Candlestick patterns are common instruments for technical evaluation of property. By observing completely different patterns, merchants might catch potential development reversals and choose the optimum time to enter or exit a deal. We’ve collected an inventory of patterns with examples to assist merchants perceive these devices and find out how they might be utilized in buying and selling.

What Is a Candle in Buying and selling

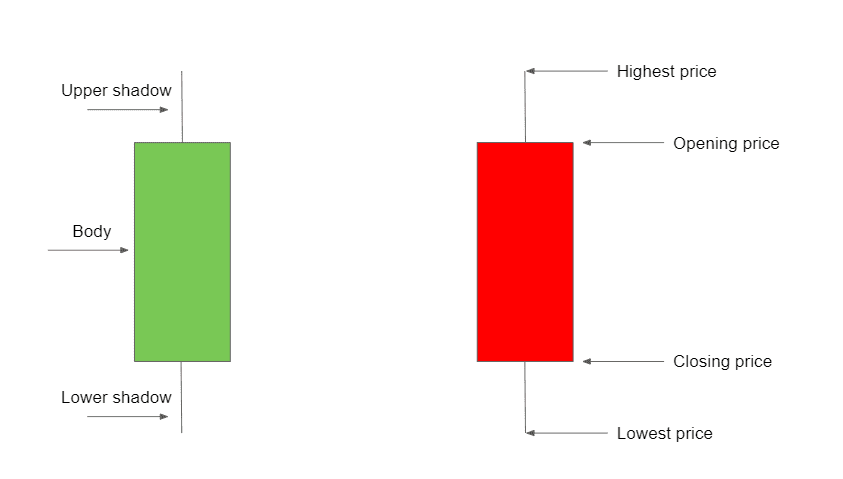

Candlestick patterns are shaped by a mix of candles, supplied within the type of a candlestick chart within the traderoom. Foremost components of the candle are the physique, the higher shadow and the decrease shadow. The physique of a candle signifies whether or not the closing worth was increased (if inexperienced) or decrease (if purple) than the opening worth. Candle colours could also be modified within the traderoom to suit a dealer’s choice.

A candle exhibits worth fluctuations of an asset over a sure time period. For instance, if a dealer chooses the 30-minute timeframe, a candle will present the information over the previous half-hour. The candle shadow gives details about the very best and the bottom costs throughout this era.

Kinds of Candles for Buying and selling

Buying and selling with candlesticks entails observing candle patterns and utilizing them for asset evaluation. There are quite a few candlestick patterns for buying and selling relying on a dealer’s targets and preferences. Listed here are just a few examples which will get you began.

Hammer

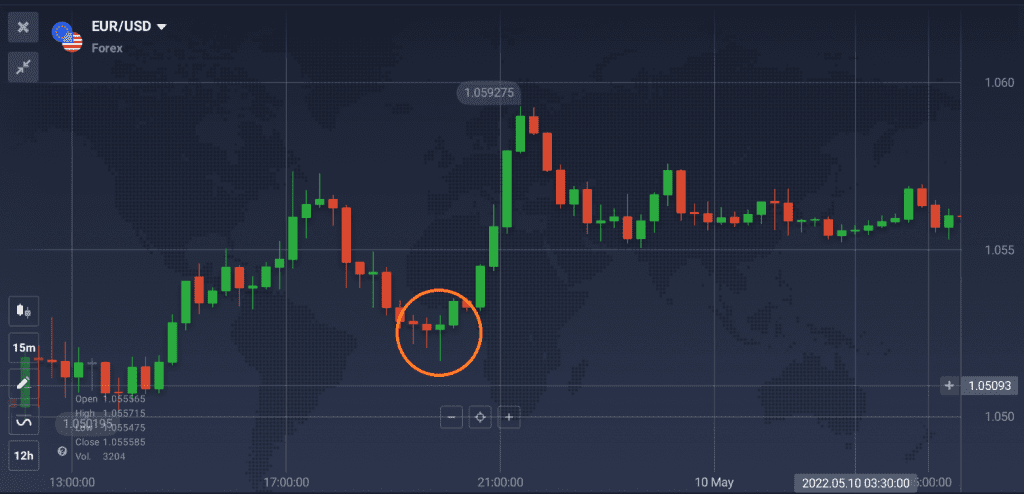

It is a bullish candlestick sample which will level to an upcoming development reversal. It would seem on the last stage of a downtrend and point out the bottom worth earlier than a bounce.

