Former Coinbase chief expertise officer Balaji Srinivasan thinks that the federal government will as soon as once more activate the cash printers and devalue the US greenback like by no means earlier than.

Srinivasan tells his 895,200 Twitter followers that the US is within the midst of a “fiat disaster” in addition to a monetary disaster.

“All the pieces is bust. Banks, industrial actual property, blue states. Listening to rumblings round insurance coverage too. The printing might be on a historic scale. As will the will to exit the printing.”

Wanting nearer on the state of the insurance coverage trade, the Bitcoin (BTC) bull says that insurers, like banks, maintain authorities bonds which were devalued amid the string of charge hikes issued by the Federal Reserve over the previous 12 months.

“On the subject of insurance coverage… you recognize all these ‘secure’ property that insurers maintain to pay you again? Quite a lot of that’s in Fed-devalued bonds too.

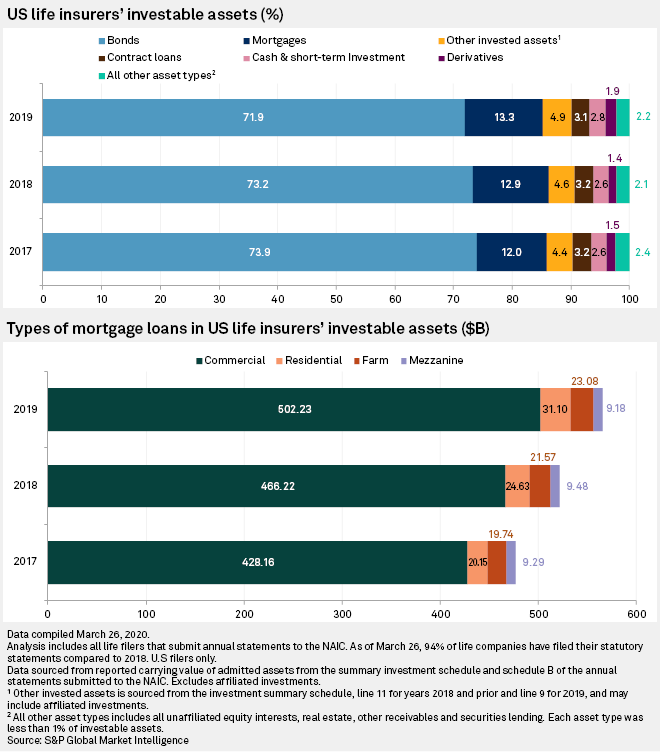

Keep in mind, insurers maintain ‘secure’ property like bonds and mortgages. And the way are these secure property doing? Within the period of unprecedented, shock charge hikes? Not so nice, Bob.”

Wanting on the former Coinbase govt’s chart, it seems that in 2019, bonds account for over 70% of US insurers’ portfolios.

Srinivasan says that the takeaway from the crises might be to not belief the state.

“This isn’t only a monetary disaster. It’s a fiat disaster. All of the payments are coming due. Only some items have come into public view. However it’ll be apparent on reflection: don’t belief the state.”

The angel investor began to be a focus for crypto merchants final month after making a significantly daring Bitcoin forecast. Srinivasan stated that Bitcoin appears poised to blow up in lower than 90 days from now to $1 million amid the meltdown within the banking sector.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney