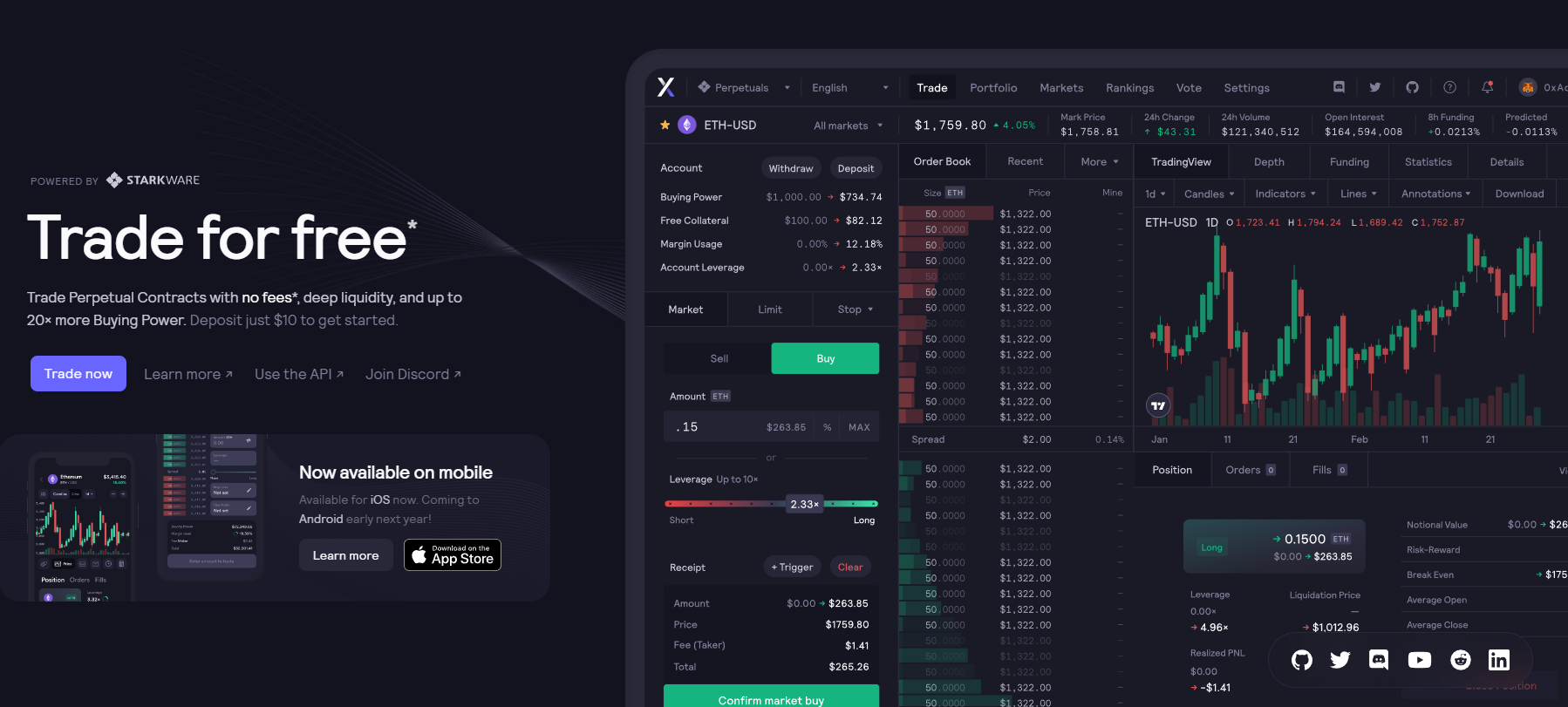

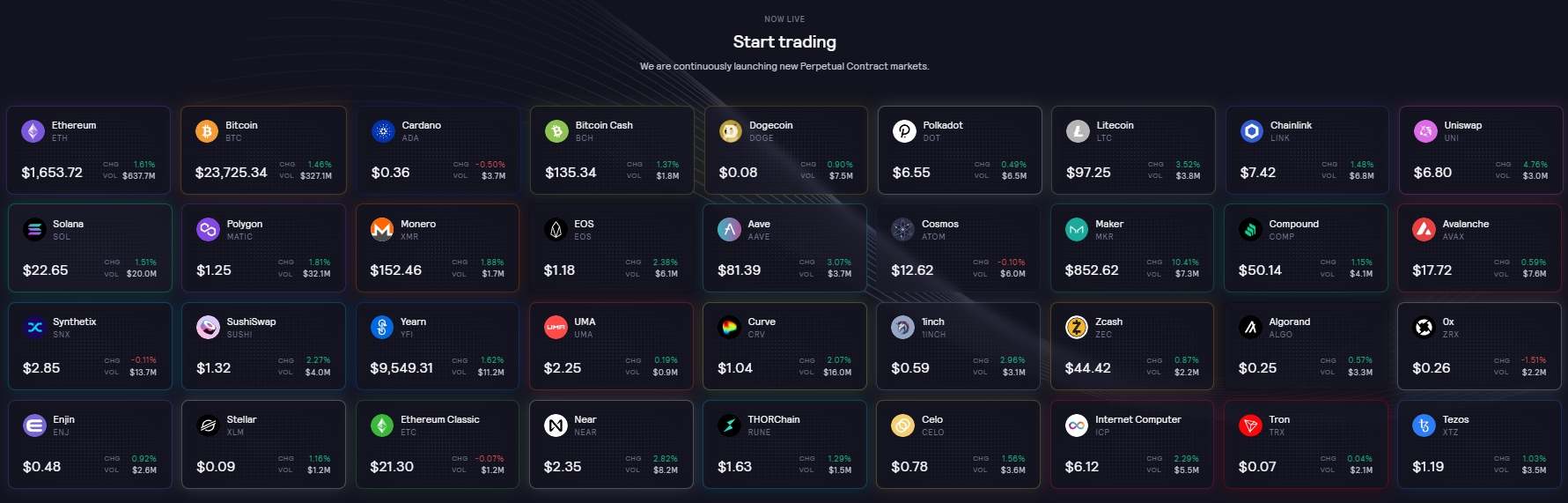

dYdX is a crypto derivatives decentralized (DEX) change providing customers a variety of economic devices equivalent to perpetuals, margin, spot buying and selling, lending, borrowing, and making bets on the longer term costs of widespread cryptocurrencies. It permits customers to commerce over 35 totally different cryptocurrencies. The dYdX protocol was developed on Ethereum sensible contracts and Stark rollups powered by Starkware. It’s designed to carry the usual buying and selling options of a centralized change to the blockchain world. In so doing, it combines the safety and transparency of a decentralized change with the velocity and usefulness of a centralized change.

The protocol has its native governance token, DYDX, which permits community contributors to regulate future developments, achieve mining rewards, and obtain buying and selling reductions on the change.

dYdX was launched in July 2017, initially providing crypto margin buying and selling, lending, and borrowing companies throughout Ethereum Layer 1.

In August 2021, the dYdX change launched Layer 2 cross-margin perpetual buying and selling enabling customers to repurpose their obtainable platform stability to supply liquidity to present trades to forestall liquidations during times of maximum volatility.

The undertaking was designed to be the quickest, most cost-effective, and strongest decentralized change. The dYdX platform is among the world’s largest decentralized exchanges by way of buying and selling quantity and market share, with over 60,000 customers. It’s value about $11 billion in perpetuals and earnings and over $25 billion in flash transactions by way of dYdX Liquidity Swimming pools.

Govt Abstract

- dYdX is an Ethereum-based decentralized change with a variety of economic devices equivalent to perpetuals, margin, spot buying and selling, lending, borrowing, and making bets on the longer term costs of widespread cryptocurrencies.

- dYdX Layer 2 improves community scalability by using zkSTARKS, a sort of zero-knowledge Rollup know-how. It offers cryptocurrency perpetual contract buying and selling for a broad vary of digital belongings.

- Customers can use dYdX to borrow, lend, and speculate on the longer term costs of main cryptocurrencies.

- DYDX token holders can stake their tokens within the dYdX security staking and liquidity swimming pools to earn rewards for securing the protocol.

- The protocol’s native governance token, DYDX, permits community contributors to regulate future developments, achieve mining rewards, and obtain buying and selling reductions on the change.

- The dYdX change’s unique objective is changing into utterly decentralized, with no centralized elements.

