The Federal Reserve’s lending program to help US banks is in excessive demand as borrowings shatter $100 billion.

The most recent knowledge from the Fed reveals that its Financial institution Time period Fund Program (BTFP) has issued loans to the tune of $100.16 billion as of June seventh, in comparison with $93.61 billion borrowed the week ending Might thirty first.

BTFP was rolled out on the top of the banking disaster to offer liquidity to banks which can be struggling to satisfy withdrawal requests. This system permits banks to pledge their belongings, together with authorities bonds and mortgage-backed securities, as collateral to entry further funding. BTFP was designed to remove a financial institution’s have to promote these belongings in occasions of misery.

The rising variety of loans issued by the Fed through the BTFP means that the banking business stays in severe want of further funding to fulfill depositor obligations.

It additionally signifies that banks are nonetheless feeling the strain of the Fed’s tight financial insurance policies.

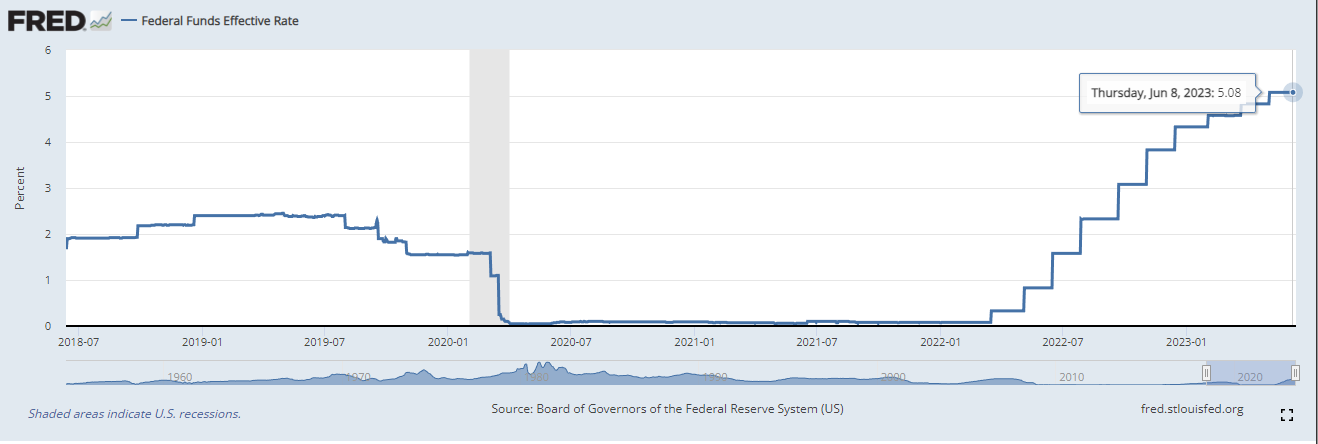

The central financial institution has imposed 10 straight charge hikes over the past 14 months, driving its benchmark rate of interest to five.08% – a degree not seen since 2007.

As a result of Fed’s aggressive charge hikes, banks that gathered treasuries a couple of years in the past when rates of interest have been near zero are witnessing their holdings decline in worth as traders search newly issued US debt that pay larger curiosity.

Banks throughout the US are reportedly nursing $620 billion in unrealized losses because of the speedy rise in rates of interest.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney