There are completely different approaches to technical evaluation for buying and selling. Most of them embrace software of technical instruments, equivalent to strains and indicators. With quite a lot of devices for evaluation to select from, some novice merchants might really feel overwhelmed. However there’s no want to make use of all of them to reinforce your buying and selling expertise and outcomes.

You could attempt completely different instruments to decide probably the most handy and environment friendly ones. On this article, we’ll examine 2 fashionable devices for technical evaluation: Schaff Development Cycle vs. MACD.

What’s Schaff Development Cycle (STC)

Most indicators belong to a group of technical instruments with related traits. Schaff Development Cycle is an oscillator, generally used for figuring out overbought or oversold property. It makes use of the idea of transferring averages (just like MACD), however together with a cycle element for extra precision.

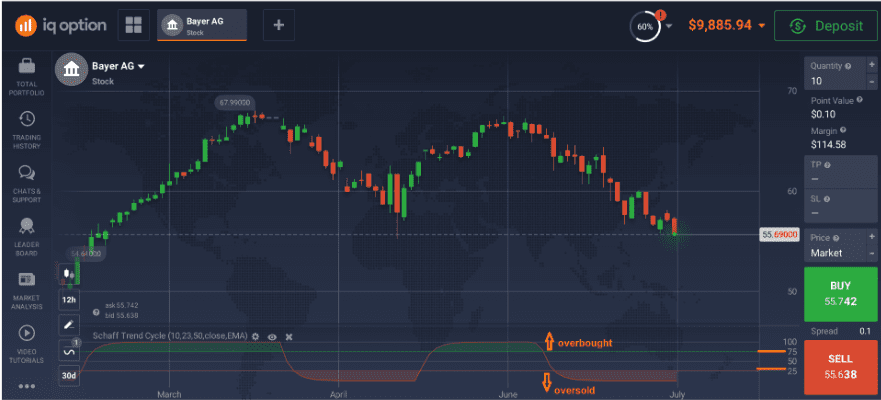

If utilized appropriately, this indicator might assist merchants see constructive and unfavorable tendencies, in addition to discover potential entry and exit factors for potential offers. Right here is an instance of its software and doable readings.

The best way to Learn the Schaff Development Cycle?

There are two baselines: one at 25 and the opposite at 75. When the indicator goes above the 25 line, it could be thought-about a bullish pattern. If it decreases beneath the 75 line, it is likely to be considered as a bearish pattern. When STC readings transfer between these baselines, the pattern is likely to be creating in one of many two instructions.

In case the indicator creates a straight line above the 75 line, the asset could also be interpreted as overbought. Equally, if a straight line seems beneath the 25 line, the asset is likely to be oversold.

For step-by-step instructions on Schaff Development Cycle settings, try this text: Schaff Development Cycle – Indicator Tutorial.

What’s MACD

MACD stands for Transferring Common Convergence Divergence. This indicator is kind of versatile: it serves as a momentum and likewise a trend-following indicator. Buying and selling with MACD might assist determine tendencies and assess their power. Catching these tendencies (each upward and downward) might present clues for when to enter or exit a deal.

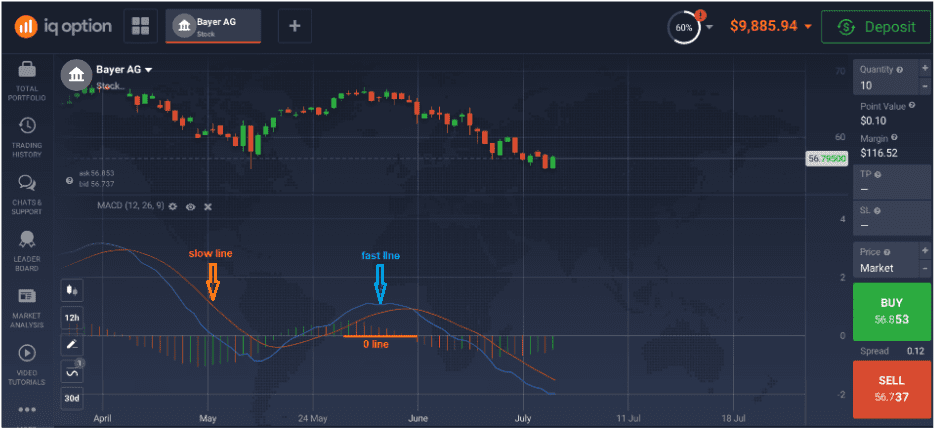

This indicator creates a sample consisting of two strains (transferring averages). So merchants might wish to consider the best way these two strains behave – on their very own and in relation with one another.

The best way to Learn MACD?

The orange line on the graph above is named a sluggish line (it’s calculated based mostly on 26 durations). And the blue one is named a quick line (calculated based mostly on 12 durations). There may be additionally a 0 line – it serves because the baseline.

One method to utilizing MACD is monitoring the strains’ actions relative to the 0 line. If each strains are above zero for a sure time period, there is likely to be an uptrend. In the event that they keep beneath zero for some time, it could be an indication of a downtrend.

One other technique of buying and selling with MACD could also be ready for the quick and sluggish strains to cross. As an illustration, if the quick line crosses the sluggish one and goes above it, merchants might take into account shopping for. And vice versa: if the quick line crosses the sluggish line and retains happening, it is likely to be time to promote.

For particulars on establishing this indicator you might flip to this text: The best way to Commerce with MACD?

Schaff Development Cycle vs. MACD

These two devices work equally, offering clues to the instructions of pattern actions. They might each be used to analyze quite a lot of property for buying and selling, equivalent to Foreign exchange, shares, commodities, and so on. These technical instruments is likely to be thought-about accessible to each novice and skilled merchants.

