After FTX collapsed, the incident prompted many main crypto exchanges to publish proof-of-reserves and lists of identified addresses so customers can confirm the solvency of the buying and selling platforms. Whereas the veracity of those proof-of-reserve lists and asset dashboards is debatable, they do present some perception into the big sums of cryptocurrency held in custody by main exchanges. For instance, Binance, the biggest cryptocurrency change by commerce quantity, manages $66 billion in crypto belongings, which is greater than 6% of the complete cryptocurrency economic system’s internet worth of $1 trillion.

An Inspection of 5 Proof-of-Reserves Lists That Present Perception into Giant Cryptocurrency Holdings

It has been greater than 80 days since Coindesk printed a story about Alameda Analysis’s steadiness sheet, which confirmed the quantitative buying and selling desk owned a considerable amount of ftx token (FTT). Then, on Nov. 6, 2022, Binance CEO Changpeng Zhao (CZ) revealed that his change could be promoting its FTT holdings. Since then, FTT has misplaced appreciable worth and FTX filed for chapter safety 5 days afterward Nov. 11. At the moment, and previous to FTX’s failure, it was difficult to watch the change’s reserves as executives stored issues very opaque. This case has led exchanges to launch proof-of-reserve lists and there was criticism from crypto trade members over particular varieties of lists and the way they’re audited.

Moreover, Paul Munter, the U.S. Securities and Trade Fee’s (SEC) appearing chief accountant, just lately said that the SEC is intently monitoring proof-of-reserves (POR). Regardless of the complaints, the out there proof-of-reserve lists present some perception into what entities maintain and, to a sure extent, they assist enhance market stability as a result of individuals can monitor the holdings. The next is an examination of 5 totally different centralized crypto asset exchanges and their holdings in crypto belongings as of Jan. 22, 2023, based on nansen.ai’s change listing. Nansen incorporates a dashboard for 18 totally different centralized crypto change platforms.

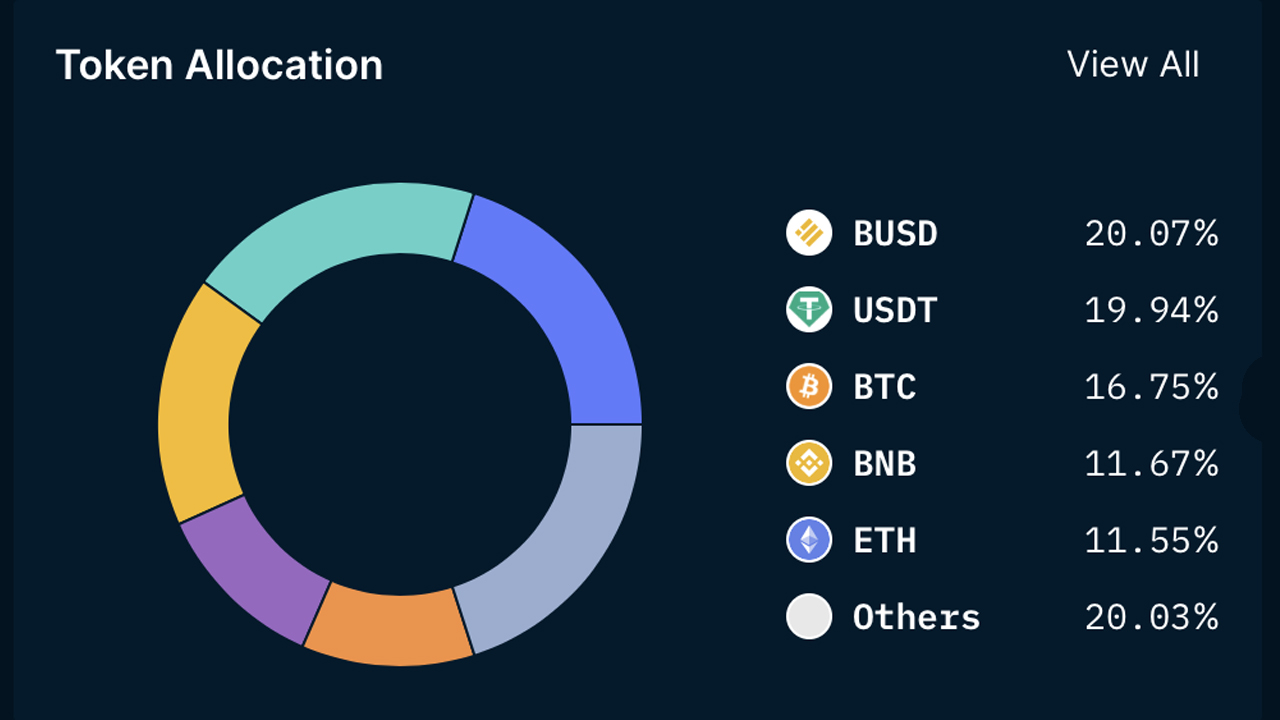

Binance

Binance is the biggest with $66 billion in digital belongings held in reserves by the crypto change large. On Jan. 22, the biggest crypto change by commerce quantity held 486,427 bitcoin (BTC), price $11.1 billion. When it comes to stablecoins, Binance holds $13.2 billion in tether (USDT) and $13.3 billion in BUSD.

Moreover, Binance holds 4.7 million ether, price $7.6 billion, and one other $7.6 billion price of binance coin (BNB). The change additionally holds greater than $13 billion price of different crypto belongings which can be too quite a few to call. If Binance’s stash was included within the high ten crypto belongings by market cap, it could rank within the fourth place.

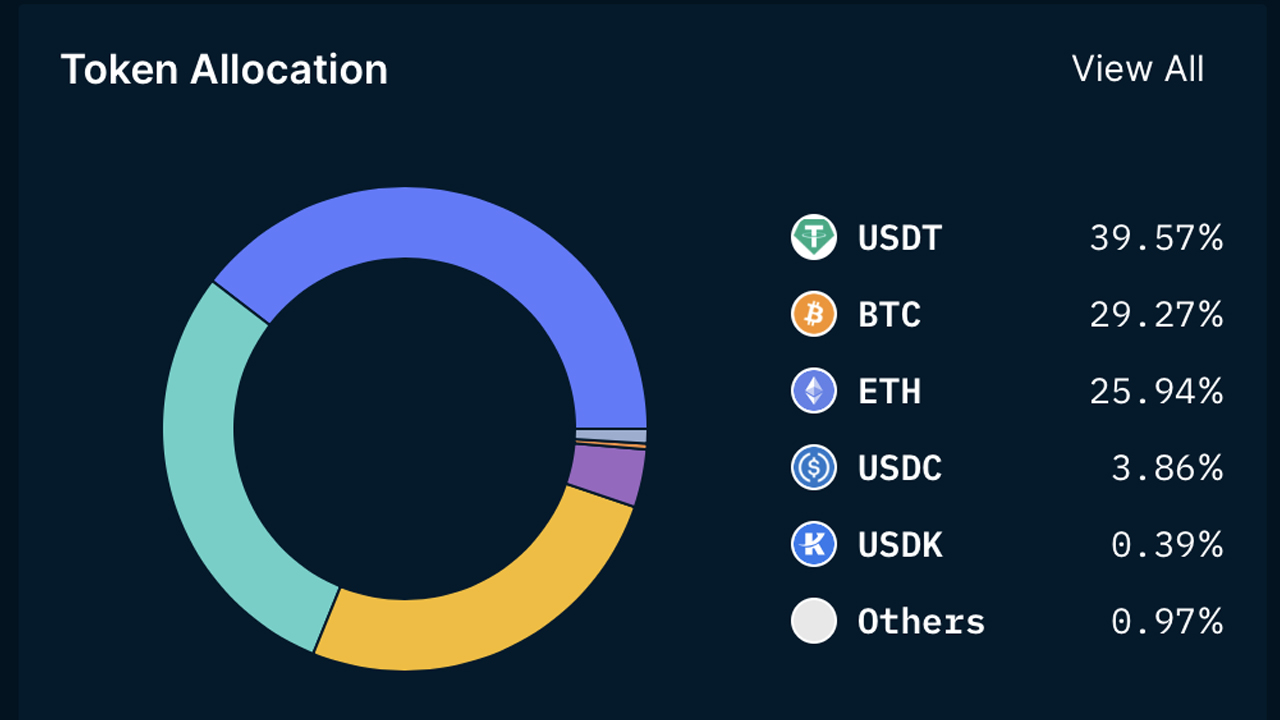

Okx

Nansen’s dashboard listing reveals that the crypto change Okx holds $7.6 billion in crypto belongings. $3 billion of the funds are held in tether (USDT), and the change additionally holds 97,656 BTC, price $2.2 billion.

