“Fed Watch” is a macro podcast, true to bitcoin’s insurgent nature. In every episode, we query mainstream and Bitcoin narratives by analyzing present occasions in macro from throughout the globe, with an emphasis on central banks and currencies.

Watch This Episode On YouTube Or Rumble

Hear To The Episode Right here:

On this episode, CK and I cowl extraordinarily necessary updates for the way forward for the worldwide financial system. First, we discuss concerning the bitcoin breakout. Then we proceed rolling by a number of extra macro charts together with currencies, U.S. Treasury yields, European pure gasoline costs and at last freight charges. Lastly, we take heed to a number of clips from a China skilled on what occurred on the twentieth Social gathering Congress and what it means for the way forward for China.

Bitcoin Breakout

In the course of the week of October 24, bitcoin made a pleasant transfer upwards, out of the triangle sample we’ve been waiting for weeks. In the course of the present, I clarified that the shortage of confirming quantity on this breakout reveals that it may very well be a fakeout and it might nonetheless roll over and go decrease.

Watch the quantity carefully. If it doesn’t are available and value hovers on this common space for a number of days, the chance that it is a fakeout will increase dramatically.

Currencies: Greenback, Yen, Euro, Yuan

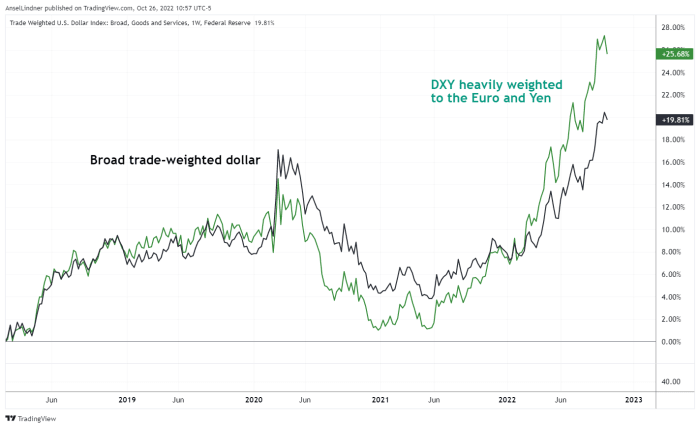

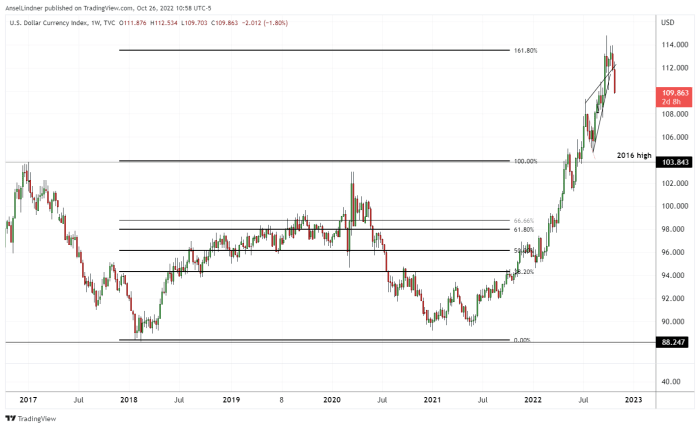

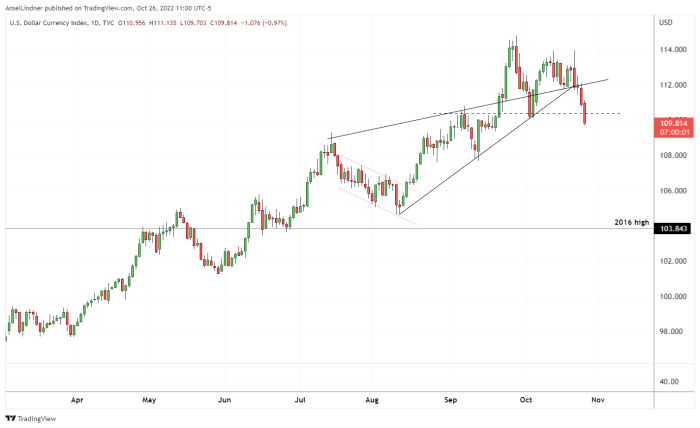

We begin our foreign money dialogue speaking concerning the greenback index (DXY) versus the broad trade-weighted greenback index. As you may see, the DXY has moved much more, which means that the weakest currencies influencing the change have been the bigger ones, the place the numerous different currencies included within the broad greenback index are barely stronger. Nevertheless, they’re now each reverting.

If the greenback is weakening barely, which means the opposite currencies have to be strengthening barely. Let’s check out the opposite main currencies.

The euro is again above parity with the greenback, exhibiting larger highs and better lows — trying robust.

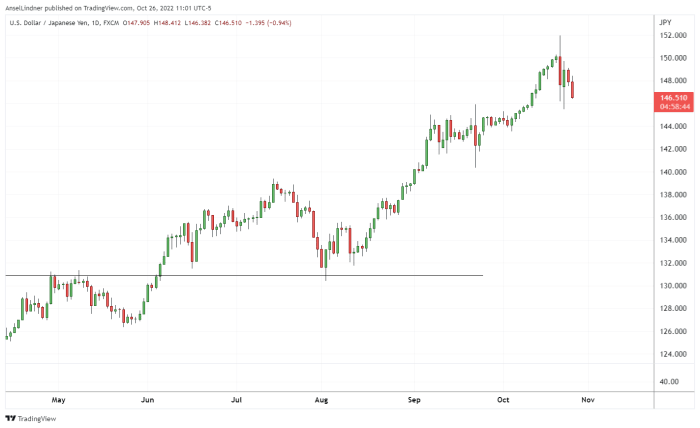

Utilizing an inverse chart to the euro chart above, the Japanese yen is 4% off its weakest and looking out prefer it additionally desires to strengthen within the close to time period.

