Risilience, a SaaS-based analytics platform that helps corporations assess their local weather threat and plan their transition towards net-zero carbon emissions, has raised $26 million in a Collection B spherical of funding.

The increase comes as ESG (environmental, social, and [corporate] governance) startups throughout the spectrum have continued to lift money all through the downturn, with climate-focused corporations in significantly apparently faring nicely. In line with knowledge from Bloomberg, enterprise capital (VC) and personal fairness funding discovered its approach into 539 offers within the third quarter of 2022, simply fractionally decrease than the 547 climate-related funding offers within the previous three months.

Individually, PwC’s State of Local weather Tech 2022 report discovered that greater than 1 / 4 of each VC greenback spent in 2022 was focused at local weather tech, totalling round $15-20 billion per quarter — a determine that’s roughly comparable with the earlier 12 months.

There may be, after all, good motive why local weather tech has maybe been a bit extra resilient to financial headwinds than different sectors. The international local weather disaster is someplace close to the highest of the agenda in lots of political and enterprise spheres, with stress mounting on companies to deal with their carbon emissions and do their bit to counter their impression on local weather change. And capturing the proper of knowledge and producing insights is central to this.

“Organisations are struggling to know and quantify how local weather threat impacts their enterprise financially, and plan their method to net-zero,” Rislience CEO Dr. Andrew Coburn defined to TechCrunch. “As we transfer to a low-carbon economic system, companies are confronted with near-term transition dangers, resembling regulatory change and climate-related litigation; and long-term bodily dangers, just like the floods and climate occasions.”

Digital twins

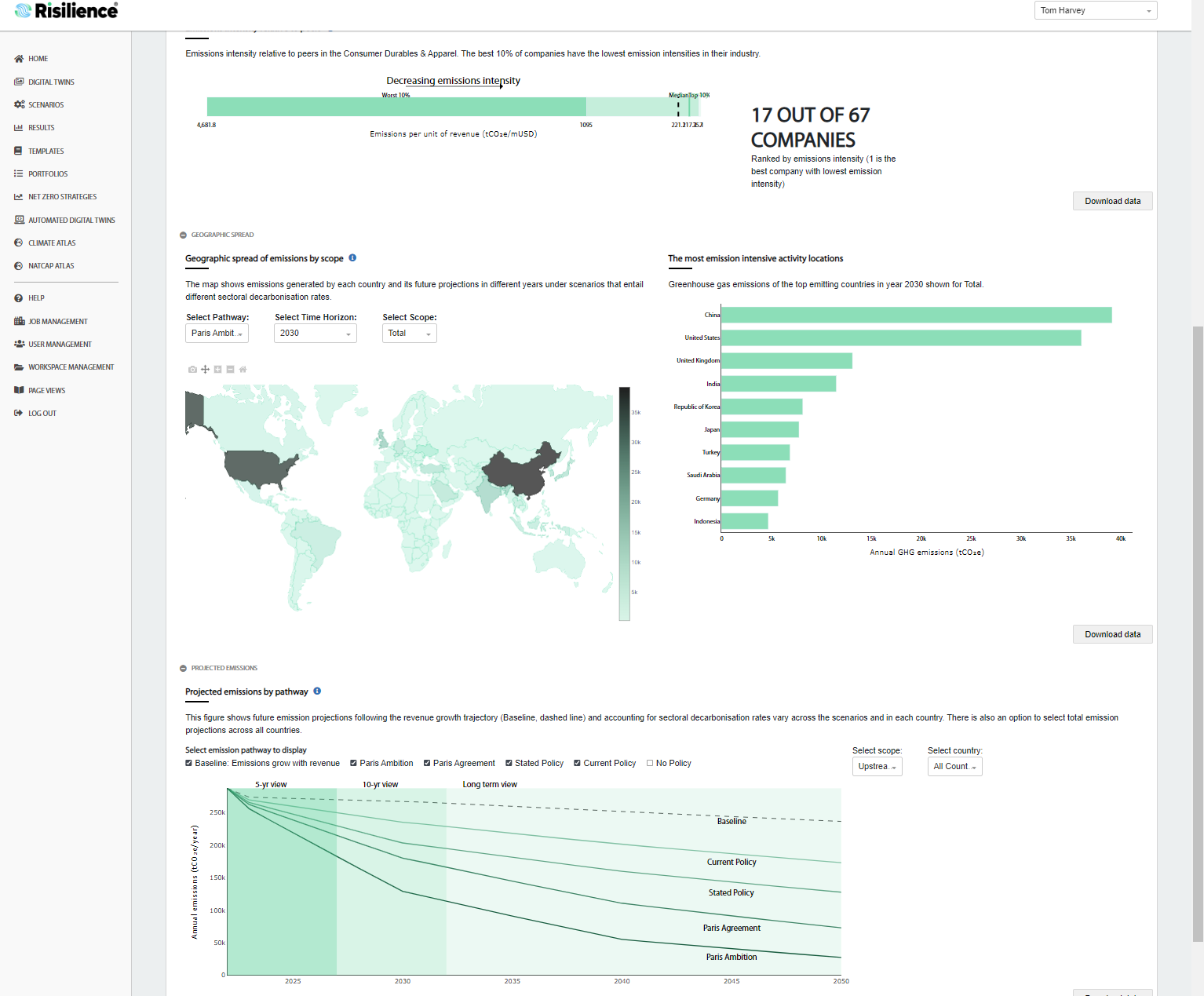

Risilience, in a nutshell, guarantees to allow corporations to “flip knowledge into actionable insights,” and measure the (potential) impression of climate-related dangers to their enterprise. For instance, the corporate has constructed “digital twin” expertise that enables corporations to attach their very own inner techniques and databases to visualise and “stress-test” the impression of myriad “dangers,” which along with climate occasions might embrace rising laws, litigation, and even evolving buyer sentiment.

By means of instance, the U.S. Securities and Change Fee (SEC) has proposed new guidelines that will require corporations to report on any dangers to their enterprise associated to local weather change when submitting updates for buyers.

“Massive organisations face numerous challenges relating to disclosing their impression on the setting,” Rislience CEO Dr. Andrew Coburn defined to TechCrunch. “With the specter of greenwashing, and growing stress from buyers, reporting must be extremely correct however, with growing regulatory pressures on companies to reveal this info, they should act quick.”

Finally, Risilience is all about serving to corporations transfer towards lower-carbon operations whereas minimizing the impression on profitability, and on the similar time permitting them to report precisely to all stakeholders.

“One other frequent drawback is that net-zero pledges are made with no detailed plan for methods to get there,” Coburn added. “Risilience offers the essential perception required in forming this plan that updates primarily based on the ever-changing panorama organisations are going through.”

Risilience in motion Picture Credit: Risilience

Spun out of the College of Cambridge’s Centre for Danger Research (CCRS) again in 2021, Risilience says it has already amassed quite a lot of high-profile enterprise clients, together with Nestlé, Maersk, EasyJet, Burberry, and Tesco.

Before now, Risilience had raised £6 million ($7.4 million) in a Collection A spherical again in 2021, and with one other $26 million within the financial institution, the corporate stated that it use the contemporary money injection to drive worldwide progress with a selected deal with the U.S. market.

Risilience’s Collection B spherical was led by Quantum Innovation Fund, with participation from IQ Capital and Nationwide Grid Companions.