Up to date February 27, 2023

Ichimoku Cloud indicator, often known as Ichimoku Kinko Hyo, is a technical evaluation instrument that belongs to the class of pattern indicators. With the suitable Ichimoku Cloud settings, it could assist establish the path and reversal factors of the prevailing market pattern.

Being fairly versatile, Ichimoku may work as an oscillator. That’s to say, it determines the pace of the value change for a given asset. As if it weren’t sufficient, Ichimoku can also be able to finding help and resistance ranges.

As you may see, this versatile instrument has the potential to turn into an awesome basis for any buying and selling strategy. Hold studying to learn the way to decide on the Ichimoku Cloud settings and study other ways to use this instrument in buying and selling.

Learn how to Learn this Indicator?

To provide an illustration of what Ichimoku Cloud is, let’s break it down into separate parts. There are 5 parts in complete and every one is a distinct form of shifting common.

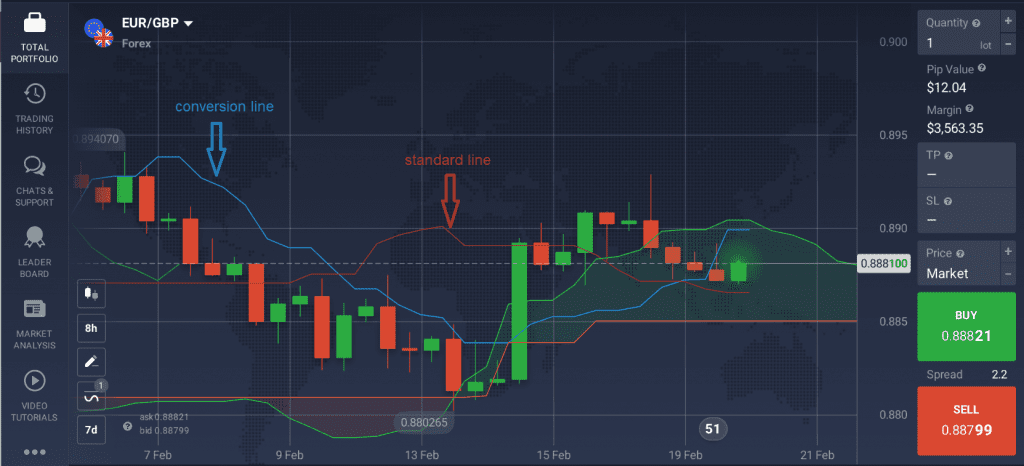

The conversion line Tenkan (blue) and the normal line Kijun (crimson) are additionally referred to as equilibrium traces. The conversion line (blue) averages the very best excessive and the bottom low for the final 9 durations. It could level to an upcoming pattern reversal when crossing the usual line (crimson).

As compared, the usual line averages the very best and lowest values for the final 26 durations. It serves as a dynamic help and resistance stage.

The second pair of shifting averages Senkou Span A (mild inexperienced) and Senkou Span B (orange) kind the so-called cloud (the shaded space on the value chart). Senkou Span A averages the 2 equilibrium traces and shifts the derived values 26 durations forward. Senkou Span B averages the very best excessive and the bottom low for the final 52 durations, shifting the outcomes 26 durations ahead.

✍️

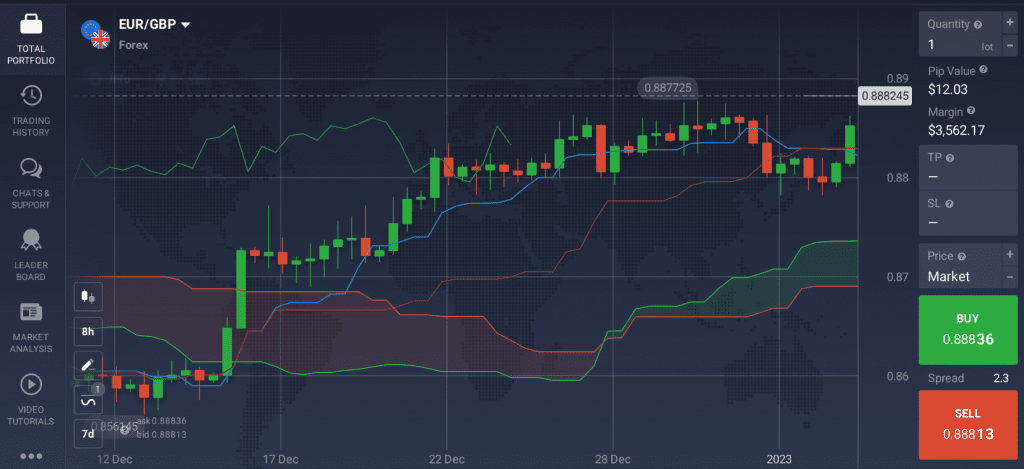

When the cloud turns inexperienced, general sentiment available on the market could also be thought-about as bullish. Conversely, when the colour turns into crimson, market sentiment is perhaps thought-about as bearish. The vertical distance between the borders of the cloud could function an indicator of the market volatility.