25.95% of Okx’s belongings are held in ethereum (ETH), or a steadiness of 1.2 million ether, price $1.9 billion, utilizing present change charges for ETH. Moreover, Okx holds roughly 294 million usd coin (USDC) as properly.

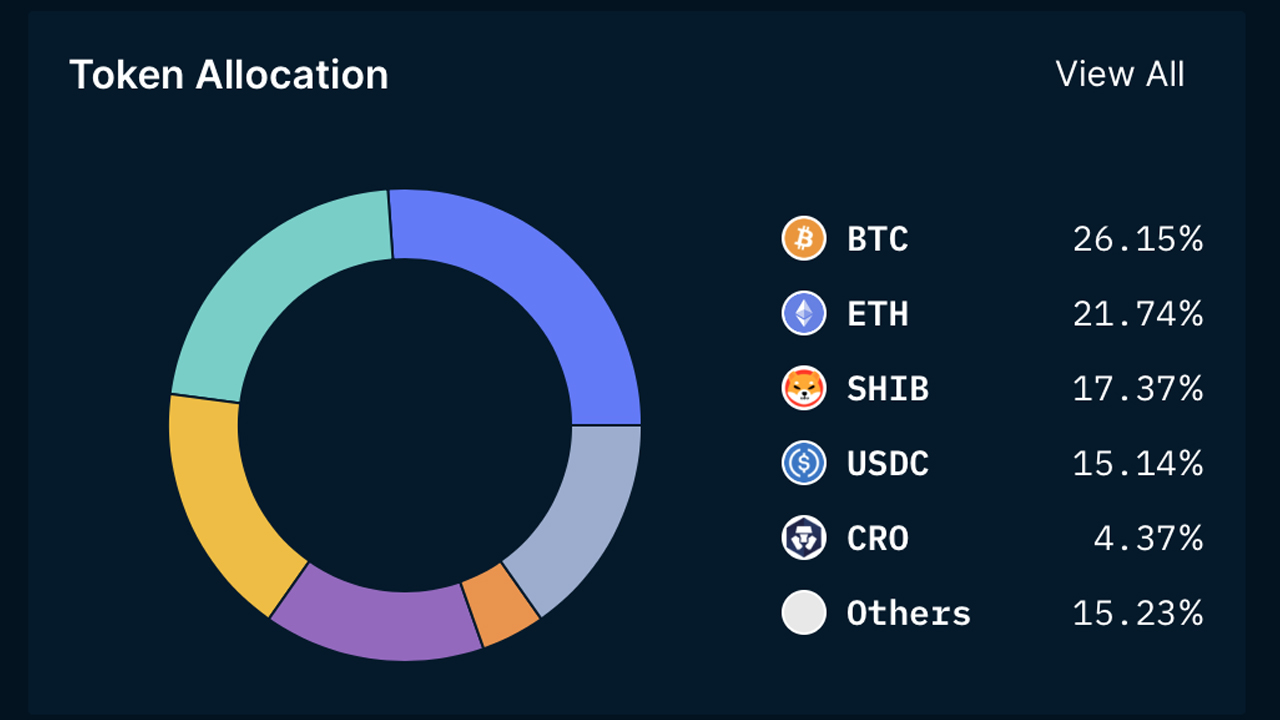

Crypto.com

Crypto.com manages round $3.83 billion on Jan. 22, and its holdings at present embrace 44,208 BTC, price simply over $1 billion. The change additionally holds 514,763 ETH, which is price roughly $833 million on Sunday.

Nansen’s Crypto.com dashboard additional reveals that the buying and selling platform holds 17.28% of its holdings in shiba inu (SHIB). Crypto.com’s SHIB holdings embrace round 55.2 trillion SHIB, or $663 million price of the meme token. The buying and selling platform additionally manages round 585 million usd coin (USDC) and a pair of.1 billion cronos (CRO), price round $167 million.

