Let’s begin in the present day’s Admiral Markets evaluate by stating that this model operates within the subject of funding monetary companies and has been right here since 2001. Headquartered within the UK, the model repeatedly expanded worldwide and in the present day has a number of workplaces in nations like Cyprus, Estonia, and Australia.

The principle intention of Admiral Market is to provide entry to purposeful software program and have a superb providing for merchants, enabling the neighborhood to commerce and revel in clear pricing and execution. The buying and selling course of is constructed for low latency and excessive buying and selling frequency, aggregated by the system’s stream that comes from completely different banks and venues right into a single liquidity pool. Because of this, each Admiral Markets dealer evaluate on-line exhibits how good spreads the dealer has, providing no restrictions on buying and selling kinds or methods, with low slippage and rejection charges, all carried out at excessive speeds.

Admiral Markets Dealer Evaluation: Does It Reside Up To The Hype?

The very first thing value noting on this part of our Admiral Markets evaluate is the sharp regulation and general picture of the agency. The spreads supplied are additionally among the many lowest within the business based mostly on our analysis, and there are numerous platforms, together with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), all providing nice training, analysis, and steady buyer assist.

There aren’t many damaging factors on the market for Admiral markets, whereas the situations and proposals fluctuate based mostly on the entity’s guidelines. Under is a abstract of among the major options of Admiral Markets on-line:

|

Headquarters |

UK |

|

Regulation |

ASIC, FCA, CySEC, EFSA, IIROC, JSC |

|

Devices |

Metals and currencies, CFDs buying and selling on indices, energies, bonds, shares, and CFDs on Cryptocurrencies |

|

Platforms |

MT4 and MT5 |

|

EUR/USD Unfold |

0.6 pips |

|

Minimal deposit |

100$ |

|

Base currencies |

EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

|

Demo Account |

Provided |

|

Schooling |

Intensive instructional and assist supplies |

|

Buyer Help |

24/7 |

Is The Platform Legit And Secure?

Closely regulated by a number of authorities, together with the Monetary Conduct Authority (FCA) of the UK, CySEC in Cyprus, and EFSA in Estonia, in addition to ASIC in Australia, the Admiral Markets foreign exchange dealer evaluate, exhibits that this dealer ticks all the bins and is a official place to commerce. The regulatory standing and licenses present that the dealer is commonly working, is allowed, and is managed by a number of jurisdictions at each step.

Subsequently, you may be 100% assured studying this Admiral Market evaluate figuring out that the dealer is overseen and that your cash is secure and received’t be taken by anybody. Plus, your cash are segregated from what the corporate owns and coated by the compensation fund of the FSCS (Monetary Companies Compensation Scheme) Nevertheless, needless to say you might be buying and selling at your personal threat.

There’s desktop buying and selling but in addition by the MT5 internet platform, in addition to a cell platform for optimum comfort. The MetaTrader Supreme Version providing is especially attention-grabbing for desktop merchants.

Account Sorts, Leverage Choices & Devices

The subsequent a part of this Admiral Markets evaluate exhibits that there are versatile accounts supplied by the dealer, permitting for the matching of explicit buying and selling wants between two sorts of platforms. Newcomers and skilled merchants can each entry primary and superior accounts. There’s the MT4 platform, in addition to Zero.MT4 accounts, both with all prices within the unfold or interbank quotes and fee for the dealer. In MT5 accounts like Commerce.MT5 and Zero.MT5 there’s a comparable construction plus a separate account sort for traders (shares and ETFs are favorable).

On the subject of leverages, Admiral Markets gives marginal buying and selling, which implies you possibly can commerce by a multiplied quantity of your preliminary deposit, working bigger positions. There are decrease ranges of leverage for retail merchants recently, largely on account of some updates in EU regulatory necessities. Within the Australian markets, increased leverages of 1:500 for Foreign exchange are nonetheless allowed.

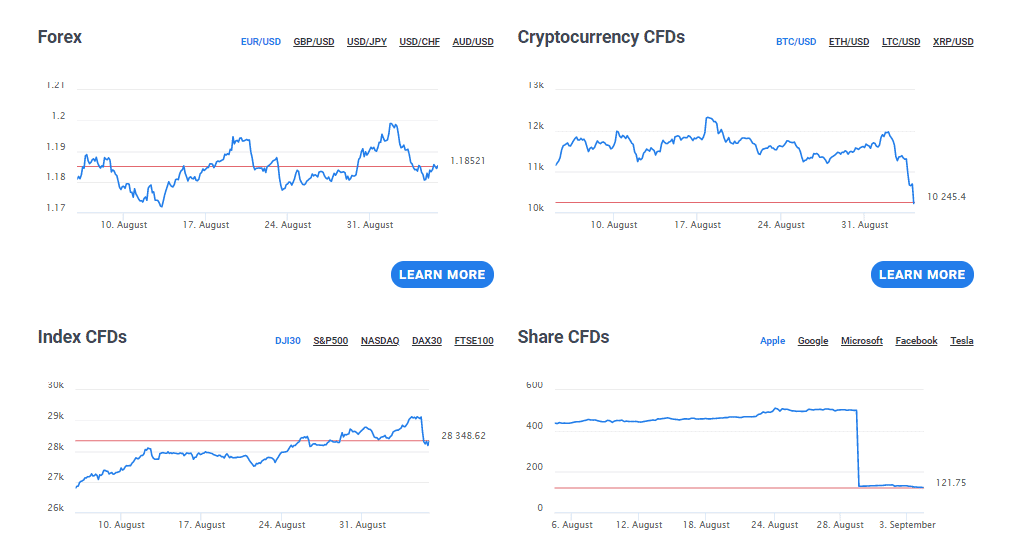

Lastly, the devices embrace metals and currencies, CFDs, buying and selling on indices, energies, bonds, shares, cryptocurrencies and CFDs. On the crypto facet, cash like Bitcoin, Litecoin, and Ethereum, in addition to Monero, Zcash and Sprint are supported. Total, the Admiral Markets opinions present that this dealer is official.

Charges, Deposits & Withdrawals

The price construction is subsequent on this Admiral Markets evaluate. It’s necessary to notice that there isn’t a deposit price, no withdrawal price, however there are inactivity charges. Total, the price rating is low, and the identical goes for spreads, the place you possibly can commerce with 0.6 pips on EURUSD, 3 pips on crude oil WTI, and 17 cents on gold spreads, with $0 on BTC/USD.

There are many deposit strategies, together with main financial institution transfers, VISA and MasterCard funds. Whereas there are not any deposit charges, e-wallet funds from Skrill and Neteller will add a 0.9% price for the deposit transaction or 1% for withdrawals.

When withdrawing, it’s good to notice that there are two financial institution wire withdrawals allowed monthly that are freed from cost, whereas additional withdrawals will incur charges. The choices are financial institution wire, and card funds, in addition to e-wallets. Total, the minimal deposit is $100 as a beginning capital.

Why Ought to You Select It

Lastly, it’s simple to see why merchants select Admiral Markets. It has a superb investor training program together with loads of superior MetaTrader options. The Supreme add-ons, alongside the regulation from many authorities and an intensive vary of shares, foreign exchange, and CFD markets, all put it among the many leaders within the foreign exchange dealer buying and selling world.

On high of that, this dealer has an amazing fame amongst traders and is taken into account a low-risk possibility with nice Admiral Market opinions throughout the board. We hope that this Admiral Markes foreign exchange dealer evaluate helped you notice why this dealer is among the many greatest on the market.