Over the last month, Russia’s ruble has dropped 16.48% in opposition to the U.S. greenback as power and commodity costs have slowed over the previous few weeks. Russia’s central financial institution revealed two weeks in the past that it’s additional distancing itself from U.S. greenback dependence by buying the Chinese language yuan on overseas change markets. Roughly across the similar time, on Dec. 21, 2022, Sberbank govt and Russian Worldwide Affairs Council (RIAC) member, Yaroslav Lissovolik, printed an opinion article that talks about exploring the pathway towards a brand new BRICS reserve forex.

Russia’s Central Financial institution Seeks to Scale back Dependency on US Greenback with Buy of Chinese language Yuan

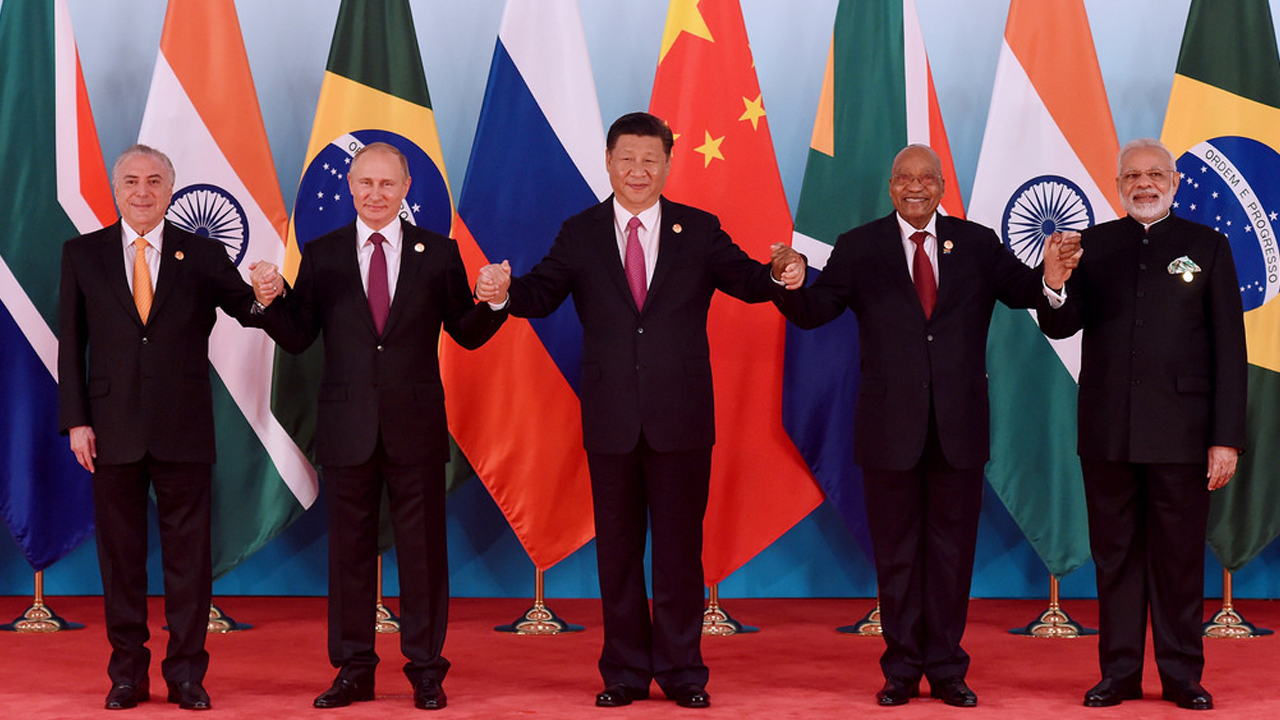

On the finish of July, Bitcoin.com Information reported on the BRICS nations’ plan to craft a brand new reserve forex after Russian president Vladimir Putin introduced the plan amid the BRICS Summit in June. Whereas the topic was topical on the time, folks stopped discussing the BRICS reserve forex for some time. Just a few months later, in October 2022, the creator of the best-selling guide Wealthy Dad Poor Dad, Robert Kiyosaki, mentioned the topic and famous that the U.S. greenback is “toast.” Over the past 30 days, power costs and commodities have subsided in worth, however some economists anticipate a $200-per-barrel run-up in oil costs in some unspecified time in the future in 2023.

Whereas power and commodity values have dropped, Russia’s ruble has dropped in opposition to the dollar as nicely. Statistics present that the ruble has misplaced 16.48% in opposition to the U.S. greenback in 30 days, however five-day metrics present the ruble is up 1.72%. Yr-to-date statistics present the Russian forex has elevated 5.37% during the last 12 months. In the meantime, on the finish of December 2022, Reuters reported that Russia will probably be making Chinese language yuan purchases on the forex market in 2023. Reporter Elena Fabrichnaya mentioned Moscow’s transfer was cited by two sources and it opens a “new entrance in an accelerating de-dollarization drive designed to scale back its dependency on Western finance.”

Sberbank Analyst Discusses Chance of a BRICS Reserve Forex Complementing Nationwide Currencies

The day gone by, on Dec. 21, 2022, Yaroslav Lissovolik, a member of the Russian Worldwide Affairs Council (RIAC) and head of the analytical division at Sberbank, printed a weblog submit titled “Exploring the Pathways,” discussing the proposed BRICS reserve forex. Lissovolik mentioned the “BRICS reserve forex has taken on explicit significance in latest months” following Russian president Putin’s remarks on the BRICS Summit. The analyst detailed that there’s additionally been latest laws and debates regarding the “expediency of making a brand new reserve forex.”

Lissovolik cited essentially the most latest dialogue in regards to the BRICS reserve forex on the Eighth BRICS Parliamentary Discussion board. On the occasion, Federation Meeting Speaker Valentina Matvienko steered that BRICS legislators begin to transfer ahead on concrete measures that bolster the nations’ economies. Matvienko singled out particular initiatives, together with the brand new worldwide reserve forex and creating higher settlement procedures throughout the BRICS nations. Lissovolik’s weblog submit additionally in contrast the brand new BRICS reserve forex thought to the 2018 Valdai Membership idea of the R5 forex, a reputation that signifies the letter “R” for the 5 currencies: the actual, ruble, rupee, renminbi, and rand.

Lissovolik detailed {that a} new BRICS reserve forex gained’t be created to exchange the nationwide reserve currencies utilized by every of the nations, however reasonably to “complement these nationwide currencies.” The Sberbank analyst mentioned a model new reserve forex may have a “transformational impact on the worldwide monetary system,” as he believes there’s a “notable scarcity of reserve currencies” within the international financial system.

“Importantly, the scope for using the brand new reserve forex on the planet financial system is sizeable given the great potential for de-dollarization,” Lissovolik’s weblog submit concludes. “The brand new BRICS reserve forex can act in live performance with the stronger position carried out by BRICS nationwide currencies to tackle a higher share of the overall pie of forex transactions on the planet financial system.”

What do you consider the Sberbank analyst’s editorial a couple of new BRICS reserve forex? Share your ideas a couple of potential new BRICS reserve forex within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.