German insurtech startup Getsafe is including a fourth market with as we speak’s product launch. Along with Germany, Austria and the U.Ok., Getsafe is now going to supply insurance coverage merchandise in France. The corporate will first supply a house insurance coverage product.

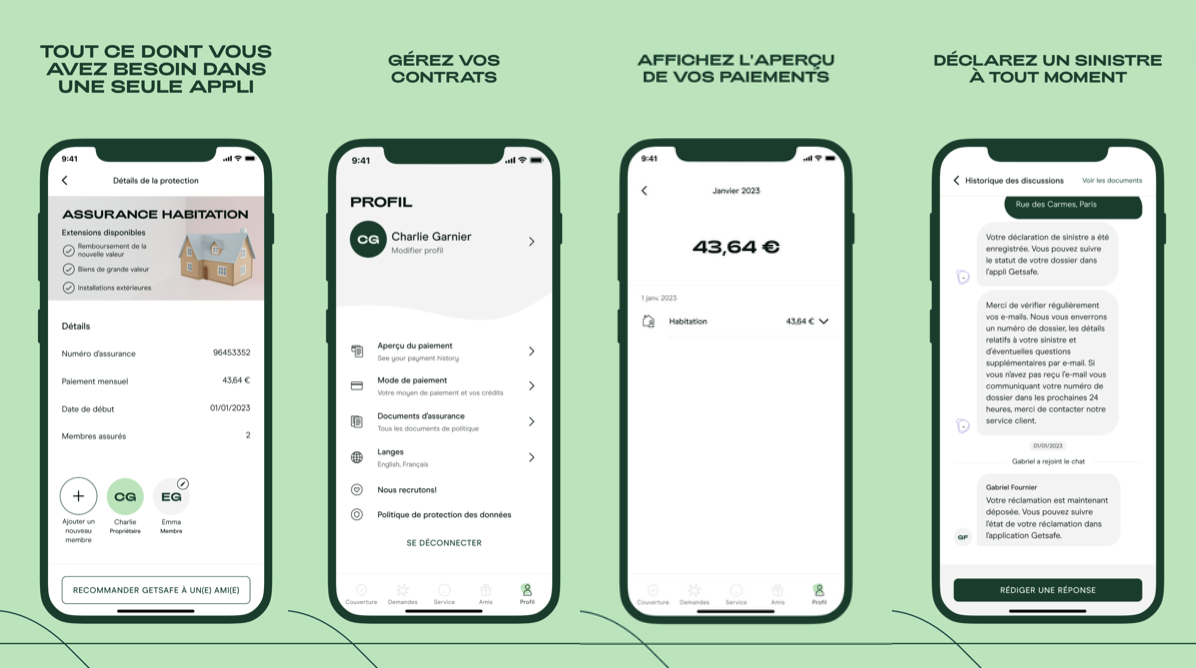

Getsafe is attempting to disrupt the insurance coverage market with a deal with digital-first insurance coverage merchandise. It sells its merchandise instantly to finish prospects via its web site and app not like its German rival Wefox.

In its residence market, Getsafe initially began with a house contents insurance coverage product. However it has drastically diversified its lineup of merchandise with the addition of personal medical insurance, drone legal responsibility insurance coverage, pet medical insurance and even some monetary merchandise like personal pension plans.

In October 2021, when the corporate introduced a Collection B extension of $63 million, Getsafe had 250,000 prospects. It now has 400,000 purchasers as it’s about to just accept new prospects in France. Getsafe has its personal insurance coverage license from Germany’s monetary regulator, BaFin.

On the French market, the corporate goes to supply an all-in-one residence insurance coverage product. This sort of insurance coverage merchandise is especially common in France as residence insurance coverage is a authorized requirement whether or not you personal otherwise you’re renting your own home. It often protects the home or residence in opposition to fires or water damages in addition to the contents of your own home. It additionally consists of residence legal responsibility insurance coverage.

It’s going to be attention-grabbing to see if Getsafe manages to seize some market share as this can be a crowded market. All legacy insurance coverage firms supply residence insurance coverage merchandise and nonetheless characterize nearly all of contracts. With regards to newcomers, French startup Luko additionally began with residence insurance coverage and now has 400,000 prospects. Final 12 months, Luko acquired Coya, a German competitor. In different phrases, Getsafe and Luko now each function in Germany and France.

Lemonade, the publicly traded American insurtech, additionally launched its renters insurance coverage in France. Whereas Lemonade carried out fairly effectively on the inventory market after its preliminary public providing, its shares dropped fairly dramatically in late 2021 and 2022. The corporate’s market capitalization is now simply above the $1 billion mark.

Lemonade’s efficiency might have a chilling impact on the insurtech startup market. However that doesn’t appear to cease Getsafe as the corporate already plans to launch extra merchandise on the French market because of its digital-first method and direct-to-consumer distribution technique. You’ll be able to count on a non-public medical insurance product, some journey insurance coverage choices or pet medical insurance plans by the top of 2023.

Picture Credit: Getsafe