9 days into their honeymoon in December 2018 in Jaipur, India, Gerald Cotten, and Jennifer Robertson made an emergency journey to a personal hospital. Cotten had come down with a extreme stomachache, and after a analysis of acute gastroenteritis, his situation worsened severely. Blood assessments pointed to septic shock because the perpetrator. His coronary heart stopped, and regardless of docs’ finest efforts, Cotten was declared lifeless simply 24 hours after his stomachache had begun.

Because the CEO and Co-Founding father of QuadrigaCX, Canada’s then-biggest Bitcoin change, Cotten’s loss of life quickly made worldwide headlines, however not simply due to his standing within the crypto world. Whereas his will detailed hundreds of thousands in actual property holdings and different belongings, it left no point out of the chilly wallets that saved most of Quadriga’s funds — which totaled $250 million in cryptocurrency. In April 2019, the Nova Scotia Supreme Court docket declared the corporate bankrupt, because the change had ceased to operate three months earlier.

Cotten’s story is among the crypto world’s most intriguing, containing all the weather of an ideal thriller novel: faux identities, Ponzi schemes, worldwide investigations, greed, disappearance, and loss of life. It additionally exposes one of many decentralized world’s weaknesses, elevating an uncomfortable query: What occurs to an individual’s crypto and NFTs after they die?

NFTs and crypto after loss of life

To the Web3 person, ceaselessly shedding digital belongings to inaccessible wallets is a nightmare state of affairs that rivals shedding every part to rug pulls and different scams. However whereas shedding crypto and NFTs on account of poor property planning is hardly any totally different, it’s much less more likely to be on individuals’s minds. The know-how remains to be comparatively new, and other people usually don’t like to consider loss of life, a lot much less their very own.

“There are individuals who don’t wish to take care of their very own mortality,” defined Asher Rubinstein, a accomplice at Gallet Dreyer & Berkey in New York Metropolis who focuses on home and worldwide asset safety, wealth preservation, and property planning in an interview with nft now. “It’s a troublesome concern to take care of. What occurs after I die? Some individuals simply don’t even wish to face the query.”

However belongings are nonetheless belongings, digital or in any other case, and having a correct plan in place to deal with their distribution post-death is vital. And the stakes transcend the private stage: Bitcoin’s whole circulation is unlikely to achieve its said restrict of 21 million on account of early adopters who both died and had no plan for succession or misplaced their non-public keys ceaselessly. And whereas the general development is encouraging — practically 70 % of monetary planners who took half in an property planning survey performed by TD Wealth this 12 months mentioned they’re now incorporating digital instruments into their shoppers’ property plans — the difficulty remains to be one which deserves extra consideration than it will get.

Digital asset safety and accessibility

The issue of digital asset distribution comes from the decentralized nature of the blockchain. Probably the most primary precept of Web3 safety is to not give away your non-public keys, even to mates and family members, as a result of there’s simply no centralized authority to return to the rescue ought to one thing go awry. Authorized consultants like Rubinstein, whose shoppers embody distinguished blockchain firm founders, assist individuals strike the nice stability between safety and accessibility relating to crypto asset administration and inheritance. Finally, there’s no good technique to go about it, however in the case of the legislation, Web3 customers have to know their choices.

“An lawyer that’s cognizant of digital belongings will know what to do along with your digital belongings, identical to they need to know what to do with your own home,” Rubinstein underlined. “There are two methods to go right here: Do we want a will? Or do we want a belief?”

“Do you actually need your will and your belongings, together with your digital belongings, to be made identified to the general public?”

Asher Rubinstein

Doing nothing, Rubinstein emphasizes, is the worst factor you may do. Whereas state legal guidelines within the U.S. account for intestacy (the circumstance of loss of life during which no will or belief is offered), this requires the state’s intervention, which means the federal government will distribute your belongings based on the legislation. Placing digital belongings right into a will is the following best choice, necessitating costly authorized proceedings and public hearings. It’s this public nature, Rubinstein famous, that the majority Web3 advocates use blockchain tech particularly to keep away from.

