Zima Purple offers readers the weekly pulse on the largest information round NFTs. Be part of our group and take the journey with us by subscribing right here:

-

Crypto, defi, DAO, and NFT taxes

-

How the IRS is spending billions on changing into web3 professionals

-

What it takes to construct a terrific product for the web3 house

-

How DAOs are evolving from a software program and enterprise standpoint

-

His funding technique

-

How repute is every little thing

-

How he fell down the web3 rabbithole

-

How he grew his Constancy enterprise from $0 {dollars} to having $18b underneath administration

-

The normal asset supervisor enterprise and the way it works

-

Internet hosting the web3 breakdowns podcast

-

Why crypto is so alpha wealthy

-

How the crypto markets experiences full increase and bust cycles in condensed timelines

-

US securities legal guidelines and the way they will co-exist

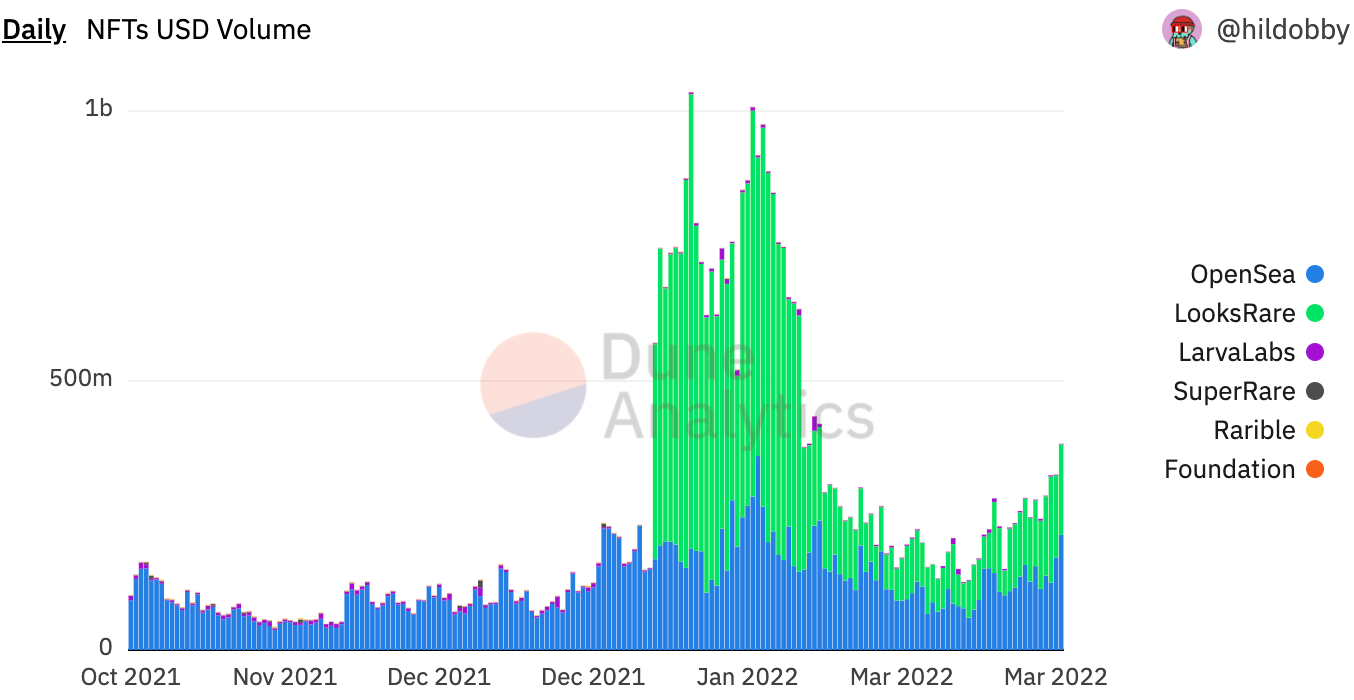

First off, shoutout to @hildobby_ for the superior Dune dashboards.

