Apple Card has been round for just a few years now and, with it, Each day Money. Up till now, you’ve got solely had one place to accommodate all of that money again: the Apple Money Card.

It seems that Apple has determined to provide everybody another choice and has introduced that it’s launching a brand new financial savings account solely for Apple Card customers. Jennifer Bailey, Apple’s vice chairman of Apple Pay and Apple Pockets, says that its new financial savings account is one other device for its customers to “lead more healthy monetary lives.”

“Financial savings allows Apple Card customers to develop their Each day Money rewards over time, whereas additionally saving for the longer term. Financial savings delivers much more worth to customers’ favourite Apple Card profit — Each day Money — whereas providing one other easy-to-use device designed to assist customers lead more healthy monetary lives,” reads an announcement from Apple on the brand new launch.

However what precisely will it supply, and is it value shifting your financial savings into an Apple-branded vault? Here is every little thing we all know up to now concerning the Apple Financial savings account.

What’s the Apple Financial savings account?

The Apple Financial savings account is a brand new financial savings account that customers with an Apple Card can select to open. Apple is advertising and marketing it as a “high-yield” financial savings account that customers can deposit their Each day Money into with a purpose to get extra out of the rewards they earn with their Apple bank card.

Along with mechanically depositing earned Each day Money into the account, customers will even be capable of deposit extra funds into the account straight from a linked checking account.

How a lot curiosity will the Apple Financial savings account earn?

Apple has not but mentioned precisely how a lot curiosity its upcoming financial savings account will earn for account holders. In its press launch saying the account, Apple has solely mentioned that it will likely be a “high-yield” financial savings account.

Nonetheless, we do know that the brand new financial savings account is held by Goldman Sachs, Apple’s present associate with Apple Card. Goldman’s consumer-facing model is Marcus and that does at present have a financial savings account with an rate of interest of two.35% APY.

So, we will doubtless count on the rate of interest for Apple’s Financial savings account to equal or exceed that quantity.

What sorts of charges will the Apple Financial savings account cost?

Similar to Apple Card, the corporate is attempting to go the no-fee route with its new Apple Financial savings account.

There are lots of financial savings account merchandise within the monetary market which have month-to-month upkeep charges, a minimal month-to-month steadiness with a purpose to keep away from these charges, and a minimal preliminary deposit to earn a sure proportion price. Apple, compared, says that its new Apple Financial savings account can have “no charges, no minimal deposits, and no minimal steadiness necessities.”

So, when you have discovered that your present financial savings account has been nickel and diming your cash, Apple’s Financial savings account may be choice for you.

Who can open an Apple Financial savings account?

At launch, Apple says that its new Apple Financial savings account will solely be obtainable for Apple Card prospects. Which means that, when you don’t have the corporate’s bank card, you will be unable to enroll in the brand new financial savings account.

Extra particularly, Apple’s Financial savings account will solely be obtainable for Apple Card house owners and co-owners of the bank card. This language appears to point that when you have co-owners of an Apple Card, every particular person will open their very own separate Financial savings account somewhat than one joint Financial savings account.

Limiting the Financial savings account to Apple Card house owners and co-owners additionally implies that members of your Apple Card Household, like a toddler which may be a certified person, will be unable to open an Apple Financial savings account.

How will I create and handle my Apple Financial savings account?

