Standard on-chain analyst Willy Woo says that Bitcoin (BTC) could have extra room to run after crossing the $30,000 degree.

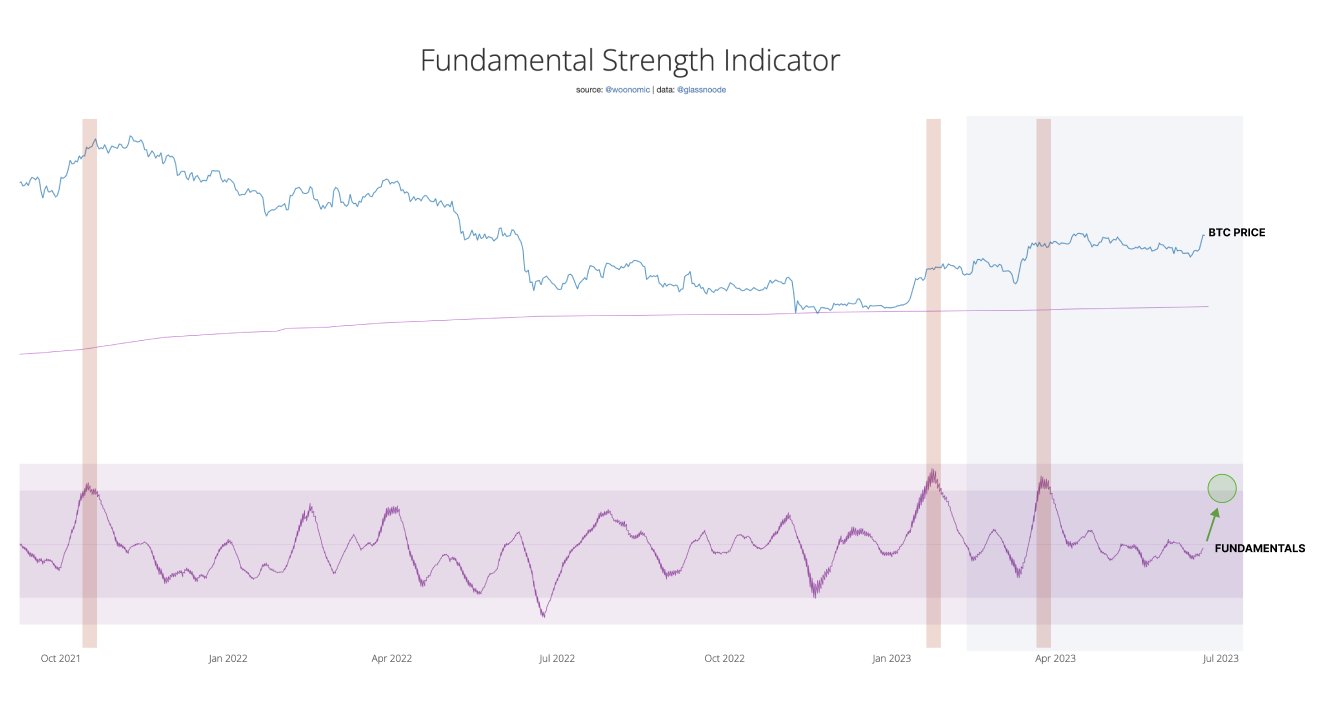

Woo tells his a million Twitter followers that he’s retaining an in depth watch on Bitcoin’s elementary energy indicator, which tracks 17 elementary and technical indicators.

In response to Woo, Bitcoin may shoot up greater than 30% from its present worth of $30,555 earlier than the highest digital asset turns into overbought.

“If this transfer completes, right here’s a chart to offer an concept of how a lot room we now have to maneuver earlier than it’s basically overheated.

By fundamentals, I imply what’s occurring throughout the BTC community… miners, value foundation of newest traders, skilled fingers promoting, technicals, and so on.”

In response to Woo, Bitcoin may cross the $40,000 degree in an extension of its present rally.

“i.e. ~$40,000 BTC.”