We’re additionally closing on the 5 consecutive weeks the place weekly NFT buying and selling quantity has outpaced the prior week.

However month-to-month…

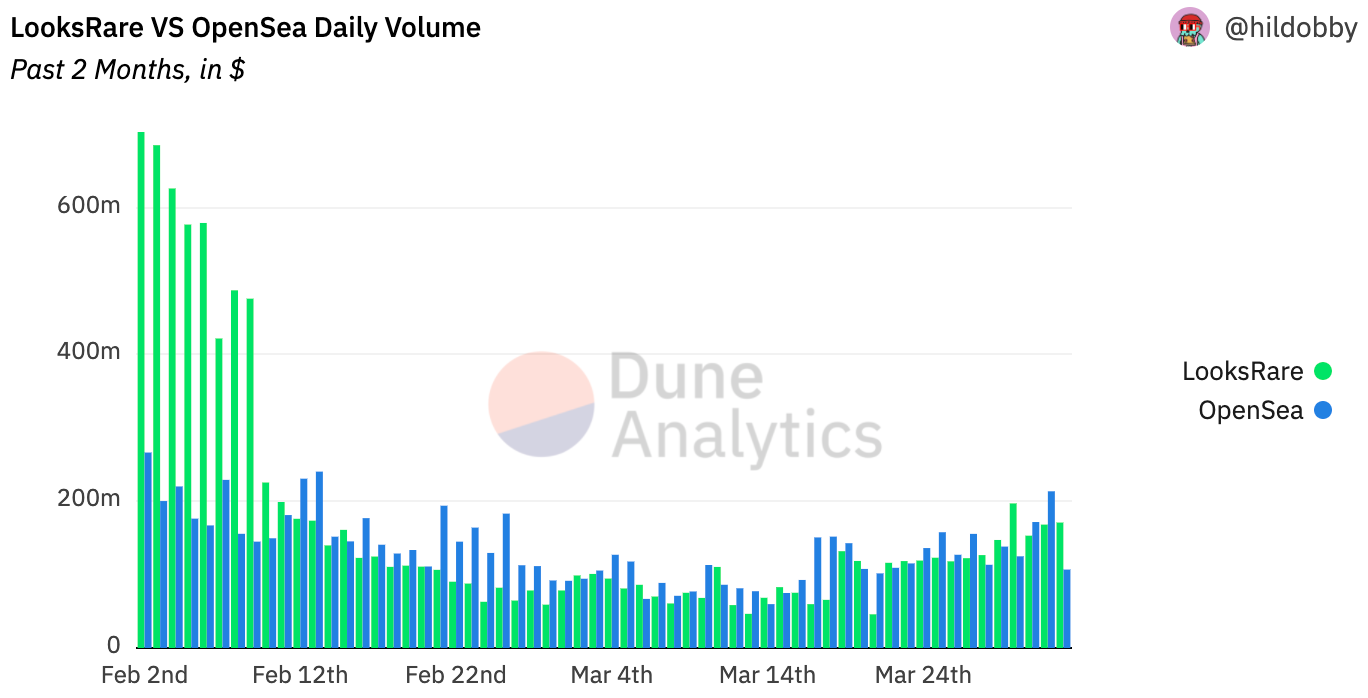

Seems Uncommon has cemented itself because the clear favourite amongst decentralized NFT marketplaces largely because of the $LOOKS earnings trades on its platform present.

The worth proposition is smart. Promote an NFT for 100ETH on OpenSea and get nothing or promote it on Seems Uncommon and get like ~$9K in $Seems.

At a look Seems Uncommon is neck and neck with OpenSea proper now.

Check out the quantity.

There are many days when Seems Uncommon outright beats OpenSea in gross sales quantity.