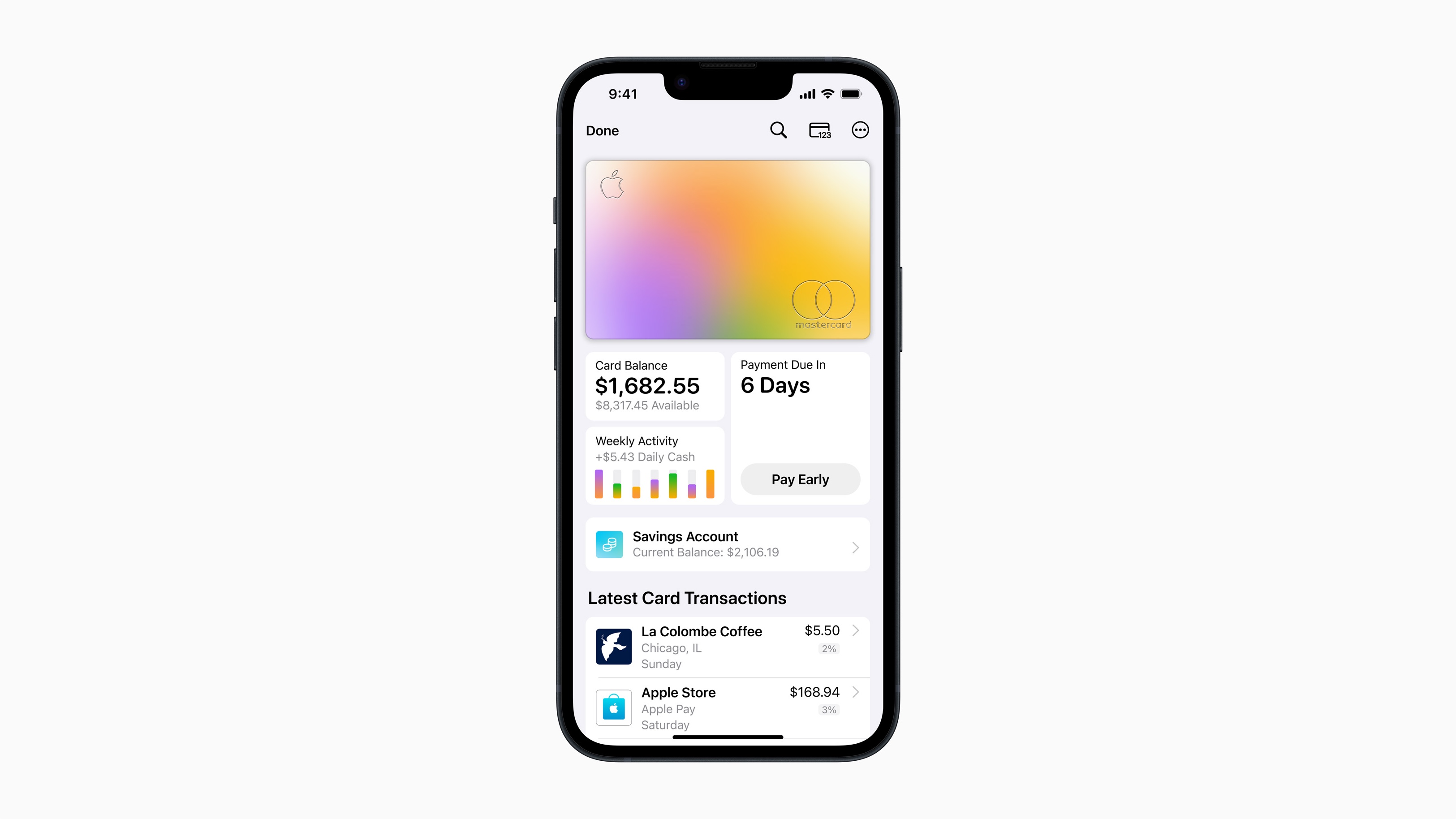

In response to Apple, its new Financial savings account will not be discovered straight within the Pockets app. As a substitute, it will likely be contained inside the Apple Card expertise within the Pockets app.

“Apple Card customers will be capable of simply arrange and handle Financial savings straight of their Apple Card in Pockets,” states Apple.

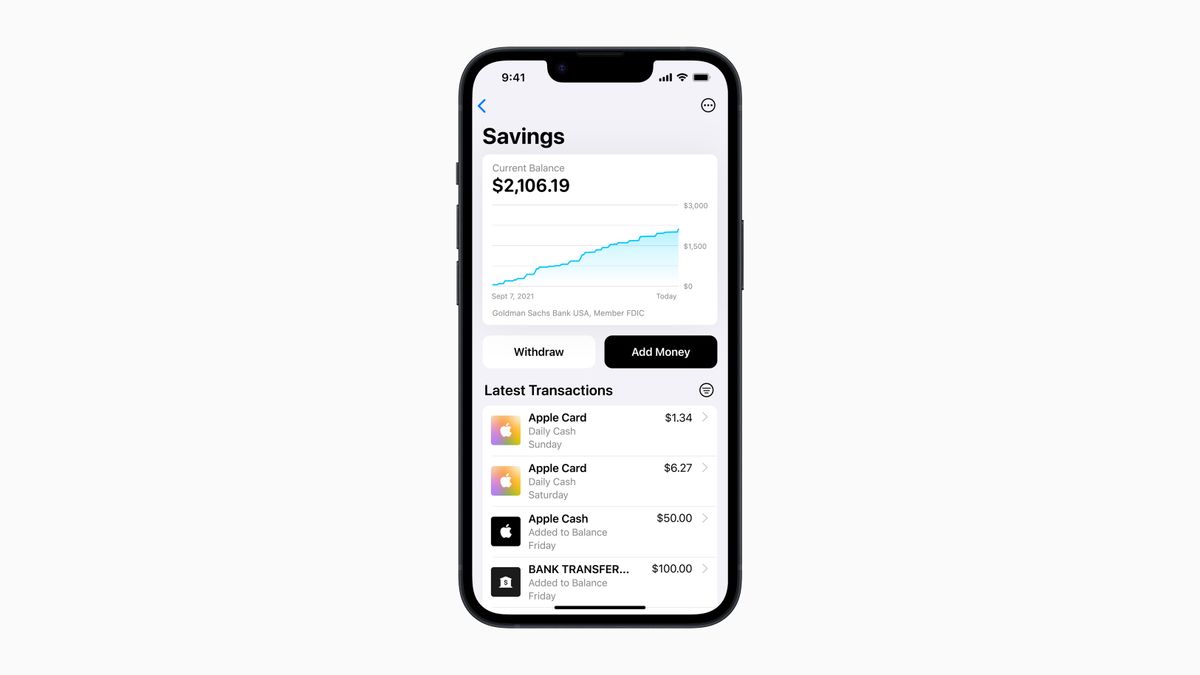

The corporate says that the Financial savings account will characteristic its personal dashboard, exhibiting customers their steadiness and the quantity of curiosity they’ve earned.

“As soon as arrange, Apple Card customers can watch their rewards develop in Pockets via an easy-to-use Financial savings dashboard, which reveals their account steadiness and curiosity accrued over time,” is the way it’s described.

How will I make deposits and withdrawals from my Apple Financial savings account?

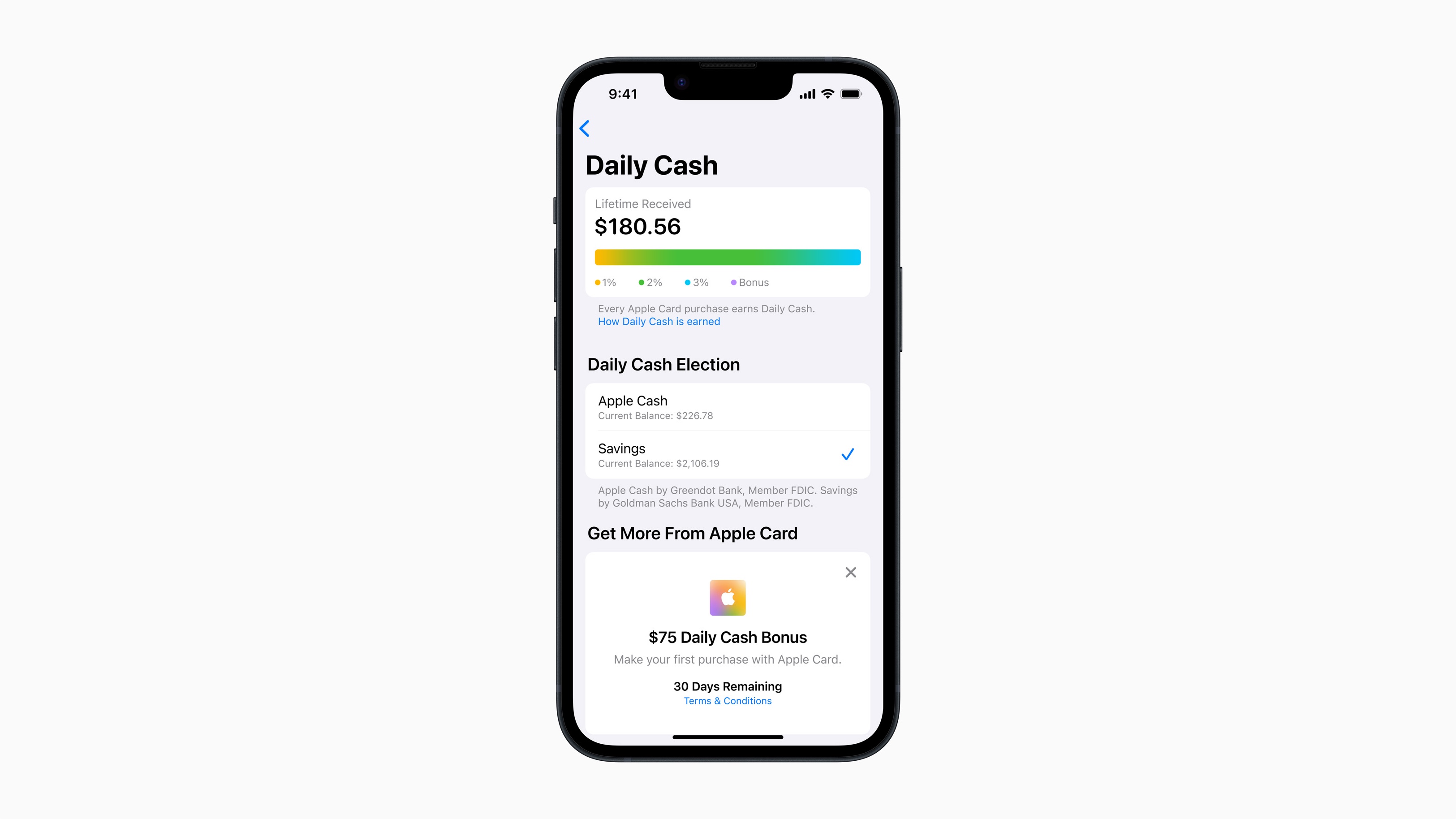

In response to Apple, there are going to be two methods to make deposits into your Apple Financial savings account. The primary permits account holders to have Each day Money earned with their Apple Card mechanically deposited into their new Financial savings account somewhat than their Apple Money card:

“All future Each day Money acquired can be mechanically deposited into it, or they’ll select to proceed to have it added to an Apple Money card in Pockets. Customers can change their Each day Money vacation spot at any time.”

Account holders will even be capable of make extra deposits into their Financial savings account from a linked checking account. The corporate additionally notes that it is possible for you to to make withdrawals to your Apple Money card or linked checking account:

“To broaden Financial savings even additional, customers may also deposit extra funds into their Financial savings account via a linked checking account, or from their Apple Money steadiness. Customers may also withdraw funds at any time by transferring them to a linked checking account or to their Apple Money card, with no charges.”

When will the Apple Financial savings account launch?

Apple didn’t initially present a launch date when it introduced the Financial savings account. The corporate simply mentioned that it will be obtainable “within the coming months.”

Nonetheless, within the launch notes for iOS 16.1, the corporate revealed that the account will launch alongside the software program replace on Monday, October 24.