Merchants use indicators and technical instruments with a view to discover entry factors and doubtlessly catch the suitable time to execute a commerce. There are lots of indicators out there on the IQ Choice platform to select from. Some of the fashionable instruments is the KDJ indicator. Some select to work with the usual KDJ settings, however others might select to vary the KDJ parameters with a view to have a greater customization which will open new prospects. Maintain studying to grasp the way to arrange KDJ based on your private method.

How does the KDJ indicator work?

KDJ is much like the Stochastic indicator. It has the Okay and the D traces that point out the overbought and oversold situations very similar to different oscillating indicators. The J line is what distinguishes KDJ: it’s used to indicate the deviation of Okay from D and signifies the energy of the development. The indicator oscillates between 0 and 100 values and signifies when the asset enters the overbought or oversold space.

With a purpose to learn the indicator’s indicators, merchants typically seek for crossovers of the indicator’s traces. These are referred to as the golden fork and the useless fork.

The golden fork

This crossover of KDJ traces signifies that the asset entered the oversold space and that the development may quickly reverse upwards. A Purchase sign could also be registered when:

- All three traces cross on the 20 stage or beneath (oversold space);

- The indicator traces are transferring upwards from the crossover;

- The chart is displaying a bullish candlestick sample.

The useless fork

This crossover may point out that the asset is the overbought space and its value chart might quickly reverse and begin dropping. A promoting sign could also be acquired when:

- All three converge above the 80 stage, within the overbought space;

- Traces Okay and J cross line D downwards;

- A bearish candlestick sample is current.

KDJ settings adjustment

Whereas the usual settings for KDJ are 9, 3, 3, these settings might not at all times work completely for various timeframes. The reason being that the interval of 9 takes under consideration 9 earlier candlesticks. Some merchants select to extend the indicator’s interval with a view to easy the value motion.

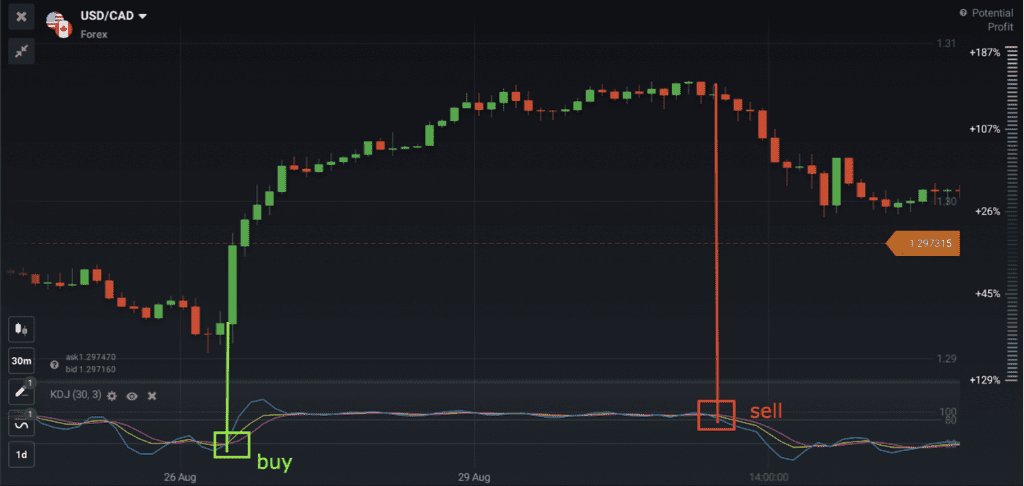

You might take a look at the instance above. Right here KDJ is utilized with the usual settings of 9, 3, 3. Based on the indicator, a promoting sign is acquired when the value enters the overbought space, nevertheless, the upward development nonetheless continues properly after the promoting sign is acquired. Following these indications, a dealer might have missed out on potential higher outcomes after closing the deal.

With a purpose to alter the indicator and make it extra common, merchants might change the interval of the indicator (the quantity of candlesticks taken into calculation). To do that, you could click on on the settings wheel close to the indicator and alter the settings of the Okay line.

After adjusting the KDJ indicator with a interval of 30, the identical chart appears to be like fairly totally different. It’s clearly seen that the indicator smooths the value motion higher, fluctuates much less, and solely reacts to extra important value modifications.

The way to know the right KDJ indicator settings?

Adjusting the KDJ indicator to your explicit buying and selling type and asset is essential with a view to enhance the accuracy of the indicator. In fact, it doesn’t imply that the indicator won’t ever make errors: there may be nonetheless at all times a chance of divergence and incorrect indicators. There isn’t a technique or indicator that may assure good outcomes each time. Nonetheless, selecting the indicator settings appropriately can enhance one’s possibilities and assist with the general buying and selling method.

The overall rule of selecting the interval calculation for an indicator is to extend the interval for longer timeframes and reduce it for shorter timeframes. One other means of calculating the interval is counting the quantity of candlesticks between the newest earlier excessive and low and setting that because the interval of the indicator.

With a purpose to grasp the talent of customizing indicator settings, it is very important spend a whole lot of time doing it on the observe stability. This fashion, there is no such thing as a stress of constructing a mistake and no danger of shedding actual funds.

To sum up

KDJ indicator is a well-liked and great tool which will assist to find out doable commerce entries and exits. Nonetheless, as any indicator, it may possibly present false indicators and trigger losses. With a purpose to doubtlessly enhance the percentages, merchants can be taught to regulate the indicator settings based on the timeframe they’re buying and selling. Selecting a smaller interval for brief timeframes and a bigger interval for lengthy timeframes is the final rule of thumb.

Сообщение KDJ Settings: Customise It Your Means появились сначала на IQ Choice Dealer Official Weblog.