Again in March of 2022, the U.S. Division of Justice (DOJ) charged Frosties founders Ethan Nguyen (“Frostie”) and Andre Llacuna (“heyandre”) with conspiracy to commit fraud and conspiracy to commit cash laundering in what is taken into account to be the company’s first NFT “rug pull” bust.

Within the wake of the DOJ’s $1.1-million NFT bust, the jig was up for Frosties and its founders. The ice-cream-themed challenge, which was closely marketed as a “cool, delectable, and distinctive” assortment of 8,888 NFTs, additionally promised traders raffles, merch, and a “particular fund to make sure the Frosties’ longevity.” They didn’t precisely dwell as much as these guarantees.

Following a two-month investigation, prosecutors within the Southern District of New York arrested and charged Nguyen, 20, and Llacuna, 20, for “promis[ing] traders the advantages of the Frosties NFTs, however when it bought out…pulled the rug out from underneath the victims, nearly instantly shutting down the web site and transferring the cash,” in line with the press launch. However does Frosties maintain the title of the worst NFT ever? Not fairly — it’s removed from the one one who’s pushed individuals to ask themselves, “Are NFTs a rip-off?”

Crypto scams are nothing new. They’ve been plaguing regulators and traders since as early as 2017. Rug pulls are simply the newest type of fraud; nevertheless, they’ve had severe penalties. In keeping with Chainalysis, in 2021, NFT rug pulls resulted in additional than $2.8 billion in losses, accounting for 37 % of all cryptocurrency rip-off income for the 12 months and a 1 % improve from 2020.

As person numbers proceed to skyrocket, the rise in rug pulls has compelled lawmakers, regulators, and members of the crypto and NFT communities to stay ultra-cautious and vigilant in relation to new initiatives. At this level, if you wish to be concerned within the NFT ecosystem, it is advisable to know what NFT and crypto rug pulls are and the right way to shield your self. Right here’s all the pieces it is advisable to know.

Crypto scams 101: What’s a “Rug Pull?”

Much like a “pump and dump” scheme, a “rug pull” is a malicious act through which crypto builders lure in early traders after which abandon the challenge by both (1) taking off with the challenge funds or (2) promoting off their pre-mined holdings, with the intention of draining all funds from traders.

Typically, as soon as the costs hit a sure ceiling, the builders will shortly switch the funds out of the ecosystem and disappear completely. For instance, in line with the felony criticism, after producing over $1 million in crypto from its neighborhood, Nguyen and Llacuna shut down the challenge’s web site, closed the Discord server, and transferred the entire gross sales proceeds to varied digital wallets. Those that invested within the challenge weren’t capable of attain the builders and had been by no means given something they had been promised.

Now, Nguyen and Llacuna every face 20 years in jail.

It’s an sadly frequent situation and positively not the primary crypto rip-off of this sort. But, whereas this isn’t the primary “rug pull” to focus on each new and veteran traders within the NFT house, the DOJ’s current bust in opposition to Nguyen and Llacuna is a primary. Because of this, the occasion definitely raises plenty of new questions concerning the authorized panorama. However to grasp the authorized significance of this occasion, we have to dive a little bit deeper into the character of this particular sort of crypto and NFT rip-off. However U.S. authorized techniques responded to the Frosties NFT rug in full pressure, which to many signaled the beginning of an unraveling of crypto and NFTs’ picture as an internet Wild West.

Because of this, new questions arose concerning the authorized panorama. Definitely, with high-profile arrests of different unhealthy actors within the crypto and NFT areas, the Frosties case might dissuade copycats from trying to mimic the rip-off. Nonetheless, even with federal brokers conserving a more in-depth eye than ever on Web3 for foul play, our legal guidelines might need some catching as much as do. To grasp the authorized significance of this occasion, we have to dive a little bit deeper into the character of this particular sort of crypto and NFT rip-off.

Are crypto and NFT rug pulls unlawful?

The primary query to ask is whether or not NFTs, by nature of their nascent presence within the fintech house, play by totally different guidelines than different varieties of investments?

The reply, after all, isn’t any.

“NFTs characterize a brand new period for monetary investments, however the identical guidelines apply to an funding in an NFT or an actual property growth,” Particular Agent-in-Cost Thomas Fattorusso mentioned in his March assertion. “You may’t solicit funds for a enterprise alternative, abandon that enterprise and abscond with cash traders supplied you.”