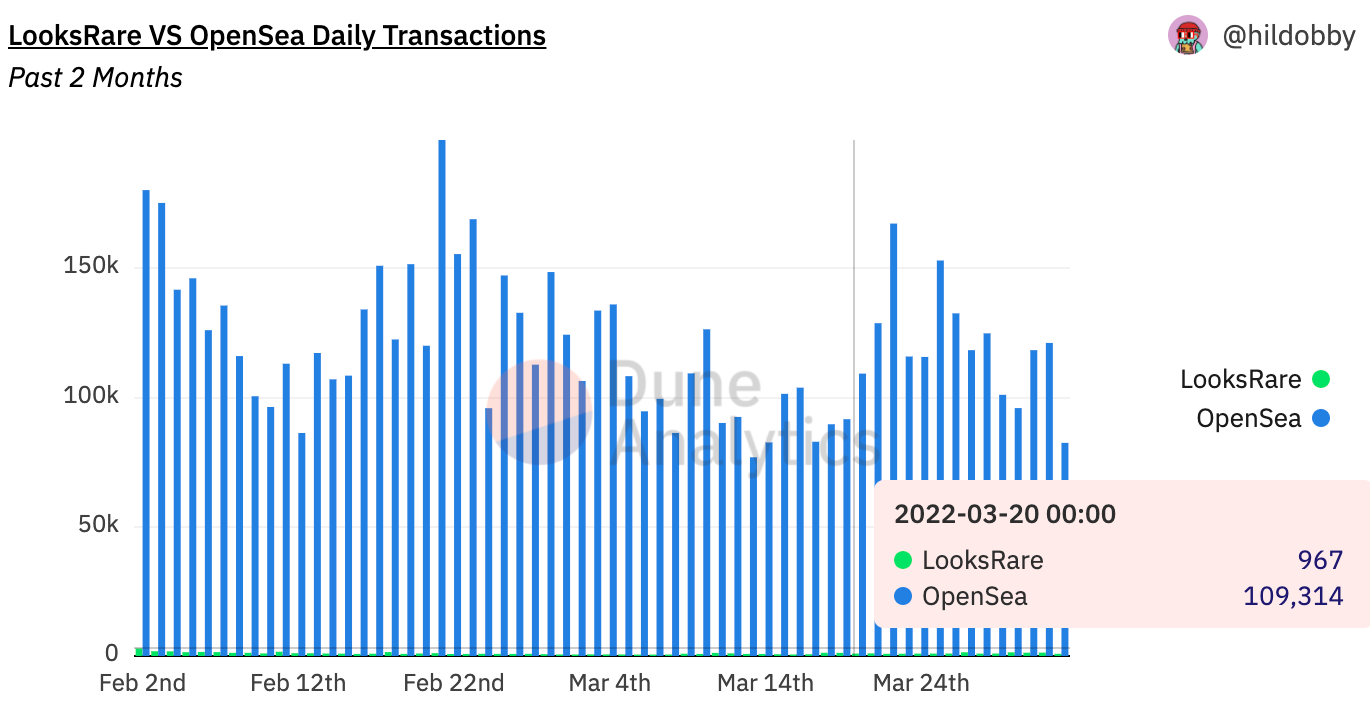

However quantity will be deceptive. Now try the precise variety of transactions.

Not even shut.

