The ADX (Common Directional Index) is a development energy indicator – a technical evaluation software used to measure the development energy. Which means that it might point out whether or not the development is upward, downward or weakening earlier than the upcoming value motion.

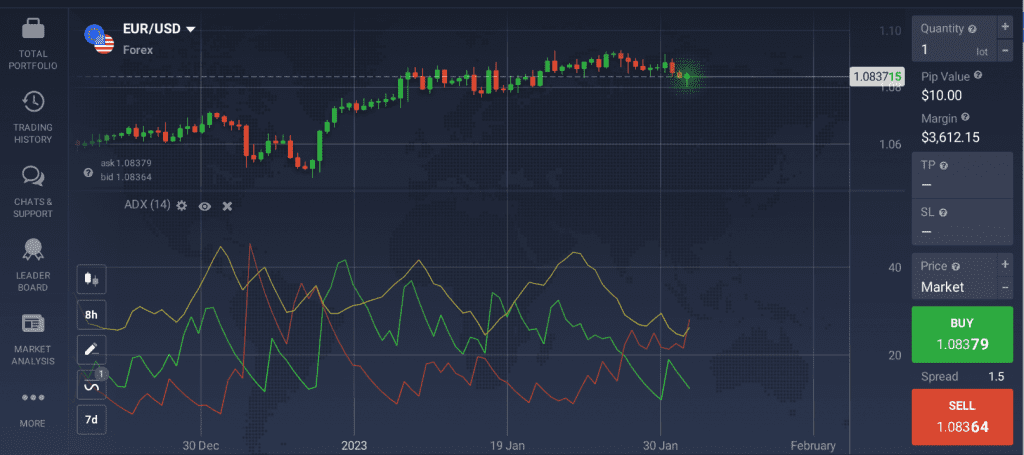

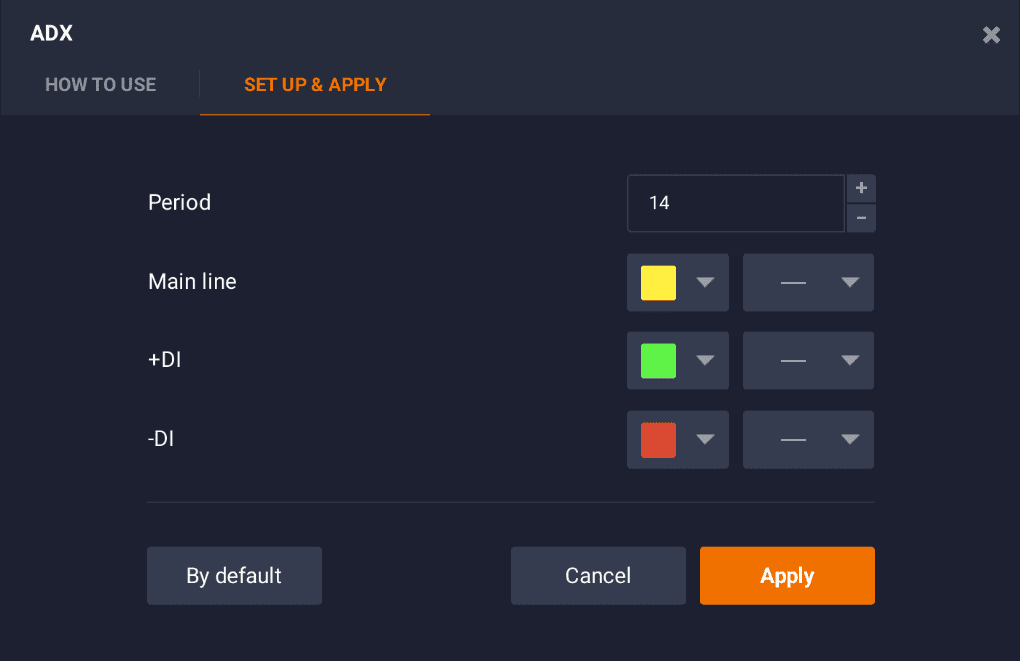

To grasp easy methods to use the ADX indicator, it’s essential to first be taught the fundamentals. This indicator consists of three strains: the predominant line (yellow), the +DI (inexperienced line) and the -DI (crimson line).

