The president of the Federal Reserve Financial institution of Minneapolis, Neel Kashkari, says the present banking disaster has pushed the U.S. financial system nearer to a recession. “We’ve got elementary points, regulatory points dealing with our banking system,” the Fed official harassed.

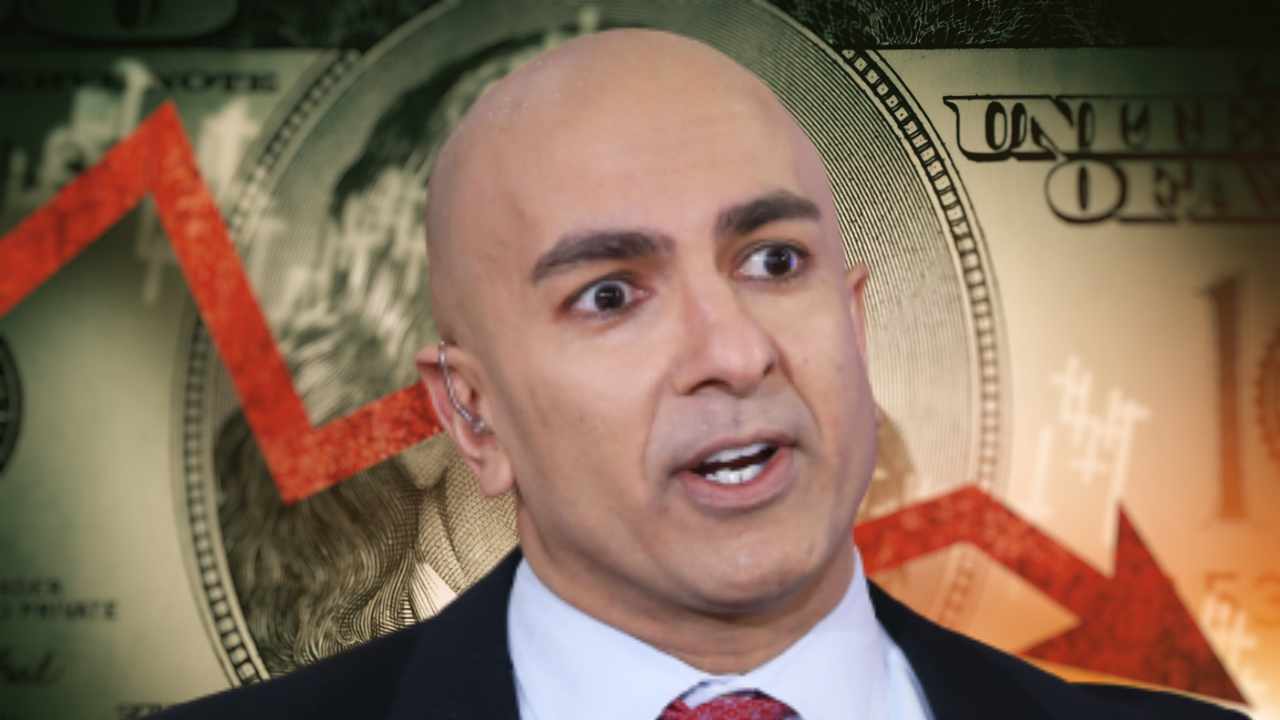

Neel Kashkari on U.S. Economic system, Banking Disaster, Recession

Federal Reserve Financial institution of Minneapolis President Neel Kashkari shared his ideas on the state of the U.S. financial system, the present banking disaster, and whether or not the U.S. is headed towards a recession in an interview with CBS Information Sunday.

Responding to a query about whether or not the current banking disaster has induced the U.S. financial system to edge nearer towards a recession, Kashkari stated:

It positively brings us nearer. Proper now, what’s unclear for us is how a lot of those banking stresses are resulting in a widespread credit score crunch.

“That credit score crunch … would then decelerate the financial system,” he cautioned, noting that the Fed is monitoring the state of affairs “very, very carefully.”

“Such strains may then convey down inflation. So we’ve to do much less work with the federal funds price to convey the financial system into stability,” Kashkari continued. “However proper now, it’s unclear how a lot of an imprint these banking stresses are going to have on the financial system.”

A number of main banks, together with Silicon Valley Financial institution and Signature Financial institution, failed in current weeks, prompting the Federal Reserve, Treasury Division, and Federal Deposit Insurance coverage Company (FDIC) to step in and shield depositors.

Kashkari was requested whether or not extra laws are wanted to forestall financial institution failures and if the FDIC deposit insurance coverage must be raised above $250,000. Moreover, he was questioned whether or not the 2018 rollbacks on the regulation of mid-sized banks must be reinstated. The Financial Development, Regulatory Aid, and Client Safety Act of 2018 reversed a few of the laws that had been carried out following the 2008 monetary disaster.

The Fed official replied:

Nicely, we’ve elementary points, regulatory points dealing with our banking system. I’ve argued for years that the most important banks on this planet are nonetheless too massive to fail.

Commenting on deposit outflows from smaller banks to bigger establishments, the Fed financial institution president harassed: “The explanation that deposits are flowing to the massive banks, the explanation that Credit score Suisse was bailed out by the Swiss authorities, is as a result of banks have this premium place, and it’s unfair.” He elaborated:

It’s an unfair enjoying subject that places monumental strain on regional banks and neighborhood banks, and that must be addressed. We’d like regional banks in America, we want neighborhood banks in America.

“As soon as we get by means of this stress interval, we’ve to give you a regulatory system that each ensures the soundness of our banking system, however it’s additionally honest and even, so the neighborhood banks and regional banks can thrive. We don’t have that at present,” Kashkari concluded.

Some folks have urged the federal government to lengthen their bailout to smaller banks. Billionaire Invoice Ackman not too long ago stated, “We’re heading for a prepare wreck,” warning of everlasting harm to smaller banks if the federal government permits the present banking disaster to proceed.

What do you concentrate on the statements by Federal Reserve Financial institution of Minneapolis President Neel Kashkari? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.