The subsequent query to ask is whether or not rug pulls are unlawful, given the horrific ramifications that victims in the end face in any potential situation. As legal professionals broaden their authorized data because it pertains to NFTs, most will agree that the reply to that query will depend on the shape the rug pull takes because it’s occurring.

What are the totally different sorts of rug pulls?

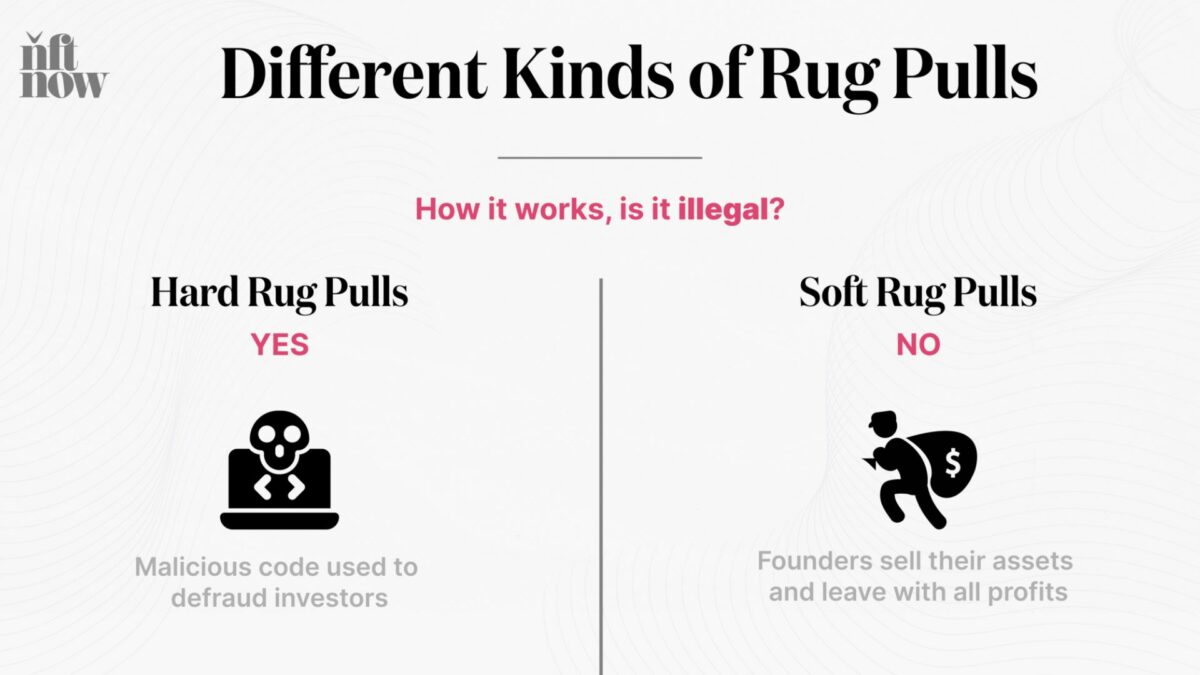

Onerous rug pulls, which happen when a challenge’s founder makes use of coding to maliciously use the challenge as a strategy to defraud traders, are fully unlawful. On this case, the good contract accommodates hidden phrases in its code which might be designed to dupe traders with the intent to steal funds. The code serves as prima facie proof of that intent to mislead and steal investor funds, mostly locking traders into an asset that has no real path or function.

Gentle rug pulls, however, aren’t by definition, “unlawful,” however are thought of extremely unethical — and are universally frowned upon within the NFT house all the identical. When information unfold that Azuki founder had deserted prior initiatives, many feared a possible Azuki rug pull sooner or later. So what makes a comfortable rug pull totally different from a tough rug pull? It’s refined, however clear: as a substitute of designing the good contract code to defraud traders, the potential of holding intent to steal or defraud traders stays.

Most often, this happens when founders and their groups dump their property quickly, in the end devaluing the token and exploiting the revenue created from traders shopping for the cryptocurrency itself. An instance being the place a crypto challenge that guarantees to donate funds, however chooses as a substitute (regardless of the motive) to maintain the funds.

So, what does this bust means for the authorized panorama transferring ahead?