Lastly, the Chikou Span (green-colored line) represents the closing value of the present candle, which is shifted again by 26 durations. This lagging shifting common serves as an assist to verify different alerts acquired by this indicator.

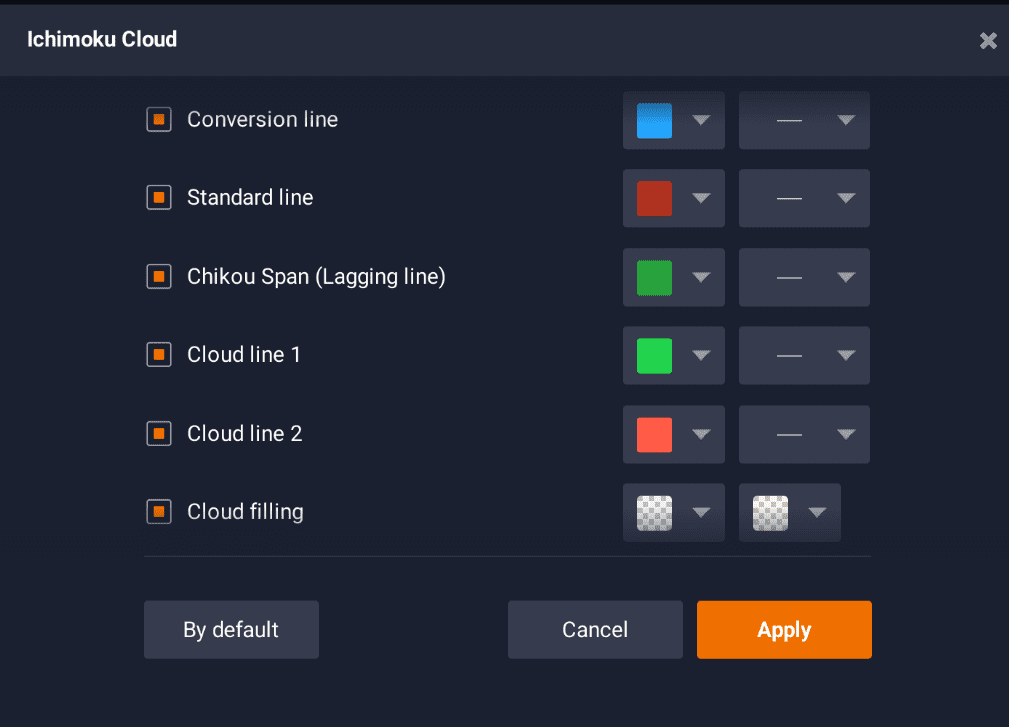

Ichimoku Cloud Settings

So, the right way to arrange Ichimoku Cloud indicator? Let’s cowl the principle steps.

- To decide on the Ichimoku Cloud settings, go to the ‘Indicators’ menu by clicking the corresponding button within the bottom-left nook of the display.

- Go to the ‘Pattern’ tab.

- Select Ichimoku Cloud indicator from the record and click on apply to make use of the usual settings.

That’s it! You’ll be able to change the settings for Ichimoku Cloud indicator or take away it from the chart by going again to the ‘Indicators’ icon.

How Correct is the Ichimoku Cloud?

The Ichimoku cloud indicator could level to a bullish pattern if the next indicators are noticed:

- The candles seem above the cloud;

- The cloud turns from crimson to inexperienced,

- The candles transfer above the Kijun line (crimson);

- The Tenkan conversion line (blue) strikes above the Kijun line (crimson).

However, a bearish pattern could also be arising, if:

- The candles transfer beneath the cloud;

- The cloud turns from inexperienced to crimson;

- The candles transfer beneath the Kijun line (crimson);

- The Tenkan conversion line (blue) strikes beneath the Kijun line (crimson).

Remember the fact that no indicator could provide a 100% correct outcome. Skilled merchants could choose to mix Ichimoku Cloud indicator with different instruments for extra exact evaluation.

Put up Views: 24