Cardano worth has been in a robust bullish pattern prior to now few weeks, making it one of many top-performing cryptocurrencies. ADA, its community token, has risen to a excessive of $0.39, which was the very best level since November 8. It has jumped by over 58% from the bottom stage in 2022.

Cardano DeFi ecosystem rebound

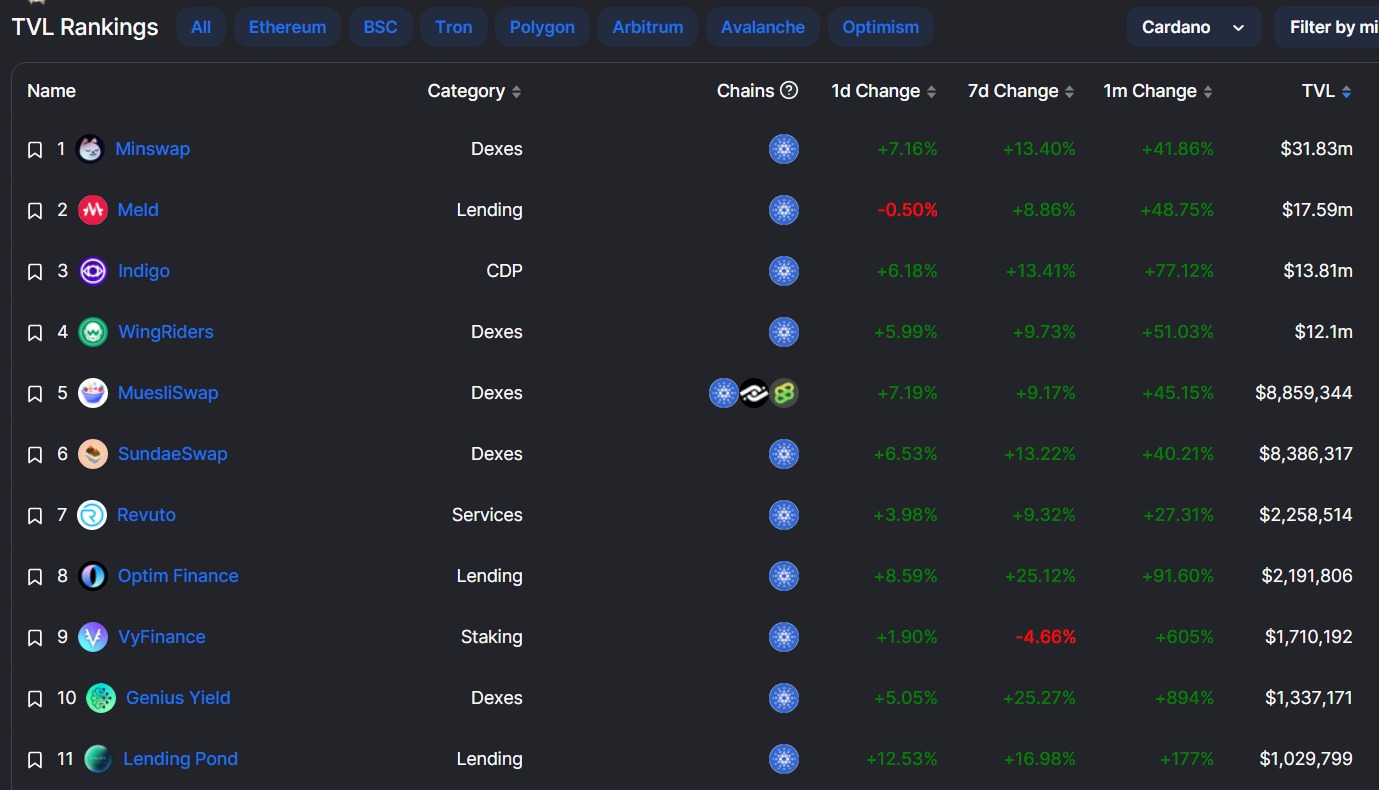

Cardano worth has been in a robust restoration as exercise in its community do properly. Knowledge compiled by DeFi Llama reveals that the entire worth locked (TVL) in Cardano’s DeFi ecosystem has been in a robust restoration as cryptocurrencies rebound. After falling under $60 million in 2022, the TVL has bounced again to about $102 million.

A better look reveals that the majority DeFi platforms are doing properly. For instance, MinSwap has seen its TVL bounce by over 41% prior to now 30 days. It has a market dominance of 31.4%. In the identical interval, Meld has seen its TVL soar to over$17.59 1,000,000, making it the second-biggest DeFi platform in Cardano.

Different high gamers within the ecosystem are Indigo, WingRiders, MuesliSwap, and SundaeSwap have all seen their TVLs bounce by double-digits, as proven within the chart under.

Cardano NFT ecosystem is recovering

ADA worth has additionally risen as the amount of its NFT collections rise. Knowledge compiled by CryptoSlam reveals that the entire gross sales in its ecosystem rose to greater than $9 million in December. That was a exceptional comeback from the $7.9 million that had been offered in December. It nonetheless stays considerably decrease than its peak of over $61 million in January 2022.

There are a number of causes for the robust Cardano comeback. A very powerful one is that analysts imagine that the Federal Reserve will begin easing financial coverage within the coming months since inflation is falling. That is proof by the truth that shares are rising whereas the US greenback index has fallen to the bottom pont in months.

Another excuse is that Cardano was extraordinarily oversold as its coin crashed onerous in 2022. As such, buyers had been shopping for the dip.