The ADX is taken into account a robust development energy indicator, so the primary line reveals the total development energy.

In case the +DI line is above the -DI, the ADX measures the energy of the uptrend. When the -DI strikes greater than +DI, the ADX line measures the energy of the downtrend.

Collectively, they type a buying and selling system which will assist decide each the development course and the development energy.

The right way to Learn the ADX?

To determine easy methods to use the ADX indicator in buying and selling, you must first be taught to grasp its readings.

The ADX values vary from 0 to 100, with 0 being an equal of the completely flat market and 100 — a really highly effective development.

| ADX Worth | Development Power |

| 0-25 | Absent or Weak Development |

| 25-50 | Robust Development |

| 50-75 | Very Robust Development |

| 75-100 | Extraordinarily Robust Development |

When the +DI line is above the -DI, the market could also be thought of bullish.

Alternatively, when the -DI line is greater than the +DI, it might level to a bearish market sentiment.

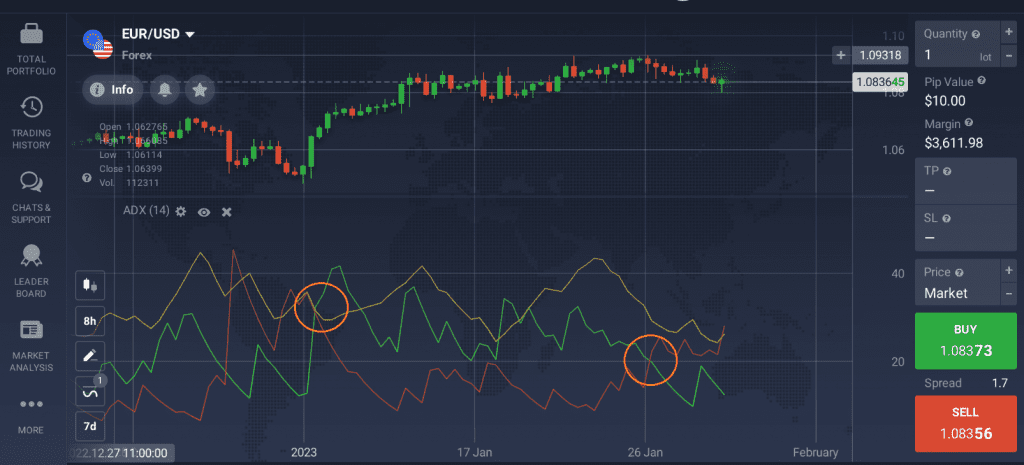

Generally the +DI and -DI strains cross, which can level to an upcoming development reversal. This info could also be used establish the optimum second to enter or exit a deal.

You will need to perceive that the ADX (the yellow line) demonstrates solely the development energy and never the course of the development. Development course will be decided by trying on the +DI and -DI (crimson and inexperienced strains) as an alternative.

The right way to Set Up the ADX Indicator?

There are totally different ADX interval settings that you could be select relying in your buying and selling method. To learn the way to arrange the ADX indicator, let’s check out the primary steps.

