Hong Kong has reaffirmed its dedication to develop into a regional crypto hub in following the collapse of cryptocurrency alternate FTX. “As sure crypto exchanges collapsed one after one other, Hong Kong grew to become a top quality standing level for digital asset corporates,” mentioned a high authorities official.

Hong Kong Goals to Change into Regional Crypto Hub

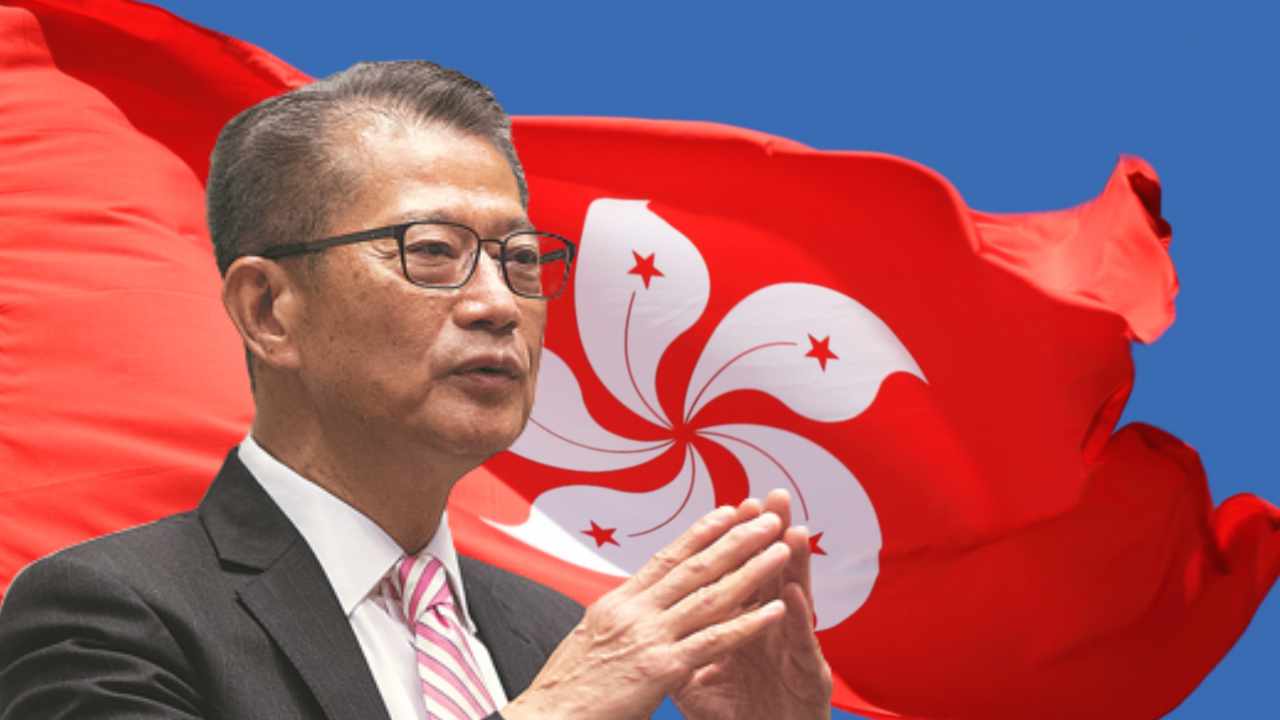

Hong Kong Monetary Secretary Paul Chan Mo-po reaffirmed town’s crypto dedication at a web3 summit in Cyberport Monday.

Emphasizing that Hong Kong stays dedicated to changing into a regional crypto hub, the monetary secretary described:

As sure crypto exchanges collapsed one after one other, Hong Kong grew to become a top quality standing level for digital asset corporates.

He added that Hong Kong has a strong regulatory framework for crypto that “matches worldwide norms and requirements.”

Joseph Chan, the undersecretary for monetary providers and the Treasury for the federal government of Hong Kong, revealed on the similar occasion that town is getting ready to subject extra licenses for digital asset buying and selling corporations. Furthermore, it’s planning a session on crypto platforms to discover the potential for retail participation within the trade.

Hong Kong is pushing to develop into a regional crypto hub regardless of the collapse of crypto alternate FTX and a number of other different crypto corporations submitting for chapter. Final month, town’s Securities and Futures Fee (SFC) issued a assertion warning in regards to the dangers related to crypto platforms providing deposits, financial savings, earnings, and staking providers.

After years of strict rules, Hong Kong is now pushing to make it simpler for retail buyers to commerce crypto property. Elizabeth Wong, the SFC’s director of licensing and head of the fintech unit, mentioned in October final 12 months: “We’ve had 4 years of expertise in regulating this trade … We predict that this can be truly a great time to essentially think twice about whether or not we are going to proceed with this skilled investor-only requirement.”

In November final 12 months, Julia Leung, one other SFC govt, mentioned the regulator is “actively wanting” to arrange a regulatory framework that enables retail buyers to commerce exchange-traded funds (ETFs) with publicity to cryptocurrency futures. In December, town’s first crypto futures ETFs have been launched.

What do you concentrate on Hong Kong changing into a regional crypto hub? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.