When the decrease shadow of a candle on the finish of a downtrend is at the least twice so long as the physique, a hammer sample could also be noticed. This exhibits that the worth has lately decreased after which bounced again to the preliminary degree. To substantiate the studying, the next candle ought to shut above the low or (even higher – above the physique) of the earlier candle.

Catching this sample would possibly assist merchants choose an optimum second to enter a deal. Nonetheless, this method just isn’t 100% correct, so merchants ought to rigorously take into account potential dangers earlier than making a transfer. To get additional affirmation of development reversal when buying and selling with candle patterns, they might apply technical indicators, like MACD or RSI.

Engulfing Sample

Some candlestick patterns might level to each bullish and bearish developments relying on specific situations. The engulfing sample is an effective instance of such a instrument.

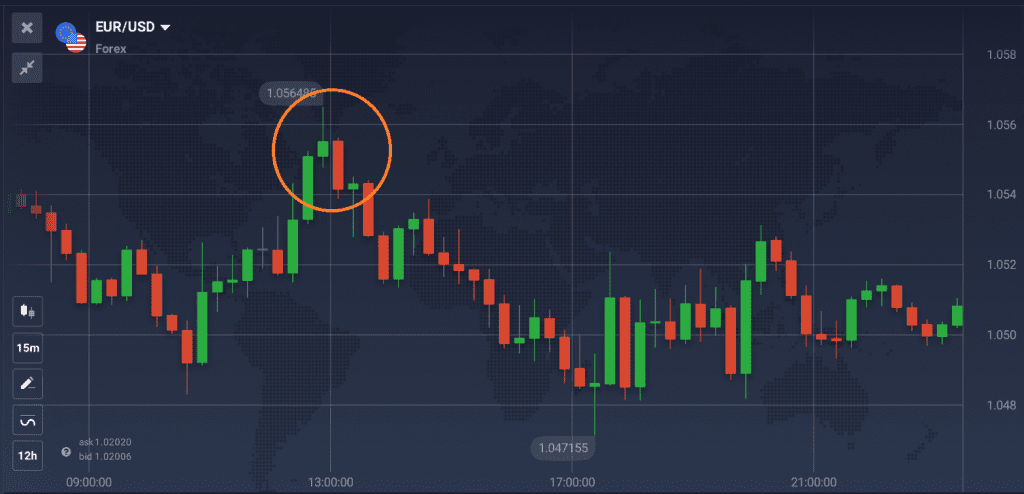

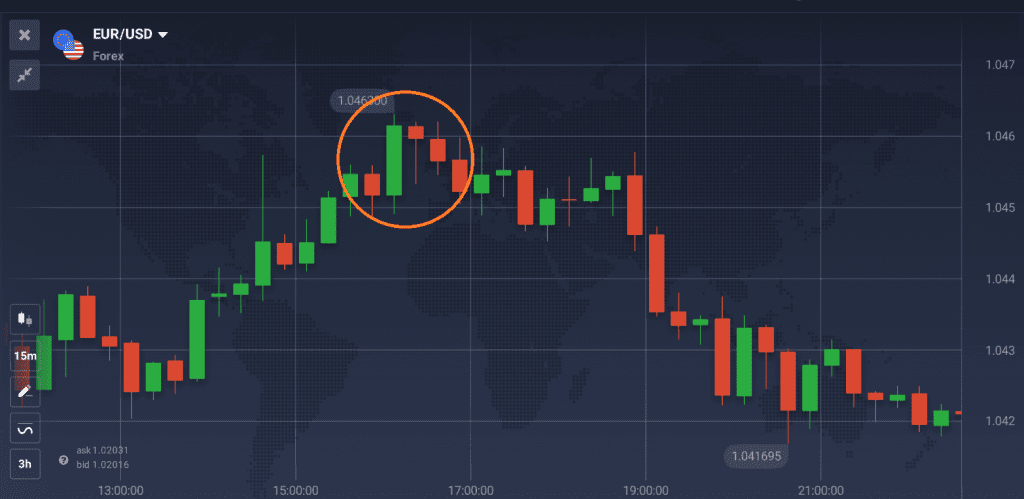

Bearish Engulfing Sample

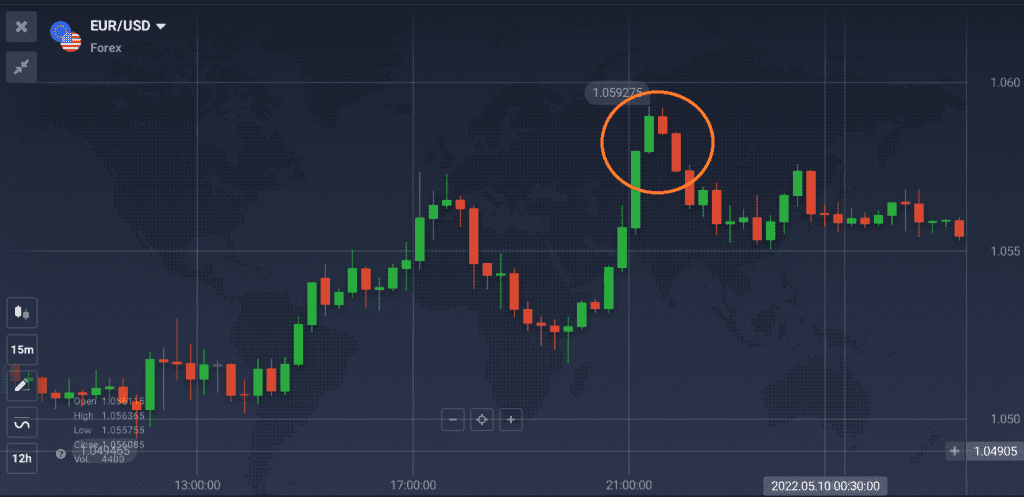

This candlestick sample might happen on the finish of an uptrend and point out the next worth decline. It entails a protracted purple candle that engulfs a smaller inexperienced candle that got here earlier than it.

Merchants would possibly wish to estimate how for much longer the purple candle is in comparison with the inexperienced one. If it consumes the complete physique of the earlier candle, this can be sufficient to point a delicate change within the sentiment. Nonetheless, if it exceeds not solely the physique of the inexperienced candle, but in addition its higher and decrease shadows, it is perhaps an indication of an upcoming robust reversal.

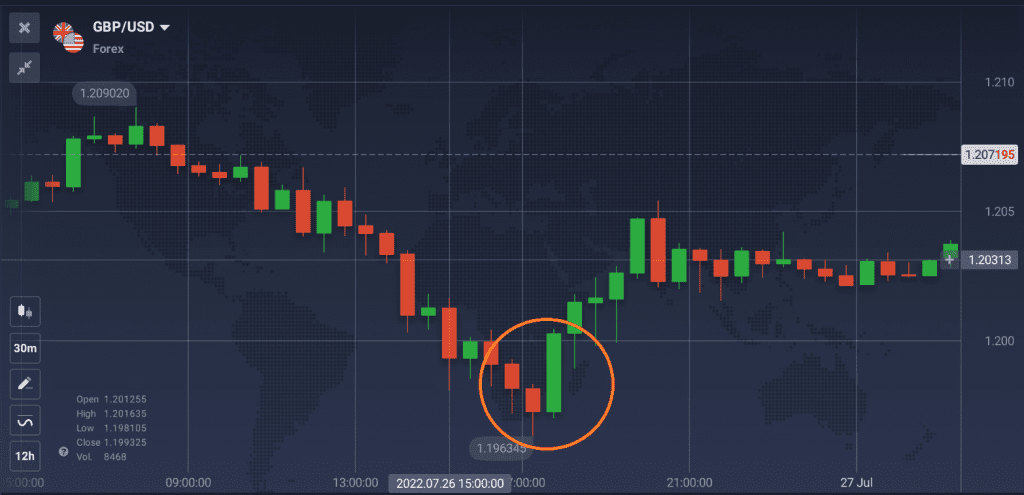

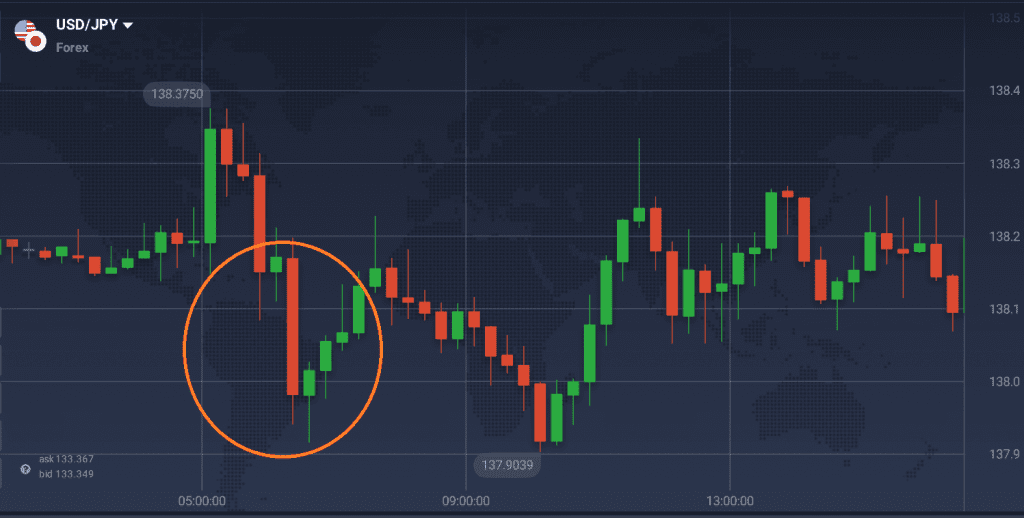

Bullish Engulfing Sample

Equally to the bearish sample, this one is shaped by a bigger candle engulfing the earlier smaller one. On this case, the primary purple candle seems on the finish of a downward development. The second is inexperienced, and it ought to cowl the total physique of the earlier candle.

Bullish engulfing candlestick sample might point out an upcoming development reversal, which could current potential buying and selling alternatives. Nonetheless, as with every technical evaluation instrument, there is no such thing as a assure that it’ll happen. So merchants ought to preserve this in thoughts and make knowledgeable choices when buying and selling with candlestick patterns.

Harami

Bearish Harami

This sample is shaped by a small purple candle following a bigger inexperienced one. It could point out an upcoming change within the sentiment. If the worth continues to go up after this sample is noticed, the uptrend might final. Alternatively, if the Harami sample is adopted by a down candle, the worth would possibly proceed declining.

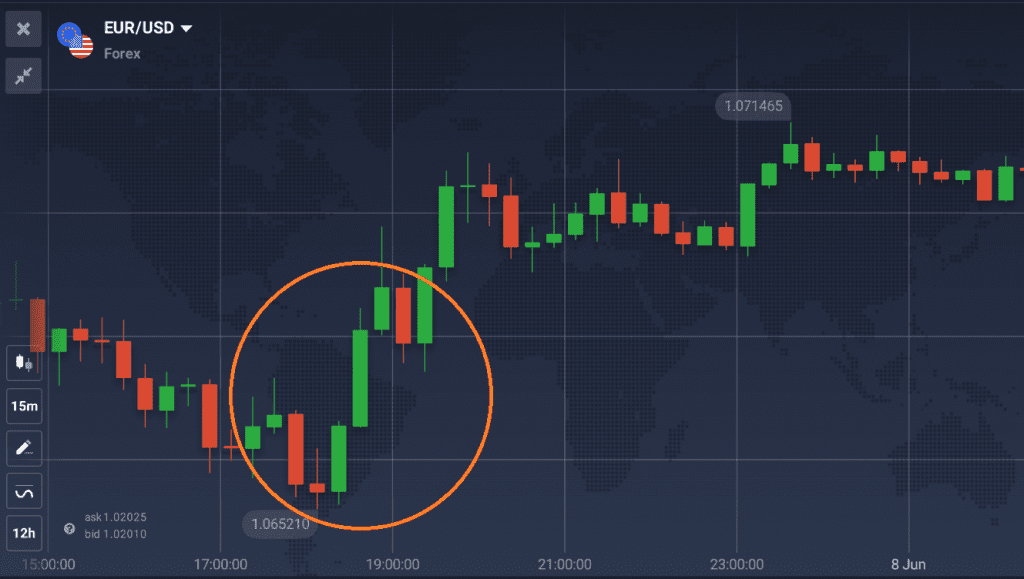

Bullish Harami

Merchants might observe this sample on the last levels of a downtrend, when a big purple candle is adopted by a smaller inexperienced one. Similar because the bearish Harami, it might point out two prospects: the continuation of a downtrend or a possible reversal. To substantiate the studying, merchants ought to take note of the candle following this sample. Whether or not it continues to go up or down, it might level to an enduring development or a attainable reversal.

One vital level to recollect when utilizing Harami candlestick patterns for buying and selling is that they’re fairly delicate. Some merchants would possibly overlook them, assuming that the latest development will proceed shortly and never anticipating any main shifts. So if a reversal bounce happens, it might take them abruptly. It’s your decision to remember when searching for the optimum time to make a commerce.

Three White Troopers

This candlestick sample consists of three lengthy inexperienced candles following a downtrend. They seem one after one other, each ideally opening withing the physique of the earlier candle.

If this sample is noticed, it might supply a possibility to open a bullish place. To get extra accuracy, merchants would possibly use the three white troopers sample along with technical instruments, corresponding to development traces and indicators.

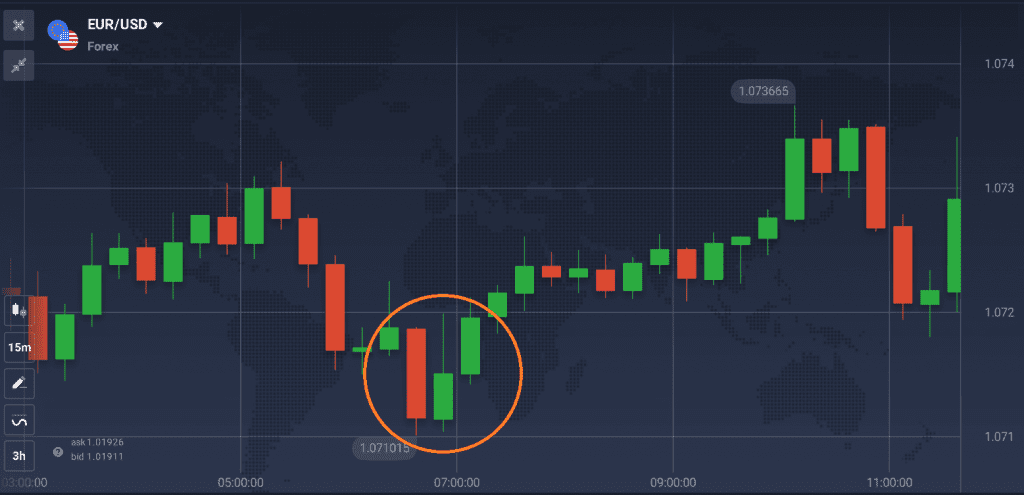

Three Inside Up

It is a bullish reversal sample that consists of a mix of three consecutive candles. The primary one is a big purple one, the second is a smaller inexperienced candle opening and shutting inside the physique of the primary one. And the third candle can also be inexperienced, closing above the earlier candle.

Three Inside Down

This sample is considerably just like the earlier one, consisting of three consecutive candles. Nonetheless, on this case, a big inexperienced candle is adopted by a smaller purple one contained inside the physique of the primary candle. The sample is accomplished by an extended purple candle that closes under the second.

Remember that these two candlestick patterns is perhaps thought-about short-term and do no not assure main development shifts. But, they might be helpful when searching for worth actions that may probably result in vital development reversals.

Does Candlestick Buying and selling Work?

The concept on the base of this technical evaluation methodology is that worth actions are usually not random. Consequently, merchants might spot particular patterns. Chances are you’ll select to commerce candlestick patterns for quite a lot of property, together with shares and foreign exchange.

There are particular indicators that merchants ought to take note of. As an example, in the event that they observe a protracted inexperienced candle, it might be an indication of a bullish development. In case of a protracted purple candle, a bearish development could also be rising. Nonetheless, it’s all the time a good suggestion to use different evaluation instruments to assist these findings, as candle patterns on their very own could also be deceptive. Merchants would possibly use technical indicators to verify their readings and make an knowledgeable choice.

Additionally it is vital to do not forget that candlestick patterns are shaped by previous and present worth fluctuations. Which suggests, they can not exactly point out future worth modifications.

Key Takeaways

Mixtures of candles kind candlestick patterns that merchants might monitor to substantiate their predictions concerning worth actions. Completely different candle patterns would possibly level to potential bullish or bearish development reversals, which can supply buying and selling alternatives. Nonetheless, it’s higher to make use of candlestick patterns for buying and selling along with different technical instruments to get extra correct readings.