“[With a will,] your subsequent of kin has to rent an lawyer to undergo the probate course of,” Rubinstein elaborated. “And it’s public. Do you actually need your will and your belongings, together with your digital belongings, to be made identified to the general public? You’ve additionally created a discussion board the place someone can go and problem your will. My expertise with shoppers who’re within the crypto realm is that they don’t need the court docket to know the place their crypto is. They don’t need the general public at giant to learn their will and see the place their NFTs are positioned or what they personal within the digital world. Wills are usually not mistaken, per se, for property planning, however they do have inefficiencies. There’s a greater method — a belief.”

Managing digital inheritance with a belief

Managing digital asset inheritance with a belief comes with some vital advantages. One is that it bypasses courts. Other than the general public nature of the court docket system, the judicial techniques that deal with wills will be remarkably slow-moving. To probate a will in New York Metropolis, for instance, courts don’t even start the method till six to 9 months after a loss of life happens. If a will consists of unstable cryptocurrencies, inheritors can win or lose total fortunes in that point.

When establishing a belief, it’s additionally crucial to know the way well-versed a trustee is in digital currencies and NFTs. In the event that they don’t know how you can entry your pockets, your autopsy digital belongings may very well be in hassle. To keep away from this case, the perfect factor to do is to put in writing one thing into the belief that empowers the trustee to rent the sort of one that does have experience with digital belongings.

“Most individuals don’t wish to half with custody and management over their digital belongings.”

Asher Rubinstein

Trusts aren’t an ideal answer both, as they contain sharing non-public keys with or transferring digital belongings to a trustee, and most are reluctant to share that sort of info if there’s even a slim likelihood that it in some way will get out.

“Most individuals don’t wish to half with custody and management over their digital belongings,” Rubinstein conceded. “They wish to retain their digital belongings till they die. And they may not share their keys with the trustee. However they could depart behind directions on the place the trustee might discover these keys, for instance, in a security deposit field.”

Nevertheless, there’s a wholesome debate within the Web3 group about whether or not the protection deposit route is an effective one, because you’re in the end storing your keys with a centralized authority that may change the principles surrounding its security deposit system at any time.

Crypto property planning: the authorized vs. the technical strategy

Some Web3 protocols are trying to carry a technical answer to the difficulty of digital asset dispersal within the occasion of somebody’s incapacitation or loss of life. The Sarcophagus protocol, which acts like a digital lifeless man’s change, is one among them. Customers can retailer paperwork or messages that mechanically reveal themselves to a delegated recipient if that person stops signing cryptographic messages (as an indication that they’re alive and properly).

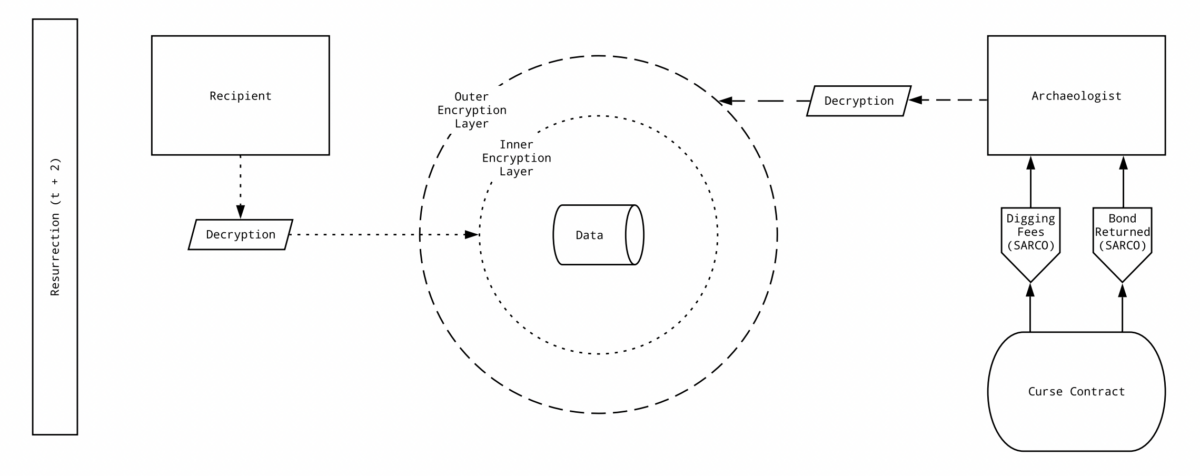

Primarily, Sarcophagus layers an encrypted information storage unit (which may very well be composed of paperwork, messages, or different information) with a set off that releases upon the inaction of a person. For instance, customers might set it as much as enact in the event that they don’t entry their pockets inside a specified time. The system depends on three forms of people: creators (additionally known as embalmers), recipients, and archaeologists.

Within the context of asset inheritance, the embalmer is the one who desires to cross on their digital belongings. They create the Sarcophagus change and encrypt the information they need the receiver to acquire within the occasion of their inaction. The recipient (represented by an ETH tackle) can obtain the encrypted file at “resurrection time,” a time decided by the embalmer (say, any variety of hours and even years after their inaction has been seen by the system). This time specifies when the information is on the market to be decrypted in case the embalmer fails to carry out the digital signature.

Recipients can solely decrypt the internal encryption layer of a sarcophagus, nevertheless. First, an archaeologist must decrypt the outer layer. Archaeologists are actors within the Sarcophagus community that run nodes to watch whether or not sarcophagi must be decrypted. In addition they stake SARCO tokens (the protocol’s native token) that may be slashed in the event that they decrypt too early or late or in any other case act outdoors of the phrases of the settlement between the embalmer and archaeologist. Belongings in a portfolio will also be transferred to a specified pockets tackle by placing a signed (however unpublished transaction) right into a sarcophagus. The recipient(s) then publish that transaction to execute the inheritance.

It’s a intelligent system that may very well be utilized to a number of conditions starting from password restoration to emergency communication to political activism. And whereas its potential for aiding the inheritance of digital belongings can be compelling, technical options don’t essentially override the need of correct authorized counsel and knowledge in these issues.

“We reside in a society the place ingenuity and creativity are rewarded,” Rubinstein mentioned whereas commenting on technical options like Sarcophagus. “Individuals have needed to do their property paperwork for a whole lot of years. And many individuals suppose, ‘Effectively, do I want a lawyer to do that? Let me discover a technique to have know-how do it for me.’ I’m skeptical as a result of except there are legal professionals behind the know-how, then I’m going to query whether or not all of the i’s are dotted and the T’s are crossed with regard to the legislation. If a tech firm is offering an alternative choice to correct property planning paperwork, then now we have to ask if what the tech firm is doing is correct and full.”

Managing your digital belongings in life

Eager about and taking steps to handle your crypto and NFTs is an ever-evolving course of. Web3 strikes quick, so it’s a good suggestion to replicate on the way you deal with your digital belongings with some frequency. The Inside Income Service (IRS) and the Securities and Exchanges Fee (SEC) repeatedly launch statements that replace their place on crypto and NFTs. Conserving an ear to the bottom for these is significant.

Whereas the blockchain has created a brand new, largely decentralized world, Web3 fans shouldn’t make the error of pondering that it’s a world past the attain of the federal government. The Division of Justice has proven that it’s not afraid to go after fraud within the house, and the IRS is well-known for its worldwide attain.

“I might not put DeFi and anonymity above the duty to abide by the legislation.”

Asher Rubinstein

“The IRS has tentacles all over the world,” mentioned Rubinstein on the institution and implementation of the International Account Tax Compliance Act (FATCA). This 2010 legislation requires sovereign governments to signal on to implement U.S. tax legislation abroad by giving info to the IRS. “You need to by no means assume that the federal government is silly. Have a look at how the FBI and different legislation enforcement companies are literally in a position to decide how blockchains have been hacked.”

The IRS not too long ago up to date its tax legislation to incorporate NFTs in the identical class as cryptocurrencies, saying that those that have “disposed of any digital asset in 2022,” whether or not by change, sale, or switch, must report and pay capital features tax accordingly.

“Sure, we’re speaking concerning the world of DeFi, however I might not put DeFi and anonymity above the duty to abide by the legislation,” Rubinstein underscored. “It is advisable preserve information of your buy value of cryptocurrencies or NFTs as a result of whenever you promote these belongings, you must pay tax on any features. And I don’t suppose it might be prudent so that you can suppose that the federal government won’t ever discover out that you just bought these belongings and made earnings.”

Total, count on regulation relating to digital belongings to vary because the U.S. authorities grapples with crypto and NFTs and what they imply for society at giant. To this point, that course of has been removed from a easy one. For private property planning and correct administration of your digital belongings, whilst you’re alive, the perfect recommendation appears to be to plan for the worst and hope for the perfect.