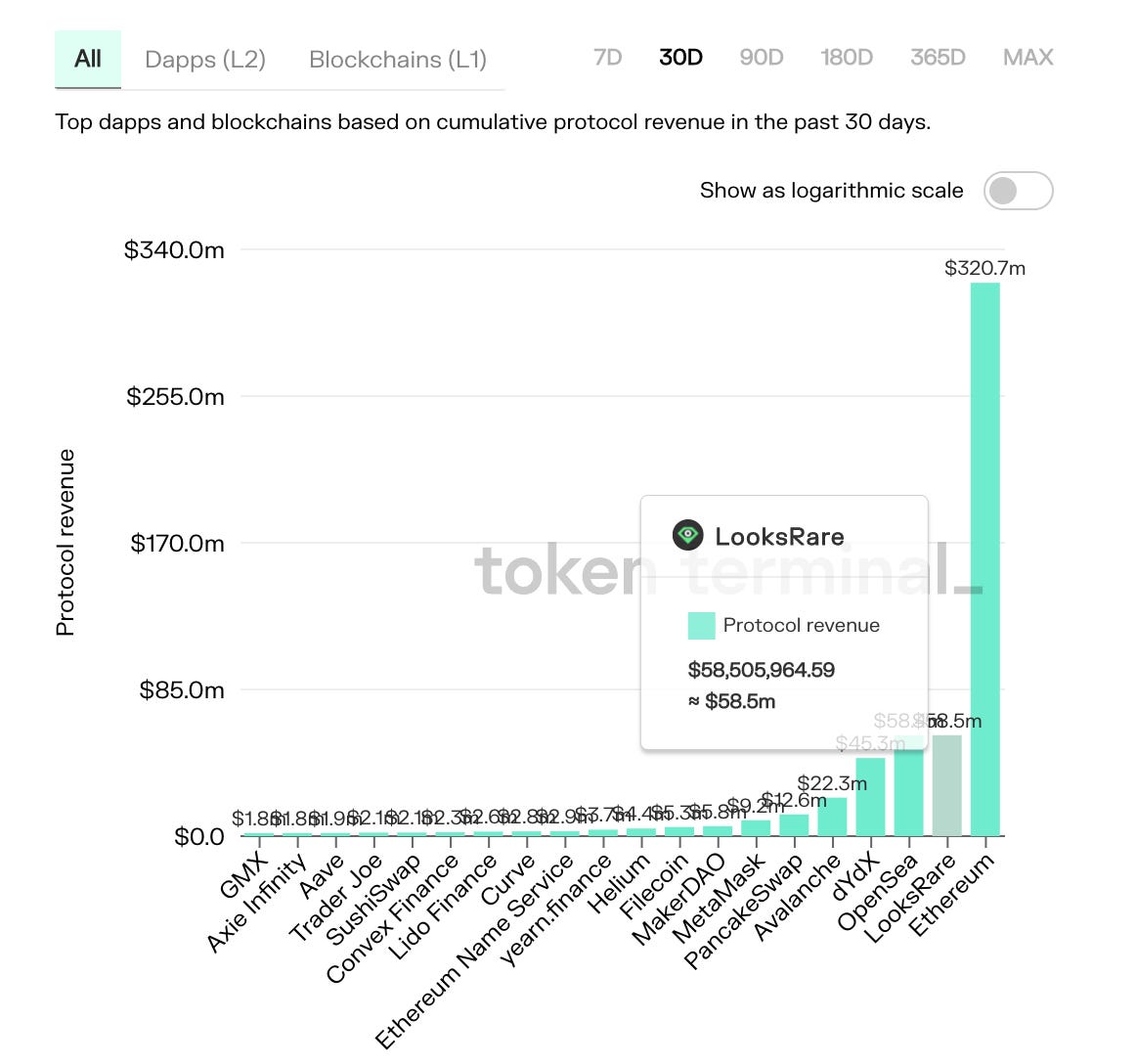

Seems Uncommon appears to be positioning itself as {the marketplace} for giant gross sales (and wash buying and selling).. and that’s okay as a result of now let’s take a look at protocol revenues on token terminal.

Seems Uncommon has really edged previous OpenSea because the #2 highest-earning protocol in crypto after Ethereum. The bedrock metric of conventional monetary asset valuation, value to earnings ratio (P/E) for Seems is 3.6X.

Contemplating that almost all crypto property have double to triple-digit P/E ratios, Seems seems to be a bit undervalued.

Not funding recommendation.

Because the platform seems to be to stray additional and additional away from the sunshine it can start permitting customers to make use of fiat to pay for NFTs on the positioning. All jokes apart, OpenSea is clearly seeking to place itself past the crypto native userbase. With Instagram steamrolling in direction of establishing an NFT market of its personal, OpenSea is making an attempt to make a push to seize the mainstream crowd.

In what OpenSea jokingly stated was “the best-kept secret in Internet,” Solana NFTs are coming to the world’s largest NFT market.

Solana “blue-chips” like Solana MBS and DeGods have watched their flooring soar on the information.

With 90% of the Solana NFT gross sales quantity, Magic Eden would be the largest loser by far.

