Ethereum value has been struggling in current weeks on the again of its unstable on-chain efficiency and world financial uncertainty. The final market efficiency has not helped a lot both, as most altcoins have failed to carry an upside momentum. Ethereum, probably the most precious property within the cryptocurrency market, has dipped by practically 3% previously week and greater than 5% within the month so far.

Basic Evaluation

Ethereum value has been on a constant bearish trajectory over the previous few weeks in opposition to the backdrop of a boring crypto market and a stronger greenback. The greenback index, which measures the efficiency of the dollar in opposition to six main currencies, has been hovering round its highest stage since December 2022 since Thursday. At press time, the greenback index was buying and selling greater at 105.720. A stronger greenback tends to be bearish for danger property, significantly cryptocurrencies.

Buyers have been assessing the financial outlook, contemplating what could possibly be subsequent for rates of interest and the economic system, forward of a string of key financial knowledge due later this week. Buyers will likely be wanting on the knowledge from the housing sector, in addition to the CB Shopper Confidence knowledge slated for Tuesday. Moreover, the quarterly GDP knowledge for Q2 is anticipated to be printed later Thursday, concurrently with the preliminary jobless claims.

The Fed’s favourite inflation gauge, the non-public consumption expenditure index (PCE), can also be anticipated to be printed on Friday. Varied Fed audio system are additionally because of give remarks and will present contemporary hints in regards to the financial coverage outlook. Notably, Fed Chair Jerome Powell is slated to present a speech on Thursday.

Final week, the US Federal Reserve introduced its resolution to carry rates of interest at its September coverage assembly. Even so, Fed officers warned of additional fee hikes later within the yr, with markets pricing in a 25.5% likelihood of a 25-basis level hike to five.75% in its November assembly.

Hope for Ethereum?

Ethereum value has not loved favorable sentiment in current weeks amid its struggling value and unstable on-chain efficiency. Even so, the most recent on-chain knowledge renews some hope for the asset’s value. On-chain analytics have all the time helped present real-time analytics into crypto market developments.

In accordance with knowledge by Santiment, the Ethereum charges have dropped to their lowest ranges since 2023, which could be a turning level for the asset’s market worth and efficiency. As of Saturday 23rd September, the Ethereum community charges had dropped to $1.15, a big fall from big ranges seen in 2021 and 2022 of above $50.

Traditionally, such a decline in charges prompts an increase in utility and adoption because the asset turns into extra reasonably priced to flow into. Notably, elevated utility and adoption may result in a restoration within the asset’s market cap ranges and worth. Even so, this improvement doesn’t appear to have a big influence on the ETH value, because it continues to wrestle to interrupt out from the present promoting strain.

Ethereum Value Technical Evaluation

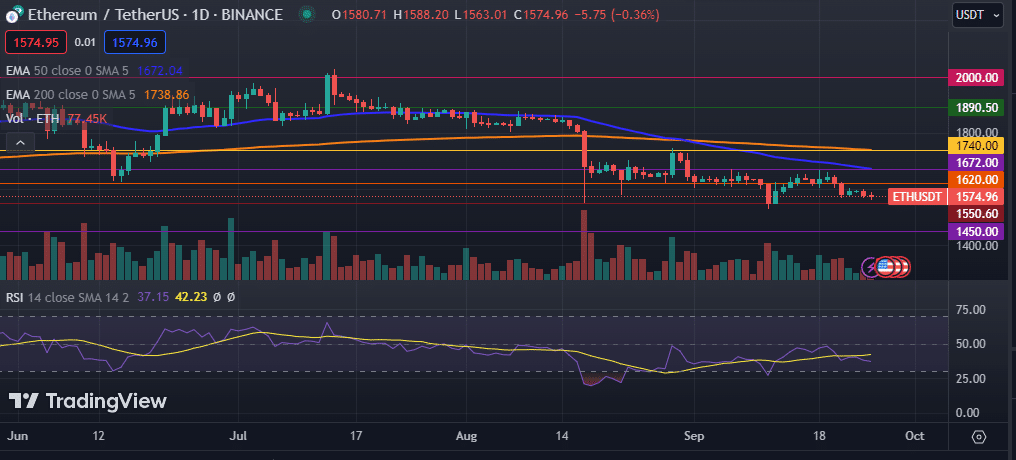

The every day chart reveals that the Ethereum value has been on a steep decline over the previous few days, after going through a robust rejection at $1,620 stage. Throughout this era, the asset has been hovering barely above the essential assist stage of $1,565. The digital foreign money stays beneath the 50-day and 20-day exponential shifting averages, in addition to the 50-day and 100-day easy shifting averages.

As such, the Ethereum value is prone to prolong its losses into the following classes as bears take full management of the market. A drop beneath the rapid assist stage of $1,550.60 would possibly push the ETH value decrease to seek out assist at $1,450. Conversely, a breakout above the 50-day EMA at $1,672 would possibly pave the best way for additional will increase.