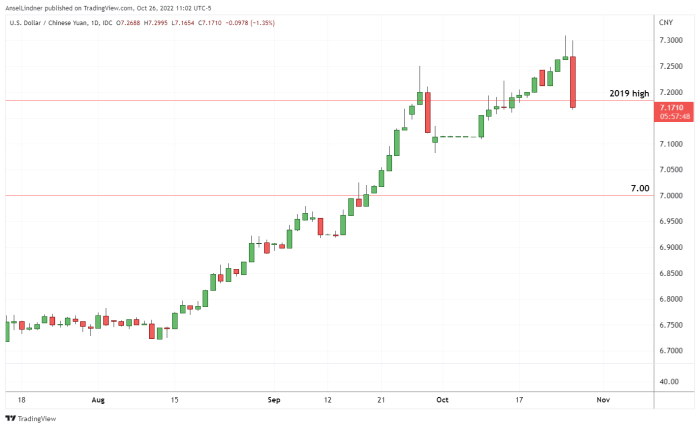

Lastly, the Chinese language yuan. The rumors are that the Chinese language authorities ordered intervention within the yuan to aim to strengthen it in opposition to the greenback. The chart reveals an enormous crimson candle in late September, adopted by every week of obvious manipulation to peg the alternate fee. Instantly after that, the yuan continued its sample of devaluation. Then, on the day of recording, there was one other giant crimson candle, probably the results of intervention. Regardless of the motive, the yuan is stronger in opposition to the greenback in the present day than final week.

U.S. Treasury Yields

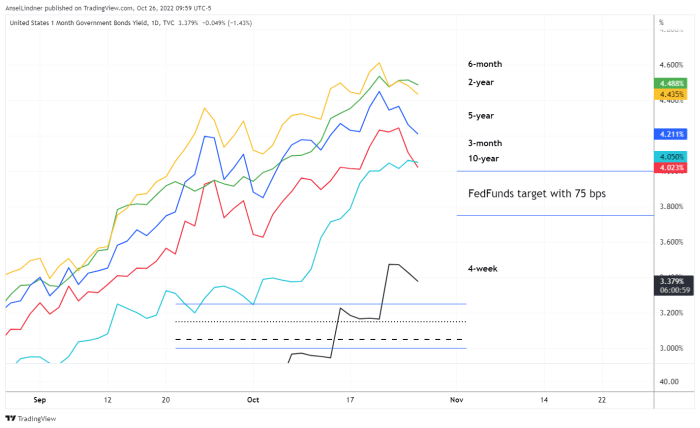

The following couple of charts CK and I take a look at have been U.S. Treasury yields. Particularly, we take a look at the 3-month to 10-year inversion.

It is a crucial inversion to the Federal Reserve, because it means a recession is imminent. As you may see under, it was 3 foundation factors detrimental on the time of recording, and on the time of writing it was detrimental 10 foundation factors. That’s a fairly robust inversion, and is probably going getting Jerome Powell’s consideration.

Under is my rainbow yield curve chart. I labeled every of their vertical order. You may see the 3-month/10-year inversion. I additionally added the fed funds fee and the long run fed funds vary after the upcoming FOMC assembly (in the event that they increase 75 bps once more).

On the present, I attempt to articulate my place which is that if the yields crash down, the Fed won’t have a alternative however to pause or pivot.

Perception Into The twentieth Social gathering Congress

The second half of this episode is devoted to three clips from “Lei’s Actual Speak,” a YouTube channel that stories on occasions in China. Lei is a monetary skilled turned impartial journalist. She has a deep expertise with China, Chinese language tradition, Chinese language politics and censorship. I believed her insights have been extraordinarily beneficial.

First, Lei goes over the additions made to the Chinese language Communist Social gathering’s (CCP) Structure, which was voted on instantly after Hu Jintao’s public purging on the final day of the Congress.

The additions included:

- Making Xi Jinping synonymous with the CCP; nobody in China can query Xi with out questioning the get together itself.

- Including language about Taiwan, with caveats that may be interpreted any method Xi desires.

- Shifting the CCP’s financial focus to the home financial system and inserting exports as a solution to increase home provide and demand.

The second clip was a historical past lesson about how the CCP views Xi Jinping inside their inside historic accounts (a attribute of Marxism is rewriting historical past). Lei says that the highest strategist to Xi in contrast Xi’s rise to energy as on par with Mao in 1935 and Deng Xiaoping in 1978. These two occasions have been framed as saving the get together from collapse. Now, Xi is seen as “saving the get together from collapse.”

On the finish of this second clip, Lei offers her opinions of what this implies for the close to time period in China. She concludes there shall be extra purges, a lot tighter financial controls and China will mainly turn into “a super-sized model of North Korea.”

Within the final clip, Lei solutions a query from her viewers about whether or not the CCP really thinks these reforms will lead the nation to turning into the worldwide hegemon or if they’re proud of No. 2 standing. Her reply is blunt: The CCP doesn’t care concerning the financial system. The financial system is by far a secondary concern to the get together and energy. They consider a lot in Marxism that they may push ahead and attempt to impose it domestically and overseas.

It is a visitor publish by Ansel Lindner. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.