It was a tough quarter for the cloud infrastructure market as corporations appeared for tactics to chop again on spending in an unsure financial system. While you mix that with the robust greenback and a weak Chinese language market, the market slowed to 21% progress, a precipitous drop from the 36% progress we had seen the 12 months prior.

Whereas we aren’t seeing the gaudy progress of years previous, Synergy Analysis nonetheless discovered the market exceeded $61 billion for the quarter with the 12 month trailing revenues of over $212 billion, a hefty sum by any measure, even with the slowdown.

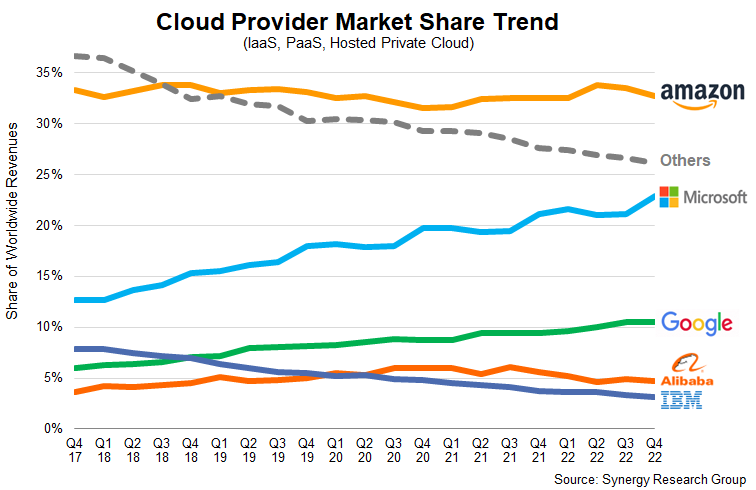

Additionally of observe was that whereas every of The Massive Three noticed progress gradual in This fall 2022 from the earlier quarter, Microsoft nonetheless managed to realize market share floor on Amazon. Microsoft elevated its share from 23%, up from 21% the prior quarter, whereas Amazon fell from 34% to 33% and Google remained regular at 11%. The Massive Three cloud suppliers accounted for 66% of worldwide cloud income.

That comes out to roughly $20 billion for Amazon, $14 billion for Microsoft and $7 billion for Google. Per normal, that is taking a look at IaaS, PaaS and hosted non-public cloud providers. It doesn’t embrace SaaS, which is measured individually.

Picture Credit: Synergy Analysis

Amazon cloud income grew a modest 20% over the prior 12 months, and the corporate acknowledged within the earnings name that progress dropped even additional to the mid-teens within the first month of the 12 months. In the meantime Microsoft reported cloud progress of twenty-two%, down from 24% the prior quarter and Google Cloud income grew 32%, down from the 38% progress the earlier quarter.

Amazon was first to market and has had an extended head begin, nevertheless it appears because the market slows after years of regular progress, it’s giving its chief competitor, Microsoft, a little bit of a gap to realize on them. It could possibly be partly due no less than to the truth that Amazon’s market maturity is lastly catching as much as it, and Microsoft is ready to acquire some benefit despite spending slowing total.

John Dinsdale, chief analyst at Synergy says there have been three key causes for this quarter’s drop-off, which he believes are short-term points, and he stays optimistic for the longer term. “There are three primary elements. The strengthened US greenback diminishes the obvious progress price of many non-US markets; the massive Chinese language market stays constrained by pandemic points and native insurance policies; and the worsened financial system has precipitated some enterprises to extra intently evaluate spending on cloud providers. These elements needs to be primarily brief time period in nature and Synergy forecasts that progress charges will stay robust over the following few years,” he mentioned in an announcement.

It is going to be fascinating to look at the market in 2023 and see how the macro financial surroundings impacts income, and if the slower progress we’ve been seeing continues to work in favor of Amazon’s rivals by enabling them to realize extra floor.