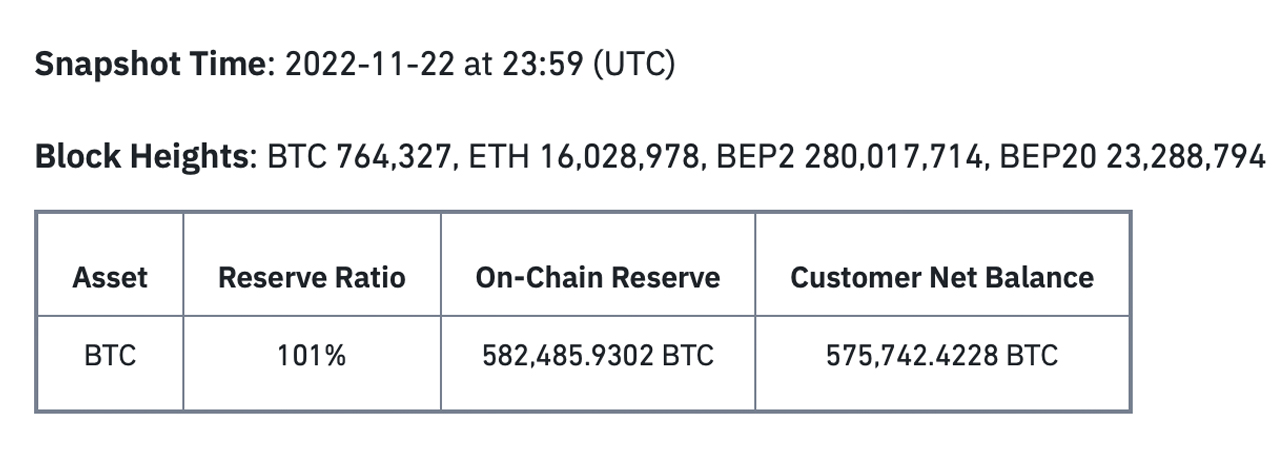

On Nov. 25, the biggest cryptocurrency trade by way of day by day commerce quantity, Binance, revealed its bitcoin proof-of-reserves (POR) system utilizing The Merkle method. On the time of writing, the snapshot offered by Binance reveals the agency’s onchain reserves equate to 582,485 bitcoin, whereas the corporate’s buyer web stability is roughly 575,742 bitcoin.

Binance’s Bitcoin Proof-of-Reserves Ratio Is Presently 101%

Binance has revealed the corporate’s proof-of-reserves system in regard to the bitcoin (BTC) cache the corporate holds. The POR function is initially beginning with Binance’s bitcoin holdings, however different “networks [are] being added within the subsequent couple of weeks.” The information follows the current FTX collapse and the crypto neighborhood insisting that centralized digital forex buying and selling platforms show their reserves. Along with the crypto neighborhood, trade executives like Kraken’s Jesse Powell additionally chimed in on the POR dialog.

Two days in the past, Bitcoin.com Information reported on Powell’s commentary about so-called POR lists that merely showcase digital forex addresses. Powell stated these lists of addresses weren’t reputable POR audits and he confused {that a} true POR audit “requires cryptographic proof of consumer balances and pockets management.” Powell additionally shared a weblog put up written in 2014 referred to as “Proving Your Bitcoin Reserves,” which discusses The Merkle method. Principally, as a result of exchanges use a whole lot of addresses a Merkle Tree could be leveraged to consolidate all the info right into a single hash, which then could be cryptographically verified by anybody.

Nic Carter’s proof-of-reserves listing or “Wall of Fame,” lists centralized buying and selling platforms which have submitted “full POR” audits. On the time of writing, there are 5 crypto platforms which have shared full PORs that function The Merkle method on the Wall of Fame. Three of them (Coinfloor, Gate.io, and HBTC), nonetheless, offered Merkle-based assessments in Might 2020, Might 2021, and August 2021. Kraken and Bitmex are up-to-date, as they shared Merkle-based assessments this month. On Friday, Binance’s CEO Changpeng Zhao (CZ) tweeted concerning the firm sharing the agency’s POR.

Various crypto supporters have been happy with Binance sharing the corporate’s POR. The whistleblower often called Fatman replied to CZ’s tweet. “That is wonderful,” Fatman stated. “Hope smaller exchanges rapidly observe go well with. Thanks for main the best way with this extraordinarily necessary initiative. Having cryptographic proof of an trade’s solvency is a critical sport changer.”

Binance’s snapshot was recorded on Nov. 22, 2022, at 23:59 p.m. (UTC) and data present Binance’s onchain reserves equate to 582,485 BTC, whereas buyer balances equate to 575,742 bitcoin. That provides Binance a reserve ratio of round 101% and the weblog put up has a piece that claims customers can “click on to confirm” their BTC property held on Binance. To ensure that customers to have the ability to confirm balances and transactions, they will log into Binance, and click on the audit button within the pockets part. “It is possible for you to to search out your Merkle Leaf and Report ID throughout the web page,” Binance explains.

Moreover, Binance has disclosed upcoming plans for the POR listing which embrace:

- Launch the following batch of POR within the subsequent two weeks, together with extra property

- Contain third-party auditors to audit PoR outcomes

- Implement ZK-SNARKs for POR, enhancing privateness and robustness, and proving the full web stability (USD) of every person is non-negative

The ZK-SNARKs for PoR will permit for proof-of-reserves on Binance’s leverage companies. “As a result of Binance affords margin and loans companies, the audit outcomes will present the Internet Stability, Fairness, and Debt of every person, the place the Internet Stability = Fairness – Debt,” Binance’s weblog put up concludes. “As such, there shall be particular person customers having unfavorable asset balances. We’re therefore additionally working to implement ZK-SNARKs, which shall be used to show these customers have sufficient different property to cowl the funds with collateral. This may show that the full web balances (USD) of every person is non-negative.”

What do you concentrate on Binance sharing the corporate’s POR tied to the trade’s bitcoin holdings? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: 24K-Manufacturing / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.