On-chain information exhibits the Bitcoin aSOPR metric has dropped to lows not seen since December 2018, suggesting that holder capitulation is deepening.

Bitcoin aSOPR Plummets To Lows Not Noticed Since Nearly 4 Years In the past

As identified by an analyst in a CryptoQuant submit, the present capitulation is deeper than throughout each the 2015 bear and the COVID crash.

The “Spent Output Revenue Ratio” (or the SOPR briefly) is an indicator that tells us whether or not Bitcoin buyers are promoting at a loss or at a revenue proper now.

When the worth of this metric is larger than 1, it means the general market is realizing some quantity of revenue presently.

However, the indicator having values beneath the edge implies the common holder is promoting at a loss in the meanwhile.

Naturally, the SOPR being precisely equal to 1 suggests the buyers as an entire are simply breaking even proper now.

A modified model of this metric is the “Adjusted SOPR” (aSOPR), which doesn’t have in mind any promoting of cash that was finished inside 1 hour of the acquisition of stated cash. By doing so, the indicator filters any noise from the info that wouldn’t have had any important penalties in the marketplace.

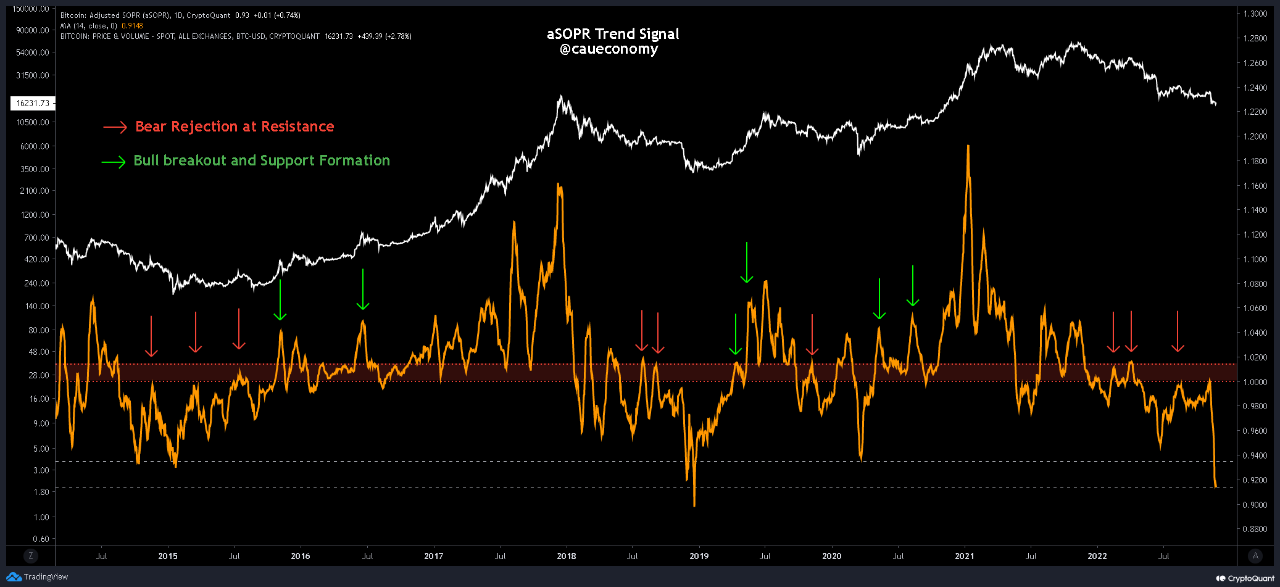

Now, here’s a chart that exhibits the pattern within the Bitcoin aSOPR because the 12 months 2014:

The worth of the metric appears to have seen a heavy drawdown in current days | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin aSOPR has noticed a speedy downwards trajectory beneath the 1-level just lately. Because of this BTC buyers have been promoting their cash at big losses.

The indicator’s worth is now the bottom it has been because the December of 2018, when the bear market of the earlier cycle noticed its backside.

These present ranges of the metric are additionally decrease than they had been throughout each the 2015 bear market backside in addition to the COVID black swan crash.

Plummets within the aSOPR just like the one now point out that there’s widespread capitulation going within the Bitcoin market. Such deep loss realizations have traditionally result in the formation of lows within the worth as they lead to a shift in cash from weak palms to robust palms.

Because the indicator is presently at historic lows, it’s attainable the market is approaching a backside for this cycle. Nonetheless, it’s value noting that the 2018 backside noticed even deeper values than now, so it’s unsure whether or not the present cycle can even see comparable lows or not, earlier than the true backside is in.

BTC Value

On the time of writing, Bitcoin’s worth floats round $16.5k, up 1% within the final week.

BTC has proven robust uptrend within the final two days | Supply: BTCUSD on TradingView

Featured picture from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, CryptoQuant.com