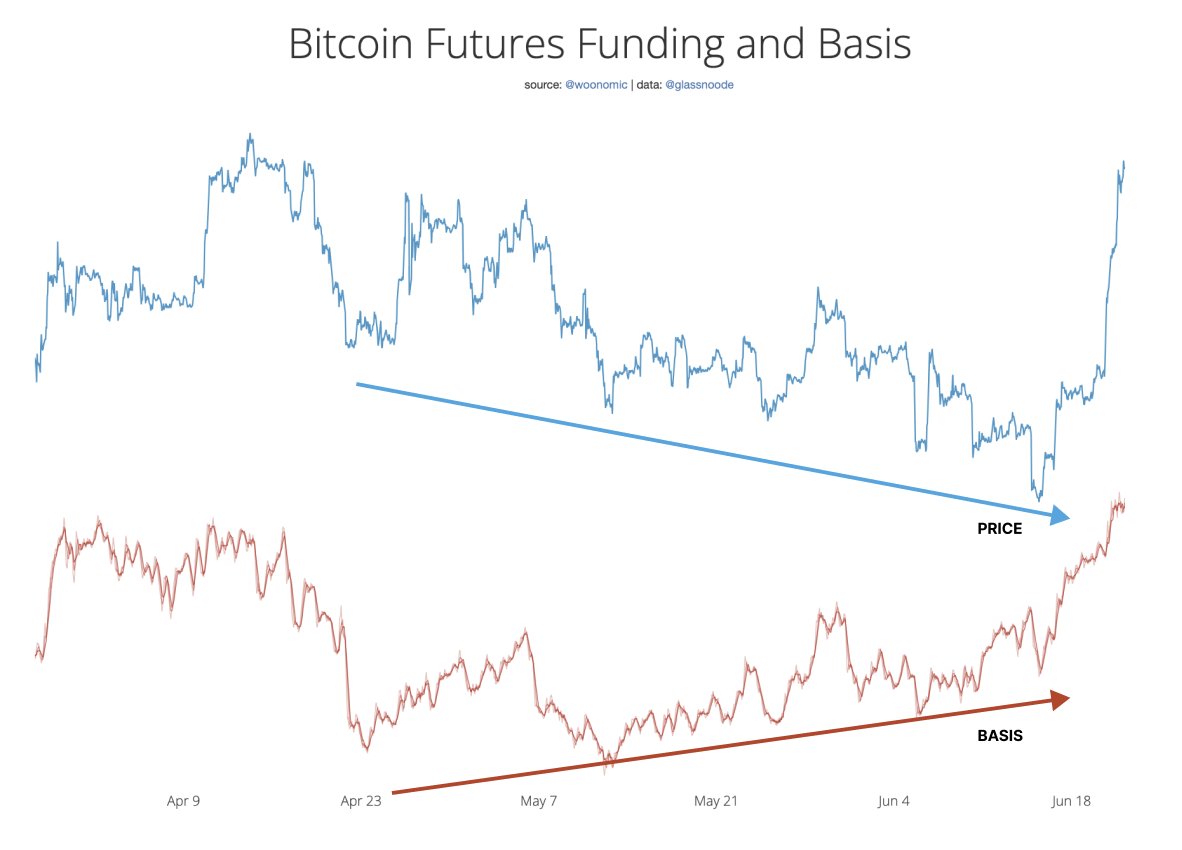

The analyst says that Bitcoin’s newest surge was possible pushed by veteran merchants accumulating BTC when the king crypto’s value dipped all the way down to about $25,000 final week.

“This transfer was dominated by professionals accumulating in opposition to a value decline.

Chart reveals futures demand, often the instrument of professionals.

They aren’t lightening their baggage simply but, this may change quick.

Spot demand (long term) was insignificant.”

Woo additionally believes that veteran merchants are betting large on Bitcoin as they consider that the US greenback index (DXY) is on the verge of a downtrend.

“My finest image is that professionals are buying and selling on longer-term weak point in DXY technical charts. BTC is a superb automobile to commerce as a proxy on account of liquidity and bigger strikes.”

Woo says that in easy phrases, the Bitcoin market is experiencing a brief squeeze.

“Folks wanting a less complicated breakdown of what this chart means.

The purple line represents constructing demand on calendar futures markets, quantified by foundation (the price of sustaining a protracted place).

Finally it’s a brief squeeze from this market…”

A brief squeeze occurs when merchants borrow an asset at a sure value in hopes of promoting it for decrease to pocket the distinction, however they’re compelled to purchase again the property they borrowed as momentum strikes in opposition to them, which triggers additional rallies.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney