Blockchain analytics agency Glassnode is providing three on-chain indicators that counsel the Bitcoin (BTC) bear market is within the rearview mirror.

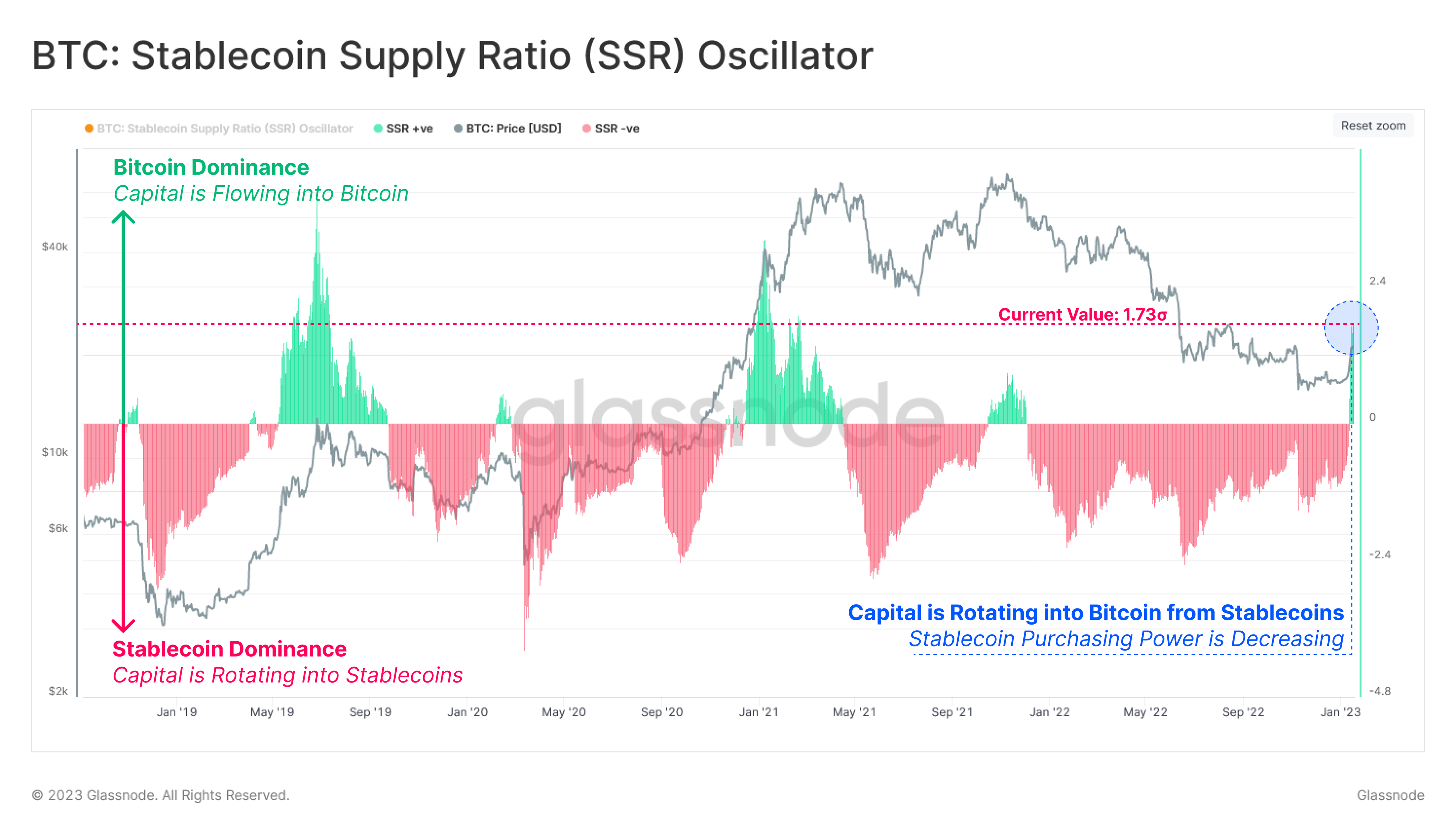

Glassnode first seems on the stablecoin provide ratio (SSR), which tracks the rotation of capital between Bitcoin and stablecoins.

A spiking SSR means that buyers are taking the plunge as they use stablecoins to buy BTC.

In response to Glassnode, the metric exhibits that capital is rotating into Bitcoin from stablecoins, harking back to the ultimate chapter of the 2018/2019 bear market.

“Currently, we notice a major switch of capital to the Bitcoin asset, akin to the twilight of the 2018 bear market and the 2021 rounded prime.”

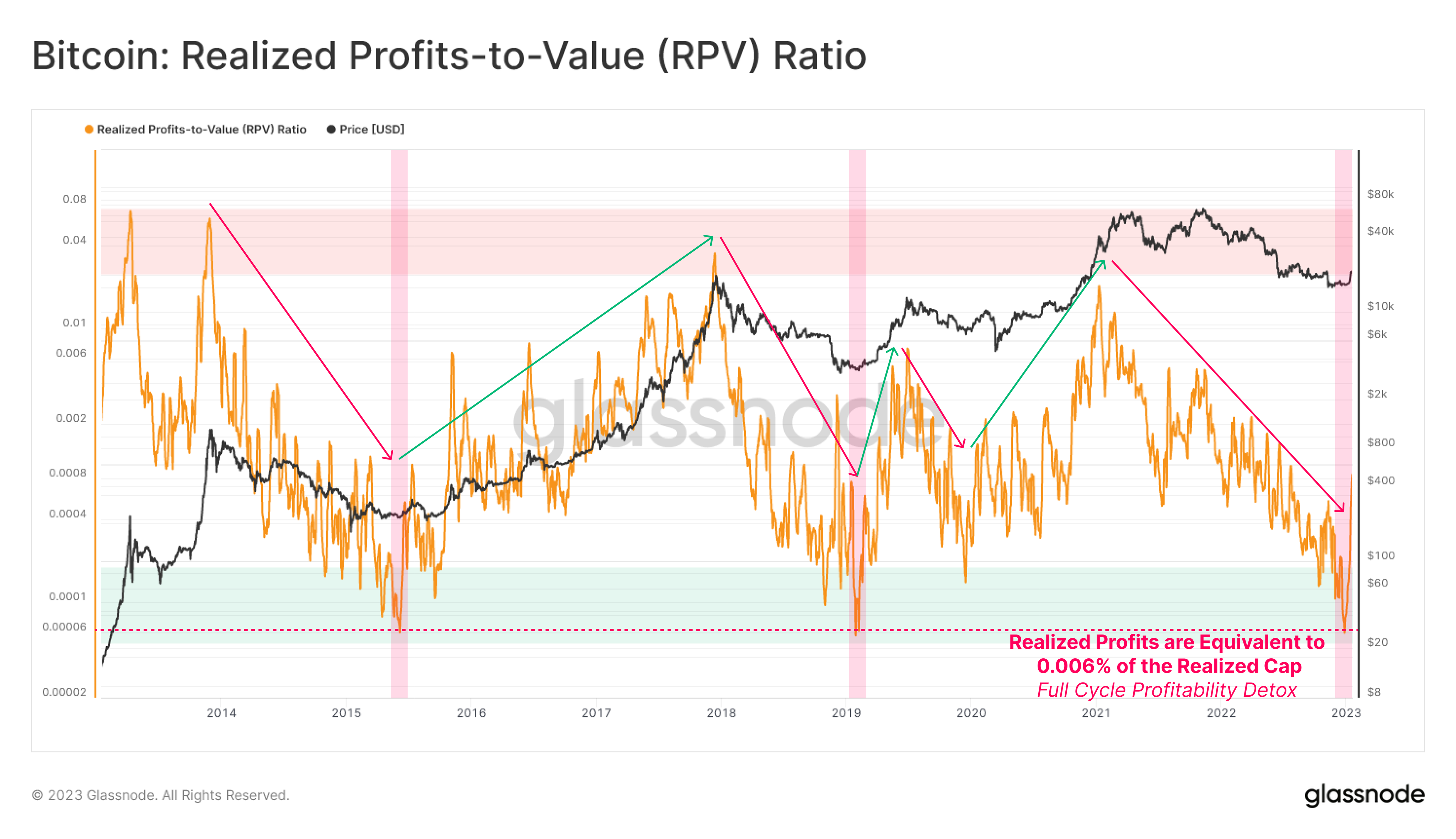

Glassnode additionally factors out Bitcoin’s realized profits-to-value ratio (RPV) indicator, which compares profit-taking out there towards the community valuation. Primarily based on Glassnode’s information, the RPV has now reached and bounced off of ranges that marked the bottoms of the 2015 and 2018 bear markets.

“The RPV ratio collapsed to prior cycle lows, suggesting a lot of the exuberance from the bull has been flushed out.”

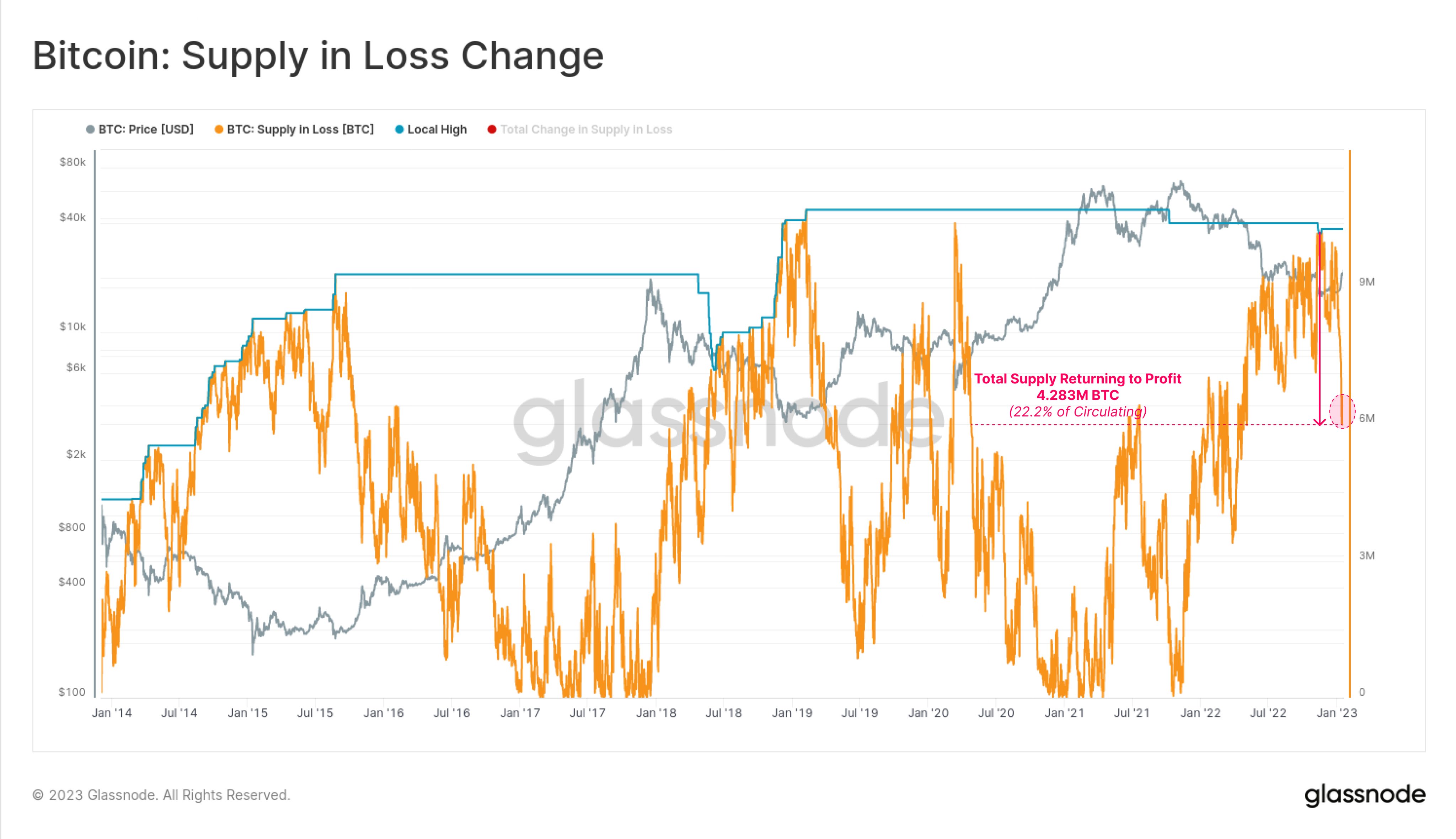

The third indicator that Glassnode says suggests the Bitcoin bear market could possibly be over is the quantity of BTC held at a loss. The agency’s information exhibits that weeks in the past, the availability in loss metric reached practically the identical stage because it did throughout late 2018, when Bitcoin bottomed out.

Since then, hundreds of thousands of BTC have been traded, indicating the intention of market members to set a value ground.

“Because the market lows set through the FTX collapse, a complete of 4.283 million BTC have returned to an unrealized revenue.

This supplies a sign of the quantity of Bitcoin that has transacted, and altered fingers between $15,500 and $22,300.”

At time of writing, Bitcoin is buying and selling for $22,737.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/nullplus