Bitcoin value has bounced again from its latest downtrend, constructing on its earlier positive aspects. Bitcoin, the biggest cryptocurrency by market cap, has bounced again above the essential help of $28,000 and is at the moment headed to $29K. The asset’s complete market cap has elevated by greater than 2% during the last day to $560 billion, whereas the overall quantity of the coin traded climbed by 89.40%.

Bitcoin value has been on an upward trajectory for 3 consecutive days as disappointing Wall Road earnings reignite banking fears. Markets have been in jitters for the previous few days, as main US banks report an underperformance within the March quarter. Earlier on Tuesday, the shares of the First Republic Financial institution dipped by greater than 50% after the financial institution reported a $104.5 billion plunge in deposits within the first quarter. Rumors of a possible seizure of the financial institution by the Fed have additionally buoyed Bitcoin’s latest rally.

The worldwide crypto market cap has elevated during the last day to $1.20 trillion, whereas the overall crypto market quantity jumped by greater than 78.74%. Bitcoin’s dominance has additionally elevated previously 24 hours to 46.90%.

Markets have additionally been cautious of a possible international recession this yr. The US Federal Reserve lately predicted a recession because the IMF hinted at a slowdown in international financial progress. In accordance with the Fed, the banking debacle will seemingly push the nation’s economic system right into a recession. The US CB Shopper Confidence Index fell in April to 101.3 because the Expectations Index additionally slipped to 68.1, suggesting a recession throughout the subsequent yr.

The worldwide crypto market cap has elevated during the last day to $1.20 trillion, whereas the overall crypto market quantity jumped by greater than 78.74%. Bitcoin’s dominance has additionally elevated previously 24 hours to 46.90%.

All eyes can be on the US Gross Home Product (GDP) for the primary quarter later within the day as traders gauge the nation’s financial sentiment. Markets will even be intently watching the Fed’s two-day coverage assembly slated for subsequent week. Markets are pricing in a 25-basis level rate of interest hike for Might.

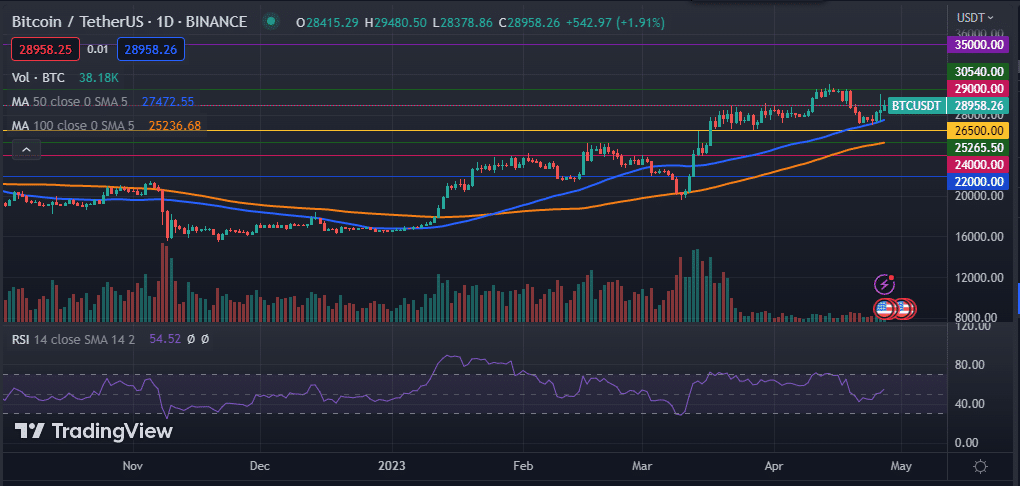

The each day chart exhibits that the Bitcoin value has been on an upside correction for the previous few days, flipping the essential degree of $28,500. The crypto chief has elevated by practically 6% previously three days and is up by 75% within the yr to this point.

The digital asset is hovering above the 50-day and 100-day shifting averages, in addition to the 50-day and 200-day exponential shifting averages. BTC has additionally moved above the 50-day and 100-day easy shifting averages, whereas its Relative Energy Index (RSI) ticks larger into the impartial zone.

Subsequently, a transfer previous the important thing degree of $29,000 will see the Bitcoin value proceed its upside correction to $30,500. If this occurs, the subsequent goal for the bull market would be the resistance at $35,000. Nonetheless, a transfer under the 50-day MA will invalidate the bullish thesis.