You may nonetheless be held criminally liable

If there’s something we’ve discovered from the DOJ, most not too long ago with its Frosties NFT bust, it’s that the Justice Division isn’t messing round. Again in February, the Justice Division introduced it had appointed its first-ever crypto enforcement group director, Eun Younger Choi, to move the Nationwide Cryptocurrency Enforcement Staff (NCET).

The NCET, in line with the press launch, was established to make sure the division meets the problem posed by the felony misuse of cryptocurrencies and digital property, and includes attorneys from throughout the division, together with prosecutors with backgrounds in cryptocurrency, cybercrime, cash laundering, and forfeiture.

In her place as NCET Director, Choi will assist establish, examine, help, and pursue the division’s circumstances involving the felony use of digital property, with a selected give attention to digital forex exchanges, mixing and tumbling providers, infrastructure suppliers, and different entities (NFT initiatives) which might be enabling the misuse of cryptocurrency and associated applied sciences to commit or facilitate felony exercise.

Whereas there isn’t a official regulation presently governing NFTs, there are nonetheless methods by which people could be held criminally liable and prosecuted, particularly for fraud, cash laundering, and naturally, conspiracy to commit fraud and cash laundering.

A month after appointing Choi and establishing NCET, the DOJ introduced it had seized almost $3.5 billion in cryptocurrency, after arresting husband and spouse Illya Lichtenstein and Heather Morgan in reference to laundering it.

Regardless of what many imagine concerning the federal authorities not having the suitable sources to deal with felony acts of this magnitude with this new type of know-how, Frosties must be a transparent warning to all that regulators are paying shut consideration to NFTs, whereas the federal authorities nonetheless is able to exerting its sources to unwind advanced transactions and to assist unmask perpetrators who try to stay nameless.

And don’t overlook The Silk Street.

Regulators and the SEC are watching carefully

Now valued at over $40 billion, the scale of the NFT market has almost doubled, exceeding final 12 months’s valuation of $25 billion, capturing all the pieces from paintings and collectibles to sport property and digital actual property.

Due to this fact, it ought to come as no shock that the Securities and Trade Fee (SEC) has reportedly began discussions with NFT creators and sure NFT marketplaces that promote them to see if NFTs are being utilized in such a means that triggers U.S. securities regulation. Regardless of expertise in regulating marketplaces prior to now, Web3 has posed a brand new set of distinctive challenges to the SEC.

Pursuant to the 1946 landmark U.S. Supreme Courtroom case, Howie, transactions that qualify as “funding contracts” are topic to U.S. securities legal guidelines, if the transaction includes the (1) funding of cash” in a (2) frequent enterprise with a (3) affordable expectation of income to be derived from the efforts of others.

Because the SEC continues its investigation to higher perceive digital property, Chairman Gary Gensler has made it clear that he, together with the company, will focus its consideration on taking higher oversight of crypto, leaving the whole crypto neighborhood scratching their heads at how the SEC will go about its first makes an attempt at rulemaking.

So must you be afraid? No — except you’re planning to grow to be a scammer your self. An enormous a part of the SEC’s efforts in regulating crypto and NFTs begins with understanding how the most important gamers within the markets work. For starters, in October 2022, the Bored Ape Yacht Membership drew headlines when information that it was dealing with an SEC investigation leaked. Nonetheless, not like scammers like Ethan Nguyen and Andre Llacuna, the BAYC welcomed this information with open arms, exhibiting full compliance with the SEC’s probe. Shifting ahead, if the NFT house and regulatory our bodies just like the SEC might work collectively, it could stand to profit all.

Take NFT issuers’ phrases with a ‘grain of salt’

On the finish of the day, earlier than you select to put money into any cryptocurrency or NFT challenge, ensure you have consulted with a lawyer, or no less than, have a lawyer simply accessible. It by no means hurts to have one other pair of eyes that may assist hold you alert, cautious, and diligent.

Most significantly, as you look to totally different NFT initiatives to put money into, be certain the challenge has a “story” or coronary heart that provides the challenge that means, path, and a transparent roadmap of the place it’s headed. With out these, you might be merely investing within the unknown and positioning your self in a scenario that would price you all the pieces.

The rising recognition of digital property – particularly NFTs – has arguably compelled legal professionals to broaden their moral tasks to competently and zealously characterize purchasers. This, after all, requires them to no less than be conversant in the house sufficient to have these basic conversations about digital property with their purchasers.

Andrew Rossow is an lawyer and journalist who focuses on fintech and mental property regulation.