Non-Fungible Tokens (NFTs) grew to become among the finest use-cases for blockchain expertise early this yr. Along with decentralized finance (DeFi), NFTs got here to dominate within the trade. Now, as quantity sinks, there are questions whether or not NFTs are actually lifeless.

NFT volumes are sinking

NFTs are distinctive merchandise which are distributed within the blockchain trade. Through the use of distributed ledger expertise, it signifies that it’s unimaginable for it to be duplicated. instance of this expertise at work was when Jack Dorsey bought his first tweet as an NFT.

NFTs have been embraced by all forms of blockchain tasks. For instance, decentralized recreation builders like Gala have used these NFTs to spice up their income. Equally, a move-to-earn platform like StepN makes use of NFTs in its ecosystem.

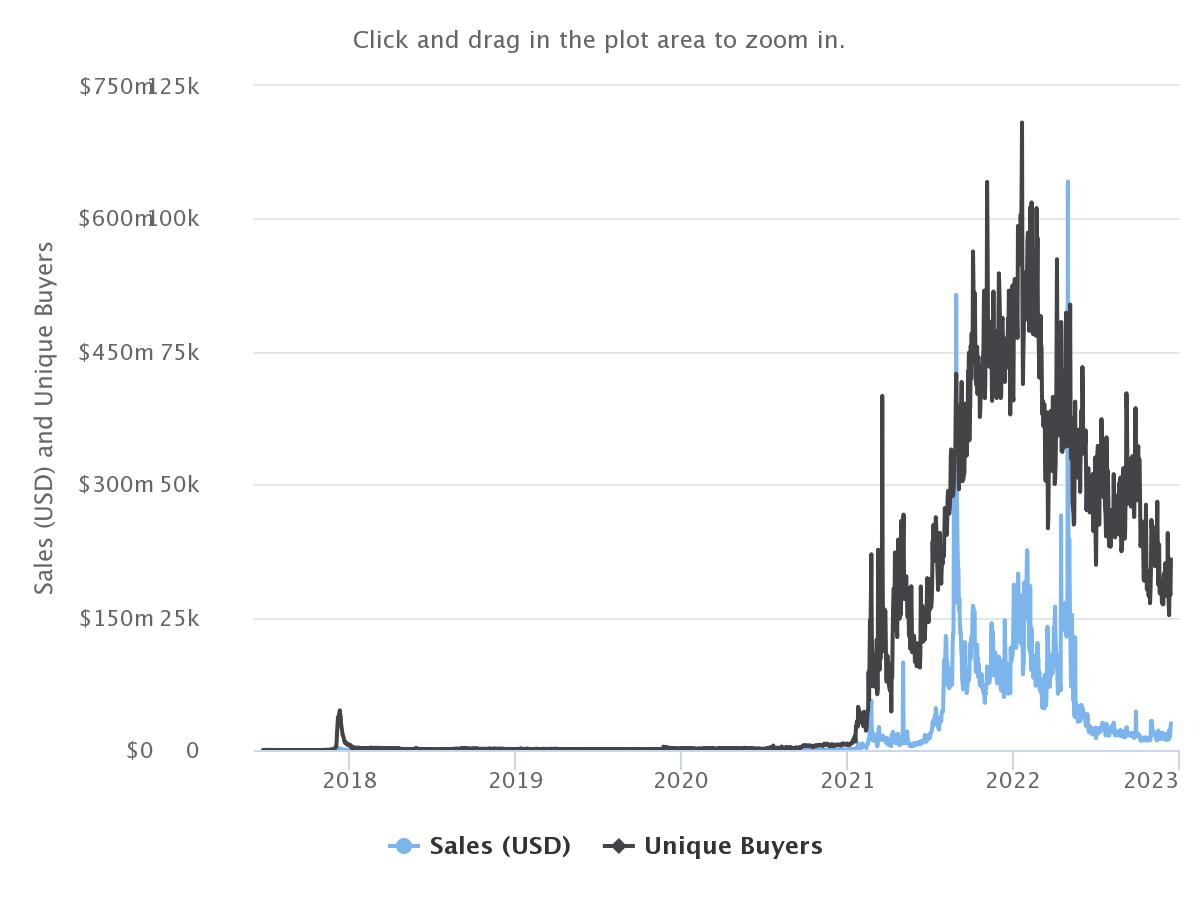

After experiencing strong development in 2021 and early 2022, NFTs have come underneath intense strain currently. Information compiled by CryptoSlam exhibits that the month-to-month quantity of NFTs peaked at $4.5 billion in August 2021.

Equally, the variety of distinctive consumers rose to over 1.1 million in October 2021 whereas distinctive sellers peaked at over 800k.

Not too long ago, nonetheless, these numbers have pale. In November, the entire NFT gross sales dropped to $534 million whereas distinctive consumers have been 522k. Due to this fact, it’s clear that the trade is in a adverse trajectory.

This explains why NFT corporations are getting embattled. The agency has introduced a sequence of layoffs because the NFT winter continued.

Ethereum remains to be the most important blockchain for NFTs because it processes over 80% of all merchandise. It’s adopted by different well-liked chains like Immutable X, Solana, Cardano, and Tezos.

Are NFTs lifeless?

Some analysts consider that NFTs are dying. Nevertheless, in my opinion, I consider that the trade is rebalancing because the crypto trade goes by way of a serious shakeup. This occurs on a regular basis when there’s a main innovation.

We noticed that within the early 1900s when banks have been new and many who collapsed. Additional, in early 2,000s, we noticed the collapse of the expertise sector. Due to this fact, there’s a probability that the NFT might want to collapse first earlier than it goes mainstream sooner or later.

This collapse comes after a time when the sector was getting pumped. For instance, a number of customers paid hundreds of thousands of {dollars} for land gross sales within the type of NFTs. That development was not sustainable from the phrase go. As such, the sector might want to rebalance earlier than it rebounds.