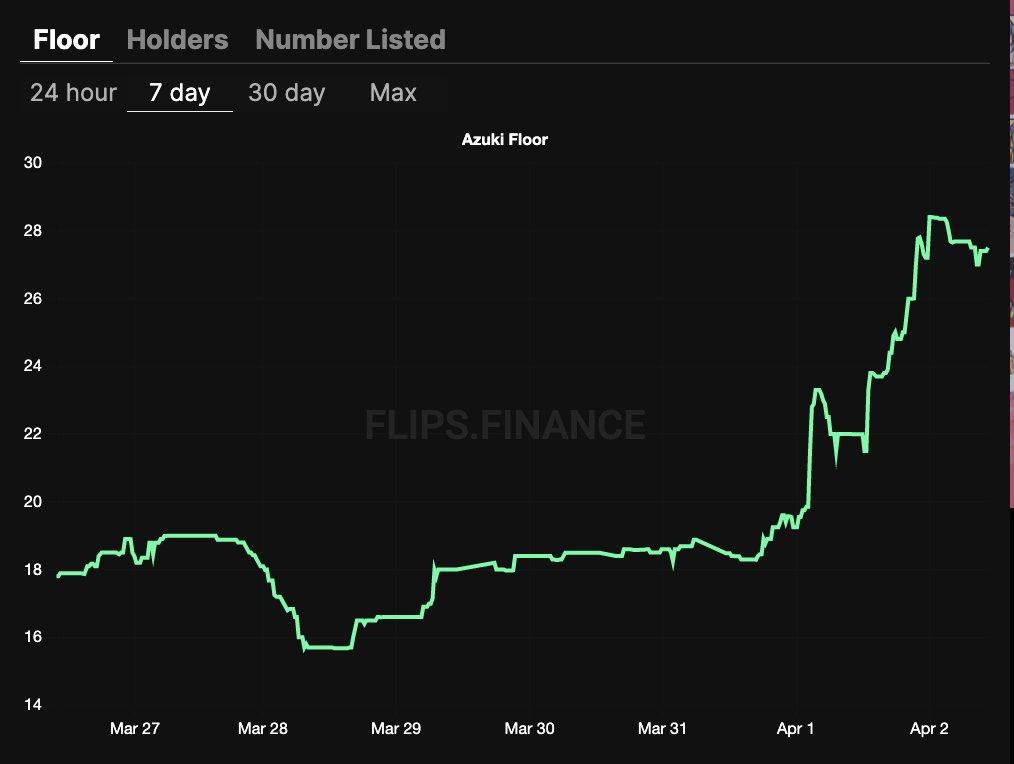

First got here the airdrop, introduced final Wednesday at a non-public NFT LA celebration. The ground for the airdropped “One thing” NFT is now round 5ETH.

Then got here the pump. One would anticipate the bottom assortment to dip roughly equal to the ground of the airdrop however this time…it went up. So much.

The ground of the bottom assortment really began to extend on the announcement however didn’t cease even after the airdrop got here and went.

Azuki is run purchase LA-based Chiru Labs.

A number of issues on them:

Chiru labs are positioning themselves and their members as “the skaters of the web” and are following the identical playbook of worth creation that allowed Yuga Labs to succeed in a $4 billion valuation.

Proof collective an NFT group began by Digg founder Kevin Rose and Treehouse founder Chris Carson has already watched the ground of their membership NFT ballon from 6 to 55 ETH this 12 months. However a membership card NFT doesn’t fairly have the identical signaling and community impact as PfPs.

Enter Moonbirds.

The gathering is dropping through a Dutch Public sale on OpenSea on April sixteenth.

The DA will begin at 2.5 ETH and has already garnered a ton of hype.

The Pudgy Penguins founders have been engaged to promote the gathering ever because the Pudgy Penguins group voted to oust them again in January. LA-based entrepreneur and Day-1 penguin Luca Nets has bought management of the initiatives together with its royalties for $750 ETH ($2.5M).