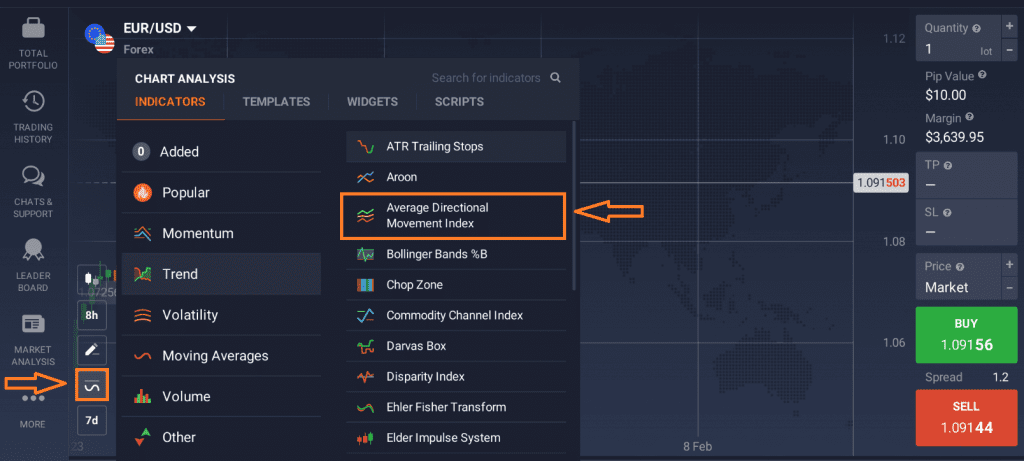

1. Go to the ‘Indicators’ tab within the bottom-left nook of the display screen.

2. Discover the ADX indicator within the ‘Development’ part amongst different related instruments.

3. Now it’s possible you’ll both apply the usual parameters or customise them to your liking. For example, it’s possible you’ll select the ADX interval settings and alter the colours of all 3 strains. Notice that by growing the ADX interval settings it’s possible you’ll cut back the indicator’s sensitivity and on the identical time enhance its accuracy.

4. The ADX indicator set-up is completed and it’s possible you’ll begin buying and selling.

Is ADX a Good Indicator?

The Common Directional Index is a superb technical evaluation indicator that, mixed with different indicators, could develop into a useful gizmo within the fingers of a dealer. Accompanied by +DI and -DI strains, it isn’t solely able to predicting the development energy, but additionally the development course.

As some other indicator, nonetheless, it ought to be used with warning and double-checked on totally different timeframes. No indicator is able to offering correct alerts 100% of the time. The ADX could generally be lagging behind the precise development and might, due to this fact, present outdated info.

What’s the Greatest Mixture with the ADX Indicator?

The ADX will be mixed with different indicators that present the course of the longer term value motion. One such mixture is ADX + Parabolic SAR.

SAR stands for “cease and reverse” and should assist establish upcoming development reversals. When utilizing SAR alongside the +DI and -DI strains, merchants might be able to affirm the development and establish potential development reversals.

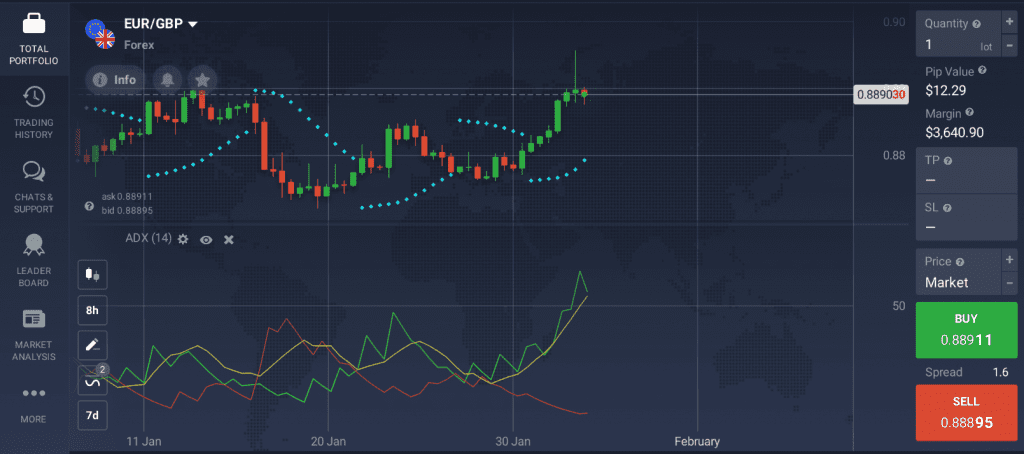

Let’s check out an instance of an ADX indicator combo. At the moment, the +DI line is above the -DI line on the EUR/GBP value chart, which can level to an uptrend. The ADX line that measures the energy of this uptrend has climbed over the worth of fifty, indicating a really robust development. Lastly, because the parabolic SAR indicator’s dots are positioned beneath the value, it additionally factors to an uptrend.

As soon as the SAR strikes above the value, it might point out an upcoming development reversal. By monitoring this indicator and evaluating its alerts with the development energy of the ADX values, merchants could catch upcoming development reversals and determine on the optimum time to enter the market.

Publish Views: 1,309