HodlX Visitor Submit Submit Your Submit

Based on the most recent report, digital forex transactions are anticipated to blow up within the close to future.

The know-how’s supporters level to elevated comfort, whereas its opponents fear it would give the federal government an excessive amount of energy and erode privateness.

What proof is there to assist the claims of either side of the talk? Let’s delve a bit deeper to see what’s beneath.

Based on Statista knowledge, between 2023 and 2030, there will likely be an astonishing 260,000% improve within the variety of transactions processed via CBDCs (central financial institution digital currencies).

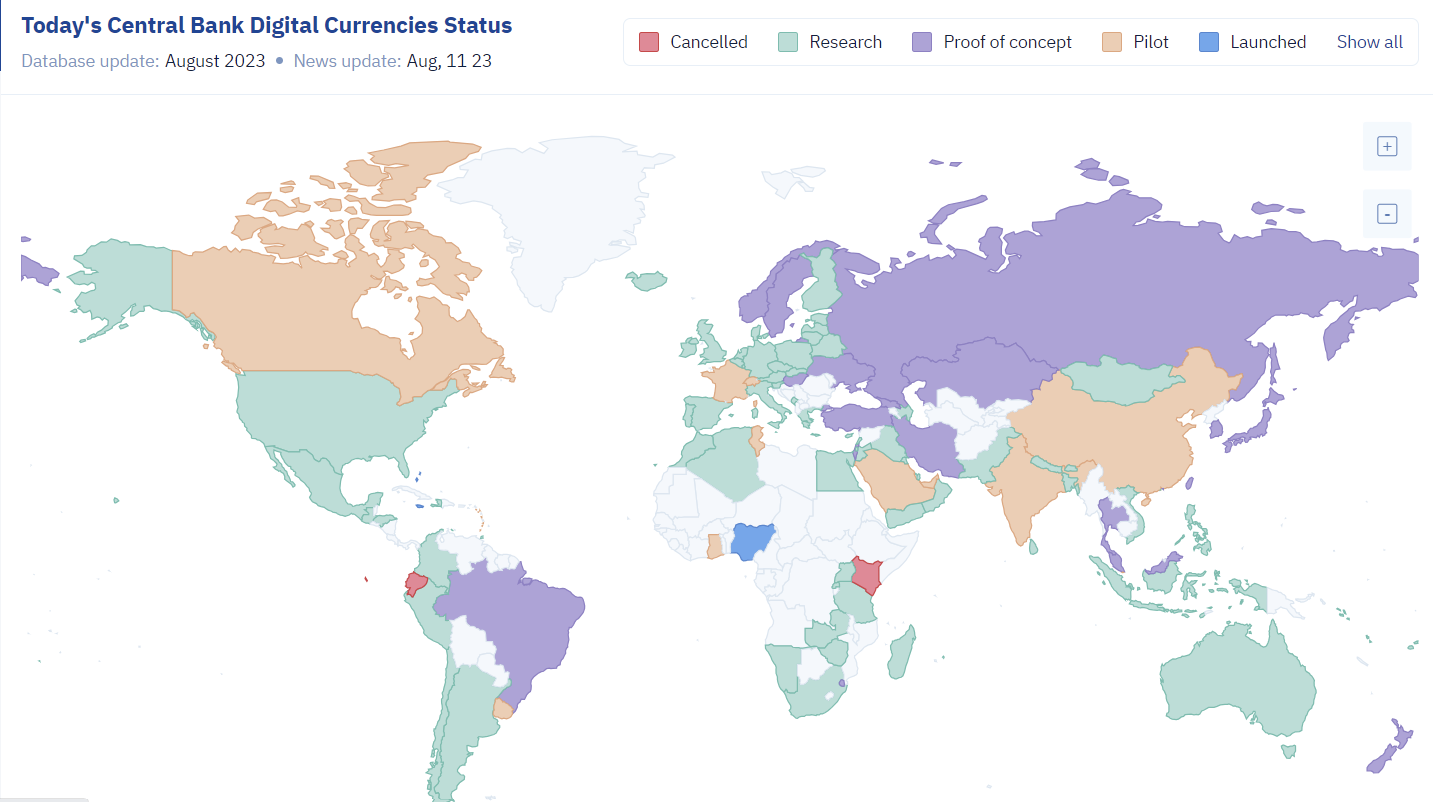

In 2023, 105 international locations are engaged on this type of forex. Which will or will not be excellent news to you, however up to now solely a handful have totally applied it and we have now the primary half of 2023 behind us.

These international locations are Nigeria, the Bahamas, Jamaica and the Jap Caribbean Foreign money Union.

Supply: Cbdctracker.org

In case you missed what CBDCs are, they’re merely digital variations of present fiat currencies that come from central banks.

Whereas cryptos have been created to reverse the facility again to the general public, CBDCs are government-issued digital currencies, enabling the central financial institution to watch your id, location and spending knowledge.

Below the present system, industrial banks are required to maintain all details about their clients confidential, except a authorized requirement requires them to take action.

As soon as CBDCs are up and working, central banks will use a blockchain most certainly a non-public one to maintain observe of who spends cash the place and the way.

The financial institution might restrict the methods wherein cash will be spent and even ban you.

Assume one other lockdown is in place, and you may solely purchase issues inside strolling distance of your house and solely on sure days.

It wouldn’t be technically inconceivable so that you can purchase a ticket and get out of there. Doesn’t that make you consider a dystopian future?

All this boils down to at least one query do central banks actually need to give us a safer digital cost setting or do they merely need to monitor our spending habits and management us much more?

CBDCs make central banks nervous as effectively

Research have proven that CBDCs might have a damaging influence on retail, wholesale and cross-border funds.

Retail CBDCs may cause portfolio modifications within the public’s relative holdings of money and deposits, disintermediating financial institution deposits and growing volatility in financial institution reserves on the central financial institution.

If substantial, these outcomes can undermine financial coverage transmission channels, similar to credit score and rates of interest, which hamper the central financial institution’s means to forecast reserves and conduct efficient OMOs (Open Market Operations) thereby making a living and IT (inflation focusing on) regimes much less efficient.

By utilizing CBDCs for cross-border funds, recipient international locations could face forex substitution dangers throughout disaster intervals, might see capital circulation reversals speed up, weakening the flexibility of home financial authorities to manage alternate charges and financial coverage.

Based on Paolo Ardoino, CTO of Tether, central banks themselves are additionally cautious of CBDCs changing bodily money.

In an interview with Mike Ermolaev, he stated that their non-public conversations with central financial institution representatives revealed their considerations in regards to the unsure results CBDCs may have on their economies in the long term and the lack to reverse course if issues don’t prove effectively.

Based on Ermolaev, actual CBDCs not pilot tasks will likely be launched no sooner than 20 years from now.

Tether’s Paolo Ardoino stated,

“Humanity has been utilizing pocket cash for peer-to-peer transactions for five,000 years, and now we’re forcing them to carry one thing digital for the primary time in historical past with none paper cash or cash.

“Leaving apart all of the potential fears the place central banks can have entry to each single transaction that any individual in that jurisdiction made, there are such a lot of different considerations.”

Based on Ardoino, there’s a effective line between central banks and the banking business on one aspect and individuals who don’t need to stay in an Orwellian world on the opposite.

Various central financial institution officers have publicly questioned CBDCs. The Fed’s Neel Kashkari, for example, wasn’t afraid to state the apparent. He stated,

“I hold asking anyone, anyone, on the Fed or outdoors the Fed, to elucidate to me what downside this [CBDC] is fixing. I can ship anyone on this room $5 with [digital wallet] Venmo proper now.

“No, severely. So, what’s it {that a} CBDC can try this Venmo can’t do? And all I get is a bunch of hand waving.

