Bitcoin value jumped greater than 3% on Monday, hitting its highest stage since August 2023 forward of the extremely anticipated FOMC assembly. At press time, the premier cryptocurrency was buying and selling 2.70% greater at $27,244.20. The digital asset has gained practically 5% within the month up to now and 64.71% within the 12 months up to now. Bitcoin’s complete market cap has climbed by 3% over the previous 24 hours to $531 billion, whereas the whole quantity of the asset traded over the identical interval elevated by virtually 100%.

Fundamentals

Bitcoin value was displaying indicators of restoration on Monday from the losses made within the final cryptocurrency market dip. Bitcoin flipped above the vital stage of $27,000, whereas Ethereum held above vital help ranges. The general cryptocurrency market was within the inexperienced with the worldwide crypto market cap up by 2% to $1.08 trillion for the day, whereas the whole crypto market quantity elevated by greater than 56%.

Even so, the Crypto Concern & Greed Index, which is a serious measure of the crypto market sentiment by members, was in a concern stage of 38, virtually like final week’s studying. This factors to a continued decline in danger urge for food by buyers, which may immediate them to promote additional.

Regardless of Monday’s bullish rally, rate of interest choices due later within the week might introduce downward strain on cryptocurrencies. The US Federal Open Market Committee (FOMC) is slated to start its two-day financial coverage assembly on Tuesday. Traders shall be carefully watching the assembly, looking for clues in regards to the financial outlook and the Fed’s rate of interest path.

A string of stronger-than-expected financial knowledge launched over the previous few days renewed worries about additional rate of interest hikes this 12 months by the central financial institution. Even so, markets are pricing in a 99% probability of a pause in price hikes by the Fed this month. Notably, expectations for additional hikes in November are rising.

The Financial institution of England can be anticipated to announce its rate of interest resolution later this week. Like most danger belongings, cryptocurrencies are delicate to price expectations, so hawkish tones by the central banks may go away investor sentiment bearish.

Bitcoin Value Outlook

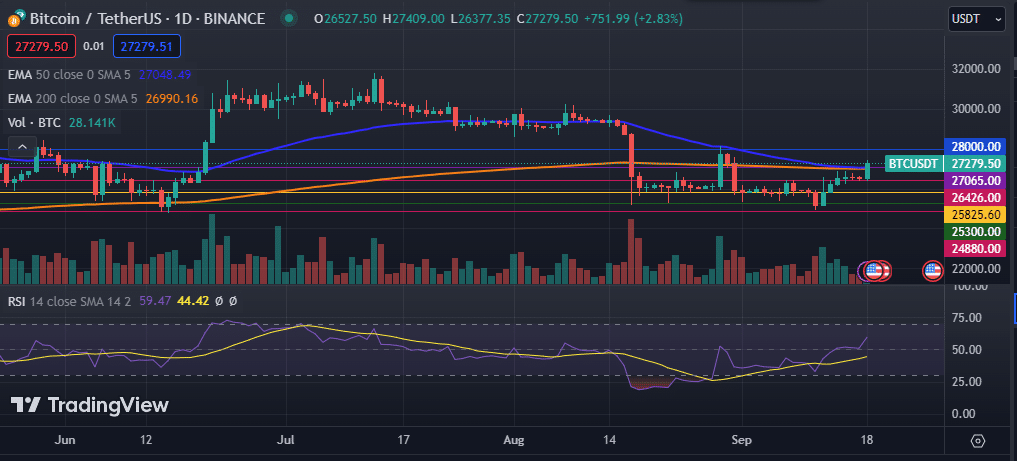

The every day chart exhibits that Bitcoin value managed to interrupt the vital psychological stage of $27,000, selling additional will increase. The crypto asset hit an intraday excessive of $27,409 earlier within the day earlier than pulling again barely. Bitcoin has managed to cross above the 50-day and 200-day exponential shifting averages, whereas its RSI moved above the sign line and the impartial stage.

Consequently, I count on the present bullish trajectory to be short-lived amid macroeconomic issues. As such, the Bitcoin value is prone to pull again under the instant help stage of $26,426 within the quick time period. If this occurs, bears shall be eyeing the subsequent help at $25,825.60. Nonetheless, a breakout above the vital stage of $28,000 will invalidate my cautiously bearish thesis.