How Does dYdX Work?

dYdX is predicated on the Ethereum blockchain. The change combines Ethereum’s safety with quick and low-cost transactions by way of its Layer 2 community.

The L2 protocol makes use of the scalability answer StarkEx and Perpetual sensible contracts of dYdX. Perpetuals are basically crypto spinoff swapping contracts based mostly on hypothesis on the longer term value of cryptocurrencies with out expiration dates. dYdX permits as much as 25X leverage.

As a substitute of particular person debtors and lenders making and accepting mortgage provides, there may be one international lending pool per supported asset on dYdX. The lending pool is managed by sensible contracts, so withdrawing, borrowing, and lending can occur anytime with out ready for matches or adequate capital. The availability and demand for every asset decide the rates of interest of every asset. The know-how ensures lender safety by requiring debtors to deposit adequate account collateral.

The protocol achieves decentralized governance by way of its native ERC 20 token DYDX.

dYdX introduces retroactive mining bonuses to previous customers along with buying and selling and liquidity supplier awards, incentivizing them to commerce on the Layer 2 protocol. DYDX token holders can stake their tokens within the dYdX security staking and liquidity swimming pools to earn rewards for securing the protocol. Whereas the protection pool serves because the platform’s security web in a shortfall occasion, the liquidity pool attracts high-quality market makers.

Layer 1 dYdX (Ethereum)

The Layer 1 model of dYdX is a extremely liquid decentralized change for cryptocurrency margin and spot buying and selling with 5x leverage on belongings like BTC and ETH paired with stablecoins (USDC & DAI).

Borrowing to fund your positions is straightforward and fast, with funds despatched on to your pockets so long as you collateralize correctly. At the moment, the collateralization minimal is 125%, that means you should deposit considerably greater than you want to borrow. Over-collateralization safeguards lenders within the occasion of a default.

Layer 2 dYdX (Starkware)

The Layer 2 model of dYdX improves community scalability by using zkSTARKS, a sort of zero-knowledge Rollup know-how. zkSTARKSe makes use of an off-chain digital machine to course of batches of transactions and put up a validity proof on-chain to substantiate. It removes costly computations from the mainnet whereas nonetheless preserving decentralization.

Layer 2 dYdX offers cryptocurrency perpetual contract buying and selling for a broad vary of digital belongings, together with USD-paired cryptocurrencies like BTC, ETH, SOL, DOT, AAVE, LINK, UNI, SUSHI, MATIC, and LTC. When it comes to leverage, you need to use as much as 25x, a big enchancment over dYdX on Layer 1.

Layer 2 dYdX provides the next advantages:

- Low/ no gasoline charges

- Cell pleasant

- Cross-margining

- Safe and personal transactions

- Quick transactions.

dYdX Founders

Antonio Juliano is dYdX founder and CEO – an skilled programmer with experience in blockchain know-how. He turned concerned in crypto as a software program developer on the Coinbase cryptocurrency change platform in 2015. Juliano is a Princeton College graduate with a pc science diploma. He launched dYdX in early 2017.

dYdX began with the launch of the Layer 1 product (Solo), which supported lending, borrowing, and margin buying and selling on Ethereum.

In 2021, dYdX launched a closed alpha for its new Layer 2 cross-margined Perpetuals product constructed on StarkWare’s StarkEx scalability engine.

In August 2021, dYdX Buying and selling Inc. introduced the creation of the dYdX Basis. The dYdX Basis deploys sensible contracts and points the DYDX governance token. It helps neighborhood analysis and training and in addition manages the dYdX neighborhood treasury.

The change launched in 2019 after receiving over $10 million in seed enterprise capital funding in 2017. The dYdX token ICO was held on September ninth, 2021.

The undertaking traders are Andreessen Horowitz, Paradigm, Polychain capital, and Coinbase CEO Brian Armstrong.

dYdX Buying and selling Choices

dYdX offers perpetual markets (shopping for or promoting orders at a hard and fast value indefinitely, i.e., with no expiry date), together with spot and margin buying and selling on the Ethereum Layer 1 blockchain and Layer 2 cross-margined perpetuals. Let’s look into the small print of every beneath:

Perpetual Buying and selling on the dYdX Trade

Perpetual buying and selling is dYdX’s major product, enabling customers to commerce open markets with non-expirable contracts. In consequence, traders can maintain their purchase or promote positions indefinitely till the predefined transaction situations are met. For instance, if a consumer locations an order to promote one Bitcoin for $100,000, the order shall be lively till Bitcoin reaches $100,000 and the commerce is accomplished. Then again, an investor can terminate the contract by pre-closing the purchase or promote order.