“In the event that they need to monitor each considered one of your transactions, you may try this with a [CBDC]. You’ll be able to’t try this with Venmo.

“If you wish to impose damaging rates of interest, you are able to do that with a [CBDC] you may’t try this with Venmo.

“And if you wish to instantly tax buyer accounts, you are able to do that with a [CBDC] you may’t try this with Venmo. Why would the American individuals be for that?”

Privateness-preserving CBDCs are possible

Based on the ECB (European Central Financial institution), 41% of responses regarding a Euro-denominated CBDC throughout its session interval targeted on privateness.

Really, there’s potential for CBDCs that will not infringe upon residents’ privateness rights.

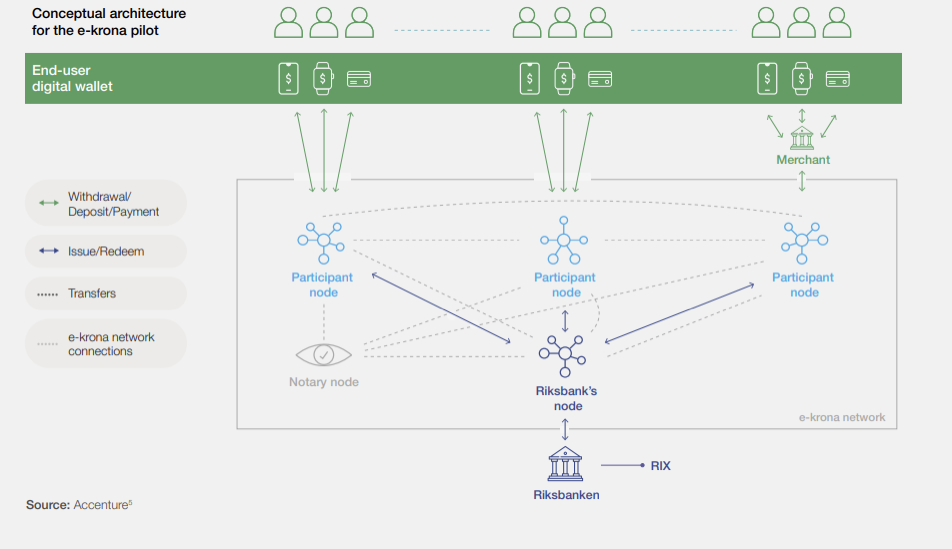

An instance of privateness structure in a CBDC is the e-crona pilot of Riksbank. It’s primarily based on Corda, an open-source blockchain undertaking developed by Accenture.

On this mannequin, transactional actors and central banks are bodily separated in order that the information is distributed on a need-to-know foundation.

These concerned within the transaction are the one ones who obtain the transaction’s knowledge.

The proposed designs of CBDCs that defend privateness additionally embrace token-based, software-only CBDCs.

Most of these CBDCs would permit customers to withdraw cash on their smartphones or computer systems with out banks having any report of the transaction or a ledger linking the CBDC to its proprietor.

On this case, privateness might be achieved via a cryptographic approach referred to as, ‘blind signatures,’ wherein customers have management over accessing the information.

This manner, central banks can’t be taught the identities of shoppers or retailers nor the quantities of transactions solely the withdrawal and redemption of digital cash.

The query is how far banks could be prepared to go along with a lot of these CBDCs.

Remaining ideas

To conclude, CBDCs supply potential advantages, however their implementation should be rigorously thought-about in an effort to be certain that privateness, monetary freedom and market stability are usually not compromised.

Consequently, there’s a want for additional exploration and dialogue to make sure CBDCs are developed in a method that advantages everybody.

Maria Carola is the CEO of StealthEX.io, an instantaneous, non-custodial cryptocurrency alternate with over 1,300 property listed. After graduating the College of Vilnius, Maria spent nearly a decade within the crypto area, working in advertising and administration for a wide range of blockchain tasks together with wallets, exchanges and aggregators.

Comply with Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/X-Poser/Fotomay