Potential capital flight from China is a vital development to observe, in response to controversial BitMEX founder and crypto veteran Arthur Hayes.

Google Finance knowledge signifies the Chinese language yuan (CNY) has fallen by greater than 5% in opposition to the US greenback for the reason that starting of 2023.

Hayes tells his 394,100 followers on the social media platform X that he spoke with Andrew Collier, a China analyst and the managing director of Orient Capital Analysis, about potential Chinese language capital flight.

Collier reportedly mentioned one of the best ways to trace the potential development is to measure the distinction between China’s internet export earnings (the quantity of export earnings minus import prices) and the nation’s international change reserves (the international forex reserve property held by China’s central financial institution).

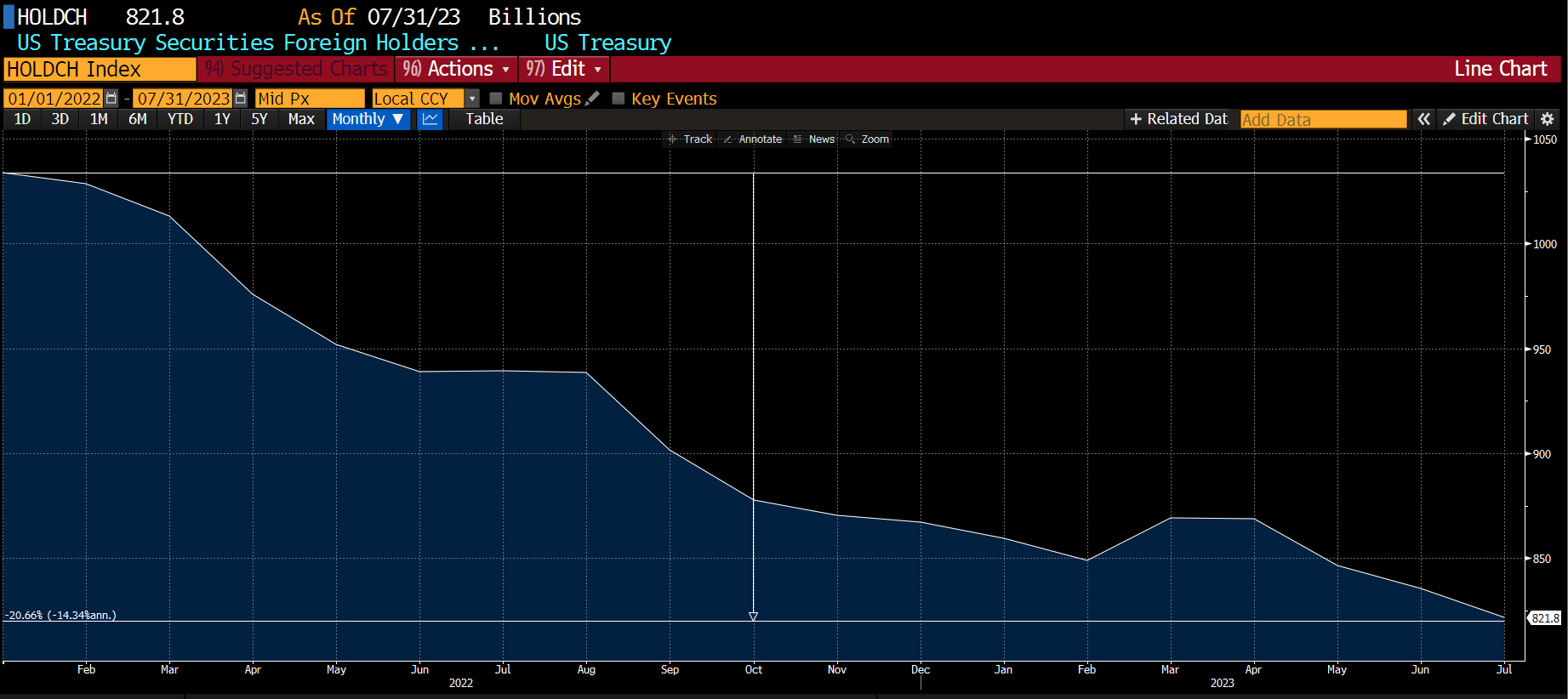

China’s international change reserves have elevated by round $32 billion for the reason that begin of 2023, in response to Bloomberg knowledge. Knowledge from Buying and selling Economics signifies China’s buying and selling surplus year-to-date sits round $553 billion.

Hayes concludes that this implies round $520 billion “has left China to do one thing.”

Says the crypto veteran,

“Some prospects:

1. China is shopping for a whole lot of gold

2. China is paying down USD offshore debt of its banks and corporates

3. Some rich comrades are fleeing the coop

Most significantly what China just isn’t doing is: BUYING MORE US TREASURIES!!!!!

So long as the JPY (Japanese yen) weakens, the CNY should weaken in order that Chinese language exports stay aggressive vs. Japan. Wherever the Chinese language capital goes, it’s going to maintain moving into SIZE. I hope some finds its approach to Lord Satoshi and BTC.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney