Goldman Sachs has ranked bitcoin the best-performing asset to this point this 12 months. The cryptocurrency additionally tops the worldwide funding financial institution’s checklist because the asset with the best risk-adjusted return — above gold, actual property, the S&P 500, and the Nasdaq 100.

Bitcoin Outshines Different Investments on Goldman’s Chart

World funding financial institution Goldman Sachs has reportedly ranked bitcoin the best-performing asset year-to-date (YTD). The Twitter account Documenting Bitcoin tweeted earlier this week:

Bitcoin is the most effective performing asset on the earth this 12 months, in accordance with newest knowledge by Goldman Sachs.

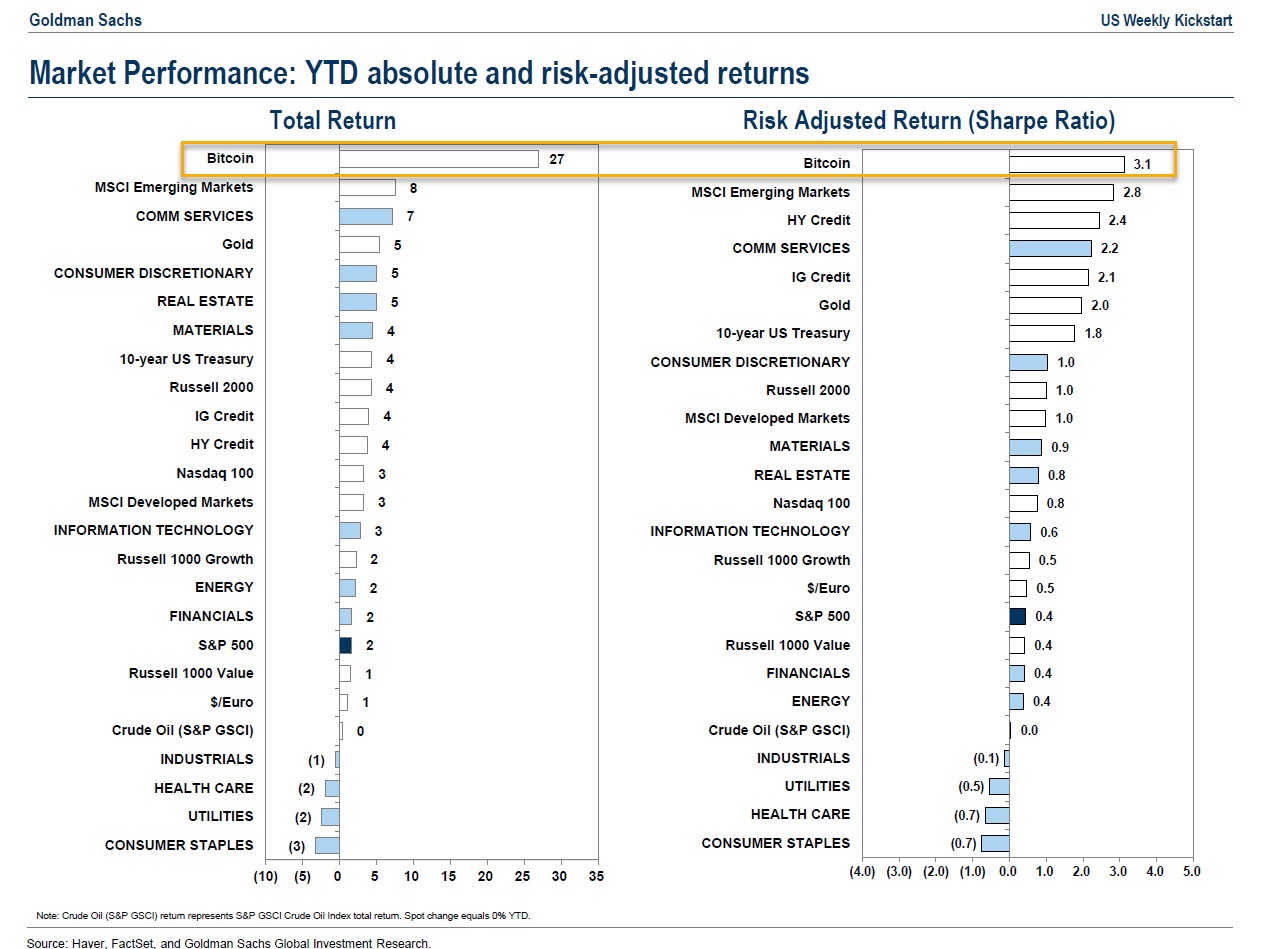

The tweet features a market efficiency chart by Goldman Sachs displaying the highest 25 markets’ complete returns in addition to their year-to-date risk-adjusted returns.

Bitcoin tops the entire return checklist at 27%, adopted by MSCI Rising Markets Index at 8%. BTC additionally tops Goldman Sachs’ risk-adjusted return checklist, with a Sharpe Ratio of three.1. The value of bitcoin has risen for the reason that agency revealed its chart. On the time of writing, BTC is buying and selling at $23,130, up greater than 39% to this point this 12 months.

Gold, which many individuals have in contrast bitcoin to as a retailer of worth and a hedge towards inflation, ranked a number of locations under BTC on each the entire and the risk-adjusted return lists. The metallic has a complete return of 6% year-to-date and a Sharpe Ratio of two, in accordance with Goldman’s chart. A better Sharpe Ratio signifies that the funding has yielded greater returns for a given degree of threat.

Nonetheless, Goldman Sachs stated in December final 12 months that gold is a greater “portfolio diversifier” than BTC since it’s prone to be much less influenced by tighter monetary circumstances. Moreover, the financial institution’s analysts consider that gold has developed non-speculative use instances whereas bitcoin continues to be searching for one.

Goldman Sachs has been within the crypto house for a number of years. The agency formally established a cryptocurrency buying and selling desk in Might 2021. In January final 12 months, the funding financial institution predicted that BTC might attain $100,000 because the crypto continues to take gold’s market share. Final 12 months, Goldman Sachs executed its first OTC crypto transaction, supplied its first bitcoin-backed mortgage, and launched a knowledge service to assist buyers analyze crypto markets.

Do you suppose bitcoin will proceed to be the best-performing asset this 12 months? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.