The dYdX perpetual is a non-custodial, decentralized margin product that gives an artificial publicity to a variety of cryptocurrency belongings. Perpetual contracts are created on prime of an underlying asset, on this case, Ethereum-based ERC-20 tokens. In consequence, dYdX permits the creation of completely new asset lessons, the values of that are derived from the underpinning blockchain-based belongings.

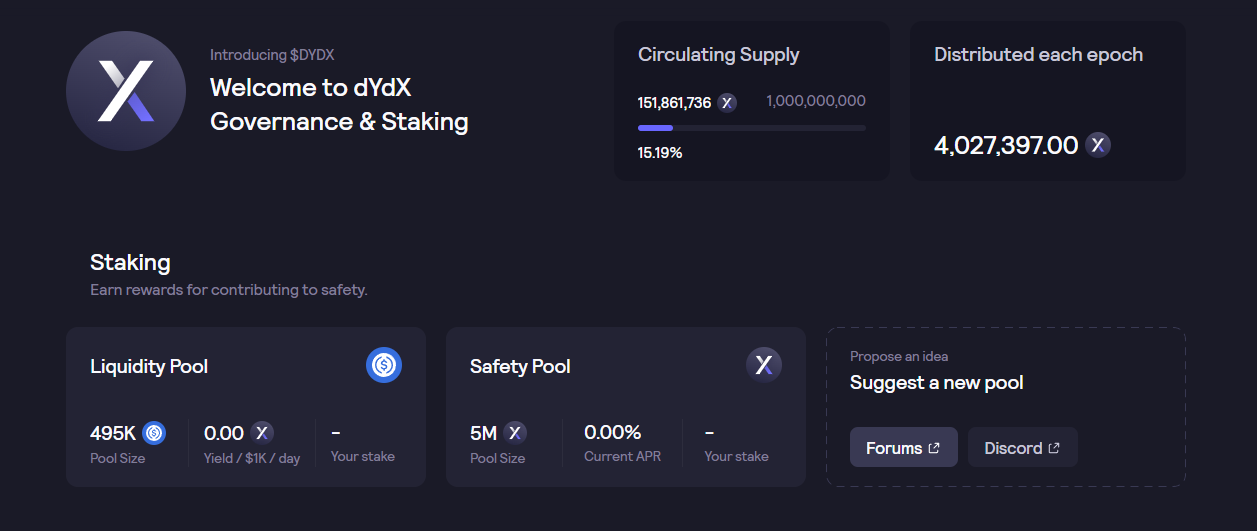

dYdX Governance & Staking

The governance token for the dYdX protocol, DYDX, was issued a yr after the dYdX platform launch. The DYDX token can be utilized for neighborhood voting and governance tasks on the platform. Customers can vote with their DYDX reserves on neighborhood proposals associated to module enhancements, restorations, and grants. Moreover, customers can earn DYDX by buying and selling on the DEX, with all prices and curiosity paid.

The dYdX change’s neighborhood arm permits customers to stake their present crypto holdings to earn yield in its in-house governance token DYDX. The change offers two swimming pools to stake USD Coin (USDC) to earn rewards for contributing to dYdX change liquidity.

To assist the neighborhood, you should purchase DYDX tokens on outstanding cryptocurrency exchanges like Kraken and Coinbase.

Non-Fungible Tokens on DYdX

dYdX’s most up-to-date NFT assortment is Hedgies, a set of animated hedgehogs developed by two unbiased digital artists, Anna and Arek Kajda. The NFT assortment went dwell in February 2022 and launched 4,200 NFTs minted on the Ethereum community.

Customers obtain Hedgies relying on their buying and selling knowledge and neighborhood engagement, together with voting. Hedgies NFT holders are entitled to particular advantages when buying and selling on dYdX. You’ll be able to mint Hedgies by way of the free app that rewards customers for numerous actions and achievements.