Nonetheless, there are a couple of variations which will have an effect on the outcomes of technical evaluation. Listed here are a couple of components that can assist you select the most effective indicator in your buying and selling.

Accuracy

Some individuals (together with the indicator’s creator) take into account the STC an improved and extra exact model of MACD. Each indicators make the most of transferring averages. Nonetheless, the STC additionally makes use of cycles – repeating patterns which will assist catch constructive and unfavorable tendencies. Along with the transferring averages, they might probably present extra correct outcomes. Nonetheless, neither can assure 100% accuracy each time and needs to be mixed with different instruments for higher outcomes.

Response

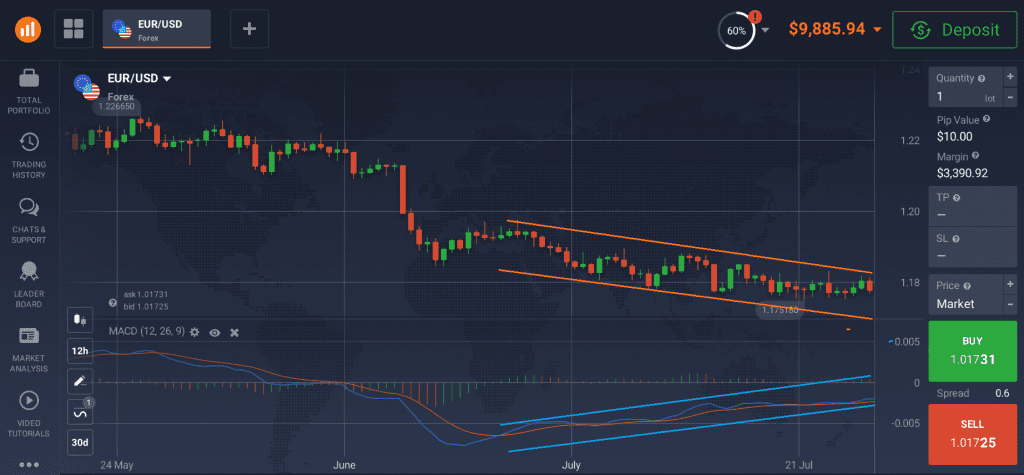

Some merchants level out that MACD is likely to be sluggish to answer pattern adjustments. It’s a lagging indicator, reflecting value adjustments that already occurred. So it could be troublesome to use this software when in search of early indicators of pattern shifts.

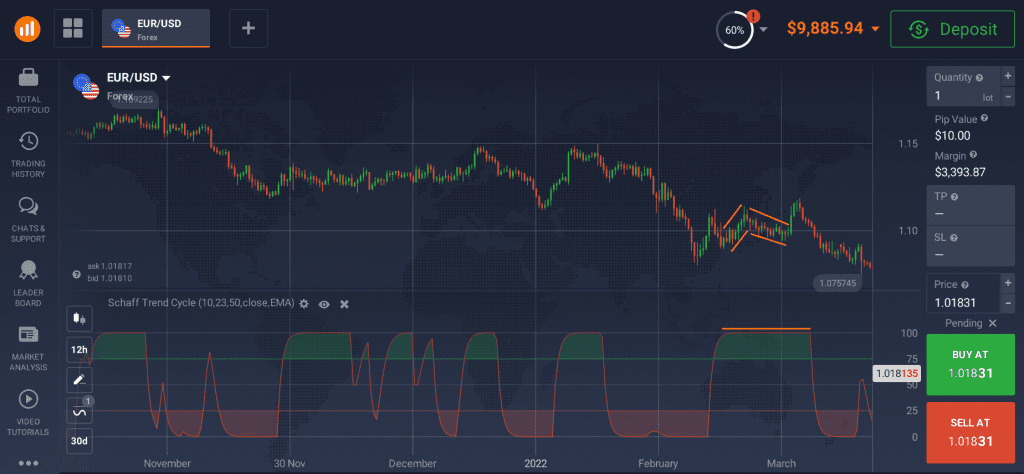

Conversely, the STC is a main indicator, supposed to point out alerts for value actions even earlier than they happen. It has an improved sign line which may present early indicators of pattern reversals. This may increasingly permit merchants to react quicker and catch the second to enter or exit a commerce. Nonetheless, it doesn’t give ensures of exact entries.

False Positives

One of many potential points with some indicators is fake positives. With MACD, it could be indicators of doable pattern reversals that don’t happen. There may be additionally divergence – when the worth is transferring in a single route and the quick line is shifting within the different. This can be thought-about an indication of potential pattern reversal. Nonetheless, such indicators is likely to be deceptive, so merchants ought to hold that in thoughts when buying and selling with MACD.

In flip, the STC tends to remain within the oversold / overbought sections for prolonged durations of time. This may generally trigger merchants to overlook pattern reversal indicators.

Usually, you might attempt utilizing a mixture of technical instruments to doubtlessly attempt to keep away from false positives. By testing completely different approaches and indicator mixtures, merchants may discover the appropriate ones for his or her buying and selling technique. Right here is an outline of the preferred indicator mixtures you might take into account: 5 Most Well-liked Indicators Defined in 5 minutes.

Conclusion

Technical evaluation utilizing indicators like MACD and Schaff pattern cycle might permit merchants to probably determine pattern reversals and discover alternatives for entries. MACD is a flexible instrument for recognizing up and downtrends. Schaff pattern cycle could also be thought-about an improve of MACD, utilizing cycles to get extra correct indicators of pattern reversals.

Nonetheless, neither indicator offers a 100% correct consequence. So merchants may take into account making use of them together with different devices to substantiate their readings and get extra exact outcomes.