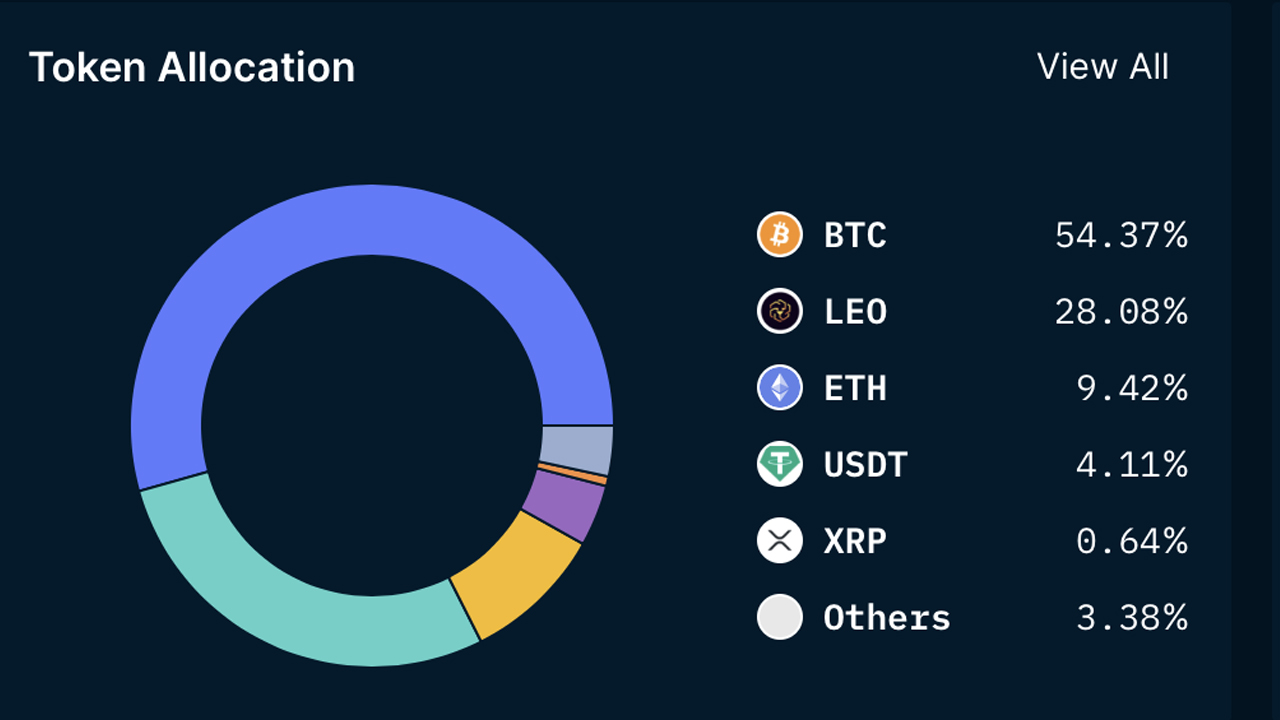

Bitfinex

The digital foreign money buying and selling platform Bitfinex holds $8 billion in crypto belongings on Sunday, Jan. 22, 2023. 54.29% of Bitfinex’s holdings are in bitcoin (BTC), or round 191,654 BTC, price $4.36 billion right now. 28.15% of Bitfinex’s belongings are stored in unus sed leo tokens (LEO), or round $2.2 billion price of LEO.

The change additionally holds 466,014 ethereum (ETH), price $756 million, on Jan. 22. Moreover, Bitfinex manages 331 million tether (USDT) and 0.64% of Bitfinex’s belongings, or round 126 million XRP, are held in reserves.

Huobi

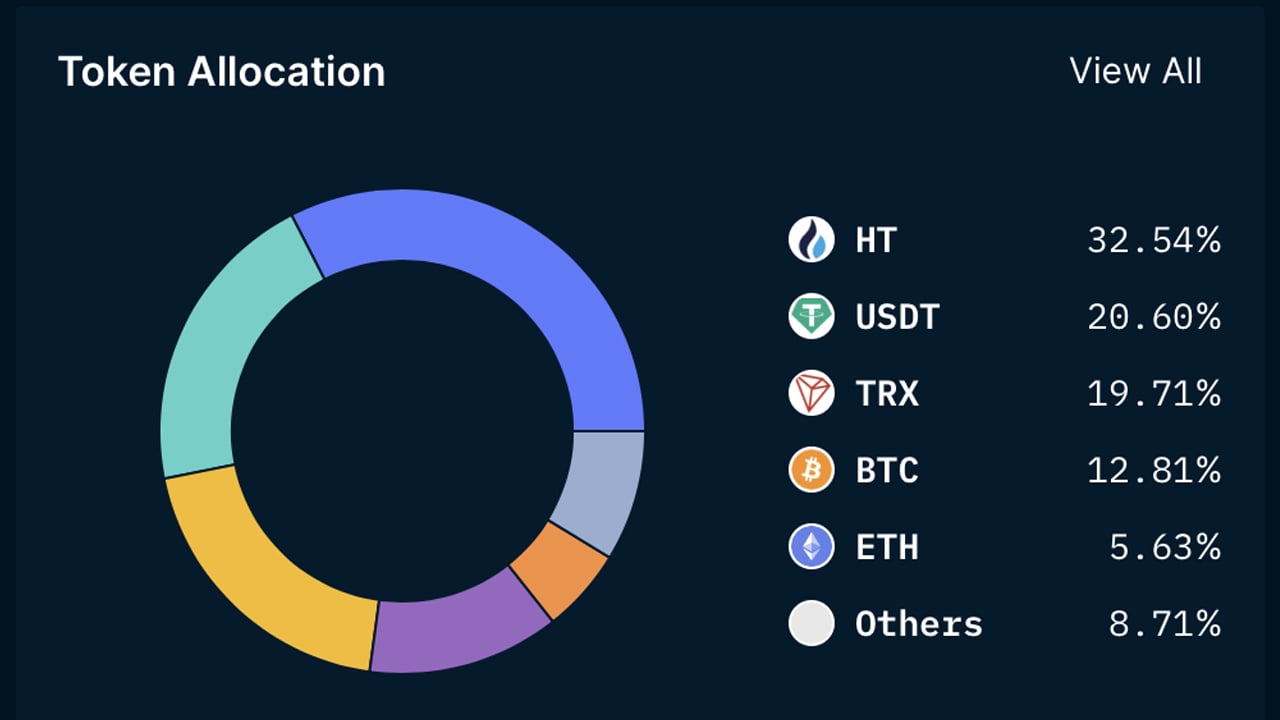

Huobi holds round $3.17 billion on Jan. 22, and 30.91% of the belongings are within the change coin, huobi token (HT). The change manages 196 million HT, which is price roughly $980 million right now in USD worth.

Huobi additionally holds 617 million tether (USDT) and 9 million tron (TRX), price $596 million. 12.13% of Huobi’s belongings are held in BTC, 5.35% is saved in ETH, and 13.35% of Huobi’s belongings are different crypto belongings too quite a few to call. $7.7 million price of the worth derives from the 57.58 million HUSD that Huobi holds, which is 30.66% of the HUSD provide. Whereas HUSD was as soon as a stablecoin pegged to the U.S. greenback, HUSD is now buying and selling for $0.13 per coin.

The 5 Exchanges Maintain $88.6 Billion or 8.6% of the Crypto Financial system’s Present USD Worth

All 5 of the aforementioned cryptocurrency exchanges maintain $88.6 billion in crypto belongings mixed. The mixed worth of all 5 of the change’s reserves equates to eight.6% of the present $1 trillion crypto economic system.

74.49% of the $88.6 billion is held on Binance, and the remainder is dispersed amongst Okx, Crypto.com, Bitfinex, and Huobi. The buying and selling platform with the biggest change token cash is Bitfinex, with its stash of $2.2 billion price of LEO. Out of the 5 talked about exchanges, Binance holds essentially the most Bitcoin (BTC) with its cache of 486,427 BTC.

What do you consider the latest pattern of crypto exchanges publishing proof-of-reserve lists and asset dashboards? Do you’ve gotten issues in regards to the veracity of those lists? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, nansen.ai’s change listing,

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.