Spot and Margin Buying and selling on dYdX

On November 1, 2021, dYdX discontinued its Layer 1 providing of spot and margin buying and selling companies on the Ethereum Layer 1 blockchain protocol. It shifted to providing Layer 2 perpetual merchandise to assist obtain its objective of decentralization.

The dYdX change leverages spot and margin buying and selling with Ethereum sensible contracts. It additionally offers buying and selling choices equivalent to stop-loss and restrict orders like different centralized and decentralized exchanges.

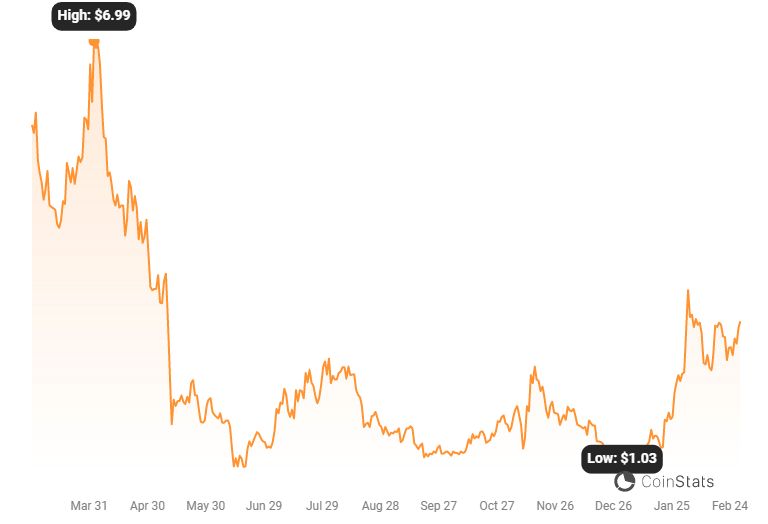

What Is DYDX Token?

DYDX is the dYdX protocol’s governance token that allows merchants, liquidity suppliers, and companions to take part within the protocol’s neighborhood development.

Token holders can stake their tokens to earn rewards and obtain buying and selling reductions. They will additionally make proposals to the dYdX’s Layer 2.

dYdX Liquidity Staking Swimming pools

dYdX provides two sorts of staking swimming pools.

The protection pool creates a security web and ensures that the DYDX customers who staked their tokens obtain a portion of rewards in proportion to their staked tokens within the pool.

The liquidity pool offers liquidity community results and incentivizes skilled market makers to spend money on the platform.

To encourage liquidity suppliers, dYdX liquidity staking swimming pools award DYDX tokens to customers depositing USDC within the pool. As a part of the initiative, 25 million DYDX tokens are up for grabs, accounting for two.5% of the complete token provide.

After depositing USDC to the protocol, customers should stake it within the pool to obtain stkUSDC. Then they have to mark their token as lively so as to add it to the liquidity pool to begin incomes DYDX tokens and a share of buying and selling charges on their USDC deposit.

dYdX Buying and selling Rewards

You don’t need to be a liquidity supplier to earn some tokens; you’ll be able to earn DYDX tokens by buying and selling on the platform. The platform rewards merchants in DYDX tokens from a 250 million DYDX token stash. That’s 25% of the whole token provide, demonstrating a considerable dedication to dYdX customers.

Low cost on Buying and selling Charges

Buying and selling on dYdX entitles you to reductions in buying and selling charges, thereby enhancing your revenue and loss.

You need to maintain DYDX tokens in your pockets to obtain buying and selling charge reductions starting from 3 to 50% for the most important dYdX traders.

How Many DYDX Tokens Are in Circulation?

A complete of 1 billion DYDX tokens have been minted and shall be distributed over 5 years beginning August third, 2021. 50.00% of the availability shall be reserved for the neighborhood; 25.00% shall be used as buying and selling rewards; 7.50% shall be put aside for retroactive mining rewards; 7.50% shall be assigned for liquidity supplier rewards; 5.00% shall be devoted to a neighborhood treasury; 2.50% shall be allotted to customers staking USDC in a liquidity staking pool, and a pair of.50% to customers staking DYDX in a security pool. Previous traders will obtain 27.73% of the proceeds, 15.27% shall be distributed to the corporate’s group members, and seven.00% shall be retained for future dYdX staff and consultants.

