Bitcoin worth dipped beneath the essential degree of $26,000 on Friday within the wake of hawkish feedback by the US Federal Reserve Chair Jerome Powell. The digital asset has been buying and selling sideways for the previous few days amid financial uncertainty and a decline in threat urge for food. Bitcoin’s complete market capitalization has plunged additional over the previous day to $506 billion, whereas the whole quantity of BTC traded over the identical interval fell by greater than 12%.

Fundamentals

Bitcoin worth has posted vital losses over the previous few weeks as financial jitters and a decline in threat urge for food proceed to weigh on crypto costs. The worldwide cryptocurrency market has additionally been on a steep decline, with main altcoins, together with Ethereum, falling to their lowest ranges in months. The worldwide crypto market cap has crashed to $1.05 trillion over the previous 24 hours, whereas the whole crypto market quantity decreased by 13.39%. Bitcoin’s dominance has additionally declined over the identical interval.

The Crypto Worry and Greed Index, which measures the sentiment of the crypto market contributors, has moved to a worry degree of 34, hinting at a decline in threat urge for food. As such, traders are more likely to promote their crypto holdings irrationally, thus coming into conservation mode.

The primary catalyst behind this week’s cryptocurrency selloff is the hawkish feedback by Federal Reserve Chair Jerome Powell. Talking on the annual Jackson Gap symposium in Wyoming, Powell mentioned that inflation was nonetheless too excessive regardless of progress, warning that additional rate of interest hikes may very well be but to come back. He famous that the Fed will stay vigilant because it contemplates its subsequent strikes, giving little indication that it’s prepared to begin quickly. Based on the CME FedWatch Instrument, there’s a 20% probability of the Fed mountain climbing its rates of interest in its subsequent assembly in September.

“Though inflation has moved down from its peak — a welcome improvement — it stays too excessive… We’re ready to boost charges additional if applicable and intend to carry coverage at a restrictive degree till we’re assured that inflation is transferring sustainably down towards our goal,” Powell mentioned.

Bitcoin Worth Technical Evaluation

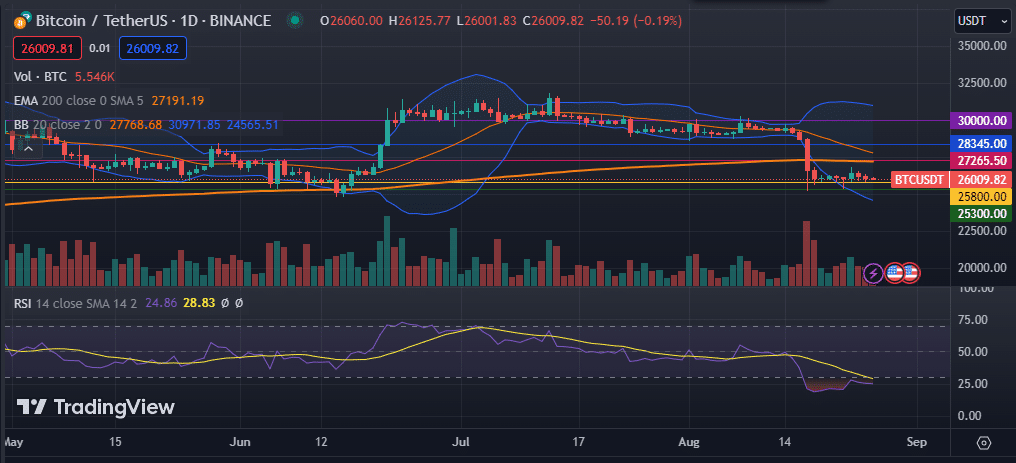

Bitcoin worth has been buying and selling sideways for the previous few days, transferring between the tight vary of $26,000 and $26,300. The digital foreign money has misplaced greater than 11% in worth within the month up to now however stays 57.48% larger within the 12 months up to now. Bitcoin stays beneath the 50-day and 200-day exponential transferring averages as seen on the every day chart.

Its Relative Power Index (RSI) is within the oversold area at 25, indicating a rise in promoting stress, whereas the Shifting Common Convergence Divergence (MACD) indicator stays within the crimson. The Bollinger Bands have widened, pointing to a better volatility, making the asset riskier.

Subsequently, the Bitcoin worth is more likely to proceed falling within the quick time period as bulls wrestle to collect momentum to push the worth larger. As such, the subsequent assist ranges to look at are $25,800 and $25,300. Conversely, a transfer above the 200-day EMA at $27,265.50 would possibly pave the best way for additional beneficial properties.