If you’re interested by buying and selling shares, you would possibly want to think about some vital factors. Now we have put collectively this information to assist novice merchants perceive how shares work. It could present some concepts on learn how to analyze shares and select those that suit your buying and selling strategy.

Fundamental Details About Shares

When somebody buys a inventory (additionally known as a share), they develop into house owners of a small fraction of a enterprise. Inventory costs are typically decided by provide and demand: somebody is all the time seeking to purchase shares, whereas others are promoting. To study extra basic details about shares, chances are you’ll flip to Fundamentals of Inventory Buying and selling Defined.

Inventory Market Sectors

When choosing shares for buying and selling, chances are you’ll begin by deciding available on the market sector. Sectors have varied elements influencing their companies. Some are usually extra affected by exterior elements, comparable to financial and political circumstances. Others develop in accordance with sure enterprise cycles (intervals of development adopted by a lower in financial exercise).

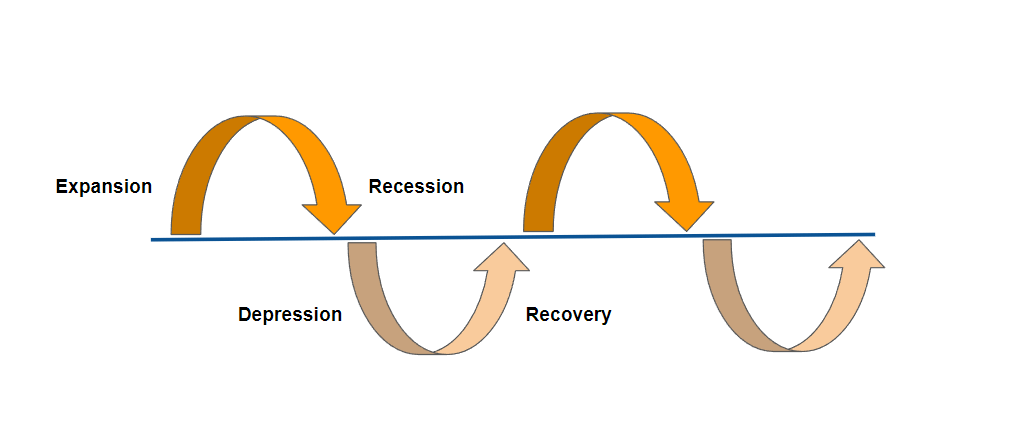

Enterprise Cycles

Enterprise cycles are generally divided into 4 levels: recession, restoration, enlargement and slowdown. Every has its personal traits and impacts corporations from varied sectors otherwise.

For example, throughout a recession (when financial exercise is reducing), corporations from Actual property and Know-how sectors present weaker outcomes. It’s because their companies are tied to extremely discretionary spending from shoppers and companies. To place it merely, folks have a tendency to save lots of on these bills when cash is tight.

Nonetheless, Shopper Staples, Utilities and Well being Care often carry out higher in such circumstances. These sectors are known as non-cyclical, as they’re much less affected by modifications within the economic system. As a result of folks must spend cash on meals and healthcare anyway, these companies are inclined to do nicely even when the economic system normally is struggling.

Alternatively, throughout a restoration, shoppers anticipate financial development and improve their discretionary spending. Companies increase their business actions as nicely, which ends up in development in sectors just like the Actual Property. However sectors that carried out higher throughout the recession — Shopper Staples, Utilities and Well being Care — are inclined to go down as buyers flip to extra cyclical sectors to catch new market tendencies and get larger returns.

Use Enterprise Cycles for Inventory Buying and selling?

It is very important perceive enterprise cycles to choose market sectors which may be performing higher in the intervening time. After which select shares for buying and selling that signify these sectors to realize constructive outcomes.

When deciding on particular person shares inside a sector, it might show helpful to take a look at the place and the way every firm matches in. What’s its market share? Does it have some benefit over the competitors? Solutions to those questions might assist select shares for buying and selling that may present fascinating alternatives.

In the event you choose buying and selling shares from a specific sector, it may additionally be helpful to comply with its principal gamers and study extra in regards to the competitors. For instance, check out this video displaying worth fluctuations of prime online game shares over a 5-year interval. It provides an outline of how inventory costs of various corporations on this sector modified through the years. It could present concepts on how this sector could be creating sooner or later.

Every sector develops in its personal distinctive method. So it might be sensible to research them individually and take into account elements that affect them to decide on shares for buying and selling.

Sorts of Shares

There are various kinds of shares that you could be select for buying and selling. Here’s a temporary overview of the principle ones.

- Based mostly on market capitalization (the entire price of all their shares):

| Kind | Market Capitalization |

| Massive-cap corporations | $10 billion to $200 billion |

| Mid-cap corporations | $2 billion to $10 billion |

| Small-cap corporations | $300 million to $2 billion |

- Based mostly on development potential:

| Kind | Traits |

| Worth inventory | Profitable corporations, often leaders of their sector. They don’t develop as quick (if in any respect), however keep extra secure inventory costs. These shares could be a good selection for long-term funding. |

| Progress inventory | Firms with quick rising income which can be creating rapidly. They could present larger returns, but in addition carry extra dangers. Fixed development is their principal energy, so if it slows down, inventory costs might drop. As these shares are extra unstable and have a tendency to fluctuate, they might provide extra fascinating alternatives for merchants. |

- Based mostly on the perceived inventory high quality:

| Kind | Traits |

| Blue-chip shares | Massive corporations – leaders of their sectors. They’ll typically present a way of stability and decrease dangers for buyers. Could also be much less fascinating for short-term merchants. |

| Penny shares | Smaller corporations with significantly cheap shares, typically lower than $1 per share. They are usually affected by many exterior elements, so costs would possibly typically fluctuate. This can be engaging for merchants, but in addition carries potential dangers. |

Diversification – having a portfolio that consists of property from completely different sectors and varied inventory varieties – could be an concept to think about. This strategy might assist to handle dangers in a altering market, when some sectors carry out higher than others. In any case, be sure you rigorously weigh all of the dangers earlier than making buying and selling selections.

Select Shares

After getting chosen the market sectors and varieties of shares you have an interest in, chances are you’ll flip to evaluation of particular corporations.

Be taught Asset Evaluation

There are 2 principal varieties of inventory evaluation for buying and selling: basic and technical. They could be used individually or together for extra exact outcomes.

Elementary Evaluation of Shares

This entails analyzing the corporate’s monetary state and associated elements, comparable to circumstances inside its sector or the economic system total. The objective is to grasp whether or not the inventory worth is accurately evaluated by the market in the intervening time. On account of basic inventory evaluation for buying and selling, a dealer ought to be capable of evaluate the findings with the present market worth. And conclude whether or not the asset is overvalued or undervalued. Which, in flip, might current a buying and selling alternative.

This kind of evaluation is usually used for long-term investments, as inventory costs would possibly take a while to meet up with the corporate’s true worth. Nonetheless, it would nonetheless are available helpful when assessing shares for short-term inventory buying and selling. Try this text to study extra about particular steps chances are you’ll take to conduct basic evaluation of shares for buying and selling.

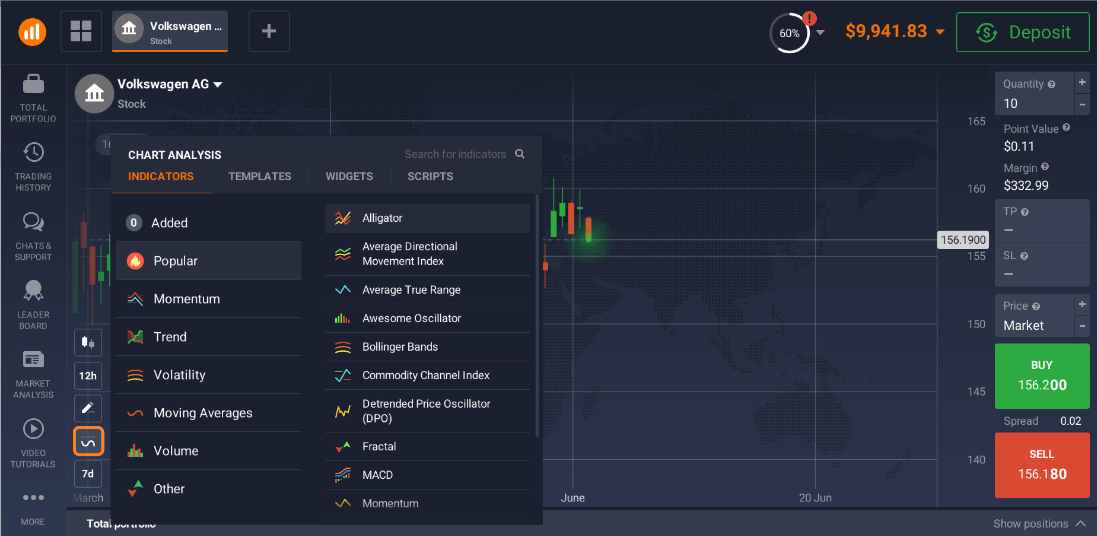

Technical Evaluation of Shares

For this strategy, merchants use indicators to try to predict the longer term efficiency of a inventory primarily based on its previous fluctuations and commerce volumes. They could apply them individually or in several combos for extra correct readings. The conclusions from this sort of evaluation are primarily based on patterns on inventory charts that will trace at future worth actions.

Chances are you’ll discover step-by-step guides on learn how to apply indicators for technical evaluation of shares on this weblog, comparable to 5 Most Common Indicators Defined in 5 Minutes.

Each varieties of inventory evaluation for buying and selling might present helpful data and doubtlessly result in buying and selling concepts. Merchants may additionally use them in a mixture: for instance, apply basic evaluation to select the fascinating corporations and shares. After which flip to technical indicators to catch the appropriate second to make an entry.

Select your dealer

There may be a wide range of inventory buying and selling platforms to select from. Some concentrate on inventory buying and selling, others additionally provide funding alternatives. With some you would possibly be capable of purchase precise property, with others you don’t want to do this and simply commerce the worth distinction.

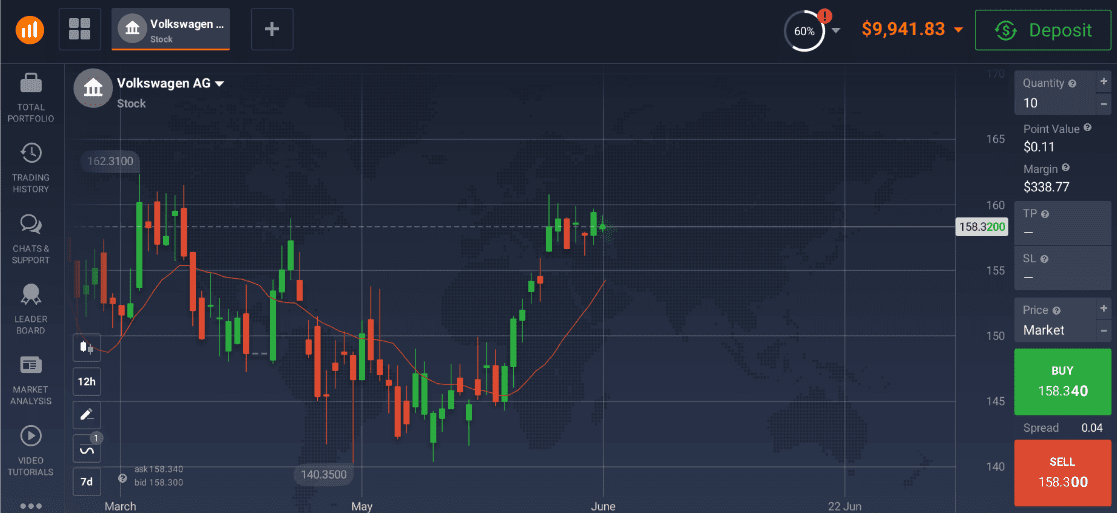

For example, IQ Choice has over 190 shares out there for buying and selling as CFDs (Contract for distinction). By shopping for a CFD inventory, a dealer doesn’t buy a share within the firm itself. As an alternative, it’s all about making a prediction concerning future worth fluctuations of the asset. Relying on the results of the worth motion, the dealer receives revenue or loses the preliminary funding.

What’s extra, with CFDs merchants can get constructive outcomes not solely when the inventory is on the rise, but in addition if the inventory goes down. Mixed with margin buying and selling, CFDs give merchants extra selection and a wide range of buying and selling alternatives.

Buying and selling these devices often entails technical evaluation of shares, so it could be helpful to verify the instruments within the traderoom. For example, IQ Choice has 100 completely different indicators that will assist conduct technical evaluation of shares and result in buying and selling concepts.

The platform additionally provides a free demo account to get some buying and selling expertise with out shedding any cash. This manner, you’ll have a while to decide on shares for buying and selling, apply utilizing instruments for evaluation and choose the buying and selling technique that works for you.

Taking all these elements under consideration, it might be sensible to think about buying and selling circumstances and devices supplied by completely different inventory buying and selling platforms earlier than signing up. This strategy would possibly show you how to keep away from disappointment and customary errors novice merchants face.

Make a Buying and selling Plan

When buying and selling any sort of asset, you will need to give you a buying and selling plan. Shares aren’t any exception: getting a constructive buying and selling consequence requires planning and consistency.

Buying and selling plan is a algorithm that helps set up this course of. It could embrace:

- Your price range: how a lot cash are you keen to place in?

- Buying and selling schedule: when do you commerce? How typically do you verify your offers?

- Your threat tolerance: when do you shut your offers? How lengthy do you retain shedding trades open?

- Your buying and selling technique: do you open and shut all offers inside sooner or later? Or do you retain them open till the pattern modifications? What number of trades do you open per day?

You’ll be able to revise and replace the buying and selling plan on occasion, however it’s essential to persist with it normally. This manner, you could possibly keep away from spontaneous selections that may negatively have an effect on your long-term buying and selling objectives.

When selecting shares for buying and selling, you will need to rigorously take into account various factors, comparable to financial circumstances, inventory market sectors and enterprise cycles. Together with basic and technical evaluation of particular shares, they might present merchants with sufficient information to make an knowledgeable determination. After that, it’s as much as the dealer to give you a buying and selling plan to make use of the acquired data and catch the appropriate second to make a transfer.