DYDX Tokenomics

- Max provide -1,000,000,000 dYdX

- Market cap – $1,251,357,416

- Absolutely diluted – $24,355,536,193

- Complete worth locked – $694,154,000

- Circulating provide – 1,000,000,000.

Who Is dYdX Designed For?

All of this dialogue about crypto margin, spot, and perpetuals buying and selling overlooks one essential truth concerning their supposed buyer. What sort of cryptocurrency dealer makes use of dYdX?

Whereas Layer 1 dYdX can be utilized for easy crypto spot trades, that’s not its supposed software. The spot buying and selling operate seems to be in-built to supply an early income stream for the location by way of transaction charges and deposit collateral, however it will likely be eliminated later. Moreover, the dYdX basis realized that the crypto spot buying and selling trade is rife with the rivalry between well-known manufacturers. In consequence, the group is solely centered on crypto derivatives equivalent to perpetual contracts.

Crypto derivatives buying and selling is usually reserved for knowledgeable merchants who’ve perfected their artwork over time and perceive the dangers, good points, and ways concerned. For instance, buying and selling BTC perpetual contracts requires a number of shifting parts and can’t be executed hands-off. Failure to adequately fund an account over time would possibly end in liquidation, which is the lack of your complete stake.

Nevertheless, though dYdX most accurately fits seasoned crypto merchants, anybody can learn to commerce crypto derivatives.

The right way to Use dYdX?

As a decentralized change, dYdX doesn’t require customers to endure Know Your Buyer (KYC) verification on the platform. You solely want a funded Ethereum crypto pockets to begin buying and selling in minutes. dYdX is non-custodial, that means merchants have full entry to their funds.

Here’s a step-by-step information on buying and selling dXdY perpetual contracts:

- Navigate to the official dYdX web site or obtain the dYdX buying and selling app on iOS.

- Join your pockets (CoinStats Pockets, MetaMask, Coinbase, and many others.). After connecting to the pockets, a popup invitations you to generate a Stark Key. The Stark Key’s a method to help with the consumer’s account’s id, making a safe interplay between Layer 1 and Layer 2. Click on on the Generate Stark Key, which generates a Signature request. Signal the transaction, and there’s no gasoline charge to signal.

- Conform to the phrases and create an account.

- Deposit funds from Ethereum mainnet. At the moment, the platform solely accepts the stablecoin USD Coin (USDC) as buying and selling collateral.

- Choose your asset and a sort of commerce.

- Create a place with the specified leverage (if any) and limits.

- Monitor your revenue and loss assertion and fund your place as wanted.

The Way forward for dYdX

The dYdX change’s unique objective is changing into utterly decentralized, with no centralized elements. At the moment, dYdX is in its third model, with a lot of the dYdX v3 platform’s elements being decentralized; nevertheless, it nonetheless makes use of centralized programs for the order e-book and matching engine.

dYdX v4, the dYdX protocol’s fourth model, shall be launched as an open-source, decentralized, and community-controlled buying and selling platform. Except for full decentralization, the dYdX v4 protocol will reintroduce buying and selling options, together with spot, margin, and different artificial merchandise.

The neighborhood will take management of dYdX v4 away from dYdX Buying and selling Inc., which can not obtain income on buying and selling charges. Following neighborhood approval, the shortcoming to earn income will lengthen to all of the related centralized programs.

Centralized exchanges equivalent to Binance and Coinbase have been dominating the buying and selling panorama by way of buying and selling volumes, regardless of cryptocurrency’s underlying objective of economic decentralization. One of many essential causes for that is the convenience of regulating centralized enterprises. Nevertheless, by way of decentralization, dYdX guarantees to present management to its investor neighborhood whereas nonetheless sustaining the very best stage of transparency.

Backside Line

Decentralized lending and borrowing can be found in DeFi by way of more and more superior buying and selling options. Nevertheless, dYdX focuses on growing extra highly effective buying and selling capabilities on the Ethereum blockchain.

The dYdX protocol, like different DeFi applied sciences, is open to anybody to make use of and broaden upon, with customers’ belongings ruled by sensible contracts fairly than people.