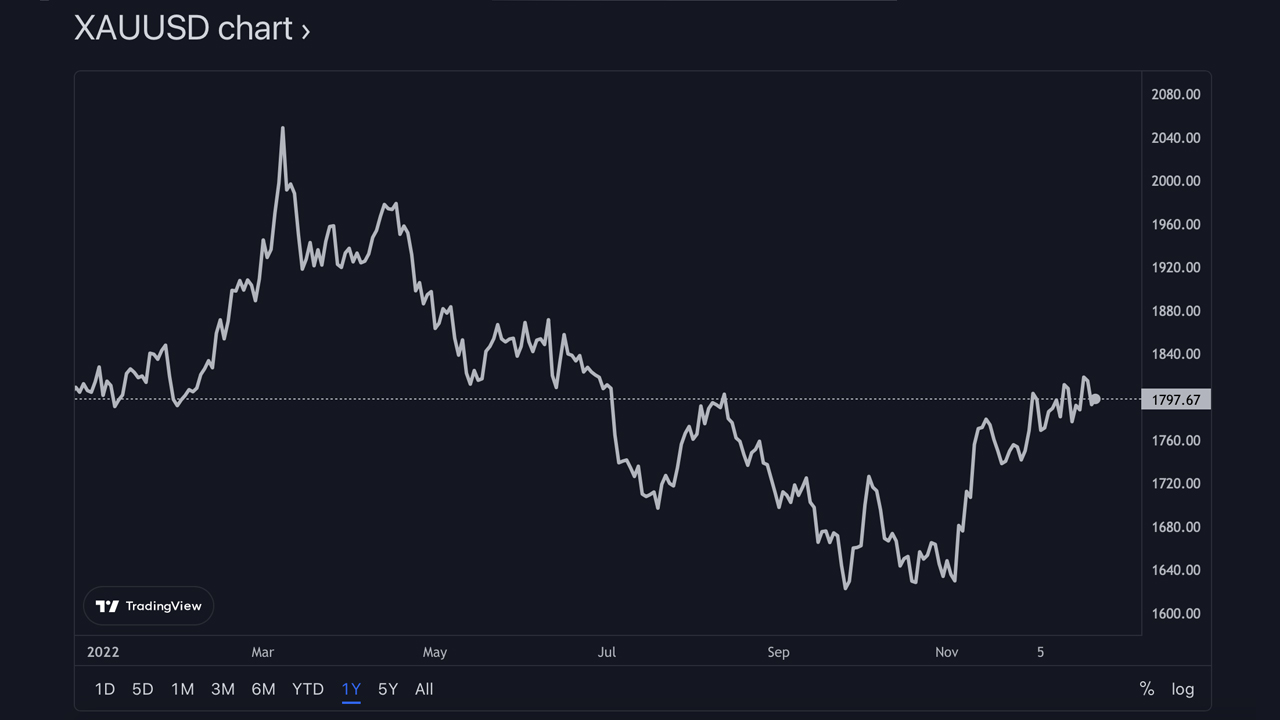

Gold costs are ending the yr a hair under the values recorded 12 months in the past. Statistics on Dec. 26, 2021, present the U.S. greenback worth per ounce of gold was $1,810 per unit, and right now gold is $1,797 per ounce. Silver, alternatively, managed to extend a hair in worth since final yr, as costs climbed from $23.04 per unit to the present USD worth of round $23.72 on Dec. 26, 2022.

Gold Dropped a Hair Throughout the Final 12 months, Whereas Silver Rose a Contact — Treasured Steel Property Managed to Maintain Worth All 12 months Lengthy Regardless of the Macroeconomic Calamity and Vitality Disaster

Whereas valuable metals like gold and silver fluctuated in U.S. greenback worth over the last yr, gold and silver year-to-date worth statistics present costs are just about the identical as final yr. Gold is down a contact over the last 12 months because it was buying and selling for $1,810 per ounce and right now it’s buying and selling 0.71% decrease at $1,797 per ounce. Silver was $23.04 per ounce and right now it’s 2.95% greater in worth at $23.72 an oz.

2022 was an fascinating yr for gold as the dear steel reached a lifetime worth excessive on March 8, 2022, as one ounce of gold reached $2,070 per unit. Whereas silver tapped a excessive on the identical day, the steel nonetheless has an extended solution to go earlier than catching as much as the $40 an oz vary reached in 2011. Silver got here awfully near surpassing the $27 per unit vary on March 8, 2022.

Each valuable metals did rather a lot higher than the highest two cryptocurrencies bitcoin (BTC) and ethereum (ETH). Metrics present BTC is down 66% since this time final yr, and ETH has misplaced a contact greater than 70% since final yr. Like cryptocurrency followers, valuable metals advocates suppose 2023 will see a bullish revival when it comes to silver and gold rising in worth. Kitco Information contributor Phillip Streible shared his predictions for the 2 valuable metals on Dec. 23.

“By year-end [2023], inflation ought to decline to 3-3.5%, resulting in gold costs averaging $1,950/oz with extensions up over $2,000 at completely different intervals,” Streible mentioned. “We must always see the two’s vs. 10’s yield curve flatten whereas Silver might simply see ‘inexperienced shoots’ up into the mid-high $ ’30s, settling again to $28 by year-end.”

Like cryptocurrencies and fairness markets, gold and silver have been affected by the macroeconomic storm and occasions like Covid-19, the Ukraine/Russia conflict, and the results of increasing the world’s cash provide like no different time in historical past. The U.S. Federal Reserve has elevated the federal funds price six instances to date in an effort to fight America’s highest inflation charges in over 40 years.

The gold bug and economist Peter Schiff believes gold and silver will do nicely in 2023 as nicely however he’s not as optimistic in regards to the inflation price as Streible. Talking with Kitco Information anchor David Lin, Schiff mentioned there’s an opportunity it might drop however he expects the U.S. inflation price to leap above 10%.

“We’re not getting wherever close to 2 p.c [inflation],” Schiff remarked. “Possibly we’ll go under 7 p.c earlier than we go above 10 p.c, however I feel we’re going to take out the highs from 2022 earlier than the tip of 2023 on a year-over-year foundation,” the economist added.

What do you consider gold’s and silver’s market performances in 2022? What do you consider Phillip Streible’s and Peter Schiff’s opinions about inflation and valuable steel costs? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.