Regardless of some mockery within the NFT world, with virtually 50,000 ETH in quantity and well-known holders like Steph Curry, Pudgy Penguins continues to be a pressure to be reckoned with. It’s now as much as Netz to comply with via with the roadmap that the mission’s founders infamously lagged on.

The attackers have been capable of receive the non-public keys of 5 of Sky Mavis’ 9 validators to withdraw 173,600 ETH and 25.5M USDC

What’s stunning is that it took Sky Mavis six complete days to comprehend that it had been hacked. The attacker was presumably seeking to double-dip by taking a brief place out towards Axie Infinity and Ronin understanding that their value would fall on the information. It took so lengthy for the information to interrupt that this quick was really liquidated.

One fascinating notice is that the $625M shall be virtually unattainable to withdraw. The thief is transferring the funds to completely different wallets and onto exchanges however cashing out with out giving up your identification may be very troublesome. Sky Mavis working with regulation enforcement to get better & reimburse the funds. They’ve famous on-chain sleuth Chainalysis on the case as effectively.

Hiro Capital’s blockchain gaming specialist, Jon Jordan, compiled an in depth record of the present blockchain gaming ecosystem. The lists necessary details about every mission together with social hyperlinks in addition to hyperlinks to its highway map.

The financial institution’s analysts estimate that the metaverse’s whole addressable market might attain $13 trillion by 2030.

To get to those projections, nonetheless, CitiBank says the metaverse will want a computational effectivity enchancment of over 1,000x immediately’s ranges. The analysts acknowledged important funding will should be made within the following areas:

In addition they suppose the metaverse can attain 5 billion customers.

However to get there, the expertise might want to faucet cell phone customers. Citi estimates a VR/AR-only metaverse would high out at 1 billion customers.

Koons, the previous commodities dealer, who turned one of many world’s most famous dwelling artists with iconic large metal balloon canine, is wanting to make use of the crypto moon meme to create a “traditionally significant NFT mission.”

Koons is even partnering with Intuitive Machines to ship a subset of bodily items to the precise moon.

Fractal ($35M) – NFT Market centered on Solana-based gaming NFTs based by Twitch founder Justin Kan. Fractal’s seed spherical was co-led by Paradigm and Multicoin and included participation from Andreessen Horowitz, Solana Ventures, Coinbase, Animoca, and extra.

Cross the Ages ($12M) | a free-to-play fantasy and science fiction recreation that includes NFT buying and selling playing cards. Participation from Animoca Manufacturers, Ubisoft, Polygon, Sebastien Borget, and others.

Blur ($11M) – NFT market designed for professional merchants. Seed spherical led by Paradigm with participation from 0xMaki, Santiago Santos, Zeneca, Deeze, Andy (Fractional), eGirl Capital, Keyboard Monkey, LedgerStatus, and extra.

SkateX ($5M) – Solana-based online game with NFT skateboards. The spherical included participation from Coinbase Ventures, Solana Capital, Animoca Manufacturers, Play Ventures, Cadenza Ventures, Kevin Lin, and others.

TeaDAO ($4.6M) – Making an attempt to resolve for NFT illiquidity and allow GameFi 2.0 as a metaverse reserve foreign money. Participation from Shima Capital, Signum Capital, UOB Enterprise, PNYX Ventures, HyperChain Capital, Spark Digital Capital, Mapleblock Capital, AU21 Capital, Fundamentals Capital, DFG, X21 Digital, LD Capital, 7 O’Clock Capital, MEXC Alternate, Momentum 6, Jsquare, FOMOCraft Ventures, Parsiq, Newave Capital, CoinW, NFV, ZBS Capital, AVStar Capital, HG Ventures, Satoshi Membership, and Token Hunter.

MultiCoin Capital: In Search of Outliers & Find out how to be Contrarian

Premint – Nonetheless obtainable for near mint value on secondary. NFTs like this do have a tendency to remain round mint value till utility builds. The founder, Brenden Mulligan, can also be the founding father of PodPage and may be very revered in Sillicon Valley.

Like what you learn? Let your mates find out about Zima Purple: